| | In today’s edition: MBS is going to Washington, AI helps squeeze in more flights in Dubai, and Abu D͏ ͏ ͏ ͏ ͏ ͏ |

| |   Riyadh Riyadh |   Washington DC Washington DC |   Dubai Dubai |

| Gulf |  |

| |

|

- MBS goes to Washington

- FII organizer considers IPO

- IMF praises Gulf ‘resilience’

- Abu Dhabi’s non-oil engine

- Dubai airport AI optimization

- UAE builder’s global dreams

The treasures of Abu Dhabi’s Natural History Museum. |

|

Trump to host Saudi crown prince |

Brian Snyder/Reuters Brian Snyder/ReutersSaudi Arabia’s de facto ruler Crown Prince Mohammed bin Salman will return to the US for the first time since 2018 next month to meet President Donald Trump, in a sign that he has largely restored his global reputation. The visit, scheduled for Nov. 18 and 19, is expected to include the signing of several trade and investment agreements and potentially a defense pact. That deal would come in the form of an executive order rather than a treaty requiring congressional approval, mirroring the guarantee recently extended to Qatar following Israel’s strike on a Hamas compound in Doha in September. Riyadh, by contrast, signed a defense pact with Pakistan last month. Talks between Trump and the crown prince are also expected to broach the subject of Saudi-Israeli normalization, which was under discussion before the Hamas attacks in October 2023 triggered two years of war. Prince Mohammed has not been back to the US since the 2018 murder of columnist Jamal Khashoggi, which badly ruptured his international standing and Saudi-US relations. Saudi Arabia hosted both former President Joe Biden and Trump since then on state visits, and the crown prince has participated in major global forums like the G20. — Matthew Martin |

|

Firm behind Saudi’s FII looks at IPO |

Courtesy of FII Institute Courtesy of FII InstituteRichard Attias & Associates, the organizer of Saudi Arabia’s flagship investment conference that returns to Riyadh next week, will “definitely” go public next year, according to the firm’s namesake founder. “We are in the IPO readiness process,” Attias told Semafor. “It will happen in 2026, definitely.” He declined to comment on the valuation the company was seeking. The company is majority owned by Saudi Arabia’s sovereign wealth fund, which is looking to sell down some of its holdings as part of a plan to recycle its cash into new investments. The company’s IPO plans will add to a growing queue of firms looking to sell shares on the Saudi stock exchange. Attias will host the latest edition of the Future Investment Forum next week, bringing together some of the biggest names in finance, tech, and more than 20 heads of state. — Matthew Martin |

|

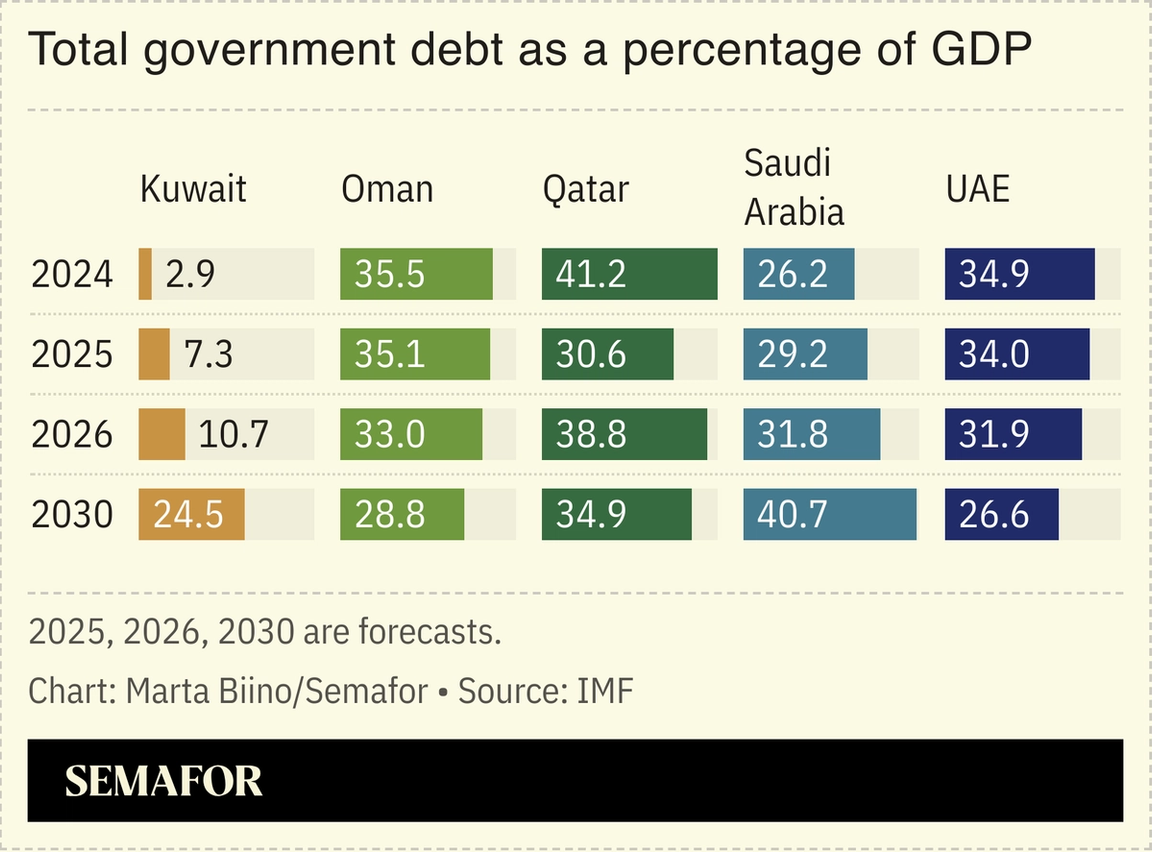

Gulf debt sales surge on resilience |

Middle Eastern and North African economies — especially in the Gulf — are showing resilience amid global uncertainty, allowing governments to tap debt markets to finance spending plans, according to the International Monetary Fund. The region has largely escaped the “direct fallout from higher US tariffs and global trade restrictions” and had limited impact from wars, Jihad Azour, the IMF’s director for the Middle East and Central Asia, said in Dubai. The fund expects stronger growth ahead, driven by higher oil output and expanding non-oil sectors such as tourism and consumption. Governments are taking advantage of this strength: regional debt issuance has already reached $48 billion this year, surpassing 2024 levels, Azour noted, as countries pursue diversification projects while preserving capital buffers. — Mohammed Sergie |

|

Abu Dhabi maps next growth phase |

Satish Kumar/Reuters Satish Kumar/ReutersAbu Dhabi has zeroed in on the sectors that will drive its next phase of non-oil growth, the chairman of the Abu Dhabi Department of Economic Development said. The diversification push is directing investment, policymaking, and research toward industries like autonomous mobility, culture and tourism, financial services, food security, and health care. The emirate, the wealthiest in the UAE thanks to oil and home to more than $2 trillion in sovereign wealth, has accelerated non-oil growth in recent years to now represent 57% of its economy, from just 20% in the late 1990s, Ahmed Jasim Al Zaabi said at the Reuters NEXT conference on Wednesday. He added that much of the infrastructure and tourist destinations that Abu Dhabi is building out — including Disneyland Abu Dhabi and entertainment venue The Sphere — will be completed within the coming decade, helping solidify the capital as a leisure destination. — Kelsey Warner |

|

Dubai uses AI to squeeze in flights |

The number of additional flights per day that Dubai International Airport was able to add by optimizing operations using artificial intelligence, The National reported. The world’s busiest international hub is nearing its 100 million passenger-per-year capacity, and leaning on technology to speed up turnarounds has the potential to generate an additional $300,000 a day in revenue. Aviation is a major industry for Dubai — forecast to comprise 32% of the emirate’s economy and a quarter of its jobs by 2030 — and the city is building a new airport designed to handle 260 million passengers a year by 2050. |

|

Emaar plots US, China growth |

Ahmed Jadallah/Reuters Ahmed Jadallah/ReutersHaving shaped the skyline of downtown Dubai, Emaar Properties is looking abroad for growth, and future targets may be in the world’s two largest economies, according to Founder and Chairman Mohamed Alabbar. Housing shortages and a lack of affordability in the US present an opportunity, Alabbar said at the Reuters NEXT conference in Abu Dhabi. “You have a huge problem on your hands, Mr. Trump,” Alabbar added, singling out California and New York over their surging prices. Emaar is exploring entry into the US through acquisitions or joint ventures, but no cities, timeline, or budget have been identified for the deals, Alabbar said. He also expressed conviction in China’s rise, quipping that if he were younger, he “would have learned Mandarin.” Asked whether he had been approached about reconstruction efforts in Gaza, Alabbar said no, and that Emaar would not be interested, implying that Israel should be responsible for rebuilding the territory, to applause from the audience. “It’s my philosophy... that everybody should clean up his garbage,” he said. “I’m going to focus on making money for my shareholders.” — Kelsey Warner |

|

Exploring opportunities for mutual growth and global reach. Convening for a full day in New York City, the Dubai Business Forum USA will advance conversations that assess how the future of business and innovation will be shaped in a new era of global expansion. Amidst shifting economic landscapes and AI disruption, this highly curated gathering of CEOs, senior executives, and policymakers, featuring Semafor’s senior editors, will explore new ideas, create meaningful cross-border connections and examine the strategic opportunity Dubai provides for adaptive, forward-thinking companies. Request your delegate invitation here. The Dubai Business Forum USA, powered by Dubai Chambers, is produced in partnership with Semafor’s events and marketing teams. The program will also feature select editorial sessions, independently developed and led by Semafor’s newsroom. |

|

Deals- Abu Dhabi Investment Authority backed a deal led by Blackstone and TPG to acquire Hologic, which focuses on medical devices and diagnostic equipment for women’s health care. The acquisition has an enterprise value of up to $18.3 billion.

- Mubadala Capital, the alternative assets arm of the Abu Dhabi wealth fund, is set to become a majority shareholder in Linha Amarela (Lamsa), the operator of one of Rio de Janeiro’s main highways, as part of a debt for equity swap. Mubadala Capital has been investing in Brazil since 2012 with assets under management of nearly $6 billion, it said last year. — AGBI

- Mubadala also completed the acquisition of a stake in Hong Kong-based Loscam International, according to an emailed statement. The firm will own 30% of the company, which offers logistics services for pooling and returnable packaging solutions across the Asia Pacific region.

- Saudi Venture Capital, a $3 billion state-backed fund, is planning to allocate more cash to private credit and equity in the future. It’s the latest sign of the appetite for private credit in the country as local banks struggle with tight liquidity. — Bloomberg

Debt- While global sentiments towards private credit lean toward caution, startups in the region are borrowing like never before, raising $3.5 billion in September alone, more than entire past years combined. Saudi fintechs like Tamara (which alone raised $2.4 billion), Lendo, and Erad are driving the boom. — AGBI

- BlackRock, Goldman Sachs and BNP Paribas helped execute the first regulated electronic trading in Saudi riyal-denominated bonds through Tradeweb Markets, as the kingdom tries to attract more international trading in local debt markets. – Bloomberg

- Property Finder is taking $250 million in debt financing from US alternatives investor Ares Management to fund growth and product development. The deal follows a $525 million equity investment into the Dubai property portal from Blackstone, alongside Permira and General Atlantic, last month.

Energy- Egypt has surpassed Kuwait as the Middle East’s biggest importer of liquefied natural gas. The region, despite having huge reserves in some countries, has become a bigger buyer of the super-chilled fuel due to a lack of cross-border pipeline network. — Bloomberg

Finance |

|

|