| | Thousands of US flights are canceled over the government shutdown, the COP30 climate conference kick͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - US shutdown woes deepen

- COP30 kicks off in Brazil

- China deflation eases

- Beijing resumes chip exports

- Setting up shop in UAE

- German activist seeks asylum

- Pharma showdown ends

- Bacteria and war

- AI copilot in Google Maps

- Polarizing SF landmark

Litter-picking becomes a sport in Tokyo, and Semafor’s tech editor on AI bailouts. |

|

US flight disruptions rise in shutdown |

Carlos Barria/Reuters Carlos Barria/ReutersThe pain of the US government shutdown deepened Sunday as flight cancellations piled up and politicians exchanged blame over the funding stalemate. The US transportation secretary warned that flights could be “reduced to a trickle” within weeks as air traffic controllers work without pay, forcing federal officials to mandate flight reductions. The disruptions are also hurting air cargo, straining the country’s already-battered supply chain before the holidays. The shutdown, in its 40th day, amounts to “government dysfunction brewed from splintered national unity,” a CNN analyst wrote. Such impasses typically end when one party decides the political costs of keeping the government closed outweigh the concessions of opening it. But “as is customary in the Trump era, normal assumptions have buckled.” |

|

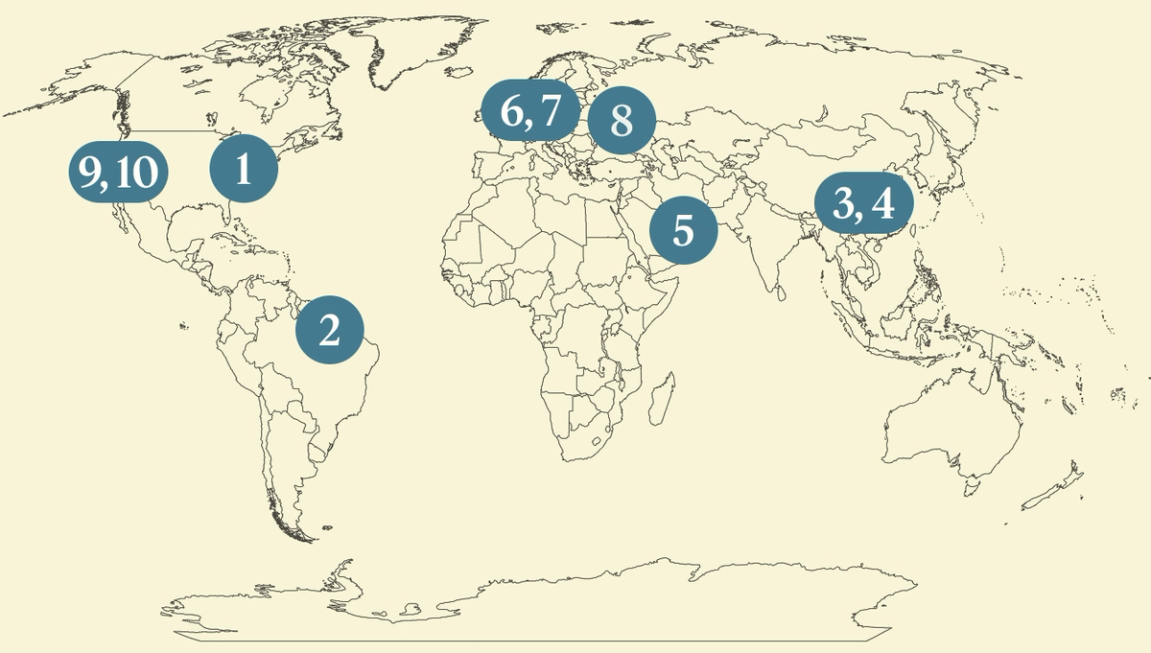

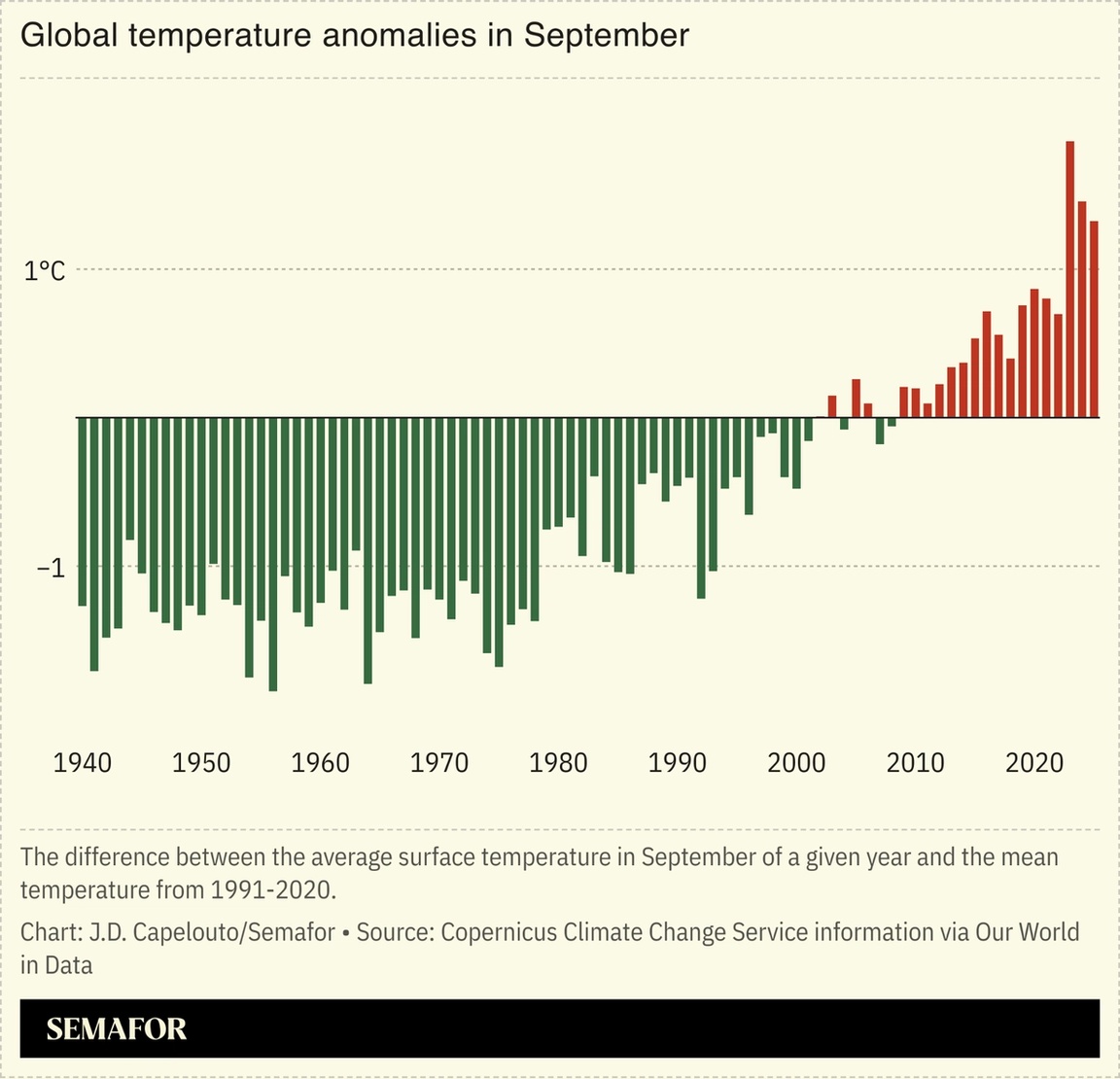

Washington absent from COP summit |

The COP30 climate summit in Brazil, kicking off Monday, will be defined largely by the absence of the US, a space that will be partially filled by China, analysts said. Washington isn’t sending any high-level officials to the gathering in the Amazon rainforest, but President Donald Trump will still loom over the event as nations grapple with the White House’s heightened animosity toward clean energy and climate action, Semafor’s climate and energy editor noted. While China’s leader also isn’t attending, COP will showcase the inroads Beijing’s clean-tech industry has made in Latin America: Brazil chose Chinese EVs to shuttle attendees, a signal that “the world is moving on, even without US political and technological leadership,” an expert said. |

|

The world’s biggest climate and energy decisions are being made this week at COP30. Semafor Climate & Energy Editor Tim McDonnell is on the ground, tracking every key moment, meeting, and deal shaping the next chapter of global policy. Get an insider look at what world leaders are debating — and how the energy transition will be affected — in this week’s editions of Semafor Energy. |

|

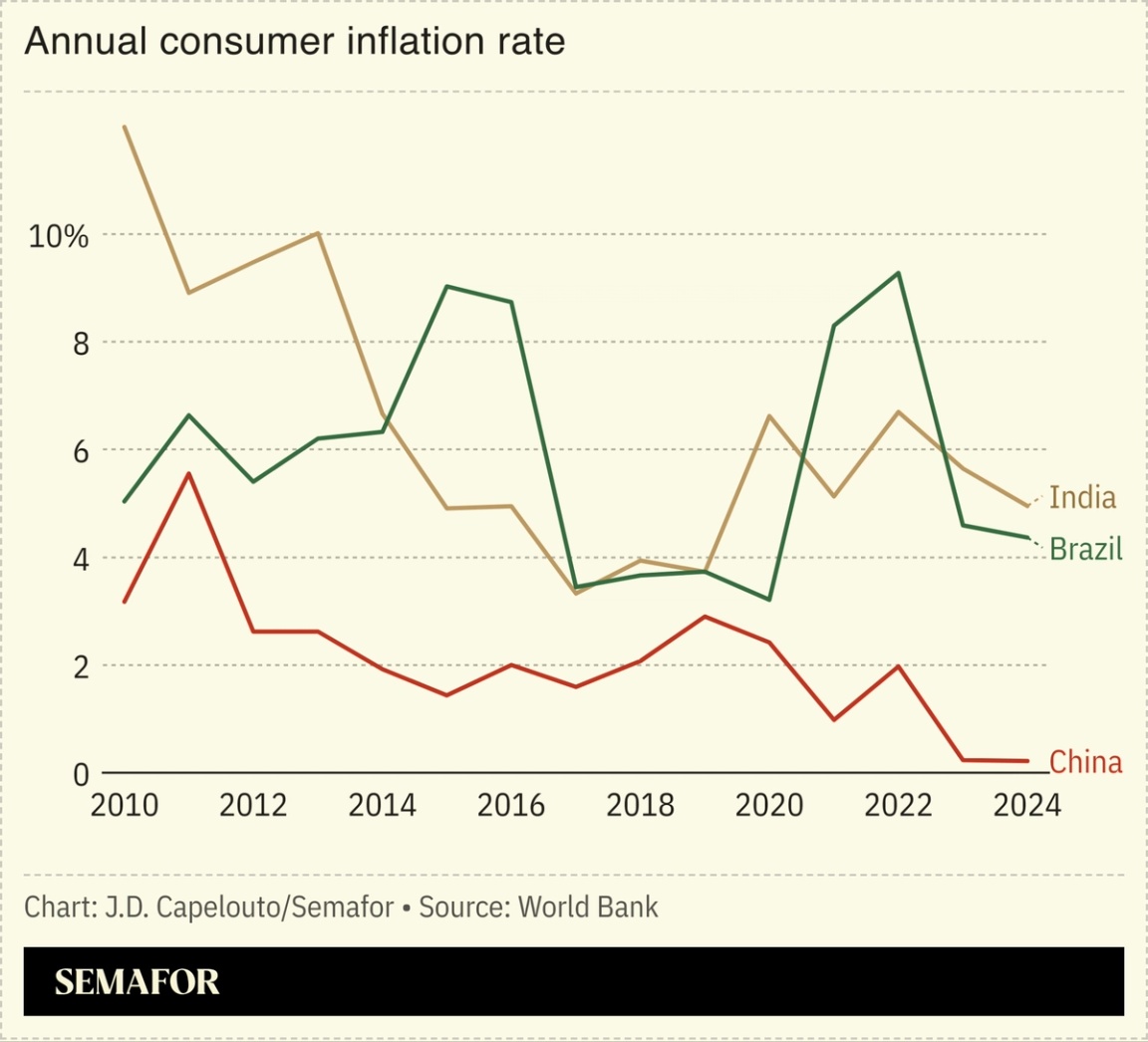

Consumer prices in China unexpectedly rose last month, new data showed Sunday, a sign that deflationary pressures on the world’s second-largest economy may be easing. The Golden Week holiday in October contributed to the 0.2% year-on-year rise, the first positive reading since June, analysts said. Chinese policymakers have prioritized fighting “involution,” a term that refers to punishing price wars across industries that have accelerated deflation, sparking concerns of a growth slowdown. While the latest data is welcome news to Beijing, the downward pressures are “entrenched” and the latest boost in prices will likely fade, a Bloomberg analyst said. |

|

Beijing resuming chip exports |

Fabian Bimmer/Reuters Fabian Bimmer/ReutersChina is resuming exports of chips critical to making European cars, potentially setting the stage for the end of a row between Beijing and the Netherlands. The Dutch government last month took control of local Chinese-owned chipmaker Nexperia, citing national security concerns, and Beijing retaliated by restricting exports of chips from Nexperia’s Chinese facility. That strained Europe’s auto sector, prompting fears of a shortage, but EU-China talks averted the “worst-case scenario,” Brussels said. The resumption of exports could lead the Netherlands to lift controls on Nexperia. Despite the de-escalation, the saga exposed the limits of Europe’s economic security policies and the fragility of its supply chains, a European Council on Foreign Relations expert said. |

|

Wealthy Chinese pivoting to UAE |

Abdel Hadi Ramahi/Reuters Abdel Hadi Ramahi/ReutersMore wealthy Chinese people are shunning Singapore and instead relocating to Dubai and Abu Dhabi to set up a family shop. For years, moving to Singapore was a status symbol, as government incentives in the Southeast Asian city-state made it easier to establish offices. But its immigration laws are restrictive, a contrast to the United Arab Emirates’ golden visa, which allows investors to gain long-term residency. Chinese crypto entrepreneurs who may be feeling pressure in China are “looking at how friendly the local regulators are” and choosing Dubai over the more risk-averse Singapore, one wealth manager told the Financial Times. The shift speaks to the growing prominence of the Gulf in global finance. |

|

German far-right figure seeks US refuge |

Samuel Corum/Getty Images Samuel Corum/Getty ImagesA prominent far-right German activist and influencer is seeking political asylum in the US, arguing she is being persecuted at home for her beliefs. Naomi Seibt, 25, said that German domestic intelligence is tracking her movements; she is an outspoken supporter of the anti-immigration Alternative für Deutschland party, which authorities have labeled extremist. Her application for asylum reflects both Berlin’s increased scrutiny of the country’s far right and Washington’s sympathy for such actors. The Trump administration, which has criticized what it sees as an improper crackdown on free speech in Europe, has signaled it will prioritize protections for white refugees and Europeans claiming their populist views are under attack, The Washington Post wrote. |

|

Pfizer wins bidding war for drug startup |

Maxim Shemetov/Reuters Maxim Shemetov/ReutersUS pharma giant Pfizer won a bidding war to acquire obesity drug developer Metsera, beating back an offer from Danish rival Novo Nordisk. The $10 billion deal — a valuation much higher than Pfizer had originally offered — followed a corporate tiff in which Novo Nordisk tried to hijack Pfizer’s purchase of the American startup, prompting Pfizer to sue. Metsera said Novo’s offer posed antitrust regulatory risks. The deal marks a win for Pfizer in its efforts to catch up with Eli Lilly and Novo, which makes Ozempic, in the obesity drug market; Pfizer has seen a rapid decline in its COVID-19 business due to lower demand for vaccines and antiviral drugs. |

|

Fears of an antibiotics ‘tipping point’ |

Oleg Petrasiuk/Press Service of the 24th King Danylo Separate Mechanized Brigade of the Ukrainian Armed Forces/Handout via Reuters Oleg Petrasiuk/Press Service of the 24th King Danylo Separate Mechanized Brigade of the Ukrainian Armed Forces/Handout via ReutersConflict zones are spurring an explosion in antibiotic-resistant bacteria. Walter Reed’s deputy director of infectious diseases told Science that he hadn’t seen anything like the bacteria emerging from Ukraine, where — as in Gaza and Syria — the destruction of health infrastructure, combat wounds contaminated with heavy metals, and medicine shortages are producing a new generation of drug-resistant microbes. Humanity is approaching an antibiotics “tipping point,” a researcher wrote in the Financial Times, with drug-resistant infections projected to increase 70% by 2050. In a few decades, “we may not have any antibiotics for many kinds of infections,” one physician and microbiologist said. “And that keeps me up at night.” |

|

AI will be copilot for Google Maps |

Kim Hong-Ji/Reuters Kim Hong-Ji/ReutersGoogle Maps will start incorporating generative AI to create an “all-knowing copilot.” Users can ask open-ended questions, such as “What’s parking like at my destination?” or “Is there a good restaurant nearby?” It’s part of Google’s wider move toward AI: Google’s Meet, Docs, and Calendar all have AI functionality via the company’s Gemini model, and its AI can also read all of your Gmail messages. As for Google’s competitors, ChatGPT is increasingly integrated within the Apple ecosystem, as well as Microsoft Office. AI hallucinations could be problematic while driving — even the unenhanced Maps app has occasionally directed people offroad — but Google says that won’t happen because the navigation features are grounded in “actual place information in the real world.” |

|

Divisive SF fountain may be razed |

|

|