| | Across the political spectrum, blame is falling on data centers.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Common enemy on power prices

- MDBs’ climate wobble

- Aramco’s AI vision

- Energy access slows

- Battery revolution

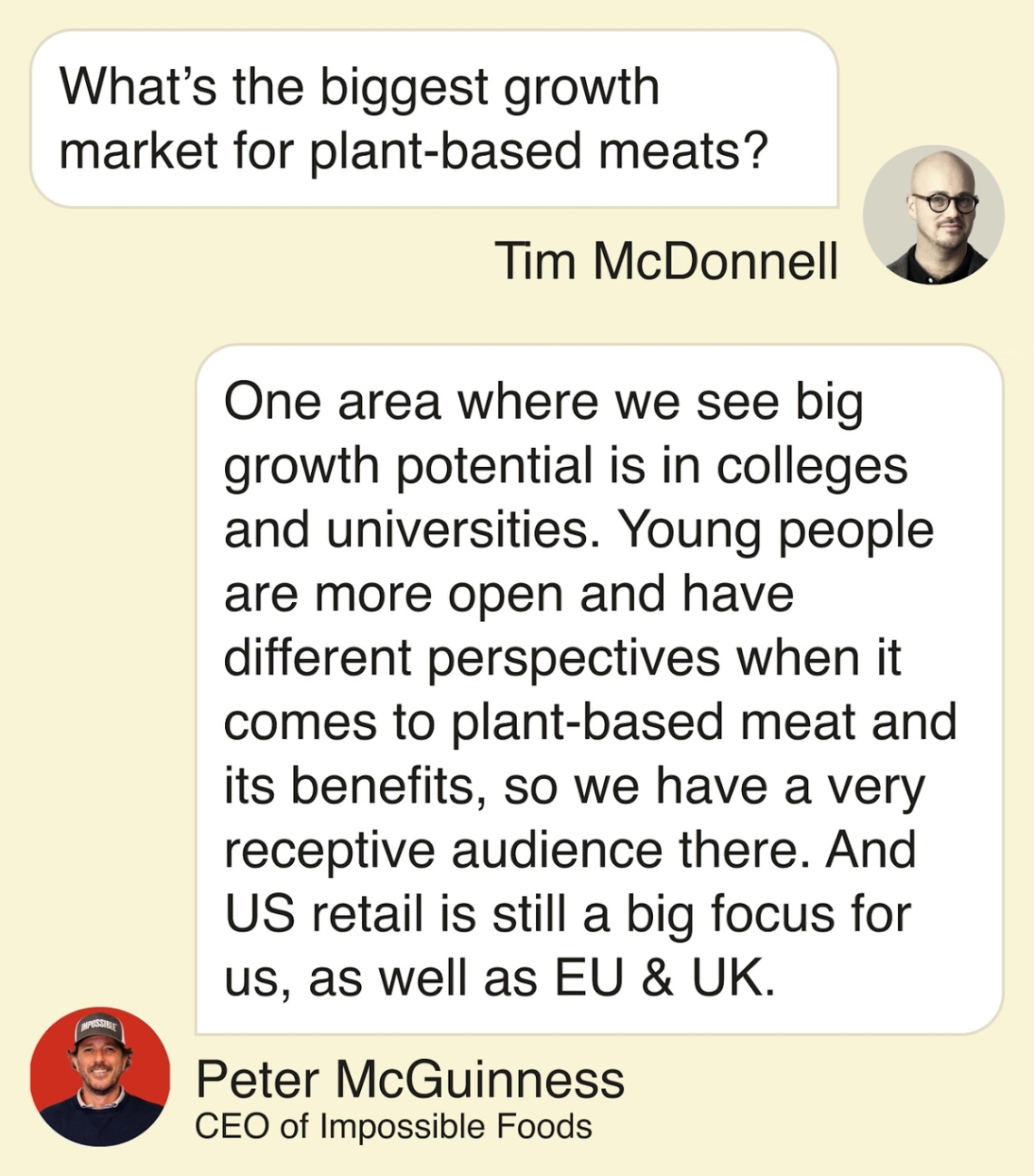

Fake meat’s coming college campus takeover. |

|

Welcome to Semafor Energy. In case you missed last week’s issue: We’re doing a bit of a rebrand here. The new title will help us focus even more on the storylines that have always been our core offering, and that are still the most important part of the global climate challenge and energy transition. But the basic tone and format, and the scoops and analysis you’re here to find, aren’t going anywhere. I’d love to hear your thoughts on the change, so please drop me a line! In the meantime, I’m in DC this week (hence the late send, my apologies for that) for Semafor’s World Economy Summit this week. Our program for tomorrow is packed with exciting energy conversations, including with: Jarrod Agen, director of the White House National Energy Dominance Council; Peter McGuinness, CEO of Impossible Foods (more from him below); Brian Melka, CEO of the leading energy hardware manufacturer Rehlko; and — in what will be the first royalty to grace my humble pages — Princess Rasees Al Saud, head of investor relations at Saudi Arabia’s Public Investment Fund. If you’re in town, please join us, or follow along on our livestream! If not, stay tuned Thursday for all the scoops and other highlights.

Drop me an email if you have any questions: tmcdonnell@semafor.com → |

|

|

US pols find common enemy |

| |  | David Weigel |

| |

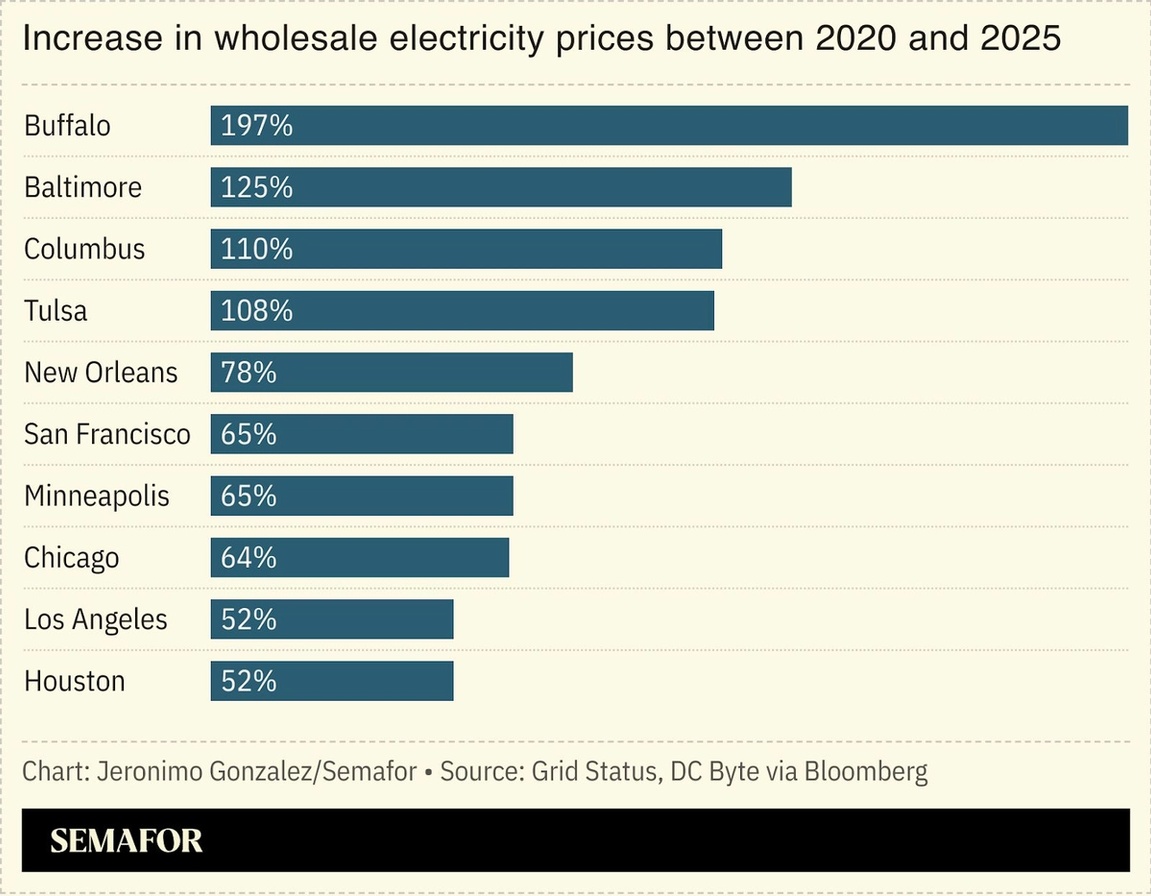

Anger over growing electricity bills in the US caused by the proliferation of AI data centers became a rare rallying point for politicians on both sides of the aisle. The Republican and Democratic candidates in a local Virginia election called for curbs on data center construction, an issue that has become “an overwhelming source of debate,” and could become a flashpoint in statewide races. Energy costs have risen at twice the rate of inflation since 2020; the key driver is the aging grid, but data centers are a more politically salient talking point. There is bipartisan support for data centers, so it makes sense that the opposition is bipartisan, too. |

|

I’ll be interviewing Peter McGuinness on stage at Semafor’s World Economy Summit on Wednesday. If you’re in town, please join us, or tune in on our livestream.  |

|

Elizabeth Frantz/Reuters Elizabeth Frantz/ReutersThe gap in global climate finance will be on the table in Washington this week during the fall meetings of the World Bank and IMF, with just a few weeks to go until COP30 in Brazil. Development banks delivered a record $137 billion in climate finance this year, more than half of which went to low- and middle-income countries. But it’s still far short of the $1.3 trillion fundraising goal that was adopted at last year’s COP in Baku. And political headwinds from the US, the World Bank’s biggest shareholder, are gathering force: The Trump administration is pushing the bank to fund more fossil fuel drilling projects, and declined last week to sign a pledge backed by most of the bank’s other leaders to maintain support for climate action. The IMF, too, is restructuring in a way that could undermine its ability to fund energy transition projects. |

|

| |  | Matthew Martin |

| |

Amin H. Nasser, president and CEO of Saudi Aramco, in 2019. Hamad I Mohammed/Reuters. Amin H. Nasser, president and CEO of Saudi Aramco, in 2019. Hamad I Mohammed/Reuters.Fossil fuels, not renewables, will power the surge in electricity demand driven by electric vehicles and data centers, Saudi Aramco CEO Amin Nasser said Monday in his latest broadside at the renewables industry. “While the icons of the transition are still clearly stuck in first gear, hydrocarbons are largely carrying the extra load,” Nasser told an industry conference. “This is not a true energy transition; it’s an energy addition.” He warned that a power “demand tsunami” from AI and EV growth is forcing governments to backtrack on climate goals. Separately, Aramco has put three domestic chemicals plants on hold as it shifts capital spending toward expansion in Asia, Bloomberg reported. The plants in the kingdom were designed to convert crude oil directly into chemical products. Those projects were at earlier stages than the ones in Asia, and the company has been borrowing to cover its huge dividends — mostly to the Saudi government — amid lower oil prices. |

|

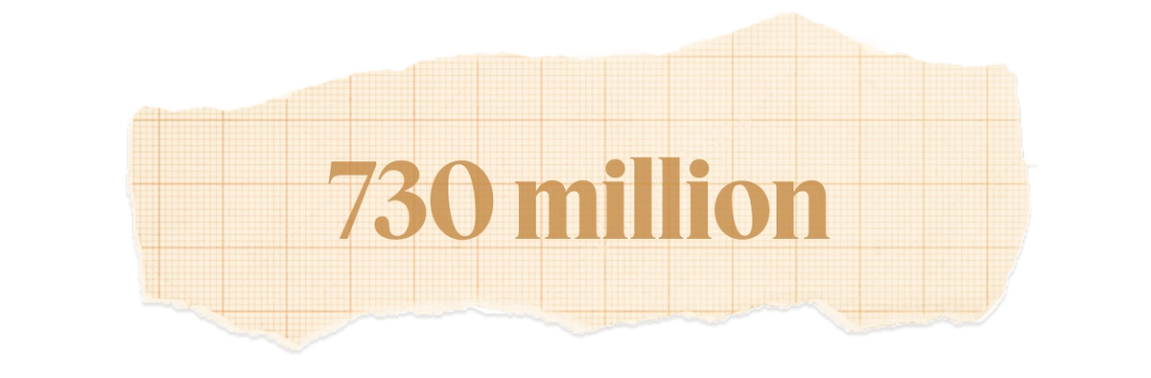

Number of people worldwide who lacked access to electricity in 2024, the International Energy Agency reported. That’s about 11 million fewer than in the previous year. But the annual rate of improvement is slowing, a sign that the easiest relative gains have already been made and that, as the IEA put it, “progress remains fragile.” Of those 730 million people, 80% are in sub-Saharan Africa. High sovereign debt loads, and the pullback of international aid, are impeding progress. |

|

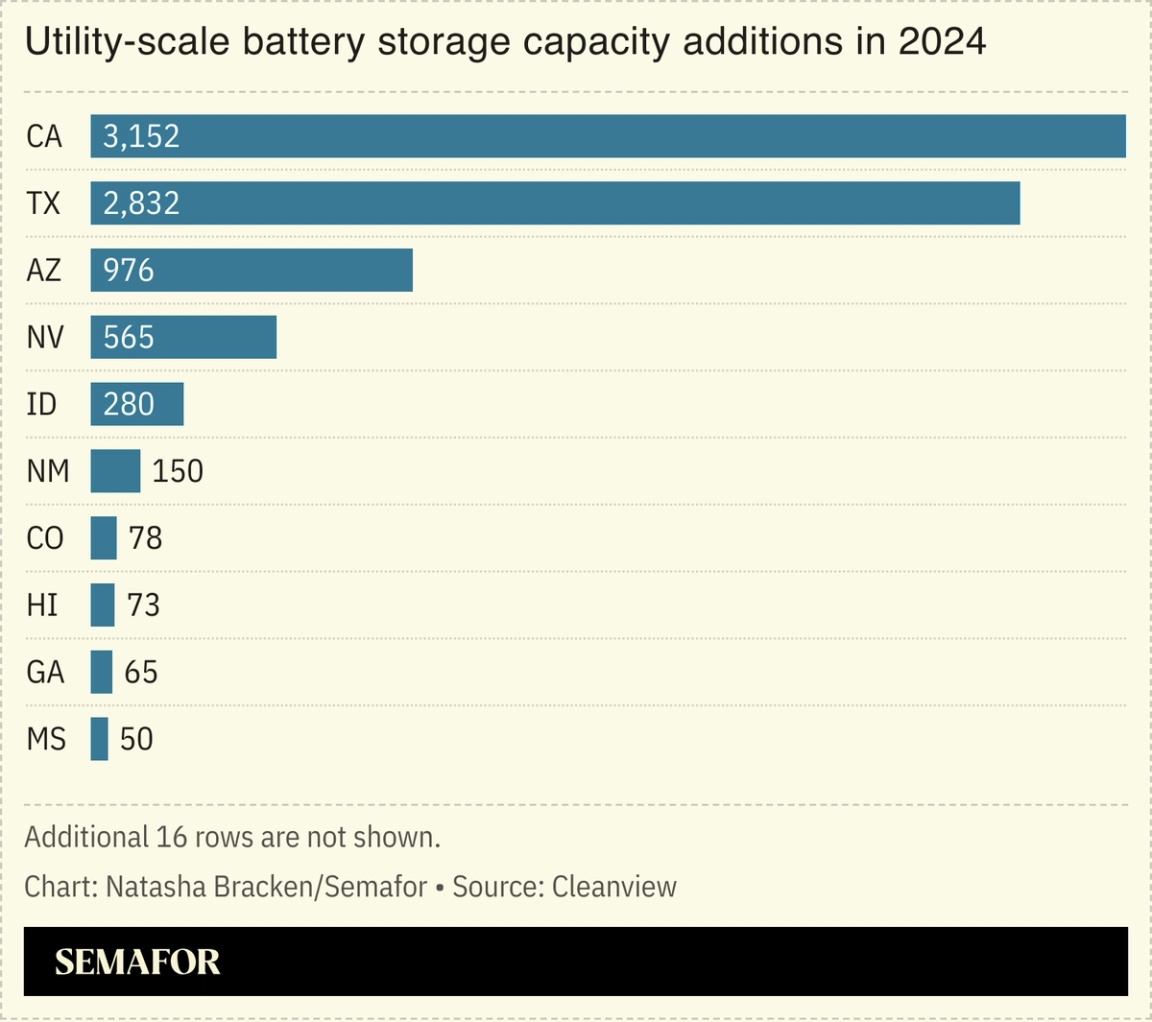

California has become a hub of the global battery storage revolution. Following a blackout in 2020 — caused by a grid shutdown during a heatwave after solar output failed to meet soaring AC demands — the state invested hugely in giant batteries. Capacity has tripled to 13 gigawatts, enough to power nearly 10 million homes, with a further 8.6 GW planned by 2027. Now, daytime solar energy is stored and discharged in the evenings, smoothing out supply. Global battery capacity is expected to rise 67% this year and tenfold by 2035, the Financial Times reported, driven by increased electricity demand, particularly for data centers, and the plummeting costs of the technology: Lithium-ion batteries have dropped 90% in price since 2010. |

|

New Energy- Ørsted announced it would cut about a quarter of its workforce as the wind company shifts its focus toward Europe following setbacks in the United States during the Trump administration.

- Ming Yang, one of China’s largest turbine makers, announced plans to invest up to £1.5 billion in a Scottish turbine factory.

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersFossil Fuels- The Department of Energy plans to distribute most of the $625 million allocated for coal investments through 50% cost-share awards administered by the Office of Clean Energy Demonstrations.

- Venture Global shares dropped nearly 25% on Friday to their lowest level in five months after it lost an arbitration case with BP.

- Sanctions, increased costs, and low prices have led miners and the coal industry in Russia into their worst crisis in decades.

Politics & PolicyPersonnel- FEMA employees who signed an open letter criticizing Trump’s cuts to disaster funding have been pressured by the administration to reveal the names of colleagues who signed the letter anonymously.

|

|

|