| Read in browser | |||||||

Good morning, it’s Carmeli from a warm Sydney here to bring you all the latest news. Today’s must-reads:

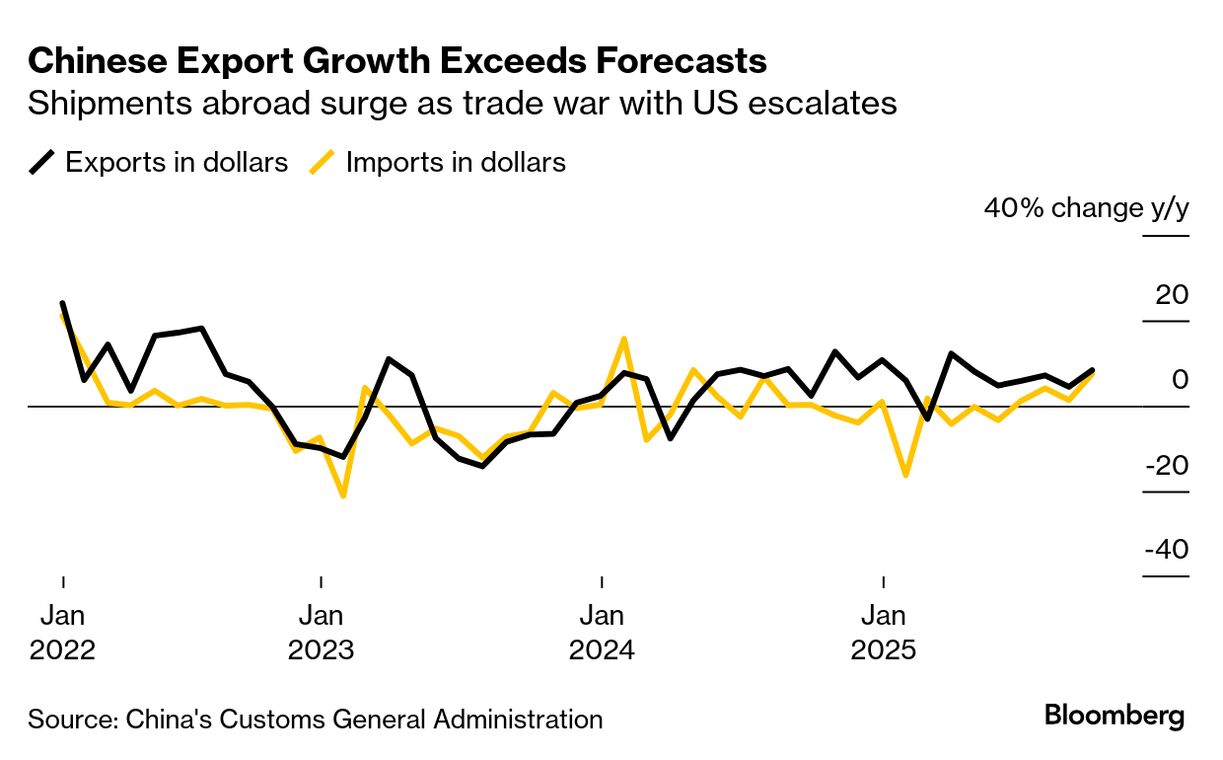

What’s happening nowANZ Group will halt its stock buyback and add more bankers as part of a push to lift performance under a wider overhaul of the Australian lender. It will target a return on tangible equity toward 12% by 2028. In a call with investors, newly-installed CEO Nuno Matos said he generally dislikes consultants, but realizes they are a necessity in some cases, days after hiring a senior McKinsey & Co. partner to run a key division. The stock climbed 3.3%.  Matos. Photographer: Paul Yeung/Bloomberg Shares in Treasury Wine Estates dropped to a 10-year low after the Australian vintner scrapped its earnings guidance for the 2026 financial year and paused a planned share buy-back due to uncertain outlooks in two of its major markets. Treasury, Australia’s largest listed winemaker and creator of the iconic Penfolds brand, cited lower-than-expected stock depletions in China. Australia’s government has rolled back some of the most contentious elements of a planned tax on large pension balances after the proposal drew heavy criticism. Meanwhile, a report from the Australian Securities and Investments Commission found that Australia’s pension funds aren’t providing members with enough guidance and information to help them retire confidently. Across the ditch, New Zealand’s decision to set a less ambitious methane emissions reduction target sets a worrying precedent that other nations may follow, scientists have warned. The government yesterday said it will target reducing methane emissions by 14-24% from 2017 levels by 2050, much less than its previous aim of a 24-47% reduction. Australia’s dollar led a rebound in risk-sensitive currencies on Monday as US President Donald Trump’s more conciliatory rhetoric toward China boosted investor sentiment and crimped demand for haven assets.  What happened overnightHere’s what my colleague, market strategist Mike “Willo” Wilson says happened while we were sleeping… Much of what was sold on Friday was bought back Monday, including stocks, Aussie, kiwi and even the dollar. Investors chose to look beyond the recent China-US drama amid expectation it too shall pass ahead of a meeting between Trump and Xi at the end-of-month APEC summit. Australia has some business data before a fly-on-the wall report in the form of the RBA’s September meeting minutes. New Zealand card spending data won’t move any FX or interest rate dials. ASX futures point to a firm opening in local equities. Trump and Chinese leader Xi Jinping’s latest tit-for-tat showdown has both countries claiming the ball is now in the other’s court, with the clock ticking toward another escalation in import tariffs. Chinese markets displayed surprising resilience in the face of escalating trade tensions, underscoring how investors have grown accustomed to the trade spat between Washington and Beijing.  Rare earth stocks extended recent gains as fresh tensions between Beijing and Washington over China’s exports of the critical minerals fueled bets on alternative suppliers. On Monday, Arafura Rare Earths, which is developing a rare earths mine in Australia’s Northern Territory, rose as much as 27% to its highest level in more than two years. Lynas Rare Earths, already a key global producer, climbed as much as 8.5%. Meanwhile, Trump pressed world leaders gathered at a summit on Gaza’s future to ensure the US-led truce between Israel and Hamas turns into a lasting peace, hailing the agreement as a “new beginning” for the war-torn region. Read our explainer on what Trump’s Gaza peace plan promises. What to watch

One more thing...Even as Israel’s war against Hamas raged in Gaza, foreign tourists kept flocking to Egypt’s most famous beach resort less than 250 miles south on the Sinai peninsula. But on Monday, the two-year conflict finally prompted vacationers in Sharm El-Sheikh to stay indoors — albeit for a positive reason. A virtual lockdown gripped the city as dozens of world leaders flew in to attend a landmark summit chaired by the US president and his Egyptian counterpart, Abdel-Fattah El-Sisi.  A billboard with images of Donald Trump and Abdel Fattah al-Sisi on an empty highway near the congress centre in Sharm el-Sheikh, on Oct. 13. AFP Follow us You received this message because you are subscribed to Bloomberg’s Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|