| | In this edition, what’s different about the new tech revolution, and behind the scenes in Grindr’s s͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Bessent digs at China

- JPM’s ‘America First’ swing

- Semafor World Economy Summit

- Peace and profit

- Grindr’s natsec snag

- LAT passes the hat

|

|

The AI boom has minted a new crop of fresh-faced celebrities like Sam Altman and Dario Amodei. When I got the tip in January 2023 that Microsoft was investing $10 billion in OpenAI, I had to Google it. Now Altman is a household name. But look across the AI landscape, and the faces are notably wizened. Oracle was born in the floppy-disk era; Larry Ellison made his first billion in 1992. Microsoft invented the operating system before memorably blowing mobile. AMD is three months older than the moon landing, and Intel is only a year younger. Even Nvidia was founded a year before Perplexity’s Aravind Srinivas was born. Altman’s tech origin story is founding a social-media app with a fashionably missing vowel; AMD CEO Lisa Su’s involves loose wires and, later, the world’s top prize in microelectronics. This Space Cowboys vibe makes sense because this tech boom looks less like the last one — social apps powered by subway ads and nap pods — than the 1980s PC revolution, powered by tinkerers with motherboards and soldering irons. Unlike asset-light software unicorns, AI is not infinitely scalable. It scales brutally, and expensively, in a bare-knuckled fight for scarce resources: chips, electrons, export licenses, land, zoning permits, President Donald Trump’s approval. There may be more proprietary value in knowing how to cram GPUs into racks so dense they are cracking data centers’ floors than in writing algorithms, my colleague Reed Albergotti noted recently. And AI’s financial success lies more in selling its products to businesses than to consumers, as so many of last decade’s “Uber-but-for-fill-in-the-blank” startups aimed to do. The real money in AI will ultimately come from corporate users, and the current buildout requires inking deals with suppliers and hyperscalers, CEO to CEO. So perhaps it isn’t surprising to see a generation of enterprise B2B giants on center stage. Whether these experienced hands can keep up with their mad scientists is less clear. But this may be the first tech revolution that doesn’t vaporize the dinosaurs, the way mobile killed Nokia and threatened Microsoft, but grafts their DNA onto something new. And with tech as powerful as AI, the more adults in the room, the better. Speaking of dinosaurs: The hottest tech stock this year isn’t Nvidia, Microsoft, or Meta, but eBay, celebrating its 30th anniversary. My colleague Andrew Edgecliffe-Johnson sat down with CEO Jamie Iannone to talk about it. (Spoiler: There’s a lot of AI.) I’m on my way to Washington, DC, for the fall edition of our World Economy Summit. Read on for my interview lineup and what I’ll be looking to learn. And a programming note: Thursday’s newsletter will be out on Friday, wrapping in the best of our live journalism. You can follow the livestream here. |

|

Bessent jumps into US-China fight |

Leon Neal/Pool via Reuters Leon Neal/Pool via ReutersTreasury Secretary Scott Bessent said China was lashing out with trade restrictions to cover its own economic weakness. The secretary said new restrictions on the sale of critical minerals risked a global slowdown, which China’s export-driven economy can’t sustain. “Maybe there is some Leninist business model where hurting your customers is a good idea, but they are the largest supplier to the world,” Bessent told the Financial Times. “They want to pull everybody else down with them.” The comments, paired with strategic leaks about retaliatory plans, show a reescalation of tensions between the world’s two biggest economies. (One White House advisor recast Trump’s conciliatory post about Xi Jinping as a bit of trolling.) Meanwhile, the US president’s trade war is starting to sting: Goldman estimates that consumers are bearing more than half the costs of tariffs, with US companies shouldering 22% and foreign suppliers eating 18%. The last 5%? Evaded. |

|

JPMorgan joins White House movement |

Shannon Stapleton/Reuters Shannon Stapleton/ReutersAs the bank lobby gets outmuscled by crypto in Trump’s Washington, the dean of the banking bar is taking matters into his own hands. JPMorgan’s “Security and Resiliency Initiative”, which will aim to invest $10 billion into sectors key to US national security, has the feel of banks’ pre-Trump commitments to ESG financing, updated for a new political moment. (It’s worth noting that CEO Jamie Dimon was early to jump off the progressive train and expressed support more than a year ago for parts of Trump’s nationalist agenda, particularly its wariness of China.) Dimon and other CEOs have recognized that going direct is the most effective line into a president who’s less in the news flow than he was during his first term. The bank didn’t take explicit direction from the White House on its investment plans, Dimon told The Wall Street Journal, but he hopes “they’ll appreciate this.” |

|

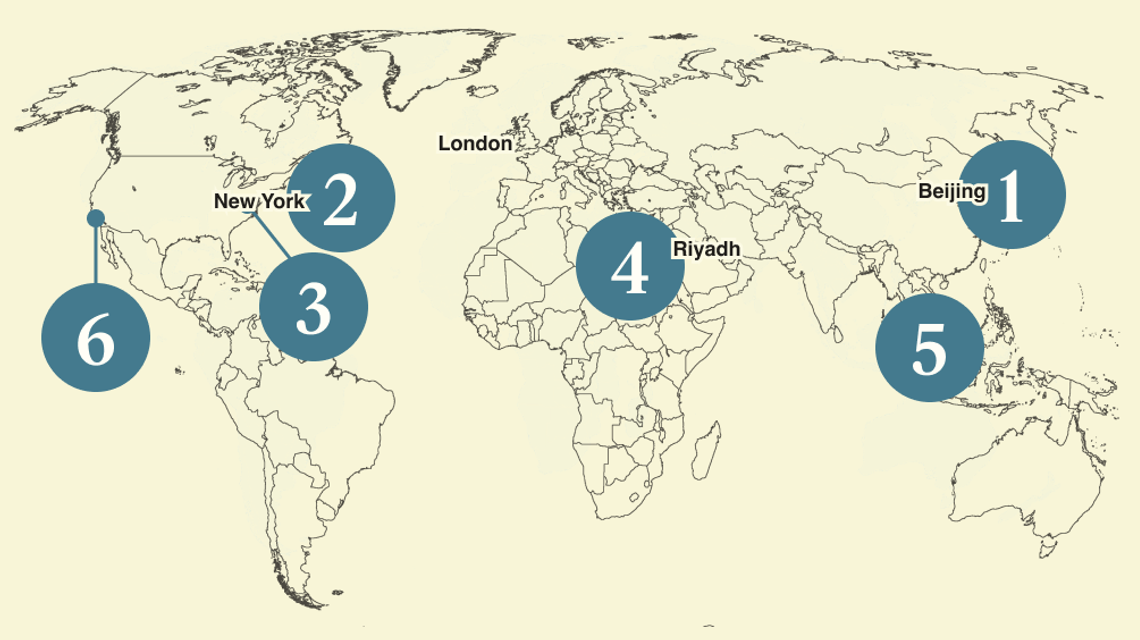

Semafor’s World Economy Summit, fall edition, kicks off tomorrow in Washington, DC. It’s a perilous moment for global policymakers, CEOs, and their customers, and we’ll get into all of it. Here are some of the people we’ll be talking to and what we want to know. You can reply to this email with your questions for our speakers and follow the livestream here. - Federal Reserve Gov. Stephen Miran: Can a politicized Fed do its job fairly?

- Walmart US CEO John Furner: How’s the consumer holding up?

- Goldman Sachs President John Waldron: Are we in an AI bubble?

- NYSE President Lynn Martin: Are betting markets the new stock market?

- PNC President Mark Wiedman: Bank mergers ahead?

- Kraken co-CEO Arjun Sethi: How does the US get on the tokenization wave?

- TWG Managing Partner Amos Hochstein: Who should get America’s best chips?

|

|

President Donald Trump and Sheikh Mansour bin Zayed Al Nahyan, UAE vice president and deputy prime minister. Suzanne Plunkett/Pool/Reuters. President Donald Trump and Sheikh Mansour bin Zayed Al Nahyan, UAE vice president and deputy prime minister. Suzanne Plunkett/Pool/Reuters.Trump’s diplomatic victory lap in Egypt was packed with business undertones, from the Indonesian president’s hot-mic request to meet one of Trump’s dealmaking sons — either would be fine — to a red-carpet moment in which Trump marveled at the Gulf’s “unlimited cash.” Also on hand was Pakistan Prime Minister Shehbaz Sharif, whose country has pitched the US on a variety of deals, from crypto ventures to an Arabian Sea port offering Washington access to critical minerals. (Saudi Arabia sent its foreign minister, suggesting it views the moment’s significance as more political than commercial.) A lasting ceasefire could open the door to Israeli tech firms joining the AI boom in the Gulf, James Stavridis, the former NATO commander and current Carlyle vice chair, told Semafor in June; he’s also bullish on a peacetime Iran. A best-case scenario, he said, looks like “the reconstruction of the Korean peninsula after the end of the Korean War.” The end of hostilities could also revive deals paused during the war, like a joint venture between BP and Abu Dhabi’s national oil company. |

|

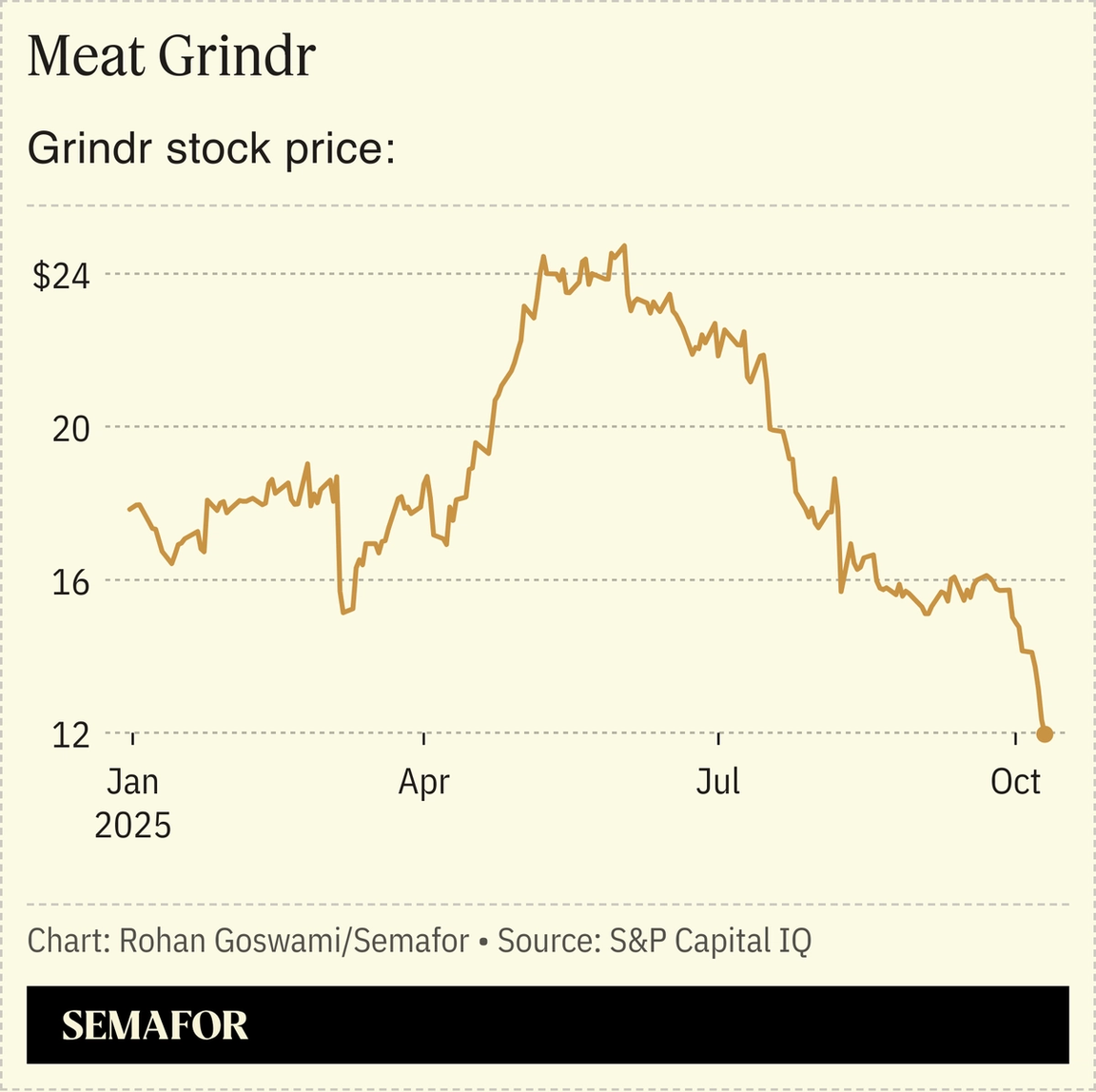

Grindr cornered into buyout talks |

Hookup culture, SPAC hangovers, national security, data privacy, and the corporate world’s debt binge: The fast unfolding problems at Grindr are a mashup of live wires. The app’s controlling shareholders are scrambling to take the company private after a stock slide prompted a lender to call loans backed by their shares, Semafor scooped Monday.  A unit of Singapore’s Temasek seized and sold shares that secured millions of dollars of personal loans to two Grindr insiders, Raymond Zage and James Lu. Boards generally limit executives’ ability to borrow against their stock to avoid exactly this situation, which played out badly at Peloton, Valeant, and nearly Tesla. A sale of Grindr would have national security implications: Its Chinese owners sold it in 2020 after US officials worried about sensitive personal data being used for blackmail. Zage is a US expat turned Singaporean national, and Lu is a Chinese-born US citizen, according to the South China Morning Post. |

|

Mario Anzuoni/Reuters Mario Anzuoni/ReutersThe Los Angeles Times’ private stock sale has all the hallmarks of a scramble for cash. Patrick Soon-Shiong’s media outfit aims to raise up to $500 million ahead of a planned 2027 IPO, pitching itself as a growthy combination of The New York Times, Twitch, and Vice at its peak. Soon-Shiong will take $100 million of the new shares in exchange for forgiving a loan he made to the Times. It’s expensive money — its dividends, if paid in cash instead of the scrip the Times is offering, would have eaten up 15% of last year’s revenue — and a bridge to an IPO that the company isn’t yet ready for: Its skinny and unaudited financials show a $48 million loss in 2024. Supersized pre-IPO rounds followed swiftly by public floats can work, as Ari Emanuel’s Endeavor showed in 2021. But they are high-wire acts that require delicate timing, a good story, and anchor investors, none of which the Times has nailed down. Soon-Shiong also has new competition: California conservatives from Rupert Murdoch’s New York Post, which is looking west. |

|

➚ BUY: Bot. Logitech’s CEO said she’d welcome an AI board member, an anthropomorphic extreme of an idea that recently got the Harvard Business Review treatment. No clarity yet on D&O policy premiums for bots. ➘ SELL: Couture. EU regulators fined Gucci and other luxury brands €157 million ($182 million) for fixing retail prices to protect their own brick-and-mortar stores. |

|

Companies & Deals- Toe stub: Running app Strava is planning to go public, and chose this moment to pick a fight with one of its most important partners, Garmin, whose fitness trackers account for a significant chunk of runners’ data uploads. (A Strava executive’s efforts to explain the lawsuit on Reddit didn’t go well.)

- Shutdown workaround: Corporate-travel firm Navan is advancing its IPO during a government shutdown that has already delayed several listings. It’s using a workaround that exposes the company to later reprimand by the securities regulators, once they’re back on the job.

- On second(ary) thought: Goldman Sachs’s latest acquisition is a play on the brisk trade in startup shares. It’s paying up to $965 million for Industry Ventures, whose 45 employees will join the firm — easily beating the $10 million-per-worker price Evercore paid earlier this year for boutique Robey Warshaw. (Separately, Goldman and JPMorgan both announced strong earnings this morning.)

- Out of juice: GM took a $1.6 billion hit after scaling back its electric-car production plans, a sign of how Trump’s fossil-fuel push has undermined investment playbooks.

Watchdogs- Truth in marketing: The Trump-aligned 1789 investment fund pitched companies on sponsoring an event that was originally billed as an official US Treasury function, but was not, WSJ reported.

|

|

|