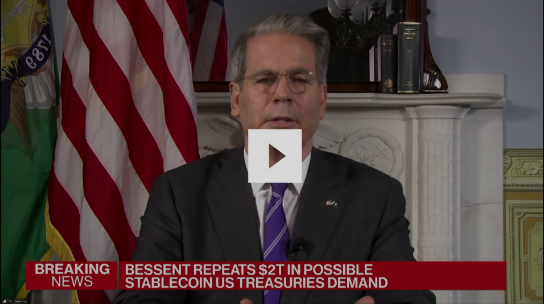

| Russia unleashed a record air strike on Ukraine with 550 drones and missiles overnight, as US President Donald Trump said he was “very disappointed” over his latest phone call with Vladimir Putin aimed at bringing an end to the war. “I don’t think he’s looking to stop and that’s too bad,” Trump said, adding that he plans to talk to Ukrainian President Volodymyr Zelenskiy today.  People shelter in a subway station in Kyiv overnight. Photographer: Barbara Wojazer/AFP/Getty Images Trump said his administration will start sending letters to trading partners today setting unilateral tariff rates that countries will have to begin paying on Aug. 1. Japanese Prime Minister Shigeru Ishiba pushed back against the idea there’s been little progress in its negotiations with Washington, while Vietnam’s US trade deal includes a differentiated tariff schedule that will put pressure on its companies to move up the value chain. China intends to shorten a two-day summit with EU leaders planned for this month, in the latest sign of tension between Brussels and Beijing over issues including access to rare-earth magnets. Read our dispatch from Australia here on how countries are trying to reduce reliance on China for critical minerals such as antimony, used in munitions, semiconductors, solar panels and batteries. The UK’s Labour government has endured a sometimes-farcical few weeks, with a series of U-turns that may distract voters from any underlying improvements in everyday British life. On the one-year anniversary of the party’s thumping election victory, we use analysis from Bloomberg Economics to mark the progress on Prime Minister Keir Starmer’s economic targets and promise of “national renewal.” Trump secured a sweeping shift in US domestic policy as the House passed a $3.4 trillion fiscal package that extends the tax cuts implemented in his first term and allocates billions of dollars to defense and immigration enforcement, while slashing funding for health-care programs, food assistance and clean-energy projects. Check out here who won and lost in the legislative centerpiece of the president’s agenda. US Treasury Secretary Scott Bessent dismissed the idea that the dollar’s recent declines raise concerns about its status as the world’s key currency, telling Bloomberg TV that Trump’s tax bill is “setting the stage for economic growth.”  WATCH: Bessent discusses the dollar’s status. The US took fresh steps to restrict the trade of Iranian oil, keeping up pressure on Iran even as Trump signaled possible relief after bombing its nuclear facilities. Ever since BRICS was founded more than a decade ago, it has struggled to identify a common purpose but Trump’s trade-tariff onslaught may have solved that problem. Read our preview here of this weekend’s summit of the group of emerging-market nations in Rio de Janeiro. US-Colombia relations further deteriorated yesterday, with both sides recalling their top envoys amid deep divisions over trade ties and migrant policy. In our selection of Bloomberg Weekend Reads, Anne-Marie Slaughter explains how the US lost its moral footing, and Filipe Campante and Raymond Fisman look at how rising political polarization in the US has turned institutional strengths into vulnerabilities. Richard Frost argues that while Hong Kong has undeniably changed, the former British colony is not just another Chinese city. On the latest episode of the Trumponomics podcast, we explore the potential for collateral damage from the president’s immigration crackdown and whether there will be an upside in the longer term for US-born workers. Listen on Apple, Spotify, or wherever you get your podcasts. |