| | Some Wall Street firms see a rich opportunity in financing climate resilience, but better policies a͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Wall St takes on adaptation

- Sanctions hit methane cuts

- Finance inequality

- Rig count falls

- Trade deal bonanza

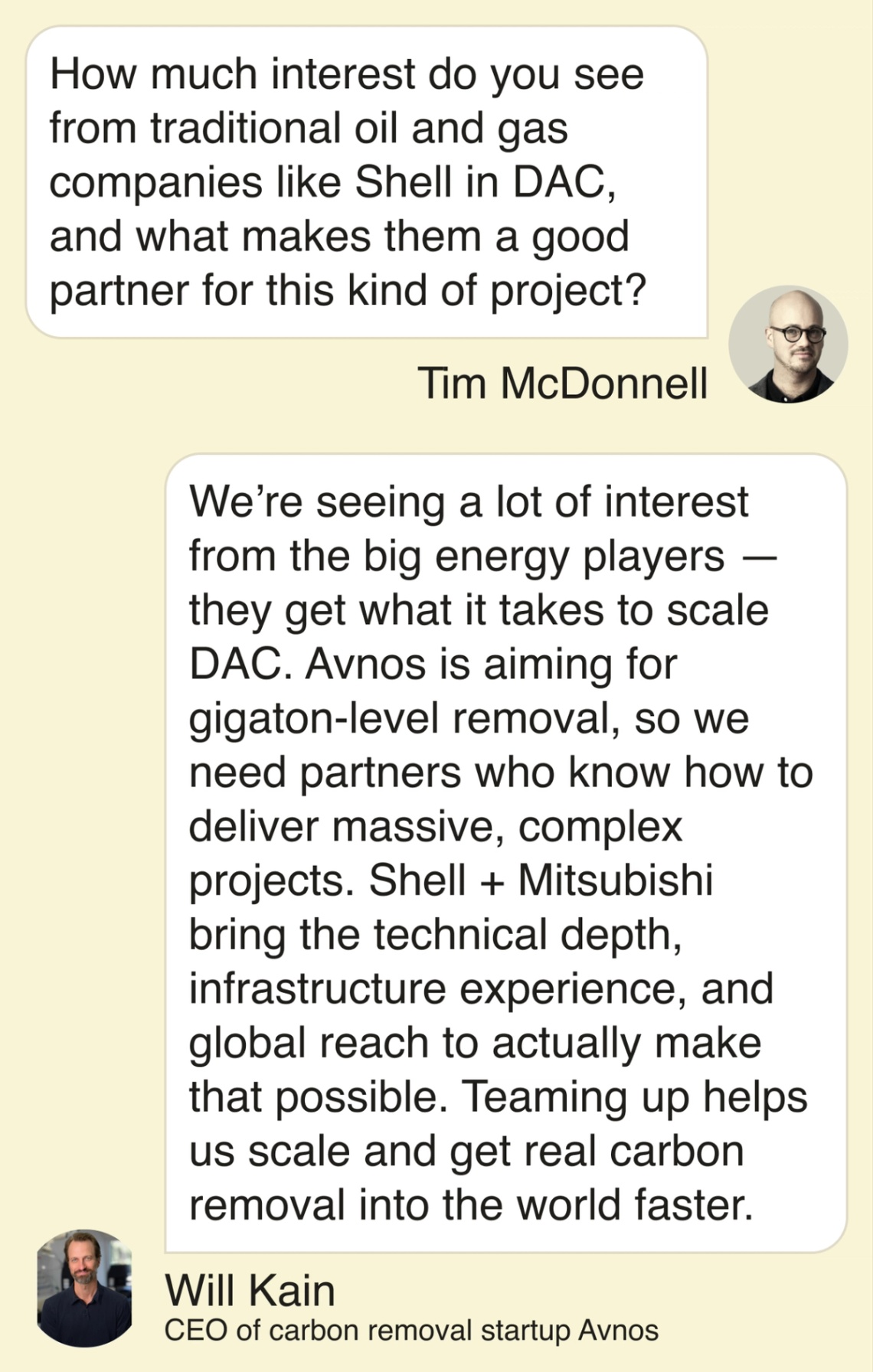

Why Shell is a good partner for carbon removal projects. |

|

Juan Carlos Monterrey Gómez is on a mission at COP30 to save the trees — specifically the untold numbers that are sacrificed for the production of UN reports that no one reads. Gómez, Panama’s climate envoy, usually spends COP meetings focused on finance and other common priorities. But this year, he told me, he is going into every meeting fixated on slashing paperwork. “People talk about drowning because of sea level rise, but no one is talking about bureaucrats drowning in stupid homework,” he said. Between COP and the multiple other environment-related UN conventions that Panama is a party to, he said, his office is responsible for producing nearly 50 reports every year, some stretching to hundreds of pages. And as a remarkably self-aware UN report in August made clear, nearly all of these reports are ignored even by the officials they ostensibly exist to inform. All this paperwork is more than just an annoyance, he said: For small countries especially, the workload is an unsustainable drain on time and money, and the fragmentation of information across so many channels makes it extremely complicated to make progress on any of the world’s climate goals. The only people who benefit from this system, he said, are the Western consulting firms cashing checks to help. Panama’s solution is to consolidate all of its environment-related plans and status updates into one Nature Pledge, to be published this week, which Gómez said he hopes can be a model for other overwhelmed countries to follow. So if you see Gómez in the hallway in Belém — look for his signature broad-brimmed hat — just don’t ask him to put anything in writing. I’m back home now after a fun week in Brazil (I highly recommend beers at De Bubuia), but still following COP until it wraps up later this week. On the second day of the conference, Brazilian officials promised it would run no more than “five, maybe 10 minutes” over schedule. If the past is any indication, that’s likely over-optimistic. Most of the key issues up for debate remain unresolved, but as more high-level ministers land in Belém this week, things can start to move quickly. |

|

Wall Street takes on adaptation |

| |  | Tim McDonnell |

| |

Adriano Machado/Reuters Adriano Machado/ReutersAs negotiators at COP30 struggle to make progress on a long-delayed global agreement on climate adaptation, some observers in Belém warn the talks overlook what could be the most important solution for improving countries’ resilience: Drawing in more private sector investment. One of Brazil’s top priorities for this COP is to hammer down a “global goal on adaptation,” which would identify universal metrics for countries to track, and articulate shared principles for how to reach them. That goal was called for in the Paris Agreement, but has remained elusive in part because adaptation — a category that can include everything from seawalls to wildfire detection software — is so broad and so geographically variable. As successive COPs have failed to reach agreement on a political framework for the problem, a growing number of private investors — including startups, major corporations, and financial firms — are identifying promising ways to turn a profit from adaptation. Experts widely agree that, as wealthy countries pull back on foreign aid of all kinds, the private sector is an indispensable source of adaptation capital. But private adaptation finance is held back by a number of technical, financial and policy bottlenecks. And the arcane debates around national goal-setting that preoccupy COP negotiators do little to address them, Meredith Ryder-Rude, a senior Environmental Defense Fund official — and until April a longtime adaptation negotiator for the US State Department — told Semafor. |

|

Sanctions impede methane cuts |

Stoyan Nenov/File Photo/Reuters Stoyan Nenov/File Photo/ReutersThe Russian oil and gas company Lukoil was suspended from a coalition of oil majors working together to reduce their methane emissions after coming under heightened US sanctions. The Oil and Gas Decarbonization Charter was launched at COP28 in Dubai, and includes 55 companies including all of the big US and European producers. That group is on track to cut its operational methane emissions nearly to zero by 2030, and to reach operational net zero for all emissions by 2050, Bjørn Otto Sverdrup, head of the charter’s secretariat, told Semafor. But for state-owned companies in emerging economies, as well as companies in sanctioned countries like Russia, Venezuela, and Iran, “many of them haven’t really started the journey” on methane, he said, leaving a major gap in the fossil fuel industry’s climate efforts. Lukoil was a rare exception, but “sanctions are making it difficult for companies to engage,” Sverdrup said. In the meantime, the US Treasury Department on Friday cleared the way for some potential buyers to negotiate with Lukoil on acquiring its overseas assets. |

|

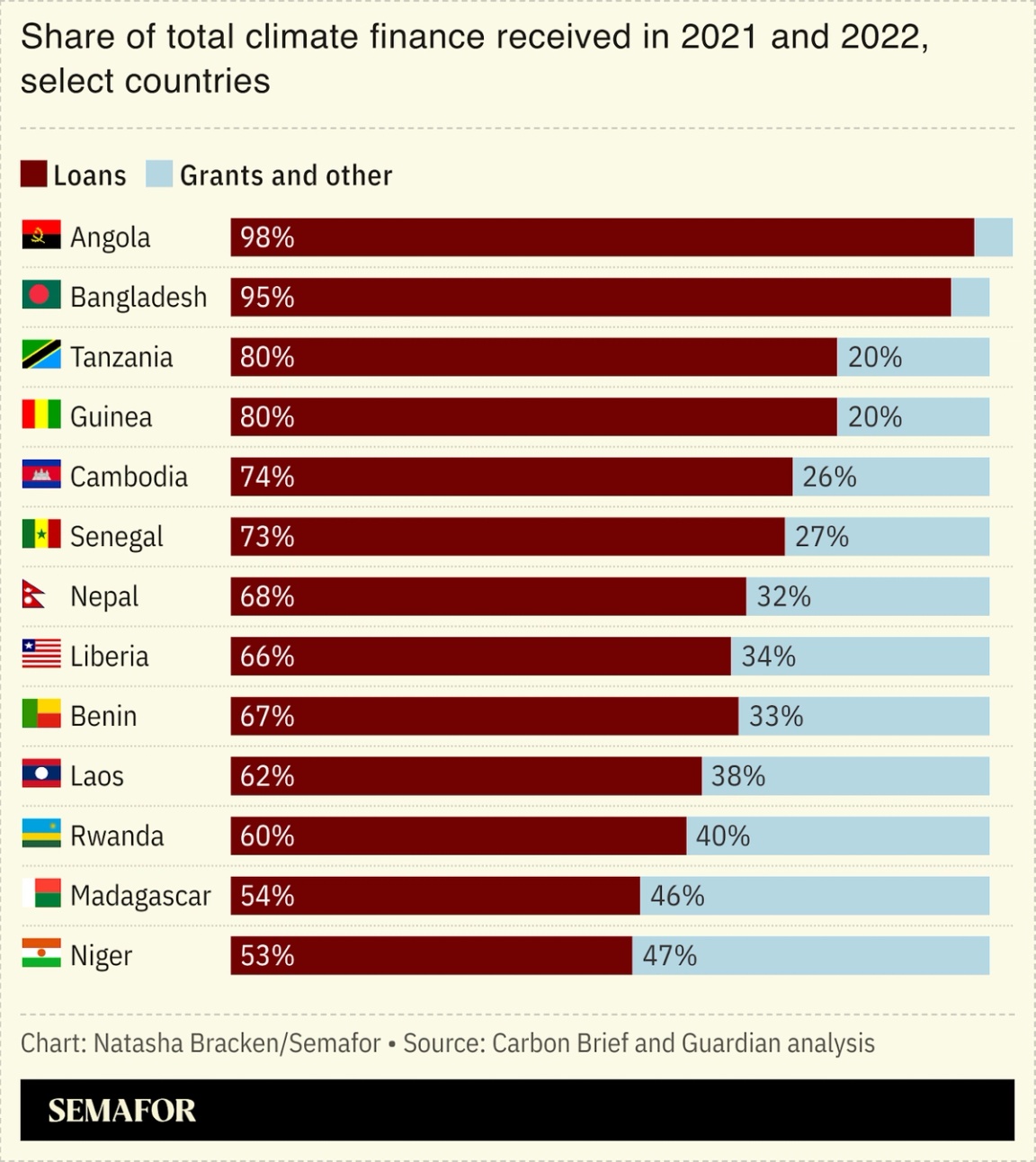

Developed countries met their $100 billion climate finance target for developing nations in 2023, but some countries’ overperformance, combined with a focus on quantity rather than quality of funds mobilized, concealed others’ inefficiency, a new report found.  To pinpoint exactly where countries fell short on their commitments, the ODI think tank calculated each nation’s fair share based on historical responsibility for cumulative emissions, GDP, and population. The US, for example, paid less than half its fair share in 2023 despite bearing responsibility for the largest portion of climate finance. By contrast, Norway, France, Sweden, and Japan provided more than twice what they would be expected to deliver. But even those figures need nuancing: France, while appearing generous in its contributions, stands out for its reliance on loans, while Japan, another generous contributor, allocated less than 15% of its climate finance to adaptation, focusing mostly on lower-emission projects rather than climate-resilient developments. — Natasha Bracken |

|

The number of active oil drilling rigs in the “Lower 48” US states this year, down from 750 in 2022. Producers in the US have cut back on drilling activity in response to lower oil prices and better drilling efficiencies, the US Energy Information Administration said on Monday. But despite the decline in active rigs, production is hitting record highs: Crude oil output reached a record 11.4 million barrels per day in July 2025, and natural gas output hit a record 117.2 billion cubic feet per day in August. The shift can be attributed to operators’ increased focus on the most productive acreage, along with longer laterals, optimized drilling plans, and more efficient completion techniques. |

|

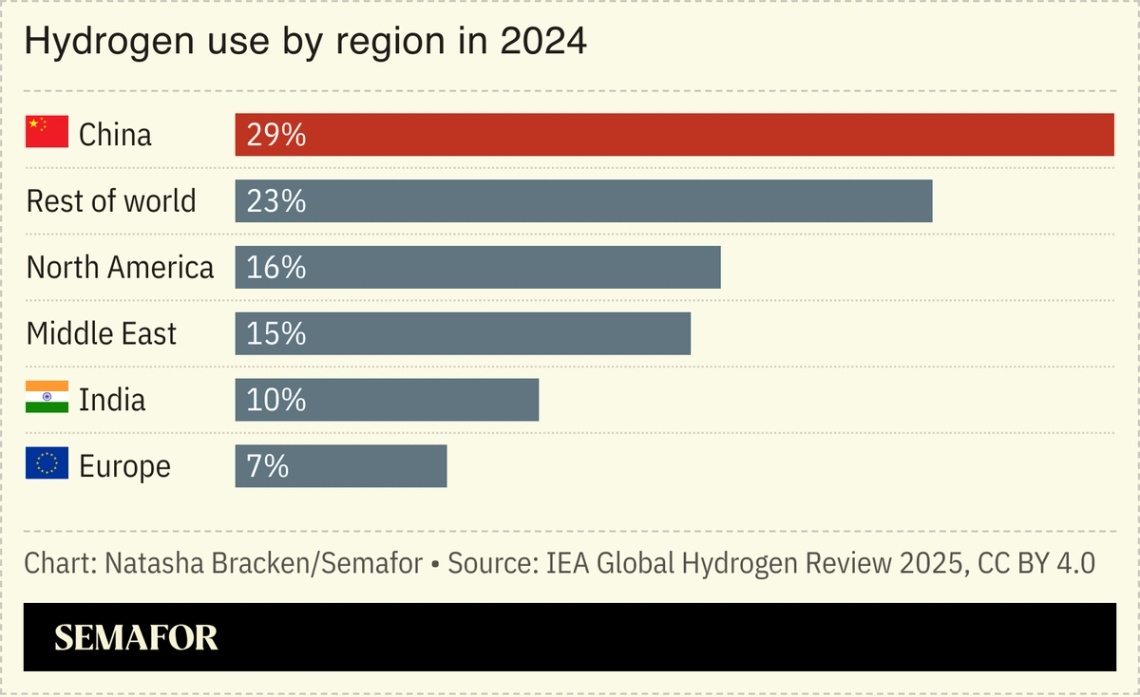

Brian Snyder/File Photo Preview/Reuters Brian Snyder/File Photo Preview/ReutersThe Trump administration is pushing through a new series of oil and gas deals, leaning again on US energy exports as a key lever in broader trade negotiations. As Saudi Arabia’s Crown Prince Mohammed bin Salman visits the White House this week, Saudi Aramco is expected to sign two deals to import US liquefied natural gas. Trump and MBS are also expected to discuss a possible deal to advance Saudi Arabia’s nuclear power program. Meanwhile, the US also agreed to increase exports of liquefied petroleum gas to India, and to sell more LNG to Ukraine, which is facing a deep gas deficit following Russian attacks on its pipelines and gas wells. While these deals offer a compelling route for Washington to strengthen its hold on global energy markets, they risk overselling what the US can actually provide: Fulfilling the US trade deal with the European Union this year would already require the US to redirect almost all of its existing fossil fuel exports there. And it’s not clear that global demand for US LNG will really match the administration’s expectations: Goldman Sachs analysts warned in a note today that LNG prices will face a significant drop later this decade as supply overwhelms demand — but could perk back up in the 2030s, depending on how quickly China works to displace coal in its power sector. |

|

New Energy - The Czech Republic is building two new nuclear reactors, as the country looks to double its nuclear output and end its reliance on fossil fuels.

Fossil Fuels- Russia’s energy giant Gazprom is moving ahead with plans for a gas pipeline to China, which would help the country make up for some of its lost fossil fuel exports to Europe.

Politics & Policy- Ukraine’s President Volodymyr Zelenskyy pledged to “overhaul” state-owned energy companies after around $100 million was allegedly embezzled by some of the leader’s close associates.

Minerals & Mining- For the first time in global climate negotiations, COP30’s draft decision formally acknowledges the social and environmental risks of mining minerals essential for a clean energy transition.

EVs- The same bureaucratic hurdles that slowed a Biden-era program meant to build thousands of EV charging stations across the country also prevented Donald Trump from getting rid of it, and eventually led the administration to adopt it.

Food & Agriculture- Brazil’s meat industry, which plays a huge role in deforestation and methane emissions in the country, is pitching a more environmentally friendly way of producing beef at COP30.

- Meanwhile, the growing push in Brazil to rehabilitate the Amazon has attracted startups that advise farmers on using climate-friendly fertilizers and soil cover to help restore the forest and generate economic value.

|

|

Will Kain, CEO of carbon removal startup Avnos, which recently secured $17 million in project finance from Shell to build its first commercial-scale direct air capture (DAC) facility.  |

|

|