| | In this edition: Tanzania unrest poses regional threat, Abuja’s diplomatic push, and how the earlies͏ ͏ ͏ ͏ ͏ ͏ |

| |   Dar es Salaam Dar es Salaam |   Abuja Abuja |   Bamako Bamako |

| Africa |  |

| |

|

- Tanzania poses regional threat

- Abuja’s diplomatic push

- Banks urge capital shift

- Jihadi siege in Bamako

- Africa’s inequality problem

- Lobito Corridor funding push

How the earliest humans lived. |

|

Regional fallout of Tanzania unrest |

| |  | Martin K.N Siele |

| |

Onsase Ochando/Reuters Onsase Ochando/ReutersElection violence in Tanzania that opposition groups say left hundreds dead is damaging investors’ confidence in East Africa and hampering regional trade, Kenya’s trade minister told Semafor. Tanzanian President Samia Suluhu Hassan was sworn in for a second term on Monday after it was announced that she won 98% of the vote in last week’s elections. Amnesty International said it was alarmed by reports that security forces used excessive force to quell the protests over the disqualification of Samia’s main challengers. In an interview with Semafor, Kenya’s Trade Cabinet Secretary Lee Kinyanjui said the unrest was having “a direct impact on the flow of trade and investment in the region,” adding that “in a regional bloc where raw materials from one country fuel industries in another, the need for sustainable peace is critical.” Tanzania has one of Africa’s fastest-growing economies, largely driven by agriculture, mining, and tourism in recent years, but fallout from the unrest threatens that trajectory. Tanzania’s main port of Dar es Salaam remains shut after workers were ordered to stay at home, causing shipping lines to redirect vessels to Kenya’s port of Mombasa. Trucks moving goods between Tanzania and Kenya have also been stranded at key border points. |

|

Nigeria scrambles for Washington influence |

| | Yinka Adegoke and Alexander Onukwue |

| |

Sodiq Adelakun/Reuters Sodiq Adelakun/ReutersNigeria’s lack of senior diplomatic presence in Washington DC under President Bola Tinubu, and an absence of lobbyist support, has left it particularly vulnerable to President Donald Trump’s threat of military action over alleged Christian persecution in Africa’s most populous country. Abuja is scrambling to appoint an ambassador to the US after two years without one, part of a broader push to appoint ambassadors to missions abroad this month. Regulatory filings examined by Semafor showed the Nigerian government has had little to no lobbyist representation in Washington since Tinubu took office in 2023. Instead, Nigeria has been outspent on Capitol Hill by Biafra separatist groups who, according to filings, have focused on raising the issue of “Christian killings” to chime with a long-running narrative in conservative Christian circles. Cameron Hudson, a former White House Africa director, said lobbyists could have given the Tinubu administration a better read of the situation. “This is not an era to be casual about your diplomacy in Washington,” he said. |

|

Banks call for capital diversification |

| |  | Alexander Onukwue |

| |

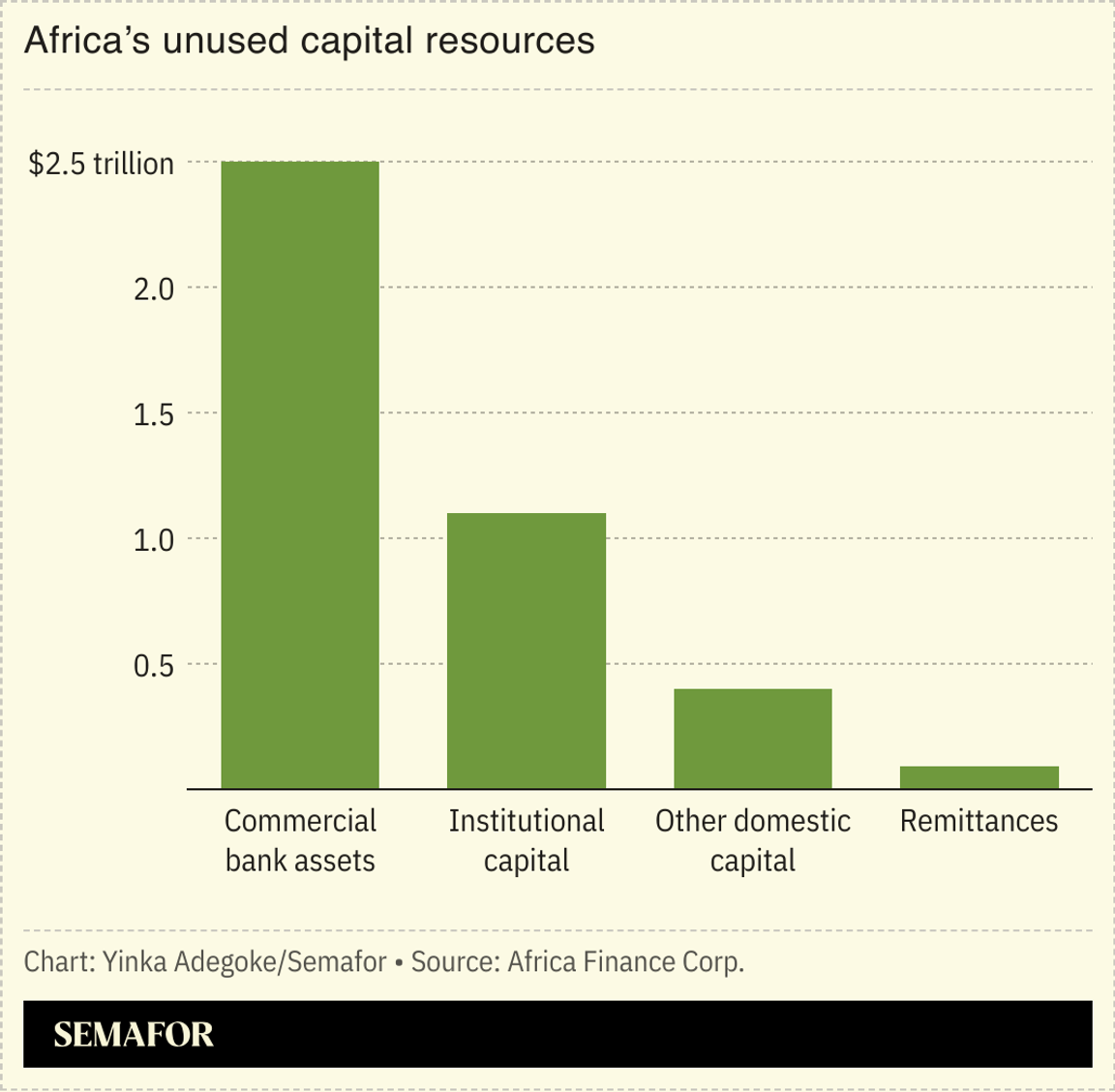

African banks must take the lead in more effectively deploying the continent’s capital for investments that boost growth, top bank executives said. About $4 trillion is estimated to be available across various sovereign and private money stores in Africa, according to the Africa Finance Corporation. It is a level of capital that can be absorbed by African economies to finance development, but efficient allocation remains an ongoing challenge. “Capital is available but it’s not being channeled into the opportunities that exist in Africa,” Aigboje Aig-Imoukhuede, chairman of Access Holdings, which owns Nigeria’s largest bank, said at the African Financial Summit in Casablanca. Jeremy Awori, chief executive officer of Ecobank group, which operates in 34 sub-Saharan African countries, said more pension funds and sovereign funds should invest in the capital of banks to enable greater lending to small and medium enterprises. “We should not just be investing in sovereign paper,” he said, alluding to a perception that most African domestic financial assets flow towards short-term government securities. |

|

Mali’s jihadis threaten junta rule |

Stringer/Reuters Stringer/ReutersThe siege of Mali’s capital by a jihadi militia threatens to topple the country’s ruling junta, which has pivoted toward Russia in recent years after severing defense ties with France and the US. Jama’at Nusrat al-Islam wal-Muslimin has spread throughout Mali for months, posing the gravest challenge yet to military leaders who took power in a 2021 coup. The al-Qaeda-linked group has forced schools to shut, imposed a fuel blockade that has paralyzed the economy, and closed off vital trade corridors in the landlocked nation that relies on imports from its neighbors. Senegal exports nearly 60% of its petroleum products to Mali, representing more than 20% of Bamako’s foreign trade, according to the Atlantic Council. JNIM’s expansion offers a lesson for other Sahel nations — now the world’s terrorism hotspot — which are increasingly reliant on Moscow for security assistance: Malian President Assimi Goïta replaced French and American security assistance with help from Moscow, a policy now widely seen as a total failure. This item first appeared in Flagship, Semafor’s daily global affairs briefing. Subscribe here. → |

|

|

Africa’s inequality struggles |

Nearly half of the world’s 50 most economically unequal countries are in Africa, a new report on global inequality led by the Nobel Prize-winning economist Joseph Stiglitz found. Commissioned by South Africa — ahead of the G20 summit it is hosting later this month — the report said that global wealth inequality should be recognized as an “emergency”: Since 2000, the world’s richest 1% have seen their wealth increase by an average of $1.3 million, while the poorest half of humanity saw their wealth rise by only $585. “The world understands that we have a climate emergency; it’s time we recognize that we face an inequality emergency too,” said Stiglitz. The report recommends the creation of a new “International Panel on Inequality” to inform policymaking globally. |

|

Angola’s $4.5B Lobito bid |

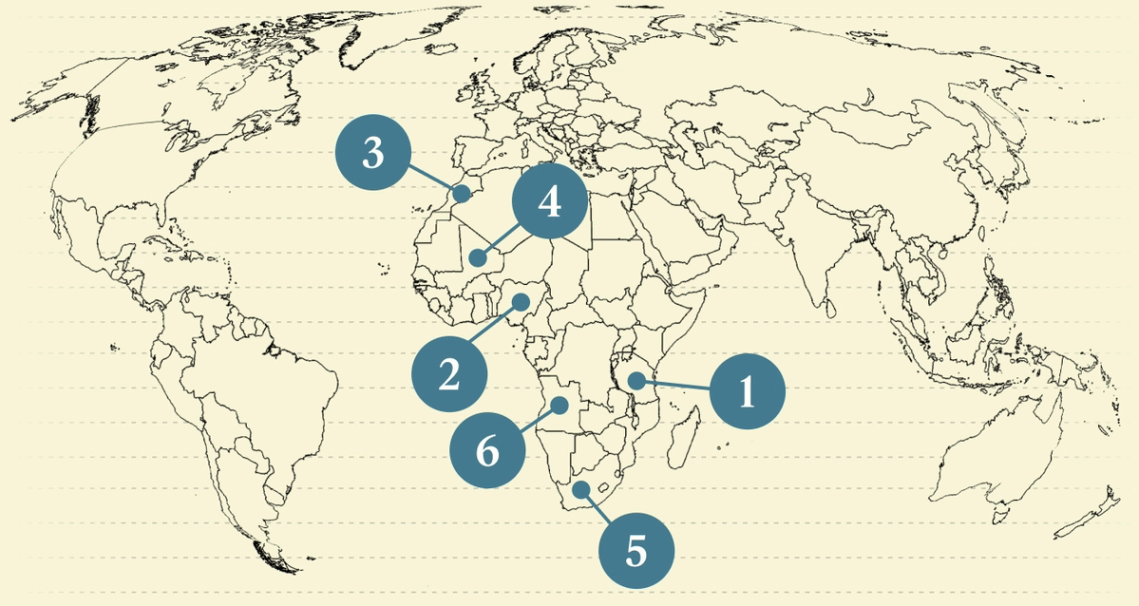

The amount the Angolan government is seeking in funding for an extension of the Lobito Corridor railway project to reach Zambia’s Copperbelt region. The request marks a significant increase from the previous $1.6 billion estimation by the African Development Bank (AfDB) in 2024, though the Africa Finance Corporation, which is overseeing the project, has avoided putting an official price tag on its development, Mining.com reported. Zambia and DR Congo produce more than 13% of the world’s copper, however, it can take weeks for the metal to reach ports from the Copperbelt region. The 830km Zambian extension of the 1,300km Lobito railway line aims to create a more efficient export route that bypasses congested transit lines through South Africa, Mozambique, and Tanzania. The US-backed project is also seen as a significant counterbalance to Chinese-led investment on the continent. Funding has been slow: A $533 million US loan for the Angolan section in 2024 has yet to be disbursed. However, Italy recently committed $320 million, and the AfDB has committed a further $500 million to the Zambia extension. Construction is expected to begin next year. |

|

On the sidelines of the G20 in Johannesburg, Semafor convenes The Next 3 Billion ON TOUR to explore how South Africa’s leadership can help scale inclusive solutions across borders — from interoperable digital payments and cross-regional investment to expanding connectivity. As one of Africa’s most industrialized economies and a G20 member, South Africa stands at the center of efforts to advance digital and financial inclusion across the continent. With its strong financial infrastructure and growing influence through the G20 and B20, the country is uniquely positioned to drive the next wave of innovation and access. Nov. 18 | Johannesburg | Request Invite |

|

Business & Macro |

|

|