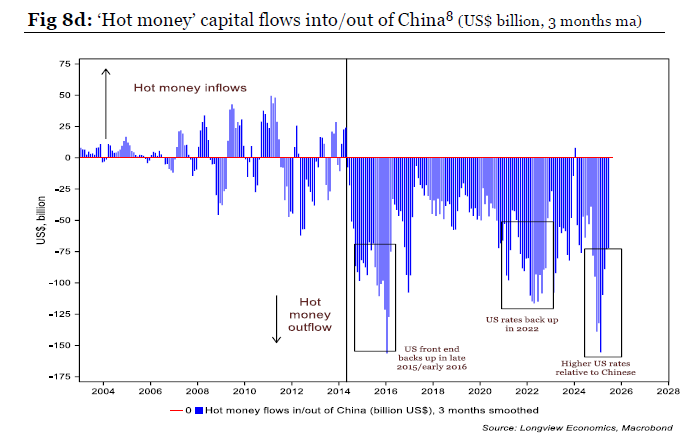

| China’s post-pandemic growth story remains lethargic, and its contentious relationship with the US doesn’t help. Few China watchers believe that Trump’s scheduled call with President Xi Jinping on Friday, arranged after two days of trade talks in Madrid, will change the balance between the two superpowers. And yet there’s no discernible effect on China’s markets. Stocks, labeled uninvestable in the West as Xi started to clamp down on the private sector in 2021, hit bottom almost exactly a year ago, when reports of a new stimulus campaign began to emerge. They’ve gained about 50% since then, with both international and domestic investors getting involved. There’s a long way to go, but it looks like the trough is in: Chinese long-bond yields had been falling precipitously as the narrative of a Japanese-style slowdown took hold. Thirty-year yields are, remarkably, above those of Japan. But they have stabilized and risen a bit over the last few months. The market seems to think the new reality is adequately priced: This has happened even though there is still little sign that the big problems in the US-China trading relationship can be overcome. Firstly, there is Beijing’s adverse antitrust findings against Nvidia Corp., which are likely to irk Washington. China’s State Administration for Market Regulation ruled that the US chipmaker violated antitrust regulations in its acquisition of networking gear maker Mellanox Technologies Ltd. This contrasts with Washington’s agreement with Beijing on a framework to keep TikTok operational in the US. Friday’s call will likely offer clarity on the deal. Despite Trump saying his relationship with Xi is “a strong one,” the latest overtures at best maintain an awkward status quo. Late July’s 90-day tariff pause, which expires in mid-November, could see a return of reciprocal levies imposed on Beijing in April, reigniting trade tensions. For Beijing, the reality of modest gains from painstaking stimulus measures shows that it cannot rely on the US to dig it out of the quagmire. If the property slump-induced economic slowdown was disquieting, the latest data on factory output, retail sales and investment point to an across-the-board deceleration and offer no comfort. Nevertheless, Harry Colvin of Longview Economics argues that the case for a cyclical recovery remains intact. He notes that Beijing’s ongoing monetary expansion and fiscal support is approaching levels consistent with prior stimulus phases that led to economic rebounds. The People’s Bank of China is on course to reduce its interest rates once the Fed has moved. Any potential monetary policy loosening makes it easier for Beijing to meet its 5% growth target. A rate cut would also battle persistent deflation and a slowdown in private-sector loan growth. Typically, during Fed loosening cycles, Colvin argues that “hot money flows” switch back into China, providing a leeway for reciprocal policy easing as illustrated in this Longview Economics chart:  The latest depressed data suggests the chance of an imminent, meaningful fiscal-policy response. So far, the pivot to “whatever it takes” has not yielded any drastic intervention. Instead, Bob Elliott of Unlimited Funds explains that the “anti-involution” campaign, an effort to prod manufacturers in over-competitive sectors to curb price cuts and avoid deflation, has changed from stability (via building excess capacity) to more prudent investment. That is a successful supply-side measure. Meanwhile, Gavekal Research shows that the demand-side remains weak despite attempts to jump-start consumption: According to Elliott: The ripple effects of the abrupt slowing of investment as a growth engine are becoming clear, driving a clear slowing across the economy that appears to be picking up momentum. Without a meaningful shift in policy stance, the economy is set to clock its worst quarters since Covid.

Is there a chance of a turnaround? Gavekal Research’s Wei He believes so as constraints on infrastructure spending should ease with more funding becoming available for localities. But if the investment pullback isn’t a statistical mirage, it will start to derail output: While the outlook is thus uncertain, real economic growth remains broadly in line with the full-year target of around 5%. GDP growth reached 5.3% in the first half of 2025, and the July and August data are consistent with 4.6-4.8% growth. Officials will probably introduce more incremental measures in the coming months to ensure that they reach the target.

Unless growth takes a sharp turn lower, policymakers see little reason to juice demand. Years of muted responses — which have co-existed with growth that remains on target — suggest that the era of big stimulus packages is over. If anything, Beijing’s campaign against involution shows it prefers short-term restraint in the service of longer-term stability. -- Richard Abbey |