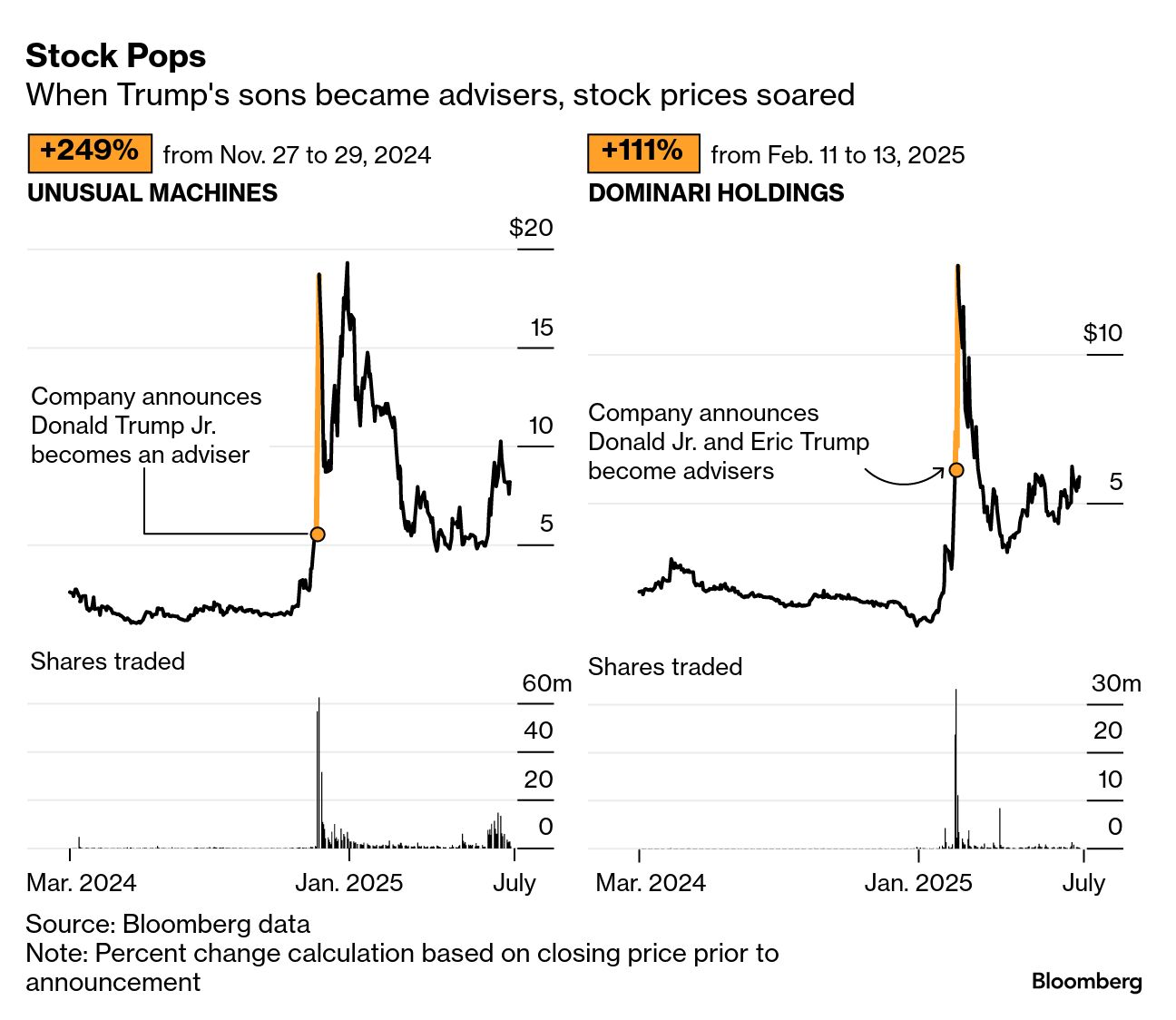

| Welcome to Bw Reads, our weekend newsletter featuring one great magazine story from Bloomberg Businessweek. Today Annie Massa and Zachary R. Mider introduce us to Dominari Holdings’ Kyle Wool, a banker who’s helped Donald Trump Jr. and Eric Trump make more than a half-billion dollars boosting stocks. You can find the whole story online here. If you like what you see, tell your friends! Sign up here. One of the newest tenants of Trump Tower in New York City is a startup investment bank called Dominari Holdings Inc. It’s located only two stories below the headquarters of the Trump Organization—a proximity that Dominari’s president, Kyle Wool, considers a point of pride. Wool spent years cultivating a relationship with the Trump family, and since last year’s election he’s emerged as a kind of financial fixer for the president’s two eldest sons and a cadre of senior Trump Organization employees. Together they’ve struck a succession of lucrative deals. Dominari is on the 22nd and 23rd floors, in a sleek space once occupied by Tommy Hilfiger’s family office. At the entrance one afternoon in July, a television tuned to Fox Business was facing a shelf of Lucite trophies commemorating successful fundraisings for corporate clients. Few of these clients are household names. The bank specializes in raising money for microcaps, small but publicly traded companies whose share prices often gyrate wildly, driven as much by hype as by any expectation of earnings. That helps explain why Wool’s partnership with the Trumps has proven so fruitful. The Trump name tends to generate exactly the kind of buzz stock promoters covet. Take Unusual Machines Inc., a money-losing drone operation in Orlando. Three weeks after the 2024 election, news broke that Donald Trump Jr. had become a paid adviser for the company, as well as an investor—a match arranged by Wool. The shares more than tripled in three days, producing a paper gain of $4.4 million for the president’s eldest son, securities filings show. Similar deals with other companies followed, attaching a Trump family member to a previously obscure stock and thriving on the ensuing publicity.  One involved Dominari itself: In February it announced that Donald Jr. and Eric Trump had become advisers and investors. Together they own more shares than any other outsider. The notice, which didn’t mention their father, said Donald Jr. and Eric would offer counsel on artificial intelligence and data centers. It didn’t seem to matter that neither son had any obvious experience in those areas. Dominari shares soared, making Wool and the Trump sons millions of dollars richer. The Trump brothers’ combined stake in Dominari was worth more than $17 million as of Oct. 9. Eric’s shares of a Bitcoin mining operation Dominari helped set up were worth almost half a billion dollars—a considerable windfall, even by the standards of the Trumps’ fortune, which the Bloomberg Billionaires Index pegs at more than $7 billion. Representatives for the Trump Organization didn’t respond to requests to interview Eric and Donald Jr. In an interview in February, after the Trumps were named Dominari advisers, Wool called them “great businessmen.” He declined to comment for this article. Dominari, provided with a summary of Bloomberg Businessweek’s reporting, said it “contains inaccurate statements and mischaracterizations.” The company didn’t respond to a request for specifics or make its executives available. The White House didn’t respond to a request for comment.  Eric and Donald Jr. outside the Nasdaq exchange in New York in August. Photographer: Timothy A. Clary/AFP/Getty Images/Getty Images The Dominari deals are a new twist on a Trump family tradition. The president’s real estate business long ago pulled back from building projects in favor of selling rights to use the Trump name. The partnership with Wool and his microcap stocks is, like the Trumps’ recent foray into cryptocurrencies, one more way to trade prestige for cash. “It’s almost a definitive characteristic of microcaps, that they are constantly struggling to gain an audience,” says Stephen Kann, the author of an investing guide called Microcap Magic: Why the Biggest Returns Are in the Stocks You’ve Never Heard Of and a banker at Dominari for a few months last year. “The Trump affiliation is a huge spotlight.” A different first family might have viewed the microcap play as a reputational risk, given the long history such companies have of burning investors. If American capitalism is, as Warren Buffett has said, a cathedral with a casino attached, microcaps are over by the roulette wheel and the penny slots. About half of Dominari’s initial public offerings are of tiny companies based in mainland China or Hong Kong—a corner of the market where wild price swings and chicanery have grown particularly intense. The ecosystem is fueled by a steady supply of small-time investors who go to the microcap casino looking for a quick score. Now, thanks to Wool, the first family sits there alongside them. With such relationships, too, comes the potential for conflicts of interest. In Trump’s first term, outcry on this subject mostly centered on the family’s real estate properties, where lobbyists and foreign government officials could host events and book hotel rooms, enriching the president in the process. (Trump’s assets are held in a trust naming him as the beneficiary, so his wealth grows as the value of his holdings increases.) In this term the family is pursuing an even more dizzying array of business ventures, including media, mobile phones and virtual currencies. Eric and Donald Jr. have maintained they are private businessmen, but their father’s policies as US president in one way or another affect all the companies they’re working with. Dominari is the family’s conduit for many of these new opportunities, multiplying the potential for official decisions to increase the Trumps’ wealth. Keep reading: The Banker Behind the Trumps’ Quick Wall Street Wins |