| Bloomberg Evening Briefing Americas |

| |

| As far as China is concerned, America started it. Earlier this week, US Treasury Secretary Scott Bessent blamed Beijing for the most recent blowup of ongoing efforts to resolve the trade war triggered by President Donald Trump. On Thursday, it was Wang Wentao’s turn: The Chinese commerce minister said recent escalations are a result of White House actions following talks in Madrid last month, blaming the “intensive introduction of a series of restrictive measures against China” for setting off the current spiral of threats. Shortly after those negotiations led by Bessent and Chinese Vice Premier He Lifeng, the US commerce department widened the application of sanctions to companies affiliated with blacklisted Chinese firms. Beijing has justified its decision to tighten control of rare-earth elements as a defensive reaction, one that’s apparently put the US on the backfoot as Bessent floats trial balloons about a new truce. Whether that cools things down remains an open question. On Thursday, Wang said the US measures “seriously harmed China’s interests and undermined the atmosphere of the bilateral economic and trade talks.” —David E. Rovella | |

What You Need to Know Today | |

| There are more signs of those pesky cockroaches Jamie Dimon warned about. Two regional US banks just disclosed problems with loans involving allegations of fraud, adding to concerns that more cracks are emerging in the credit market. Shares of Zions Bancorp plummeted after it disclosed a $50 million charge-off for a loan underwritten by its wholly-owned subsidiary, California Bank & Trust. Western Alliance Bancorp tumbled as well after it said it’s dealing with a borrower that failed “to provide collateral loans in first position.” Western Alliance also has exposure to the collapse of auto-parts supplier First Brands Group, one of the recent implosions that have investors wondering if a cliff’s edge is near. And even if each of the above credit events is isolated, banks taking losses from bad loans are making headlines more often in the past two months, something that was turbocharged this week by the JPMorgan CEO’s bug alert. After the bankruptcies of First Brands and sub-prime auto lender Tricolor Holdings last month, Dimon’s bank wrote down $170 million and Fifth Third Bancorp wrote down as much as $200 million. | |

|

| As we reported yesterday, Dimon’s foray into entomology earned him pushback from purveyors of private credit, the $1.7 trillion market that’s been all the rage of late. But a group of academics appear to agree that the easy money dreams of private credit are, by and large, exactly that. For the past decade, the private credit industry has ridden high on a swell of inflows built on the premise it will deliver annual returns close to 10% through bear and bull markets, all while keeping defaults and volatility low. But in research published in the Journal of Private Markets Investing, academics contend that the asset class produces limited alpha, or extra compensation over market benchmarks. Claims of market-beating, stress-free returns are “illusory,” said experts from Johns Hopkins University and University of California, Irvine. They argue that direct lenders offer investors marginal returns compared with more transparent and widely-traded leveraged loans—and less in some cases. | |

| |

|

| |

| Video showing heavily armed federal agents firing tear gas toward Chicago residents and city police officers triggered an angry response from a federal judge, the Associated Press reported Thursday. The judge had previously ordered federal personnel engaged in an immigration dragnet wear badges and not use certain riot control techniques against peaceful protesters and journalists. In one video last week, agents atop a federal immigration facility fired a pepper-spray projectile directly at the head of a Chicago pastor as he prayed, knocking him to the ground. A Trump spokeswoman reportedly defended the action. Illinois Governor JB Pritzker praised the judge’s ruling Thursday, in which she ordered a federal official to appear before her and agents wear body cameras. Pritzker told the AP that the government’s statements about arrests and confrontations, including last month’s killing of a suburban Chicago man, have often been false. “They clearly lie about what goes on,” he told the AP. Also on Thursday, a federal appeals court kept in place a different lower court order barring Trump from deploying US soldiers onto Chicago streets. More broadly, the Guardian reported today that a group of more than 300 former American intelligence and national security officials, applying the “same analytic methods used by US intelligence agencies to assess the fragility of democracies abroad,” concluded that there is “moderate to high confidence” that the United States under Trump is moving toward becoming a “competitive” authoritarian state.  Masked agents of the federal government in Chicago this month. Photographer: Octavio Jones/AFP/Getty Images | |

|

| US consumer demand slowed last month. After assessing a broad array of high-frequency spending data such as credit-card borrowing and same-store sales, economists say shoppers dialed back purchases after retail activity. Bloomberg Second Measure, which analyzes credit and debit card data, showed there was less appetite last month for discretionary items such as furniture, electronics and appliances. Credit-card data from Bank of America also shows cooler demand. A CNBC/National Retail Federation Retail Monitor showed that sales slowed on a monthly basis in September but year-over-year increases remain strong, and the Johnson Redbook Same-store Sales Index was up 5.7% in September from a year ago, compared with a 6.3% gain in August. | |

|

| UBS is increasing its scrutiny of sources of client money across its fast-growing Asian wealth hubs, pressing some for greater disclosure as it seeks to avoid further clashes with regulators. Using Deloitte and KPMG to help screen client documentation, the bank is said to be focused on Singapore and Hong Kong for any signs of money laundering. Singapore authorities have sought to enhance rules and scrutiny of financial services firms in the past year following a $2.3 billion money-laundering scandal in 2023 that embroiled local and global banks. Among those banks were Citigroup and UBS. Bloomberg reported today that the alleged head of a Cambodian criminal ring and his associates set up a family office in Singapore that claimed to receive tax breaks, while also building relationships with firms backed by state investor Temasek Holdings and spending millions on properties in the city-state. Chen Zhi, the chairman of Prince Holding Group, heads what US prosecutors say is one of the largest transnational criminal organizations in Asia. He and multiple associates, including three Singapore citizens, were sanctioned by US authorities Tuesday over their alleged involvement in a ring that used cryptocurrency to launder billions generated from online investment scams. | |

| |

|

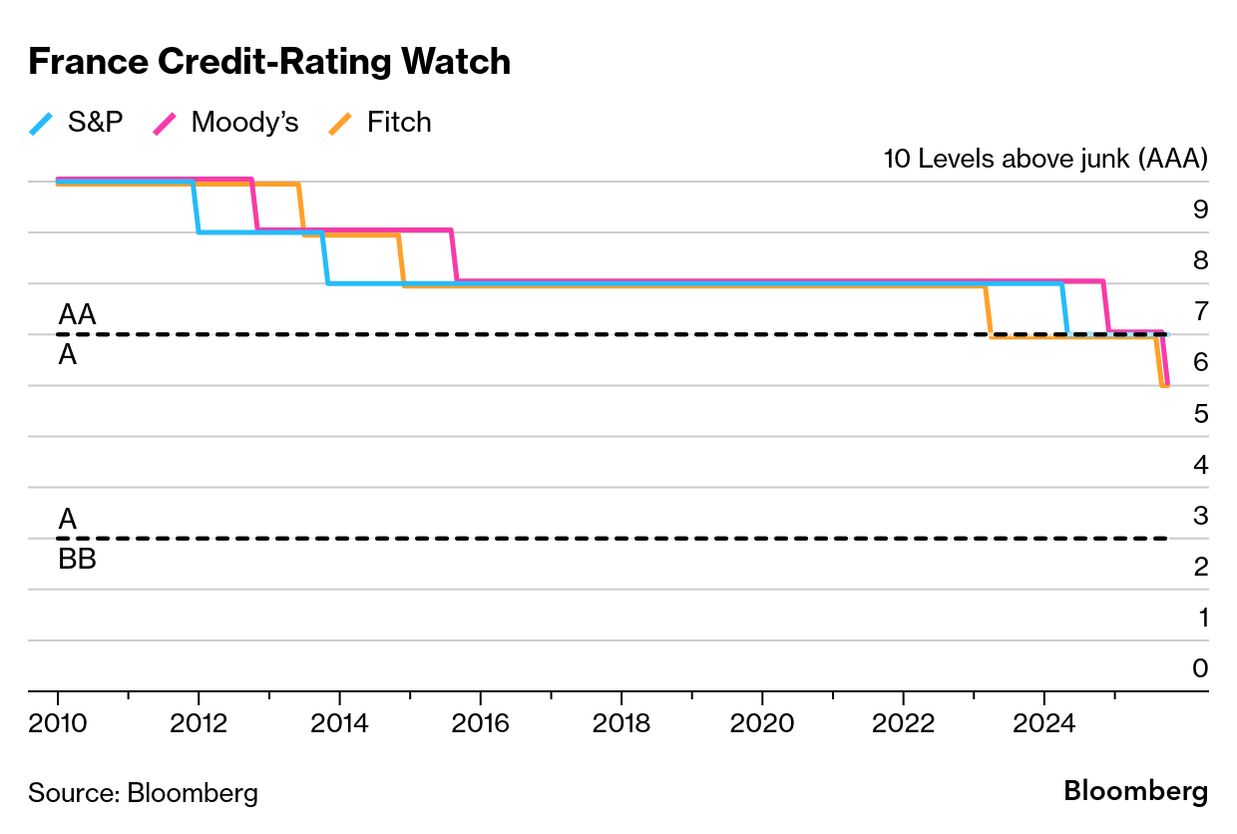

| Maybe twice is the charm. It’s the second time around for Sebastien Lecornu as French prime minister, and on Thursday he survived two no-confidence votes in the National Assembly. So all that’s left for him to do is solve the seemingly intractable problem of the nation’s budget crisis. The 39-year-old premier remains in office thanks to abstentions by most Socialist lawmakers after he bowed to demands that he suspend President Emmanuel Macron’s controversial 2023 pension law. Lecornu’s survival brings some respite from a political crisis that came close to triggering snap elections. Avoiding another government collapse has also reassured investors, bringing down France’s borrowing costs.  While suspending the pension law has brought short-term stability, it comes at a political cost for Macron, for whom the overhaul was an emblem of his pro-business economic policy. It has a financial cost of €400 million ($465 million) next year and €1.8 billion in 2027, according to government calculations. | |

|

| |

What You’ll Need to Know Tomorrow | |

| |