| | Donald Trump cheers the “end of war” in Gaza, the AI infrastructure economy booms, and Temu sees mas͏ ͏ ͏ ͏ ͏ ͏ |

| |   MOSCOW MOSCOW |   SHARM EL-SHEIKH SHARM EL-SHEIKH |   SHANGHAI SHANGHAI |

| Flagship |  |

| |

|

The World Today |  - Trump cheers Gaza peace

- Reshaped MidEast order

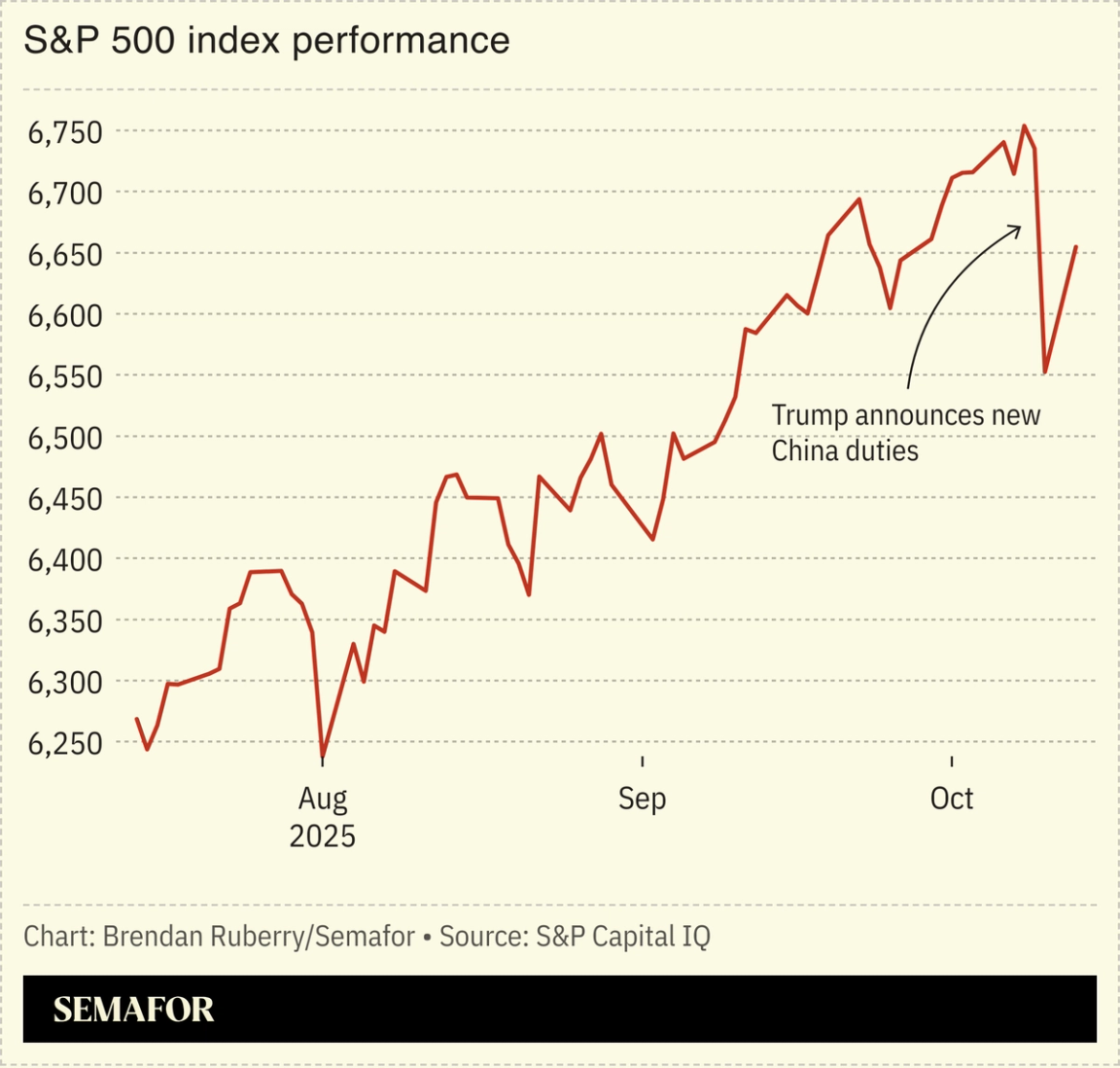

- US stocks bounce back

- Europe-China tech tensions

- Temu’s EU growth

- AI infrastructure economy

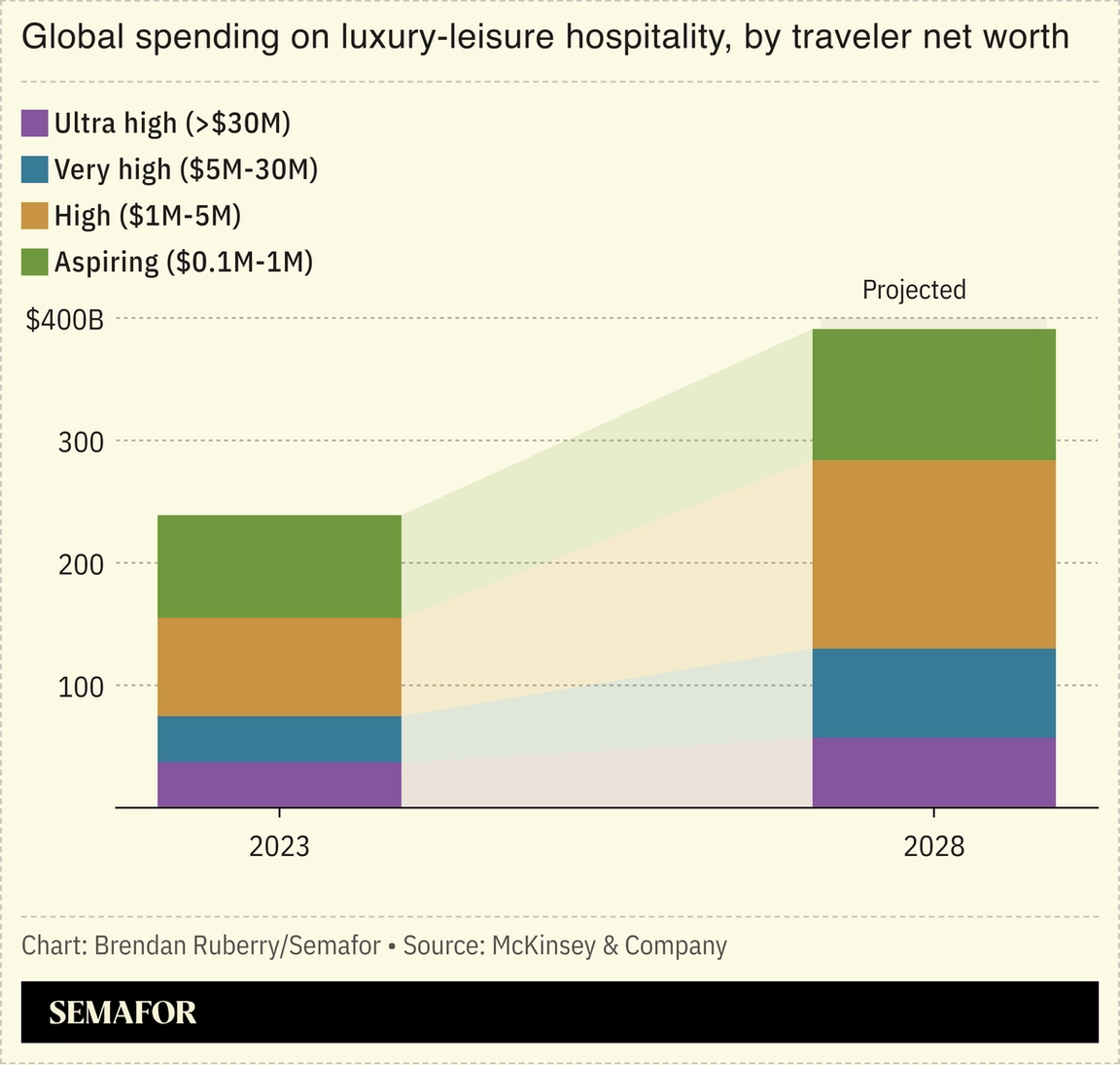

- Luxury travel is up

- Defenestration in Moscow

- Julia Roberts movie debate

- World’s oldest chess player

Celebrating the anonymous artisans of ancient Egypt, and Semafor’s tech editor on the distinction between the AI boom and the dot-com bubble. |

|

Trump signs Gaza peace deal |

Suzanne Plunkett/Reuters Suzanne Plunkett/ReutersUS President Donald Trump celebrated the “end of war” in Gaza on Monday as he addressed leaders in Israel and Egypt, capping a whirlwind 24 hours in the Middle East that saw all living Israeli hostages return home. Israel also released nearly 2,000 Palestinian prisoners as part of the Gaza ceasefire deal, which Trump formally signed alongside Gulf and Arab leaders at a summit in Egypt. While Trump cast the deal as a precursor to a broader reshaping of the MidEast, Israel and Hamas disagree on fraught issues like the governance of Gaza and Hamas’ potential disarmament. Trump also hasn’t addressed the larger regional divisions on “a pathway to a two-state solution,” one analyst told The Washington Post. |

|

Ceasefire alters MidEast dynamics |

Stoyan Nenov/Reuters Stoyan Nenov/ReutersRegardless of where Gaza peace talks go from here, the US-brokered ceasefire deal reshapes the power dynamics in the Middle East and the calculus of regional forces, analysts said. As Hamas returned all living Israeli hostages — a major turning point after two years of war — the group also gave up its only leverage for maintaining relevance in MidEast diplomacy, Eurasia Group’s Ian Bremmer said. Hamas “didn’t have a lot to fight with,” he noted, and was under pressure from all sides to accept the deal. The message to Hamas from the mediators was effectively, “Put your faith in Trump’s plan or face endless war,” The Wall Street Journal wrote. |

|

US stocks bounced back Monday on signs that Washington’s trade tensions with China were easing, coupled with deescalation in the Middle East. Following Wall Street’s worst selloff since April on Friday, top US officials signaled openness to a trade deal with Beijing to resolve a fresh spat over rare earth exports. Optimism over a permanent peace in Gaza following a landmark ceasefire deal also buoyed global markets as traders reassessed the geopolitical risk premium that has dominated sentiment. Wall Street is confident heading into earnings season, as the big banks begin reporting Tuesday: A rebound in dealmaking has boosted bank stocks, but thorny issues like AI spending and tariffs will loom over the corporate reports, Bloomberg wrote. |

|

Dutch take control of Chinese chip firm |

Nexperia production in Hamburg, Germany. Fabian Bimmer/Reuters Nexperia production in Hamburg, Germany. Fabian Bimmer/ReutersThe Dutch government took control of a Chinese-owned chipmaker, a rare intervention that threatens to escalate tensions between Beijing and the West over access to critical technologies. Citing national security concerns, the Netherlands said it was worried about Nexperia possibly transferring tech to its Chinese parent company, Wingtech, which in response accused the Dutch government of “geopolitical bias.” Wingtech is already on a US blacklist amid broader pressure aimed at curbing Beijing’s tech advances. The Nexperia takeover, which sparked speculation about possible Chinese countermeasures aimed at Dutch firms, is an “escalation of an existing trend,” with governments pressuring companies to unravel assets deemed geopolitical risks, the Financial Times wrote. |

|

Temu’s dramatic EU growth |

Adek Berry/AFP via Getty Images Adek Berry/AFP via Getty ImagesChinese e-commerce giant Temu more than doubled its EU profits last year, new filings show, netting $120 million despite employing only eight local staff. The platform’s astronomical growth reflects the increasingly global ambitions of Chinese-owned online shopping marketplaces: JD.com launched a retail platform in London this year, and TikTok Shop similarly stepped up its European presence. Those plans have taken on greater urgency after the US ended its de minimis loophole that allowed low-value packages to enter duty-free. But the companies are facing heightened scrutiny from Brussels. Temu’s EU operations paid just $18 million in corporate taxes last year, sparking calls for politicians to level the playing field for local retailers. |

|

AI build-out reshapes economy |

AI infrastructure spending is becoming a global economic force as tech companies hunt for energy to run data centers. OpenAI, which is spending more than $1 trillion on chip and data deals, unveiled an agreement with Broadcom on Monday to co-design custom chips, a first for the startup. Brookfield Asset Management launched its new AI infrastructure strategy, investing $5 billion into a fuel cell firm that powers data centers: US electric companies are expected to spend more than $1.1 trillion over the next five years as AI demand grows. Even as some analysts warn of a bubble, global dealmaking is heating up. There have already been 162 data center M&As this year, worth more than $46 billion. |

|

Travel boosts luxury sector |

Economic uncertainty has led to a decline in luxury purchases, but luxury travel is on the up. Spending on high-end shoes and handbags is down, thanks to China’s slump and the West’s cost-of-living crisis. Analysts expected the travel industry to be hit similarly, with trade wars and geopolitical tensions leaving consumers feeling anxious. But big spenders have propped up the market: First-class flight sales are up 20% year-on-year, and luxury hotel bookings are outpacing last year’s numbers as spending has shifted from goods to experiences. The risk for the travel industry, The Economist wrote, was that it makes the same mistakes as fashion houses, wooing “aspirational,” i.e. less rich, customers who are vulnerable to economic downturns. |

|

Carlos Cuerpo Minister of Economy, Trade and Business, Spain; Mohammad Nidal Al-Shaar, Minister of Economy and Industry, Syria; Kyriakos Pierrakakis, Minister of Economy and Finance, Greece; Dr. Kamau Thugge, Governor, Central Bank of Kenya; and Pierre Wunsch, Governor, National Bank of Belgium, will join the stage at the Fall Edition of Semafor’s World Economy Summit. Hosted in the Gallup Great Hall and spanning eight sessions over two days, the summit will feature on-the-record interviews on the state of global growth and finance, AI advancements, powering global energy needs, and the forces reshaping the world economy. Each session brings together the leaders and forces most directly shaping the global economy, with programming powered by Semafor’s world-class editorial and executive leadership.

|

|

Ex-Pravda publisher dies in window fall |

|

#MeToo politics in ‘After the Hunt’ |

Amazon MGM Studios/YouTube Amazon MGM Studios/YouTubeCommentators blasted a new psychological thriller starring Julia Roberts that centers on the fallout of the #MeToo movement. Luca Guadagnino’s After the Hunt is about possibly made-up sexual abuse allegations on a college campus, a premise that feels dated, The New York Times’ Michelle Goldberg argued, because taking on progressive university students no longer seems “like a brave provocation.” The movie does, however, inadvertently reveal the “seething resentments that helped set the stage for today’s right-wing crackdown,” she wrote. Rolling Stone agreed: The notion that cancel culture has gone too far and young people have it too easy “are not new ideas.” After the Hunt “would have been a great movie in 2016,” Slate wrote. |

|

|