|

We can't afford to keep cutting taxes for the rich

Trump's "Big Beautiful Bill" is an advanced stage of a disease that took hold long ago.

“I wanted the money.” — Edward Pierce

Donald Trump has done away with much of the Reaganite conservative ideology that defined the Republican party of my youth. But one Reagan tradition remains in place: Every time the GOP finds itself in control of both Congress and the Presidency, they pass a giant tax cut. Bush did this in 2001, Trump did this in 2017, and now Trump is about to do it once again in 2025. Trump’s rather ludicrously titled One Big Beautiful Bill Act is, first and foremost, a tax cut bill. The Economist tallied up the numbers on the version of the OBBBA that just passed the Senate, and found that tax cuts dominated everything else in terms of their impact on the government’s finances:

|

A more detailed breakdown is available from the Committee for a Responsible Federal Budget. The New York Times has found similar numbers for the House version of the bill.

A lot of people are mad about the OBBBA, for many reasons — the health insurance cutoffs, the huge cuts to scientific research, the crazy energy policy, and so on. But really, this bill is first and foremost about tax cuts for the rich.

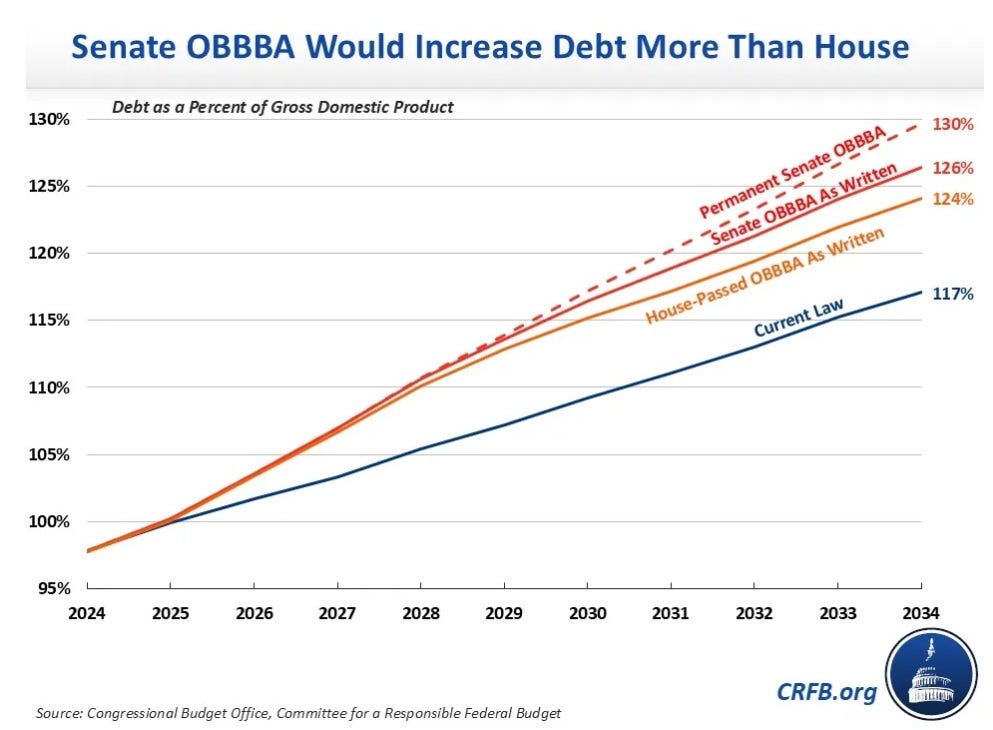

Those new tax cuts will require a staggering amount of government debt. Even with all the money that the OBBBA will cut from Medicaid, energy, and so on, the Senate version will add an estimated $3.9 trillion to the federal debt over the next decade. Federal debt is already on an unsustainable path, but this will get much worse after Trump’s big tax cut:

|

In fact, that’s a low estimate; the truth is probably much worse. As the CRFB points out, Trump’s bill pretends that some of its tax cuts will expire in the future, when in fact they will probably be made permanent. That would raise the debt cost of the bill by an additional trillion dollars or more.

What is the point of borrowing money to cut taxes? Every time they do this, Republicans claim that their tax cuts will supercharge economic growth so much that they’ll pay for themselves, and actually reduce the deficit. And if you go on the White House website, you can still find them making this claim:

MYTH: The One Big Beautiful Bill “increases the deficit.”

FACT: The One Big Beautiful Bill reduces deficits by over $2 trillion by increasing economic growth and cutting waste, fraud, and abuse across government programs at an unprecedented rate….President Trump’s pro-growth economic formula will reduce the deficit…MYTH: “But the CBO says….”

FACT: The Crooked Budget Office has a terrible record with its predictions and hasn’t earned the attention the media gives it. The CBO misreads the economic consequences of not extending the Trump Tax Cuts. The One Big Beautiful Bill delivers real savings that will unleash our economy and prevent the largest tax hike in history, resulting in historic prosperity, while lowering the debt burden.

In the 1980s, you could probably find a few economists who actually believed that tax cuts would pay for themselves. Nowadays, no one really thinks this is true; every big tax cut since the Reagan days has increased the federal debt.

In fact, Trump’s 2017 tax cuts were better in this regard than most. Economists generally agree that corporate taxes are more harmful to the economy than personal income taxes, so when Trump cut the corporate tax rate, some were optimistic. But while Trump’s first tax cut did spur a bit of growth, Chodorow-Reich and Zidar (2024) find that this only offset a tiny amount of the deficit that the tax cut created:

Domestic investment of firms with the mean tax change increases 20% versus a no-change baseline. Due to novel foreign incentives, foreign capital of U.S. multinationals rises substantially. These incentives also boost domestic investment, indicating complementarity between domestic and foreign capital. In the model, the long-run effect on domestic capital in general equilibrium is 7% and the tax revenue feedback from growth offsets only 2p.p. of the direct cost of 41% of pre-TCJA corporate revenue.

This time around, things are likely to be even worse, because of long-term interest rates.

In the late 2010s, for reasons we still don’t entirely understand, America was still in a disinflationary regime, where the Fed could and did keep interest rates at zero without causing inflation. ZIRP meant that big deficits didn’t push up interest rates. Since the pandemic, however, America has been in an inflationary regime, where the Fed has had to keep interest rates around 4-5% in order to prevent inflation from rising. In other words, it looks like interest rates have normalized, and that means there are probably no more free lunches.

There are basically three ways that increased debt can make long-term interest rates rise.

First, more government borrowing can increase inflation. People may assume the government will print money in order to help pay off the debt in the future. This can become a self-fulfilling prophecy, where businesses raise prices in order to get ahead of the inflation — thus causing the very inflation they feared. In this case, the Fed will have to hike short-term rates in order to squash inflation, and raising short-term rates causes long-term rates to rise as well.

Second, higher deficits can crowd out private investment. If banks and bond investors have only a limited amount to invest, then higher government debt can starve the private sector of capital, forcing everyone to pay higher interest rates in order to borrow.

Finally, higher deficits can introduce a default risk premium into long-term interest rates. Investors may assume that the government’s reckless borrowing is a sign that it doesn’t take its own future solvency seriously. At that point, they may start charging the U.S. government a premium to borrow money. If that happens, private businesses have to pay higher rates too.

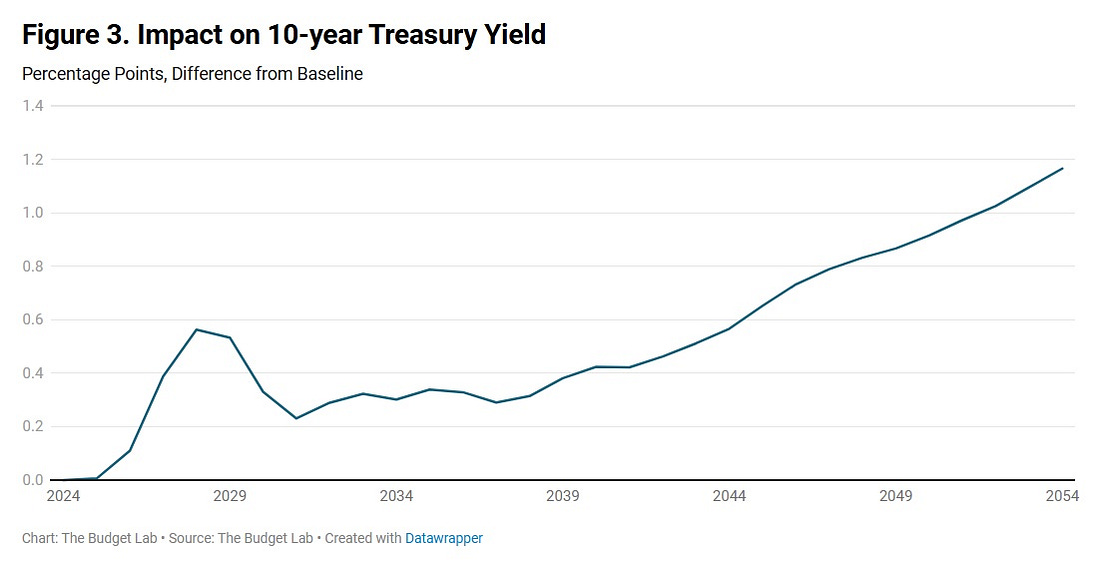

The Yale Budget Lab thus predicts that Trump’s OBBBA will cause long-term rates to rise: