| | In this edition, the song-and-dance bidding for Warner Bros. Discovery unfolds, and Six Flags makes ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Musk’s boogeyman

- Zaslav’s big payday

- CMO defends Sweeney ad

- Browser wars are back

- Amusement parks and the attention economy

|

|

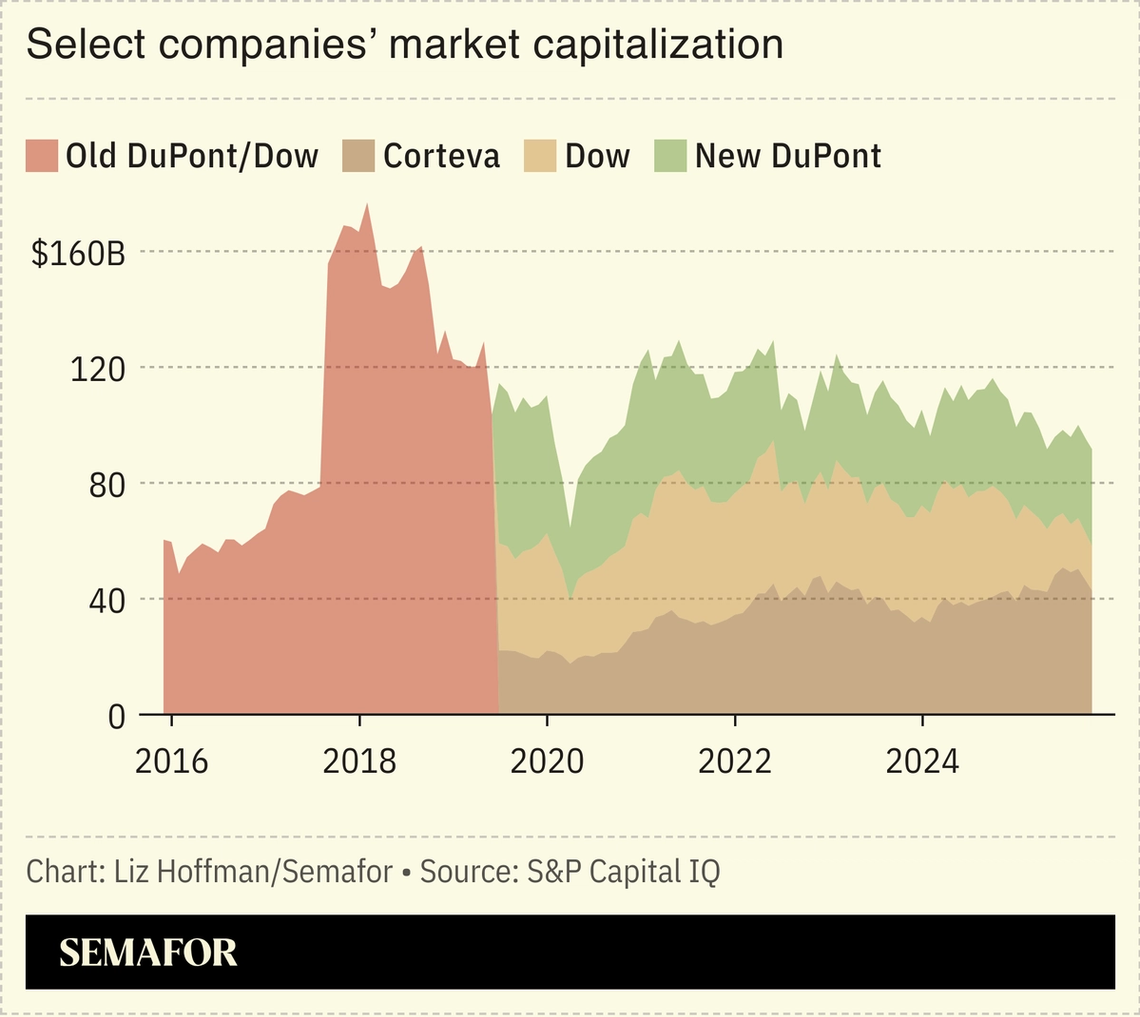

Most M&A dramas are simple enough for studio suits to grasp — capitalist rom-coms in which overeager bidders chase reluctant targets that eventually relent. The spectacle unfolding at Warner Bros. Discovery looks curiously like the opposite. The home of CNN, Harry Potter, and HBO hung out a for-sale sign this week and has been backchanneling a willingness to hear out all comers. CEO David Zaslav, as we number-crunch in today’s newsletter, has 500 million-plus reasons to sell. The short list of potential bidders, meanwhile, appear ambivalent, unprepared, or both. It’s a flipped script. Semafor and others hear that Comcast is interested in … something … but two days in, there’s not even a public promise to take a look. That may be a pragmatic nod to the current dealmaking climate: “Everything,” President Donald Trump reminded us Tuesday, “goes through the White House,” where Comcast chief Brian Roberts is not popular. Comcast could revive the spoiler role it played in the 2018 bidding for 21st Century Fox, ultimately getting nothing for itself but complicating life for a rival. Netflix’s Ted Sarandos couldn’t be less interested in WBD’s cable channels — no surprise there — but was even lukewarm on Warner Bros. Pictures’ content factory. “Nothing is a must for us,” he said, backing up his co-CEO’s recent comments that Netflix is “more builders than buyers.” And the mere existence of WBD, which was created when AT&T spat out Time Warner, is a reminder that content and distribution are better off separate. Bundling and unbundling keeps Wall Street busy. The M&A wheel has stopped on the media industry now, but it’s no more immune from the resulting chaos than industrial giants that went through this a decade ago.  Comcast, Netflix, and other bidders (dig in more here) may ultimately show up to challenge Paramount, which has reportedly bid about $60 billion for WBD. Zaslav’s job here is to get a good price, and that means creating the on-screen magic of a competitive auction. |

|

‘Those guys are corporate terrorists’ |

Daniel Cole/Reuters Daniel Cole/ReutersElon Musk, already the world’s richest man, pleaded with investors to approve his $1 trillion pay package. Musk took over Tesla’s earnings call Wednesday, interrupting his chief financial officer to press the case that he needs more control. He called shareholder-advisory firms Glass Lewis and ISS “corporate terrorists” for urging investors to vote against the bonus at Tesla’s annual meeting next month. “I just don’t feel comfortable building a robot army here and then being ousted because of some asinine recommendations from ISS and Glass Lewis, who have no freaking clue,” he said, hijacking the end of an hourlong discussion of Tesla’s AI ambitions and disappointing quarterly profits. The amount — which Musk only gets if Tesla hits certain financial and operational milestones — has appalled governance scolds (and the pope). The billionaire said it would give him “a strong influence, but not so much that I can’t be fired if I go insane.” |

|

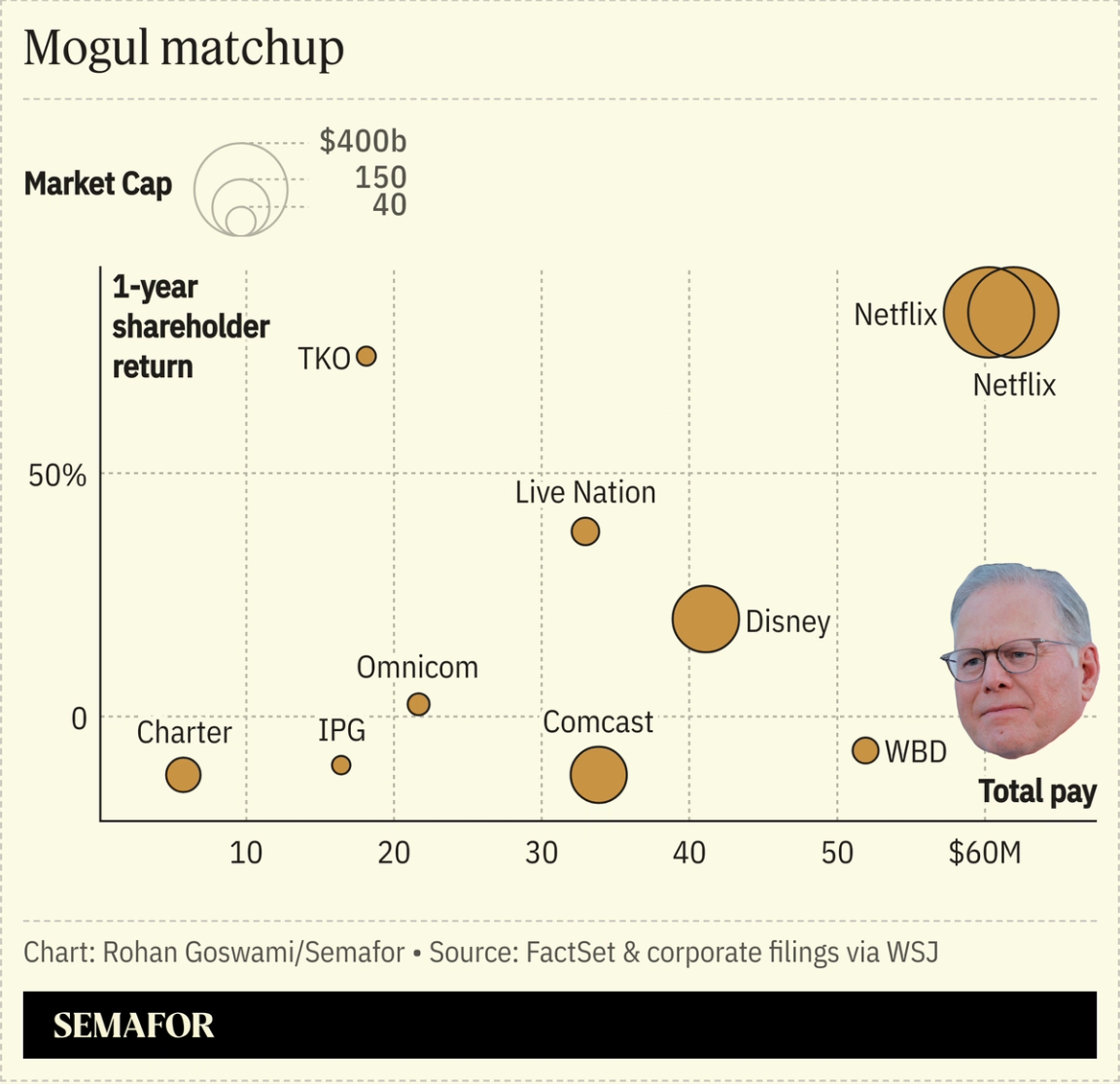

David Zaslav’s big payday |

CEO David Zaslav would make some $500 million if Warner Bros. Discovery is sold at a price near what Paramount has offered. Under Zaslav’s contract, his 21 million shares would vest immediately if the company is sold. Zaslav has long been one of media’s best-paid CEOs despite shareholder returns that lag larger rivals. Shareholders in June voted against his $52 million pay package in a symbolic but unusual rebuke.  Zaslav has made $470 million since 2019, including a $200 million package when his contract was renewed in 2021 ahead of the Warner-Discovery merger that the company is now seeking to unwind, pending the outcome of its current auction. The company has also tweaked financial goalposts to boost his bonus by excluding some losses from operations. Warner shares were down about 60% from 2021 until rumors of a deal began to swirl. |

|

American Eagle’s CMO defends Sweeney ad |

Sami Marshak/Reuters Sami Marshak/ReutersAmerican Eagle’s chief marketing officer wants to make one thing clear: The Sydney Sweeney ad was not a eugenics dog-whistle. In a conversation on Semafor’s Mixed Signals podcast dropping tomorrow, Craig Brommers goes inside the most controversial campaign in years, one that put the company at the center of a Trump culture war. At a time when most companies are opting for fuzzy blandness and any corporate messaging moves tend to backfire (see: Cracker Barrel), American Eagle leaned on the oldest advertising trope in America — the “it girl” — and sold a lot of jeans. Sales rose in every county in America, red and blue, Brommer said. “The crisis communications industrial complex tells you you need to get out there and make a statement,” he said. “I actually think the smartest thing we ever did was do nothing.” |

|

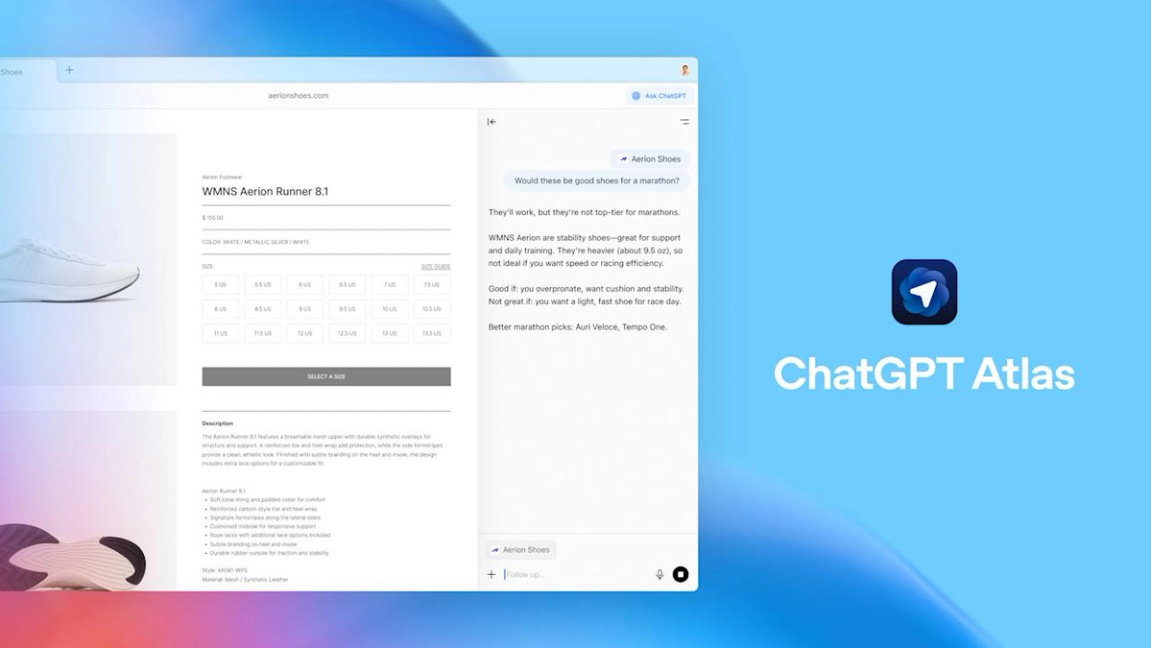

The web browsers to end all browsers |

Courtesy of OpenAI Courtesy of OpenAIThe browser wars are back. Thirty years after Microsoft beat Netscape and nearly two decades after Firefox and Opera lost to Google’s Chrome and Apple’s Safari, AI has reopened a battle for how we access the internet and what we do when we get there. OpenAI’s new web browser, which launched this week and makes ChatGPT the guide, comes just weeks after Perplexity made its browser, Comet, free for all users. Google has been furiously integrating AI tools into Chrome. But while the original browser wars were about the way people surf the web, the new AI browsers are about freeing you from the web entirely. A lot of what we use browsers for today — filling out forms, booking travel, combing through ad-laden recipes — the new generation of browsers aims to do for us. Each tab would represent an AI agent hard at work in the background on internet chores. The tech isn’t quite there yet. But a future where search bars are replaced by a bunch of invisible hands is coming, with implications for all the industries that have been built around today’s web — the one built for humans. — Reed Albergotti |

|

Activist tries Hail Mary at Six Flags |

Jay Biggerstaff-Imagn Images/Reuters Jay Biggerstaff-Imagn Images/ReutersCan the attention economy fix Six Flags? Jana Partners’ team-up with NFL star and very famous fiancé Travis Kelce is a bet that a celebrity can succeed where traditional market pressures have failed. Over the past year, several activist investors have nudged the theme-park operator toward incremental changes, including a new CEO and board replacements. But they’ve failed to turn around a stock that lost nearly 60% since the company merged with Cedar Fair in 2024, or convince the company to put itself up for sale. Celebrity endorsements haven’t always swayed Wall Street, and Six Flags shares have already given up a third of their initial 20% rise after the announcement Tuesday. Starboard brought Shaquille O’Neal onto Papa Johns’ board in 2019 — “everyone knows Shaquille O’Neal, they know that I’m in the fun business,” the star said — but he stepped down last year. |

|

In an era of meme stocks, crypto bubbles, and skyrocketing housing costs, Michael Lewis’ The Big Short hits harder than ever. A lot has changed since Lewis wrote The Big Short, but some things — like who really pays for an unchecked financial system — are as relevant as ever. Narrated by the author himself for the first time, The Big Short audiobook is a playbook for understanding today’s economic uncertainty. Listen to The Big Short now. |

|

➚ BUY: Ribs. US ranchers criticized Trump’s plans to exempt more Argentine beef from tariffs. America’s beef cattle herd is the smallest in 75 years, frustrating the president’s heartland allies on the Hill, too. ➘ SELL: Cores. CoreWeave’s CEO said it won’t raise its $9 billion price for rival Core Scientific, which he called a “nice-to-have, not a need-to-have,” after ISS recommended investors vote against the deal. |

|

“He’s spending more money against me than I would even tax him.”

— Zohran Mamdani on Bill Ackman, to the Flagrant podcast |

|

Companies & Deals- If you can’t beat ’em: Three European aerospace giants will merge their space businesses to compete with Musk’s Starlink, Reuters reports. Airbus, Leonardo, and Thales plan to launch “Project Bromo” in 2027.

- Everything’s bigger: Andreessen Horowitz is aiming to raise $10 billion for tech bets, according to the FT. Nine-figure VC funds were once eyebrow-raising, but the table stakes are getting larger in today’s hardware-heavy Silicon Valley.

- Icing on the take: The NHL announced a partnership with online-betting sites Polymarket and Kalshi, the first of its kind and another sign of the rising popularity of these platforms: They are “the next evolution into what’s driving the

|

|

|