| | In this edition, Google considers a cheaper data center in space, while China discounts energy costs͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Technology |  |

| |

|

- China’s new energy discount

- A steadfast Sequoia

- Australia takes AI copyright position

- EU’s fighting chance

- Perplexity feels bullied

Why Google wants to put data centers in space, and Tom Brady reveals his dog is cloned. |

|

I wrote yesterday about Google’s “moonshot” project to build data centers in space. Tech critics predictably dismissed the idea, while accelerationists cheered the company on. We’ll find out in ten years who’s right. But there’s a more significant question over in the accounting department. The company’s researchers predict the cost of space travel could drop below $200 per kilogram within the next decade. For comparison, the SpaceX Falcon Heavy runs about $1,500 per kg today, and NASA’s space shuttle cost more than $54,000 per kg. A decade goes by fast, and if launching things into space hits that threshold, companies are going to be forced to ask questions like: Could my product be manufactured better or for less money in space? How do the economics of my industry change when raw materials can be mined on the moon? With Google already thinking it needs to study the feasibility of using its AI chips in space, it’s probably time for other companies to start brainstorming how their businesses might change, too. There’s surprisingly little research out there about how space could affect things down here on Earth. Maybe that’s because it’s difficult to imagine a scenario that seems like science fiction. But at $200 per kg, it won’t be sci-fi anymore. |

|

China slashes big data centers’ electric bills |

A staff member introduces Tencent’s Internet Data Center cloud computing service. David Kirton/Reuters. A staff member introduces Tencent’s Internet Data Center cloud computing service. David Kirton/Reuters.China is helping cut energy bills by up to half for some of the largest data centers using domestic chips rather than foreign ones, the Financial Times reported. The subsidies from local governments come as tech giants like Alibaba, Baidu, and Tencent faced higher electricity costs after Beijing in September banned certain Nvidia chips, which are more energy-efficient than their Chinese counterparts. Chinese companies have in recent years been iced out by US export restrictions, and now Beijing is adding its own controls. The country banned foreign AI chips for new data center projects that have received any state funds, Reuters reported Wednesday. The efforts attempt to boost Chinese tech firms’ reliance on its own semiconductor sector even when it slows development or increases costs. They emphasize Beijing’s willingness to sacrifice short-term gains for long-term independence of foreign products. They also act as a warning and lesson for other countries as sovereign tech becomes a national rallying cry. France similarly helped Mistral with its data center buildout, and the US is attempting to do the same for domestic companies but is getting bogged down by debates around export controls and regulations, rather than incentives. |

|

Sequoia keeps steady despite leadership change |

Denis Balibouse/Reuters Denis Balibouse/ReutersSequoia Capital’s top partner, Roelof Botha, is stepping aside to make room for the next leadership class to run one of Silicon Valley’s most important venture firms. Founded in 1972 by investor Don Valentine, it was the first VC to invest in tech titans like Apple, Google, Yahoo, Nvidia, and many others. Sequoia has had its share of turmoil in recent years, as it grappled with geopolitics, as well as domestic and internal politics. In that context, if Sequoia were any other venture firm, Botha’s departure could be read as a bad sign. But Sequoia is an outlier, growing through four previous leadership changes. It has continuity in its DNA. What has changed is the entire venture industry. Massive fund sizes have forced VCs to take bigger swings at more established companies. Writing a check to a couple of kids inventing in a garage and watching their startup become Apple or Google is the kind of thing the best Silicon Valley investors are passionate about. Sequoia has tried to resist, retaining its early-stage investment vehicles and managing more than $56 billion in assets, but it also has a $20 billion evergreen fund that holds public market assets. The question isn’t so much who leads Sequoia, but what the firm represents in a VC landscape that is so fundamentally different from the one when Valentine founded half a century ago. |

|

Australia makes pivotal decision on AI copyright deals |

| |  | Reed Albergotti |

| |

Annabelle Herd (left) and Semafor’s Reed Albergotti. Semafor/YouTube. Annabelle Herd (left) and Semafor’s Reed Albergotti. Semafor/YouTube.Australia’s government last week rejected a tech push to create a copyright exemption that would allow AI models to train on Australian artists’ content. The decision turns the country into an experiment with one possible future for AI copyright deals. In the US, a similar issue is making its way through the legal system and seems likely to end up in front of the Supreme Court. Australian Recording Industry Association CEO Annabelle Herd told me last week that she expects that AI companies will be forced to make deals with record labels. Rather than one lump sum, those deals could include creative revenue-sharing models, based on how much of an artist’s work was used in model outputs, for instance. Watch or listen to the full interview here. |

|

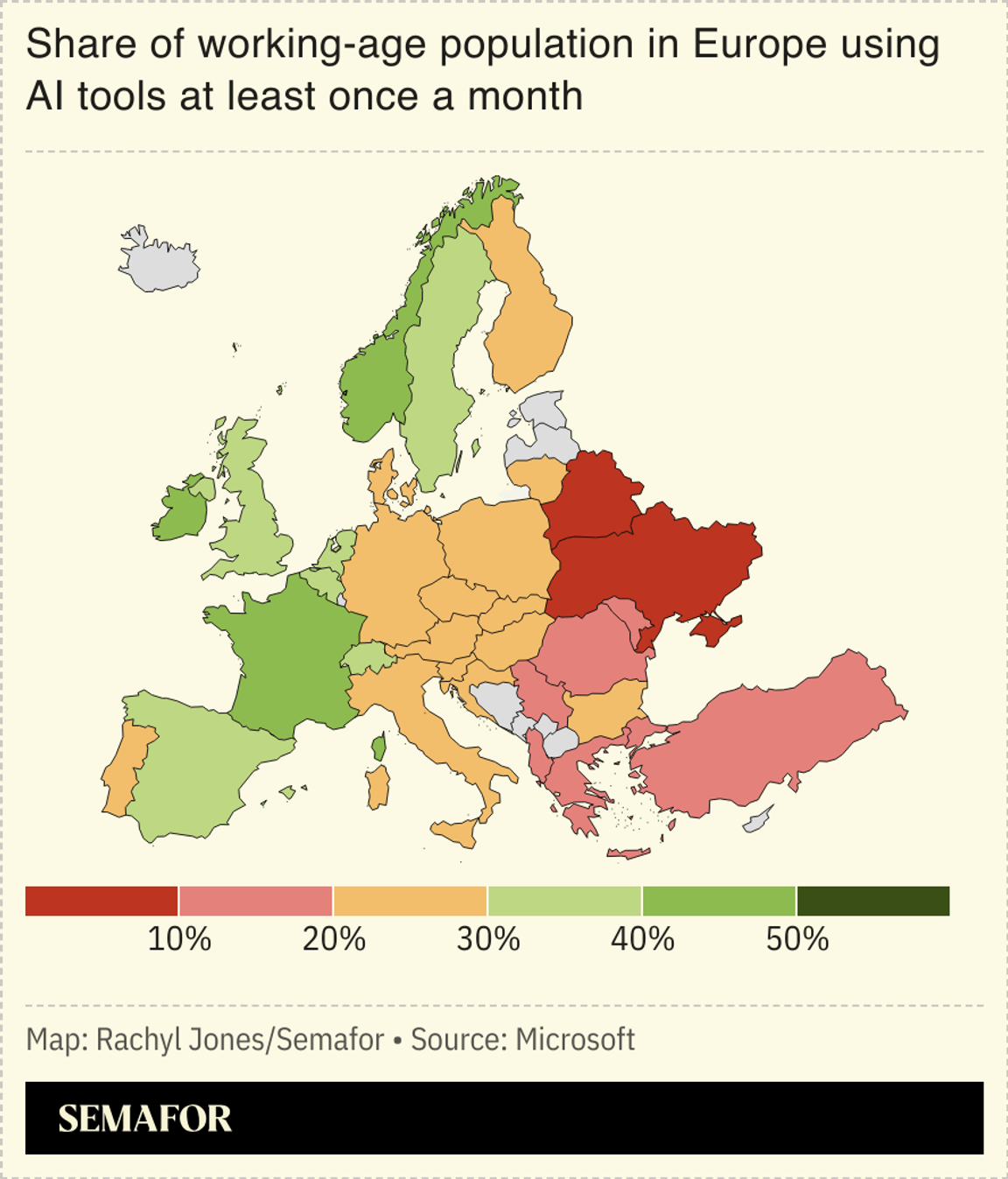

Europe’s AI science investment |

Europe, fighting for third place in the global AI race, got some good news in the form of several new public and private investments announced this week. The European Commission on Sunday launched an institute for advancing AI in science — including in improving cancer treatments, environmental issues, and disaster forecasting — as part of its mission to become a global AI leader. Fueled by €107 million ($123 million) from research program Horizon Europe, the Resource for Artificial Intelligence Science in Europe (RAISE) will act as a digital hub for companies and countries to access compute, talent, funding, and data.  Europe’s government-funded programs act as a substitute for what the private sectors in the US and China are investing in with friendlier AI governance. But tech giants are also investing in what is among the world’s biggest markets: Nvidia and Deutsche Telekom signed a €1 billion partnership this week to renovate and expand a German data center into one of the largest in Europe, aiming to boost the country’s AI compute power by 50%, the companies said. |

|

Tasos Katopodis/Getty for Semafor Tasos Katopodis/Getty for SemaforPerplexity accused Amazon of “bullying” in a blog post Tuesday, responding to a cease-and-desist letter from the e-commerce site regarding its agentic shopping feature that makes purchases on users’ behalf. “This isn’t a reasonable legal position, it’s a bully tactic to scare disruptive companies like Perplexity out of making life better for people,” the post read. It argued that Amazon prioritizes serving ads, sponsored posts, and upselling users, rather than focusing on customers. Amazon’s suit filed the same day alleges the startup improperly accessed accounts and disguised the agent as a human user, violating its terms of service. The e-commerce giant is also working on similar automated shopping tools. The dispute puts a spotlight on a problem we’ve been writing a lot about: Walled gardens threaten to slow down AI adoption. The courts will have to decide whether consumers have the right to automate their shopping, even if online retailers are against it. But the technology itself may not be good enough to circumvent whatever companies like Amazon do to block it. The reason Amazon doesn’t want its customers using their AI agents of choice is simple: Last year, Amazon made $56 billion showing ads to users, 9% of its total sales. Rather than being forced to adapt, the incumbent leaders want to retain their cash cow businesses as long as possible. As we’ve written before, it’s more lucrative to prevent innovation than to innovate. |

|

Ken Burns has been telling the story of America through his entire career with genre-defining documentaries on the Civil War, the Vietnam War, and now the American Revolution. This week, Ben and Max bring on the renowned documentarian to talk about his latest series, the parallels he sees between America’s founding moment and today’s media environment, and what we can learn from our history. They also discuss what he makes of the Trump administration’s cuts on PBS, and — after spending 10 meticulous years making a 12-hour documentary — his take on short-form video and talk podcasts like this one. Listen to the latest episode on Mixed Signals now. |

|

Tom Brady with his dog Lua in 2014. Stickman/Bauer-Griffin/GC Images via Getty. Tom Brady with his dog Lua in 2014. Stickman/Bauer-Griffin/GC Images via Getty.Football superstar Tom Brady has revealed his dog Junie is a clone of his former pet, Lua, who died in 2023. Brady worked with Colossal Biosciences, the genetic engineering company known for its work to bring the woolly mammoth back from extinction, to draw blood from Lua before her death and create Junie. “I love my animals. They mean the world to me and my family,” he said in a statement through Colossal, in which he is an investor. “Colossal gave my family a second chance with a clone of our beloved dog.” The announcement comes alongside Colossal’s acquisition of animal-cloning company Viagen, which has performed similar services for Paris Hilton and Barbra Streisand. Such high-profile cases, and Colossal’s efforts to resurrect the dire wolf, coincide with calls to “pause” animal cloning, including one from the ASPCA. The pet replication business will be Colossal’s key to generating revenue and paying back investors in the near term while the mammoth market matures. Cloning a dog or cat through Viagen costs roughly $50,000 ($85,000 for a horse), according to The American Animal Hospital Association. |

|

|