| Read in browser | ||||||||||||||

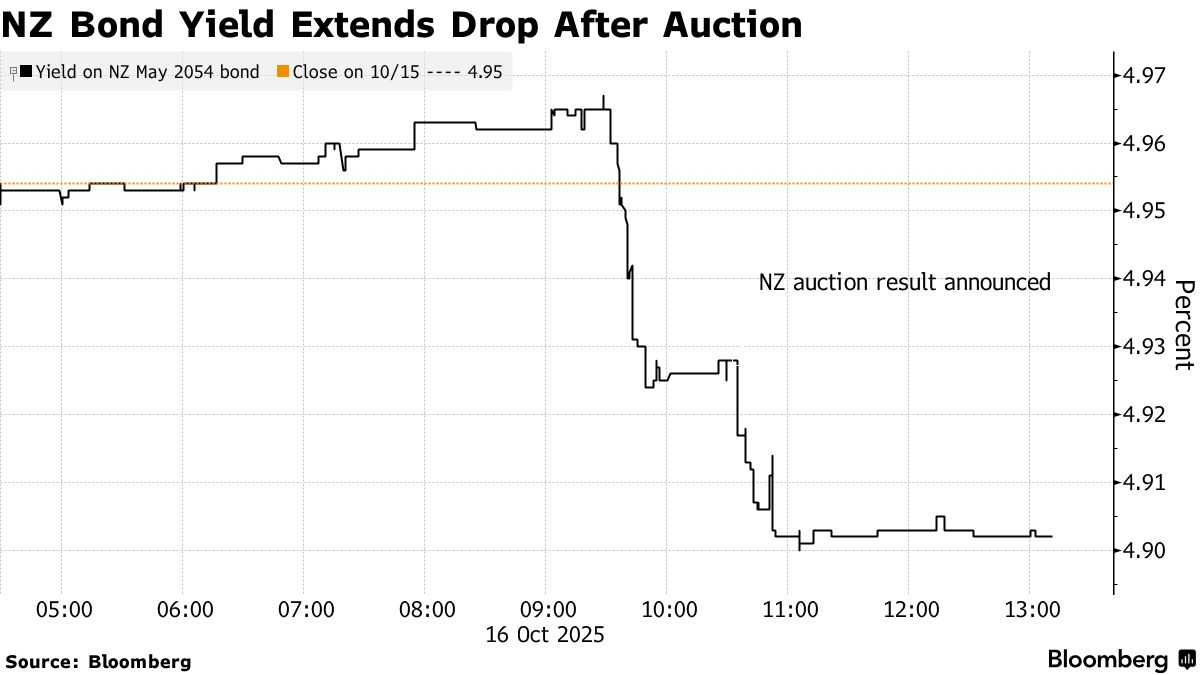

Happy Friday, it’s Keira here in Sydney. In this week’s podcast, we take a look inside Nuno Matos’s ANZ overhaul. But first ... Today’s must-reads: What’s happening nowHow will Australia’s looming social media ban for young teenagers work? Read Angus Whitley’s primer here for everything you need to know ahead of the law coming into effect on Dec. 10. EXCLUSIVE: A Bloomberg analysis of filings revealed Australia’s top pension funds cut holdings in US mega-cap tech stocks known as the Magnificent Seven before the group raced to new highs, highlighting the challenge of keeping pace with the AI-fueled bull market. Nvidia is partnering with Australian startup Firmus Technologies to create a massive fleet of renewable energy-powered artificial intelligence data centers across the country. A single bidder snapped up all of New Zealand’s longest-dated bonds at an auction, marking the first time since May 2024 that one investor bought an entire issue of any maturity.  NZ Bond Yield Extends Drop After Auction Santos trimmed its natural gas production outlook, citing a software failure that stalled its key Barossa export project and the impact from floodwaters in the Cooper Basin. This week on the Bloomberg Australia Podcast, ANZ’s new CEO Nuno Matos is moving fast to remake Australia’s fourth-largest bank. In just five months, he’s announced thousands of job cuts, paused a share buyback and pledged to refocus on core lending and business banking. Bloomberg finance editor Adam Haigh joins host Rebecca Jones to unpack what Matos’s overhaul means for ANZ’s strategy, shareholders and staff.  Listen and follow The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you get your podcasts. Terminal clients: Run {NSUB AUPOD <GO>} on your desktop to subscribe. What happened overnightHere’s what my colleague, market strategist Mike “Willo” Wilson says happened while we were sleeping. ASX futures suggest a soft opening for local equities… Gold posted a new record, boosted by bets that the Federal Reserve will keep cutting interest rates. Stocks fell, weighed by heightened US-China frictions and credit issues at two regional US banks. A gauge of the dollar fell for a third day which kept kiwi steady but Aussie still carried losses from Thursday’s jump in the jobless rate which put a November RBA rate cut very much back on the table. Australia is selling some five-year bonds while New Zealand counts down to the weekend. US President Donald Trump said he would hold a second meeting with Russian President Vladimir Putin at a yet-to-be determined date aimed at ending the war in Ukraine. Meanwhile in Asia, Trump’s tariff war has alienated longtime allies and given China an opportunity to woo the world. Now Beijing’s hardball tactics are sparking a global pushback. The amount of government spending needed to bulletproof most of the world’s rare earth supply outside China is surprisingly tiny, writes Bloomberg Opinion’s David Fickling. It comes as Australian Treasurer Jim Chalmers says rare earths will be a part of his discussions with the National Economic Council’s Kevin Hassett later this evening. What to watch• Nothing major scheduled One more thing... Jim Bolger in 2022. Photographer: Fiona Goodall/Getty Images Jim Bolger, the New Zealand dairy farmer who became prime minister for seven years in the 1990s, has died. He was 90. He died peacefully on Wednesday in Wellington, his family said. We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|