| | In today’s edition: Aramco beats estimates, Dubai buys Palantir tech, and Semafor columnist Tareq Al͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Aramco earnings surprise

- ADNOC deploys AI robots

- Bahrain bets on AI biotech

- Dubai upgrades with… AI

- Saudi AI via Syrian fiber

- Abu Dhabi’s AI moment

‘Battle of the Sexes’ redo, for the TikTok era. |

|

Headlines out of Saudi Arabia in the past few weeks have been dominated by AI, megaprojects, international investments, and sporting spectacles. One company unites the old, oil-driven economy, and the new one it is trying to build: Aramco. Oil’s surge after Russia invaded Ukraine in 2022 handed Saudi Arabia a windfall that pushed the budget into surplus for the only time in the past decade. Now the picture is very different. The government had to rewrite key forecasts due to higher spending and weaker oil income, more than doubling the kingdom’s expected deficit. Yet even with weaker oil prices, Aramco still generates huge amounts of cash to fund Saudi Arabia’s economic transformation. Its digital arm and relations with US chip manufacturers now form the backbone of HUMAIN, the country’s AI champion. Energy it produces will likely power Saudi data centers. It’s taking over sports teams, building soccer stadiums to host the FIFA World Cup in 2034, and investing internationally to shore up relations with key allies from the US to China. Saudi Arabia may want to move on from oil, but Aramco’s role in the economy is still growing. |

|

Aramco profit climbs to $28B |

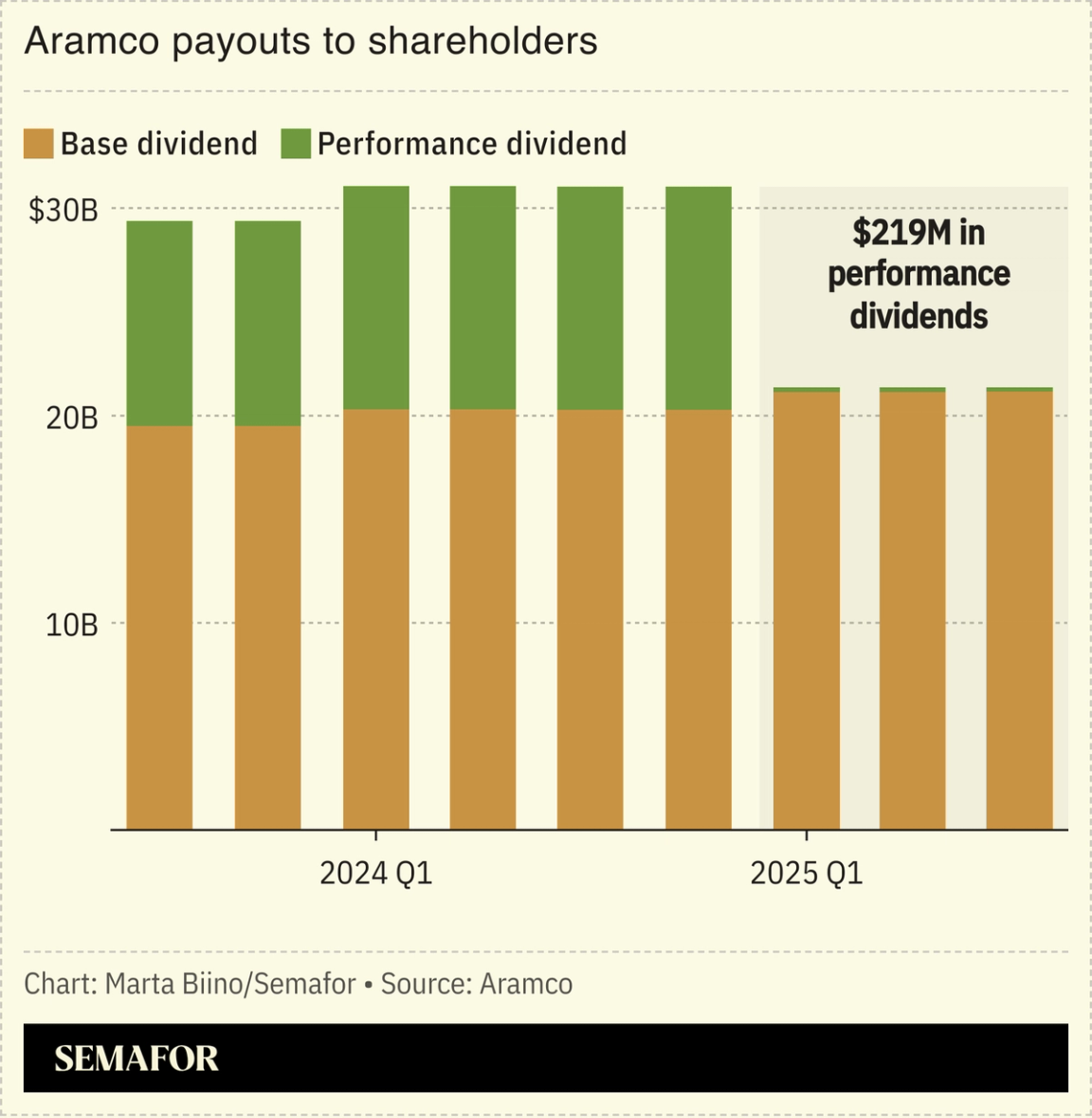

Saudi Aramco reported a surprise profit increase and boosted its forecasts for gas production forecasts as the kingdom embarked on a policy of lifting crude output to grab market share. Adjusted net income for the third quarter was $28 billion, beating a company-compiled analyst estimate of $26.5 billion and generating enough free cash flow to cover its huge dividend payments for the first time in several quarters. The payouts are critical to funding Saudi government spending, which underpins a multitrillion-dollar plan to diversify the economy. Aramco also lifted its forecasts for gas production, saying output would be 80% higher than 2021 levels by the end of the decade, up from an earlier plan of a 60% increase. The company is betting that global energy demand will continue rising and fossil fuels will remain dominant as AI data centers and electric vehicles lead consumption to surge. — Matthew Martin |

|

ADNOC unleashes the AI robots |

Courtesy of Gecko Robotics Courtesy of Gecko RoboticsADNOC and US-based Gecko Robotics are partnering on combining machines, data, and software in an effort that could redefine how energy assets are monitored and maintained. The agreement includes a deal to integrate Gecko’s wall-climbing inspection robots and related software into a suite of products developed by Abu Dhabi’s AI-for-energy firm AIQ that are trained on 50 years of ADNOC data. The goal: create autonomous systems that detect corrosion, predict failures, and optimize production — and then sell that technology together to other energy producers. Gecko, a Pittsburgh startup valued at more than $600 million, builds robots that collect millions of data points as they inspect energy facilities. “Companies that are focused on algorithms, as opposed to data sets, are clamoring for partnerships” with firms like Gecko, CEO Jake Loosararian told Semafor. The “AI race is heading toward data set creators” who can improve asset performance and productivity. — Mohammed Sergie |

|

Bahrain to accelerate biotech sector |

The value of biotech assets Bahrain aims to create in just three years through its partnership with SandboxAQ. The deal between the kingdom’s sovereign wealth fund Mumtalakat and Sandbox — which was spun out of Alphabet in 2022 and is backed by investors such as T. Rowe Price, Eric Schmidt, and the CIA’s venture capital firm — will use artificial intelligence and quantum techniques to accelerate drug discovery. Developing a biotech sector takes three to four decades, from hiring scientists to making viable medicines that go through a trial-and-error process that plagues drug development, SandboxAQ’s chief executive officer Jack Hidary said in an interview. “The majority of all intellectual property of biotech, all the medicines and patents, are owned by six countries. It’s our contention that with this kind of software we can democratize” the industry, Hidary told Semafor. “We can take it from just six countries to 30, 40 countries. And Bahrain is the first example.” — Mohammed Sergie |

|

Palantir, Dubai create AI company |

Nathan Howard/Reuters Nathan Howard/ReutersPalantir has formed a new company with Dubai Holding, a conglomerate controlled by Dubai’s ruling family, to deploy AI software across government and the private sector. The joint venture, Aither, aims to help Dubai hit its target of generating 100 billion dirhams ($27 billion) annually through digital transformation initiatives, focusing on sectors including finance, hospitality, logistics, and real estate. Aither will also look to develop Emirati talent in AI and build governance models to spur technology adoption. Palantir, the technology firm co-founded by billionaire entrepreneur-turned-investor Peter Thiel, which counts the US Army as a top customer, is one of the world’s hottest AI stocks. Dubai Holding has been a Palantir client for the past 18 months, with the Denver firm’s software used by portfolio companies like real estate developers Nakheel and Meraas, and hotel brand Jumeirah. — Kelsey Warner |

|

Saudi’s AI ambitions may run through Syria |

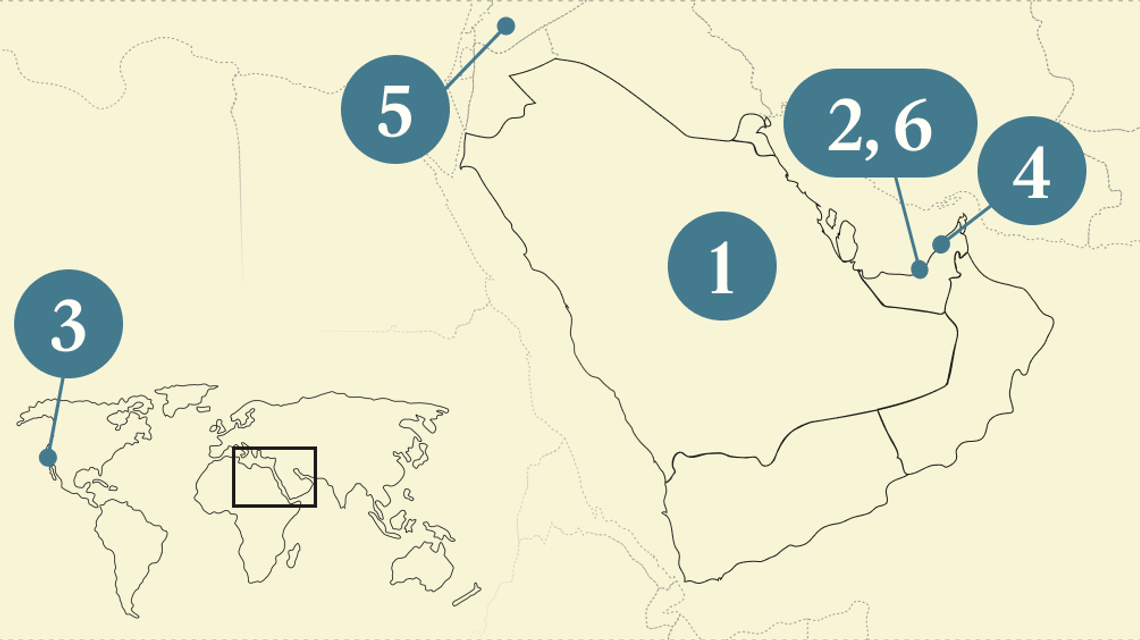

Courtesy of TeleGeography. Licensed under CC BY-SA 4.0. Courtesy of TeleGeography. Licensed under CC BY-SA 4.0.Saudi Arabia’s artificial intelligence ambitions may rely on an unlikely partner: Syria. The two are in talks over a plan to build data cables that would connect the oil-rich kingdom to Europe through the war-ravaged country’s Mediterranean coast. The so-called SilkLink project, which could cost around $500 million, would allow data centers in Saudi Arabia to be used as compute hubs for users across Europe and beyond, bypassing a choke point in the Red Sea. Data flowing through that route is as prone to disruption as physical goods are. Saudi Arabia’s biggest telecommunications firm is one of the short-listed bidders for the project. Abdulsalam Haykal, Syria’s minister of telecommunications and information technology, met his Saudi counterpart in recent months to discuss the plan, people familiar with the matter said. “We are in the last stretch before choosing a partner for SilkLink,” Haykal told Semafor in an interview. — Mohammed Sergie and Matthew Martin |

|

View: Abu Dhabi AI bets pay off |

Amr Alfiky/Reuters Amr Alfiky/ReutersMicrosoft’s $15.2 billion investment in the UAE’s AI industry — more than its outlays in France and Germany combined — crowns nearly a decade of Abu Dhabi’s efforts to compete globally, not just regionally, writes former Emirati official Tareq Alotaiba in a Semafor column. “While many countries have the capital and power to build data centers, it’s harder to match the subtle factors that have given the UAE an advantage: few can replicate the Emirati government’s AI policy and investment experience,” Alotaiba wrote. The UAE moved from being a customer to an enabler of the “public-private partnerships necessary for AI.” |

|

On Nov. 12 at Cipriani South Street in New York, the Dubai Business Forum will convene CEOs, senior executives, and policymakers for a day of high-level conversations on global growth, AI disruption, and cross-border collaboration — examining the strategic opportunity Dubai provides for adaptive, forward-thinking companies. Featured speakers include H.E. Sultan bin Saeed Al Mansoori (Chairman, Dubai Chambers), Jose Minaya (Global Head, BNY Investments and Wealth), Jared Cohen (President of Global Affairs and Co-Head of the Goldman Sachs Global Institute, Goldman Sachs) and Ola Doudin (CEO, BitOasis). Request your delegate invitation here. The Dubai Business Forum USA, powered by Dubai Chambers, is produced in partnership with Semafor’s events and marketing teams, with select editorial sessions independently developed and led by Semafor’s newsroom. |

|

Checking In- The Gulf could be getting another budget airline, this time with Bahrain as the base. Malaysian carrier AirAsia is discussing plans to operate 25 daily flights between Malaysia, Thailand, Indonesia, and the Philippines to Bahrain by 2030.

- Two Israeli airlines are waiting for permission to reenter Omani airspace after a short-lived opening prior to the war in Gaza in 2023. The go-ahead would allow El Al and Arkia to reinstate direct routes to India. — Globes

Deals- XRG announced two deals. The ADNOC investment arm will increase holdings in the Caspian Sea with plans to acquire a stake in Azerbaijan’s Southern Gas Corridor, a key link to the European market, and alongside Eni, will evaluate participation in developing a liquefied natural gas field in Argentina, marking its entry into South America.

- TA’ZIZ, a joint venture between ADNOC and Abu Dhabi sovereign wealth fund ADQ, awarded a

|

|

|