| Gold is a heavy metal and it must be handled carefully. Visitors to the New York Fed’s vaults who want to hold a gold bar must wear specially reinforced shoes. Otherwise, if they drop the bar, they might no longer have a foot. A Bad Day in a Great Year

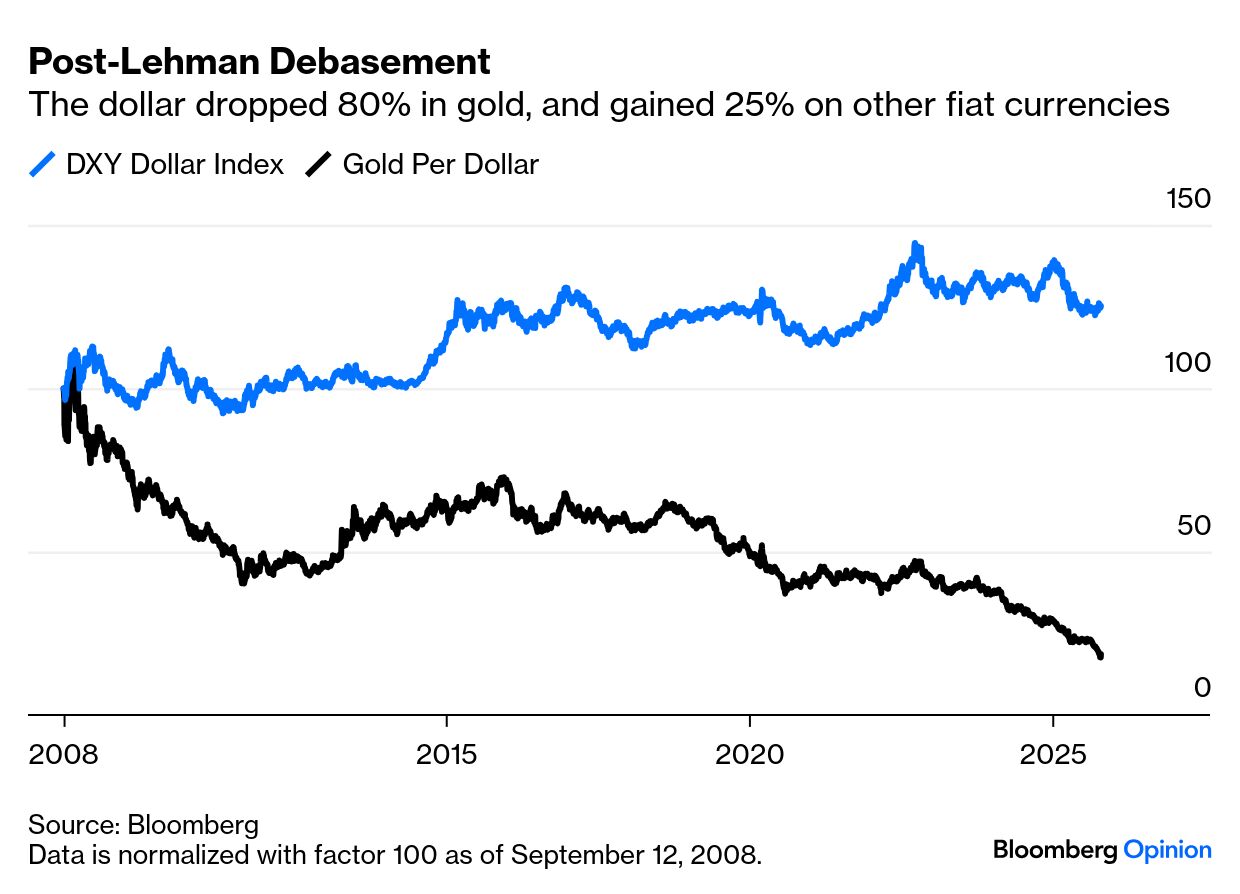

This is relevant as the gold price has just dropped more than 5% in a day for the first time in 12 years. In dollar terms, the fall of $230 is the greatest ever. The chances are that somebody out there has just crushed their foot. Any move this sudden and drastic must be taken seriously. But it also needs context. This is how gold and its cousin silver — prone to even more violent speculative swings — have fared so far this month: This is not (yet) a crash, or even a correction. Precious metals’ phenomenal year continues. Even after this selloff, and taking dividends into account, gold has easily beaten the S&P 500 and even Bitcoin: Debasement So, what has driven gold this year? In one word, it would appear to be “debasement.” The fear that inflation and lax money will lead to the intrinsic devaluation of the dollar and other fiat currencies has been turned of late into a “debasement trade.” It’s often said that narratives lead markets, and the dwindling dollar has become a powerful narrative. This is Bloomberg News Trends’ count of all the stories from all sources appearing on the terminal that include the word: Google Trends, counting similar searches in the US, is also dramatic. Interest shot up this month: The strength of the narrative, then, is unquestionable. “The Debasement Trade” could be a great thriller, with a trailer voiced by Don LaFontaine. But why now? It’s been reasonable to worry about the dollar’s debasement, and to hedge against it with gold, since at least the moment in 1971 when President Richard Nixon ended the formal convertibility of the dollar into gold at a fixed price. Since the Global Financial Crisis, which the US survived without a full-blown Great Depression by printing lots of money, the risk of debasement has been blatantly obvious for all to see. Since the weekend in September 2008 when Lehman Brothers declared bankruptcy, the dollar has gained 25% against other fiat currencies, represented in the DXY dollar index, but lost about 80% in gold terms. So why the sudden fascination?  A further point concerns fiscal policy. When governments spend beyond their means, inflation and debasement are obvious risks. The US, with its One Big Beautiful Bill, seems happy to steer that course. If there are such worries, they should show up in higher yields on longer-dated government bonds to compensate investors for the risk of debasement. And indeed, yields have edged up across the developed world this year, despite the perception that governments now have inflation under control and can afford to borrow more. But there is a big exception: America. The 10-year Treasury yield, arguably an even more important metric for global finance than the gold price, is down more than 50 basis points for 2025. It’s below 4%, at its lowest in more than a year. This as US inflation is rising again, in an epic debasement scare: The underlying narrative makes sense to some extent. All of us should be concerned about the risk of debasement. Sudden overweaning terror at this juncture, however, seems misplaced. Past Bulls It’s useful to compare with the last two great bull markets, which peaked in January 1980 at the depths of fears over eternal stagflation, and in September 2011 after Standard & Poor’s had downgraded US Treasuries’ credit rating. This bull market looks very much like 2011 and nothing like 1980: In January 1980, the Soviet Union had just invaded Afghanistan, there were US hostages in Tehran, the Federal Reserve was hiking rates, US stocks were deep in a bear market, and all hope had been lost. This gold rally has coincided with what many describe as a stock market bubble. Looking more closely at 2011, and at the very different behavior of stocks, reveals more differences. Back then, S&P triggered an extreme “debasement trade.” Within weeks, the world was still turning, it was apparent that the QE bond purchases of the era hadn’t sparked inflation, and a fresh equity bull market was underway. This time, gold has outperformed a booming stock market, and there was no clear triggering event like the downgrade to get people talking about debasement: One other point from past bull markets: They grow more erratic in their final extreme phrase. The Nasdaq in 1999-2000 and the Shanghai stock exchange in 2007 both saw numerous sharp corrections as they went parabolic. As this unscientific comparison suggests, Tuesday’s selloff looks more like the start of a final phase than the top: So Who’s Been Buying? So why has the narrative taken hold now? Probably because the professionals can see that there are big new purchases of gold, and debasement has been retro-fitted as a narrative to explain it. Writing last week, Deutsche Bank’s Steven Zeng warned that custody holdings of US Treasuries for foreign central banks had declined in 11 of the past 14 weeks, and hit their lowest level in more than 13 years. The outflows started in April and accelerated in August after Powell’s dovish pivot at Jackson Hole. Importantly, the latest shift comes amid the gold surge, suggesting a possible connection such as one or more foreign central banks reallocating out of Treasuries and into gold.

This plausibly explains why the narrative took hold right at this point. The Tuesday snapback isn’t because of any reversal of this trend; there’s no evidence that foreign banks have started selling gold again. Rather this looks like an overreaction to genuine news (not unlike gold’s response to the Standard & Poor’s downgrade in 2011): Another empirical reason to bet on debasement now comes from evidence that Chinese investors are buying. Jim Bianco of Bianco Research points to the data on Chinese gold warrants — certificates that indicate the holder has physical gold in a warehouse recognized by the Shanghai Futures Exchange: Bianco comments: “If anyone asks the question, ‘Who is buying gold?,’ show them the updated chart and say, ‘China.’” It’s this extra buying that got the gold price moving, and prompted new interest in the decades-long phenomenon of debasement. The latest selloff might be the top of the biggest gold bull market since 2011 — but for now it’s best viewed as a violent correction to over-excitement in a plausible narrative. |