| | In today’s edition: Abu Dhabi covets Australian gas, Qatar’s big project in Egypt, and Jon Medved on͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Abu Dhabi’s global gas hunt

- Bahrain lures the wealthy

- UAE reveals its AI spend

- Qatar captures carbon…

- … and a chunk of Egypt

- The economics of peace

A Dubai connection in Gracie Mansion and other weekend reads. |

|

ADNOC still interested in Australia’s Santos |

Hollie Adams/Reuters Hollie Adams/ReutersXRG, the global investment arm of Abu Dhabi-owned energy company ADNOC, is taking a never-say-never approach to Santos, the Australian gas supplier it attempted to acquire for $18.7 billion before walking away in September after protracted negotiations. A person with direct knowledge of the talks told Semafor that XRG executives “still like the company” and haven’t ruled out revisiting the deal. Global gas demand hit a record in 2024, according to the International Energy Agency, and Asia Pacific economies are expected to drive half of the growth through the end of the decade. Santos has faced turbulence since the failed takeover. Its chief financial officer resigned last month after only a year in the role. In hindsight, XRG is glad to have stepped away and watched the “soap opera” play out, the person said. For now, both sides “need a break,” they added. A spokesperson for XRG declined to comment. — Kelsey Warner |

|

Bahrain looks to attract global super-rich |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersBahrain is revamping its rules for investment trusts, as it looks to pitch the country as a global wealth management hub and attract the type of super-rich residents that have flocked to the neighboring UAE in recent years. The government has already made some tweaks in response to feedback from potential investors and is now working on a broader rewrite of laws to convince wealthy families and trusts to domicile themselves in Bahrain, Noor Ali Alkhulaif, CEO of the Economic Development Board, the country’s inward investment agency, said in an interview. The UAE has convinced many of the world’s wealthiest families, including the likes of hedge fund billionaire Ray Dalio, to open offices in the country to manage some of their riches, lured by low taxes, long-term residency programmes, new infrastructure, and year-round sunshine. Bahrain was the region’s main financial hub in the 1980s and ’90s, before the rise of Dubai; it would like to recapture some of that glory. — Matthew Martin |

|

UAE bets big on AI future |

The amount of money the UAE has poured into artificial intelligence at home and abroad since the beginning of 2024. The figure — revealed by Omar Sultan Al Olama, Minister of State for AI, on Wednesday — includes 100 billion dirhams ($27.2 billion) for the Stargate data center project and 180 billion dirhams in overseas investments. The UAE, along with Qatar and Saudi Arabia, is investing heavily in AI infrastructure and applications, with the Emirates taking a notable lead in data center capacity and in attracting foreign investment. Microsoft said it’s committing more than $15 billion in the UAE from 2023 through 2030, more than its combined investments in Germany and France. At both the government level and within the state-owned energy company ADNOC, AI is already yielding economic benefits, said Sultan Al Jaber, UAE Minister of Industry and Advanced Technology and ADNOC’s group CEO. The company’s board of directors now uses a proprietary AI assistant, trained on internal data, to provide real-time advice — part of a broader push to deploy the technology across all aspects of its operations. — Mohammed Sergie |

|

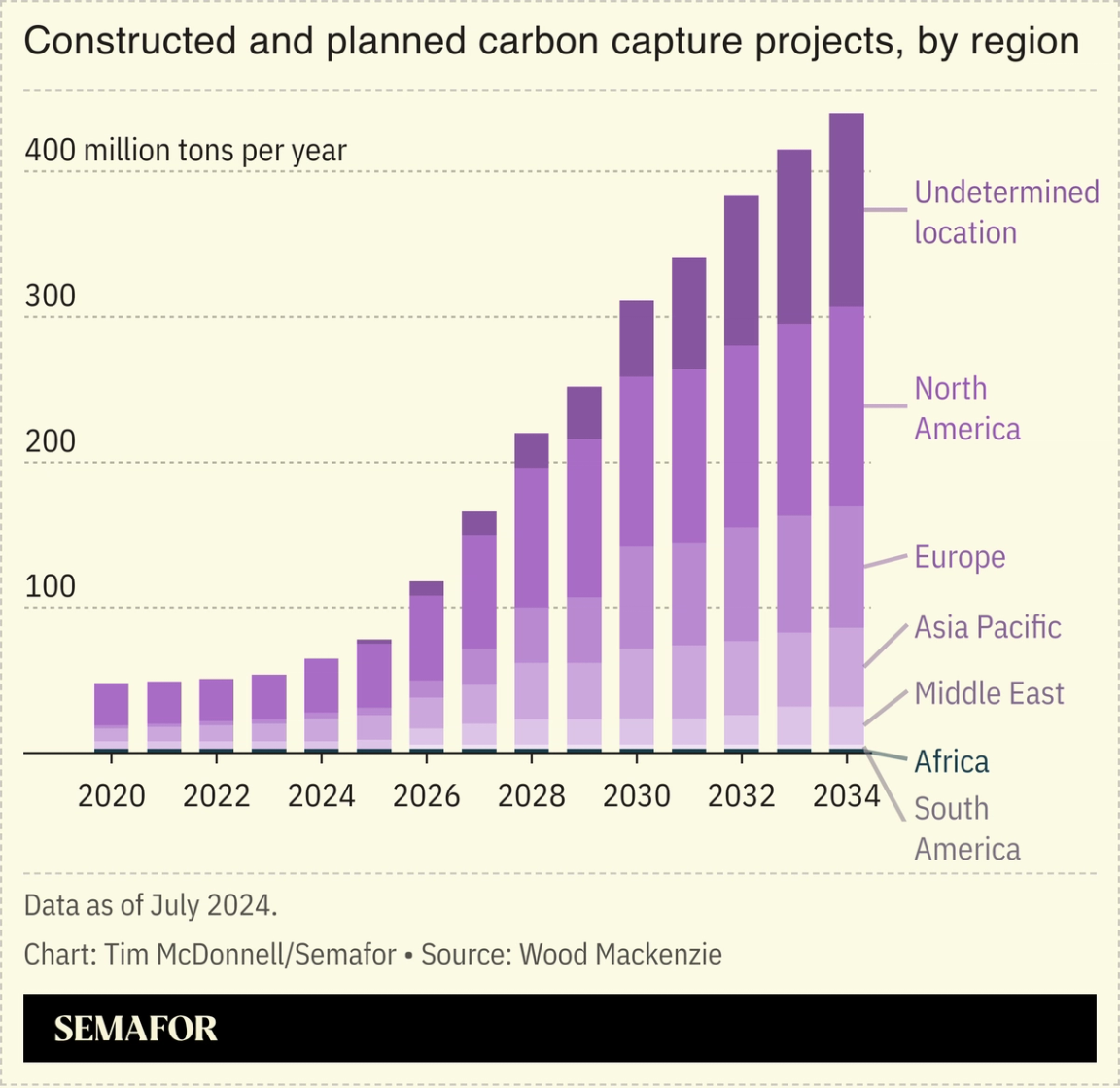

Qatar leans on tech to decarbonize |

Qatar has awarded Samsung C&T a contract to build a facility to remove up to 4.1 million tons of CO2 a year. The announcement comes just ahead of the COP30 conference in Brazil, where ‘energy realists’ are once again likely to push back against stricter climate goals. Carbon capture and storage (CCS) projects can be a useful way to clean up heavy industries where decarbonizing is hard. Qatar aims to have 11 million tons per year of CCS capacity in place by 2035. Saudi Arabia is building a similar amount, while Kuwait, Oman, and the UAE are also developing projects. Some will reinject the captured carbon back into oil wells to help maintain production levels. Last year, global emissions hit a record 53.2 billion tonnes of CO2 equivalent. Against that backdrop, the world’s 64 million tonnes of CCS capacity now in place made a tiny contribution. |

|

Qatar doubles down on Egypt’s coastline |

Stringer/Reuters Stringer/ReutersGulf countries have a healthy — and luxurious — competition going on Egypt’s long Mediterranean coast. Qatari Diar agreed to pay $3.5 billion for the rights to an area of land about a third the size of Manhattan in Matruh province, the same region where the UAE’s state-owned Modon Holding is developing its $35 billion Ras El Hekma megaproject. These deals reflect a wider shift by Gulf countries, which are moving away from providing aid to Egypt and instead focusing on investment opportunities. Saudi Arabia has pledged to invest $5 billion in the country. Qatar’s Alam El Roum project is valued at almost $30 billion. Qatari Diar, the real estate arm of Doha’s sovereign wealth fund, is also developing a tourism resort on Egypt’s Red Sea coast. |

|

View: Trade is key to Abraham Accords |

A billboard sponsored by the Coalition for Regional Security in Israel. Violeta Santos Moura/Reuters. A billboard sponsored by the Coalition for Regional Security in Israel. Violeta Santos Moura/Reuters.Diplomacy is the first step toward US President Donald Trump’s goal of expanding the Abraham Accords, but it won’t be enough to cement enduring peace in the region, Jon Medved, founder of Jerusalem-based venture investment platform OurCrowd, writes in a Semafor column. “Israel’s experience of cold peace with its neighbors Jordan and Egypt show that diplomatic treaties don’t create harmony and prosperity,” Medved wrote. “Commerce and investment will help the peoples of the Middle East create the personal and constructive relationships that come from solving shared problems and increasing mutual prosperity.” |

|

On Nov. 12 at Cipriani South Street in New York, the Dubai Business Forum will convene CEOs, senior executives, and policymakers for a day of high-level conversations on global growth, AI disruption, and cross-border collaboration — examining the strategic opportunity Dubai provides for adaptive, forward-thinking companies. Featuring journalist and filmmaker Nayeema Raza, alongside leaders from Careem, Kitopi, and Mumzworld, the Dubai Business Forum will explore how the Gulf’s founders and investors are redefining global business. Request your delegate invitation here. The Dubai Business Forum USA, powered by Dubai Chambers, is produced in partnership with Semafor’s events and marketing teams, with select editorial sessions independently developed and led by Semafor’s newsroom. |

|

Checking In- Emirates posted a record pre-tax profit of $3.3 billion for the first half of its fiscal year as more passengers paid for premium cabins. The Dubai carrier expects revenue to grow this year after more Airbus A350 jets join its fleet.

- Qatar Airways is selling its entire 9.57% stake in Cathay Pacific for 6.97 billion Hong Kong dollars ($896 million). Its exit from the Hong Kong carrier is seen as an orderly buyout of a non-strategic asset for Doha, according to an analyst. — The Wall Street Journal

- A passenger ferry service has been launched between Al Ruwais Port in northern Qatar and Sa’ada Marina in Bahrain — a sign of warming ties between two neighbours that have often been at odds.

Data Centers- UAE-based Bitcoin miner Phoenix Group has signed a deal for a data center in Ethiopia, backed by 30 megawatts of hydropower.

- HUMAIN, Public Investment Fund’s AI unit, plans to develop a multi-gigawatt pipeline of data centers with fellow Saudi company DataVolt.

Finance- Abu Dhabi asset manager Lunate expects to debut an AI-focused exchange-traded fund (ETF) on the ADX on Nov. 25. The AI Data Power ETF will hold shares in 35 companies including Oracle, NextEra Energy, Siemens, ABB, and Eaton Corp.

Logistics- Abu Dhabi’s AD Ports Group is buying a 20% stake in the container terminal at Latakia, Syria, for about $22 million. Its rival, Dubai’s DP World, is developing the Tartus port just up the coast.

|

|

|