| | In this edition: Interview with Sim Tshabalala of Standard Bank, South Africa’s coalition tensions, ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Getting more credit

- Coalition tensions

- The US business opportunity

- DRC, Rwanda peace concerns

- Afreximbank’s new boss

- Debt management

- Week Ahead

Thomas Sankara’s mausoleum opens in Ouaga |

|

Concerns on African debt ratings |

| |  | Yinka Adegoke |

| |

Tasos Katopodis/Getty Images for Semafor Tasos Katopodis/Getty Images for SemaforThe chief executive of Africa’s largest bank by asset value has added his voice to growing frustration on the continent over the valuations of Africa’s sovereign debt by the big three global credit ratings agencies. Sim Tshabalala, CEO of Johannesburg-based Standard Bank, said his institution’s own analysis often did not align with that of Fitch, Moody’s, and Standard & Poor’s. “Our statistical work suggests that the average African sovereign is rated four rungs below what their fundamentals would imply,” he told Semafor in a wide-ranging interview. Tshabalala said if the analysis was applied to South Africa, the continent’s most advanced economy would go from a BB- rating to BBB, translating into savings of nearly $3 billion in borrowing costs annually. The big three New York-based agencies have been criticized for not having teams with deep understanding of African economies, which critics say leads to an overestimation of risk, which in turn forces many countries to pay too much interest on their debt. The African Union is set to launch its own credit ratings agency this year to help challenge the establishment with additional transparency for African sovereign ratings. But Tshabalala was more circumspect about the impact of an African agency. “If Africa set up its own rating agency, how long would it take before it gained the credibility similar to the credibility that the big three have?” |

|

Ramaphosa’s tough stance works for now |

John Rodger Bosch/AFP via Getty Images John Rodger Bosch/AFP via Getty ImagesSouth African President Cyril Ramaphosa was decisive in firing a government minister from a coalition member party last week, but it didn’t come out of nowhere, writes Sam Mkokeli in a column for Semafor. People familiar with the matter said that there were already tensions between Andrew Whitfield, the deputy trade minister and a member of the Democratic Alliance party, and his senior ANC counterpart. But it was a decision by Whitfield to travel to the United States without prior approval which incensed the president, according to a source close to Ramaphosa. South Africa is in the middle of sensitive trade negotiations with the US and needs to be seen to be on the same page. However the DA’s ultimatum to the presidency — to reverse Whitfield’s firing or risk their party’s exit from the government of national unity — expired without effect because internally, the party was divided, two DA sources told Mkokeli: “Some saw the hardline stance as essential. Others feared being left behind. The result is a party still in government, but weaker than it was the week before.” |

|

Encouraging US investment in Africa |

If US policy makers really want to take on China in Africa they should deploy their greatest weapon: American business, writes the former co-founder of two of Africa’s billion-dollar startups. American businesses can be incentivized to make much-needed long term investments in African countries with smarter foreign tax credit policies, writes Iyinoluwa Aboyeji, founding partner of Future Africa for our One Big Idea column. Aboyeji proposes that policy makers could move some of the billions of investment dollars currently routed through US development finance institutions over to a form of enhanced foreign investment tax credits for American companies that invest directly in Africa’s special economic or free trade zones. “For every dollar invested, American firms could claim an additional dollar in tax credits, provided the host country also offers favorable local incentives,” writes the former co-founder of Flutterwave and Andela. “This would make it easier for US companies to commit capital to long-term projects that build African capacity while opening fast-growing markets to American innovation.” |

|

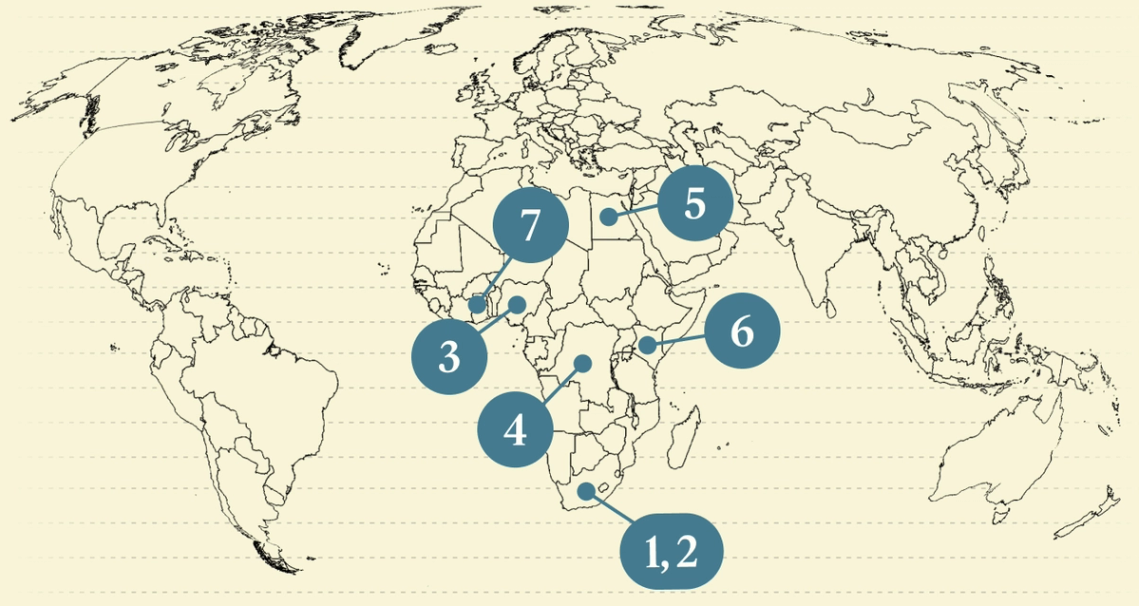

Skeptics eye DRC, Rwanda peace deal |

Ken Cedeno/Reuters Ken Cedeno/ReutersThe US-brokered DR Congo-Rwanda peace deal is already being viewed skeptically by long time watchers of conflict in eastern Congo who worry that the agreement does not address some of its root causes and might not be sustainable in the long term. The agreement was signed in Washington on Friday by the foreign ministers of both African countries. US President Donald Trump has claimed a major diplomatic win in bringing an end to the three-decade conflict which has cost millions of lives. In recent months the Rwanda-backed M23 rebels have claimed large swathes of the eastern Congo subregion leading to the displacement of hundreds of thousands of people. The “Critical Minerals for Security and Peace Deal” will allow US partners to extract and trade Congo’s rare earth minerals in exchange for improved security and peace to offset China’s dominance in the country’s supply chain. But on the continent that has also raised the spectre of “resource exploitation, camouflaged as diplomatic triumph.” Mvemba Dizolele, of Washington’s Center for Strategic and International Studies, said minerals were only ever one driver of the conflict alongside ethnic tensions, land disputes, and citizenship claims in the troubled region. The Congolese-born analyst said the US must ensure a robust legal framework including reparations for victims, disarmament, and accountability for war crimes: “Without these elements, the deal will not live up to its promises,” he wrote. |

|

Afreximbank appoints new president |

Afreximbank/X Afreximbank/XThe African Export-Import Bank appointed Cameroonian lawyer George Elombi as its next president and board chair. He takes over the reins amidst increased scrutiny over the lender’s approach to development financing. Elombi, who has been at Afreximbank since 1996, succeeds Nigerian banker Benedict Oramah who has overseen the bank since 2015, in two five-year terms. The last decade has seen Afreximbank expand its lending, with assets rising to $40 billion last year. Before his appointment this past weekend at the bank’s annual meeting in Nigeria, Elombi served as the bank’s most senior executive for governance and legal services At his victory speech on Saturday, Oramah said Afreximbank had chosen to follow “African best practices” in expanding its operations to support Africa’s needs, as against international best practices that had not done much for the continent. But his time at Afreximbank ended with a downgrade by the Fitch Ratings agency that placed the bank at a level above junk. |

|

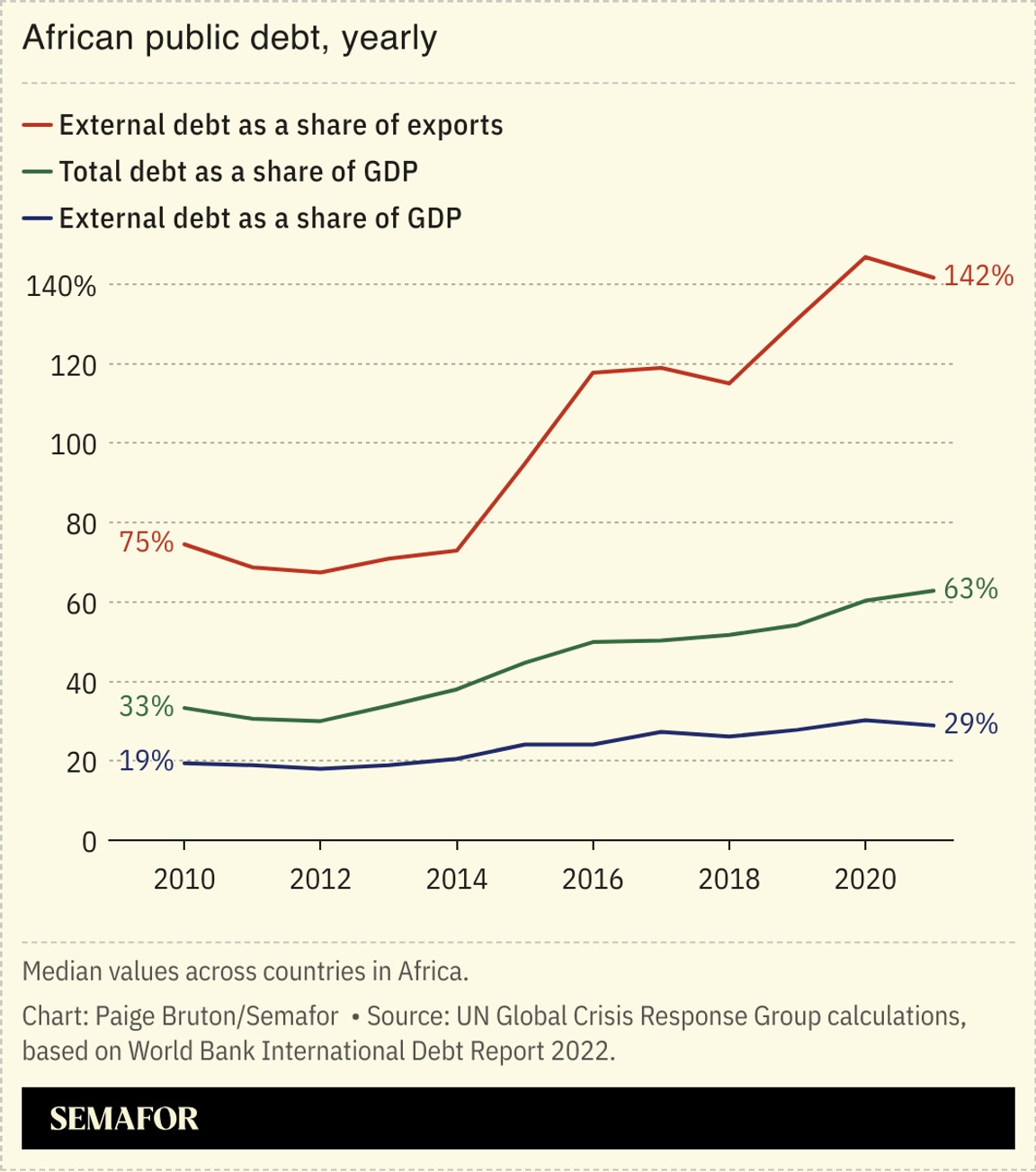

African debt outpaces revenue growth |

African countries are increasingly struggling to pay down their external debt even as their borrowing has grown at a faster pace than most could generate revenue from exports, according to analysis from a UN agency. As a percentage of GDP, external debt rose to around 29% in 2022 from 19% in 2010. But debt growth has seriously outpaced that of export revenue in most countries. External debt nearly doubled as a share of export revenue to 140% in the same period. “The imbalance between debt and exports has made it more difficult for Africa to service its external debt as its ability to obtain foreign currency has grown at a rate lower than its debt-servicing costs,” write analysts at the UN Conference on Trade and Development. Their analysis also showed that 17 African countries had spent more on interest payments to external private creditors than they received in fresh disbursements in 2023. |

|

- June 29 - July 3: The NOG Energy Week conference for the oil and gas industry is held in Abuja, Nigeria.

- July 2: India Prime Minister Narendra Modi to begin Africa tour with a visit to Ghana.

- July 3: Digital Finance Africa conference on fintech to be held in Johannesburg.

- July 3: South Africa publishes data on electricity generated and available for distribution in May

|

|

Business & Macro |

|

|