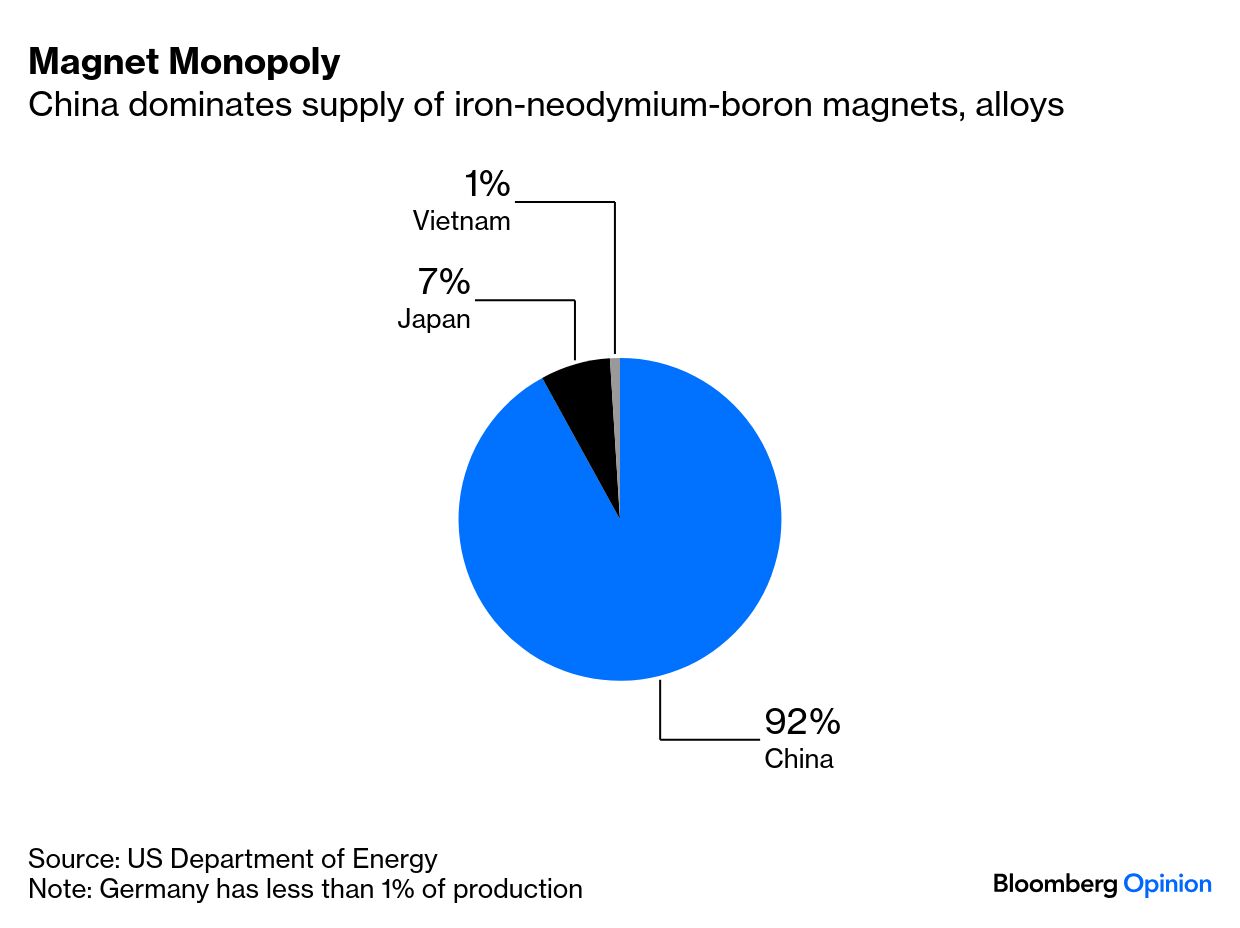

| This is Bloomberg Opinion Today, the single-minded pursuit of global efficiency of Bloomberg Opinion’s opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. Electricity is magic. Don’t believe me? When you return to your darkened home tonight, flip a switch on the wall and then, abracadabra!, you are in a room that’s bright as the sunniest day of the year. Even more magical, if you are like me and are returning to piles of dirty laundry and dirtier dishes, flip that switch back and, voila!, your chores are done and you can order Seamless. Electricity is magic. Hollywood has always known this, and not just because of the whole “lights, camera, action!” thing. Just think of the robot Maria coming to life in Fritz Lang’s Metropolis, of Gene Wilder’s “It’s alive!” in Young Frankenstein, of the DeLorean time machine’s return to the present in Back to the Future, of the magical and AC vs. DC rivalries in Christopher Nolan’s underrated The Prestige, of D.W. Griffith’s The Birth of a Nation, which President Woodrow Wilson reportedly said was “like writing history with lightning.” [1] Electricity is magic. And now it is the Pledge, Turn and Prestige in the greatest magic trick in human history: artificial intelligence. The problem is, it takes a whole lot of magic to make a machine as smart as a human. And Woofle dust ain’t gonna cut it. Turns out, of course, that an energy crisis is a miraculous opportunity, and plenty of folks are rushing to make green off the blackout, including … former Texas Governor Rick Perry? The energy firm Perry co-founded, Fermi Inc., hit a valuation of $19 billion on its first day of trading. Have they created a nuclear-powered miracle, or a magic bubble? “Fermi has several trappings of a bandwagon IPO. Its stated mission is to ‘power the artificial intelligence needs of tomorrow,’” writes Liam Denning. “What defines the AI boom, above all else, is a desire to deploy capacity yesterday. It is the job of the ambitious electricity executive to funnel that desire and as much of the gargantuan quantity of money behind it as possible into their own coffers, and quickly. The advanced nuclear startups, however promising their technology might be, cannot do this; they are, at best, years away from commercial operation at scale.” While AI may be the technology of the the future, its still runs on the past’s blackest art: The good news for AI, if the bad one for humanity, is that fossil-fuel enthusiasts are back in power. “President Donald Trump’s current government includes 43 former employees of the industry,” writes Mark Gongloff. “The US economy has suffered $6.6 trillion in economic damages from climate-related disasters in the past 12 years, Bloomberg Intelligence has estimated, making it a costlier event over that time period than the Great Depression. US workers lost more than $1 trillion in wages because of wildfire smoke alone between 2020 and 2024, Bloomberg Intelligence has estimated. These are mere down payments for future damage.” That dismal future has already arrived in, no surprise, Rick Perry’s Texas. “Imagine being marched by force through a desert with barely anything to drink while your captor repeatedly cools himself by dumping gallons of water on his head, and maybe you’ll start to get a sense of what it’s like to live in Texas these days,” writes Mark in a separate column. “Water supplies in South Texas, already stretched thin after a seven-year dry spell, are being further strained by thirsty oil refineries, petrochemical plants and other energy-related industries that have boomed in Corpus Christi in recent years, Bloomberg News reported recently.” Turns out that the massive energy suck might not even be the biggest hurdle for AI. Rather, it’s China’s President Xi Jinping, who controls more than 90% of the world’s refined exports of the rare-earth minerals necessary for high-speed chips, data storage, batteries, optical communications and pretty much everything else.  “China’s threat to curb the supply of rare-earth elements, which are crucial for making goods from autos and aircraft to headphones and vacuum cleaners, is a symptom of riding for too long the peace dividend after the Soviet Union’s collapse in the 1990s. The single-minded pursuit of global efficiency, supercharged by China’s entrance in the World Trade Organization in 2001, has backfired,” writes Thomas Black. “The current predicament of China’s rare-earth dominance is worth noting for those urging a speedy demise of oil and gas that’s plentiful in the US in favor of wind turbines, solar panels and lithium batteries for energy storage — all areas now dominated by China. Handing over US energy security to China would create an even bigger national security threat.” David Fickling, however, thinks the US could easily slip out of China’s stranglehold. “Given the ability of the words rare earths to bring the leadership of the world’s largest economy to its knees, it’s tempting to think that establishing a supply chain to produce the minerals outside of China is a challenge on the scale of putting a man on the moon,” he writes. “In fact, that’s a vast overestimate. The amount of government spending needed to bulletproof most of the world’s supplies of the elements is tiny. It’s probably on the order of a single White House ballroom ($200 million), or six hours of spending on AI data centers by Silicon Valley’s hyperscalers ($350 million). By some measures, governments might even turn a profit on the transaction.” John Authers questions whether Beijing’s new export controls on the mighty minerals might be a bluff. “China’s moves to tighten curbs on rare earths last week, and then early Tuesday to add controls over companies involved in shipping them, punctuated with President Donald Trump’s menacing higher tariffs, came as an ugly surprise,” he writes. “Is this a reminder from China of strength, or a desperate attempt to play its best card when its position is weakening?” To speed things up, Americans may want to look south. “While the US has an ambitious — and unconventional — plan to rebuild its own mining industry, Washington will need all the help it can get from allies if it wants to challenge China’s near-total dominance. Enter Brazil: already a mining powerhouse, geographically close to the US and home to the world’s largest rare-earth reserves after the Asian nation,” Juan Pablo Spinetto writes. “For the US, any additional supply chain that challenges China’s dominance is a win — even if it develops abroad. Plus, it would help counter Brazil’s relationship with Beijing, already its main trading partner and destination for most of its ores and commodities.” OK, let’s say we solve all the seemingly intractable problems facing AI — energy, rare earths, tariffs, geopolitics, bubbles, Rick Perry — what will we end up with? Porn, of course. “After pitching your powerful chatbot technology to businesses, who struggle to make it useful, your next option may be monetizing your enormous user base of 800 million weekly visitors — with a sex bot,” writes Parmy Olson. “That’s the ignoble trajectory of OpenAI under Sam Altman, who’s made a career of justifying opportunistic business moves — like inflating the AI bubble with circular dealmaking or releasing a TikTok clone — with the promise that his tech will eventually, one day, solve intractable human problems. There’s little evidence that OpenAI’s systems will do that, but in the short term it can make some money, especially with erotic roleplay.” Altman has famously said there is no “magic red button” to stop AI; that he aims to create a “magic unified intelligence”; that “in the next couple of decades, we will be able to do things that would have seemed like magic to our grandparents.” My maternal grandfather was 12 when Birth of a Nation came out, and died the year AOL mail was released. Perhaps that’s enough magic for anyone’s lifetime. Bonus Magic Reading and Quizzing: What’s the World Got in Store ? Remember when EVs were on the Hollywood A-List? Leo, Oprah, Brad, Arnold — they were all on the AC-powered bandwagon. Then Elon went to Washington, robotaxis were shunned in San Francisco, and the Cybertruck was, well, the Cybertruck. Which led to a celebrity exodus including Bette Midler, Cheryl Crow, John Cusack and Jason Bateman. OK, maybe some of them are B-Listers, but when you’ve lost Michael Bluth, you’ve lost America. But the biggest blow to the industry has come from the TV celebrity now in the halls of power. Not Dr. Oz or Pete Hegseth, but the president himself. “A year ago, General Motors Co. was touting a profit tailwind from electric vehicles worth $2 billion to $4 billion. Then, just a little less than a year ago, the US elected a president with a seeming allergy to EVs. Today, Tuesday, GM paid the price. Instead of a tailwind, the company took a $1.6 billion hit in the form of impairments and other charges,” Liam Denning writes. “Trump’s tariffs, along with anti-EV measures, have simultaneously ensconced the US automakers inside fortress America, while also eating away at their profits.” EVs aren’t the only celebrity-fueled trend to be facing a power outage. “Vertical farming was once so sexy that it tempted the likes of Natalie Portman, Lewis Hamilton and Justin Timberlake to join venture capital and private equity firms buying into high-tech facilities cultivating crops in stacked layers using soil-free growing techniques. Those investments have turned ugly recently,” Lara Williams writes. “But as the hype fades, concern about food security is keeping interest in vertical farming alive. Our food sources are threatened by climate change. Extreme weather and increased pests and diseases are undermining farming yields around the world.”  “At the same time that biodiversity loss, flooding and drought harm farming, there’s increased competition for land use such as growing bioenergy crops, rewilding and housebuilding,” adds Lara. “UBS AG analysis suggests that rising global consumption could lead to an 8% crop production shortfall by 2050 if yield growth doesn’t improve. Vertical farms offer a solution to this problem.” Will vertical farming may save the planet? To some of us, it just seems like more magic beans. Note: Please send sky-grown strawberries and feedback to Tobin Harshaw at tharshaw@bloomberg.net |