| | In this edition, the AI deals with Saudi Arabia are here, and so are the delayed jobs reports, comin͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Saudi’s AI champion preps deals

- Data blackout ends (sort of)

- SEC’s tempting offer

- Whither Europe’s banks?

- Beer economics

- Big Tech’s debt binge

Google’s Gemini 3.0 is out … The ‘JPMorgan boys’ behind Milei … Meta wins antitrust trial over Instagram, Whatsapp acquisitions |

|

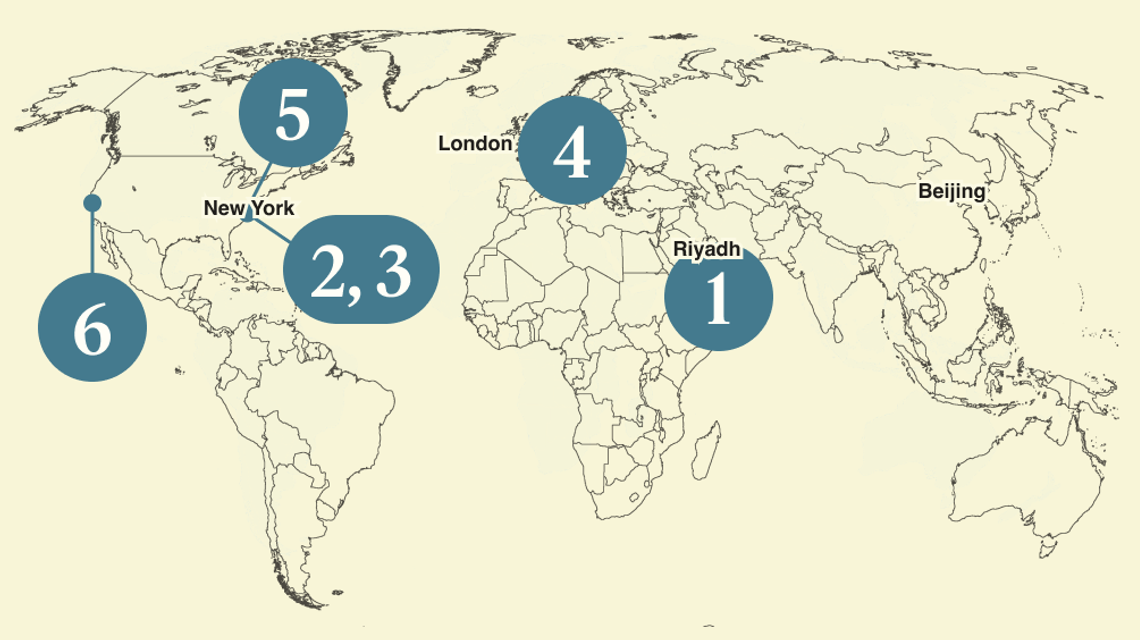

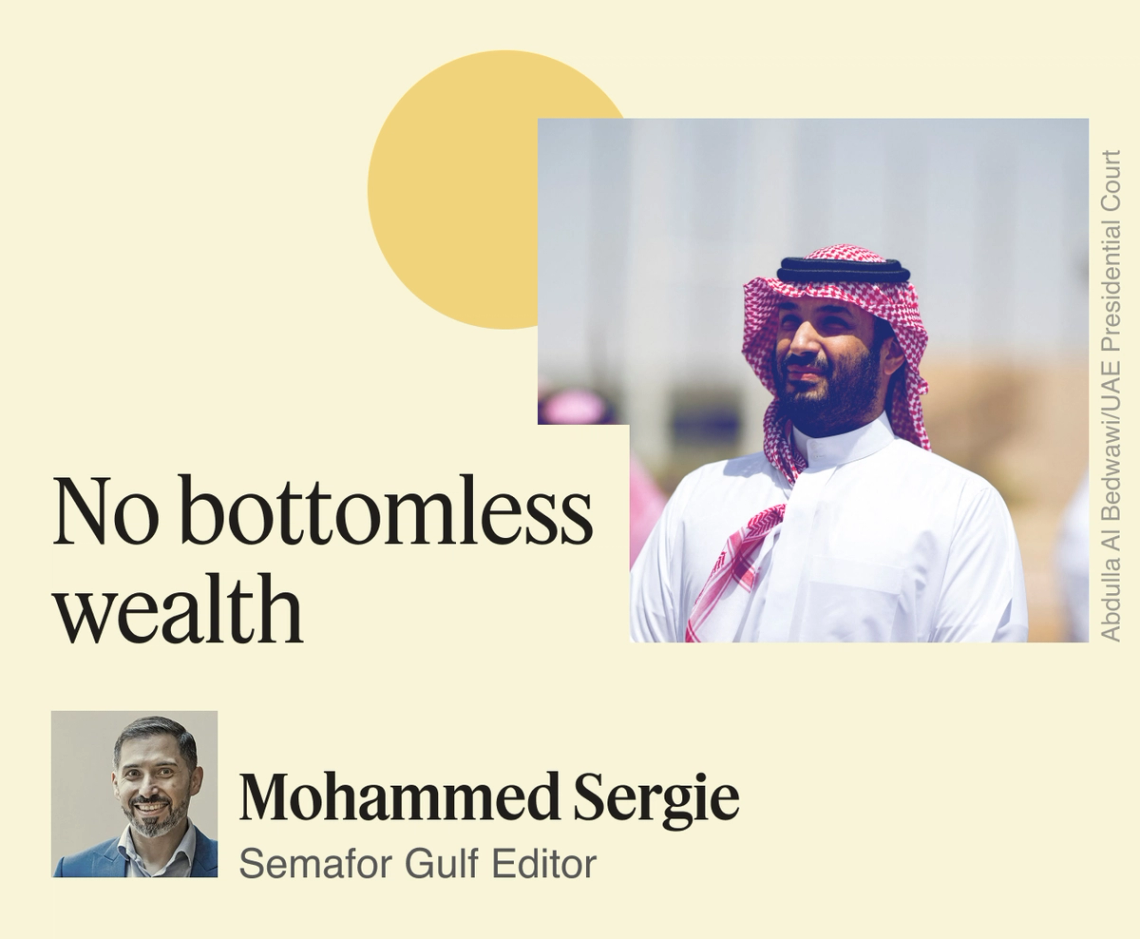

Saudi Crown Prince Mohammed bin Salman’s visit to White House today gives President Donald Trump another chance to boast about the $9 trillion-plus in investment pledges he’s pulled in this year, with more than $3 trillion coming from Gulf states. For the expat financiers in Riyadh and their bosses in New York, that largesse contrasts with Saudi efforts to rein in foreign spending and redirect money toward domestic projects and jobs. That nuance will likely be lost in Washington this week, where the old stereotype of Gulf royals with endless oil wealth tends to stick. Many are surprised to hear that the Saudi model of recycling energy riches into US assets has flipped: The kingdom is no longer a net exporter of capital. Like the US, it wants to be a destination for global investment, not park assets abroad. Defense and tech are outliers: Expect announcements of massive arms deals and AI infrastructure projects. But even those industries aren’t solely siphoning cash out of the kingdom anymore. Wall Street already knows this. Saudi Arabia stopped being a bottomless pit of outward-bound investment cash a few years ago, right around the time oil prices fell and the kingdom’s ambitious megaprojects started to run into obvious problems of feasibility. Its sovereign wealth fund, PIF, is now directing most of its efforts domestically and demanding investment of capital, both financial and human, from Westerners coming to call. There will be less focus on another storyline, one uniquely tied to America’s first billionaire president. The business ties between entities controlled by MBS and the Trump family are well documented: real estate licensing agreements, $2 billion to Jared Kushner’s Affinity Partners, and increasingly, crypto ventures. It’s a new twist in the decadeslong US-Saudi relationship that was built on institutional ties, not personal enrichment. |

|

Trump meets MBS, with deals to come |

Trump and Mohammed Bin Salman in May. Brian Snyder/Reuters. Trump and Mohammed Bin Salman in May. Brian Snyder/Reuters.The Saudi-US summit at Washington’s Kennedy future Make Entertainment Great Again Center will host some big deal headlines tomorrow, but it’s unclear how many are new and substantive versus prior agreements repackaged for headline effect. Saudi’s homegrown AI champion, Humain, is planning to announce big data center buildouts with Amazon, AMD, xAI, and GlobalAI, people familiar with the matter told Semafor. The deals are expected to follow on from an agreement for the US to approve a large semiconductors sale to the country. Chevron CEO Mike Wirth, Pfizer CEO Albert Bourla, Blackstone CEO Steve Schwarzman, Salesforce CEO Marc Benioff, and a16z’s Ben Horowitz are all expected to show up, one of the people said. The most significant outcome, though, will be the contours of a new regional security order: Saudi Arabia will likely get the F-35 jets it wants, and may come away with a not-quite-a-treaty defense agreement similar to the US’ arrangement with Qatar. |

|

Too little, too late on jobs data |

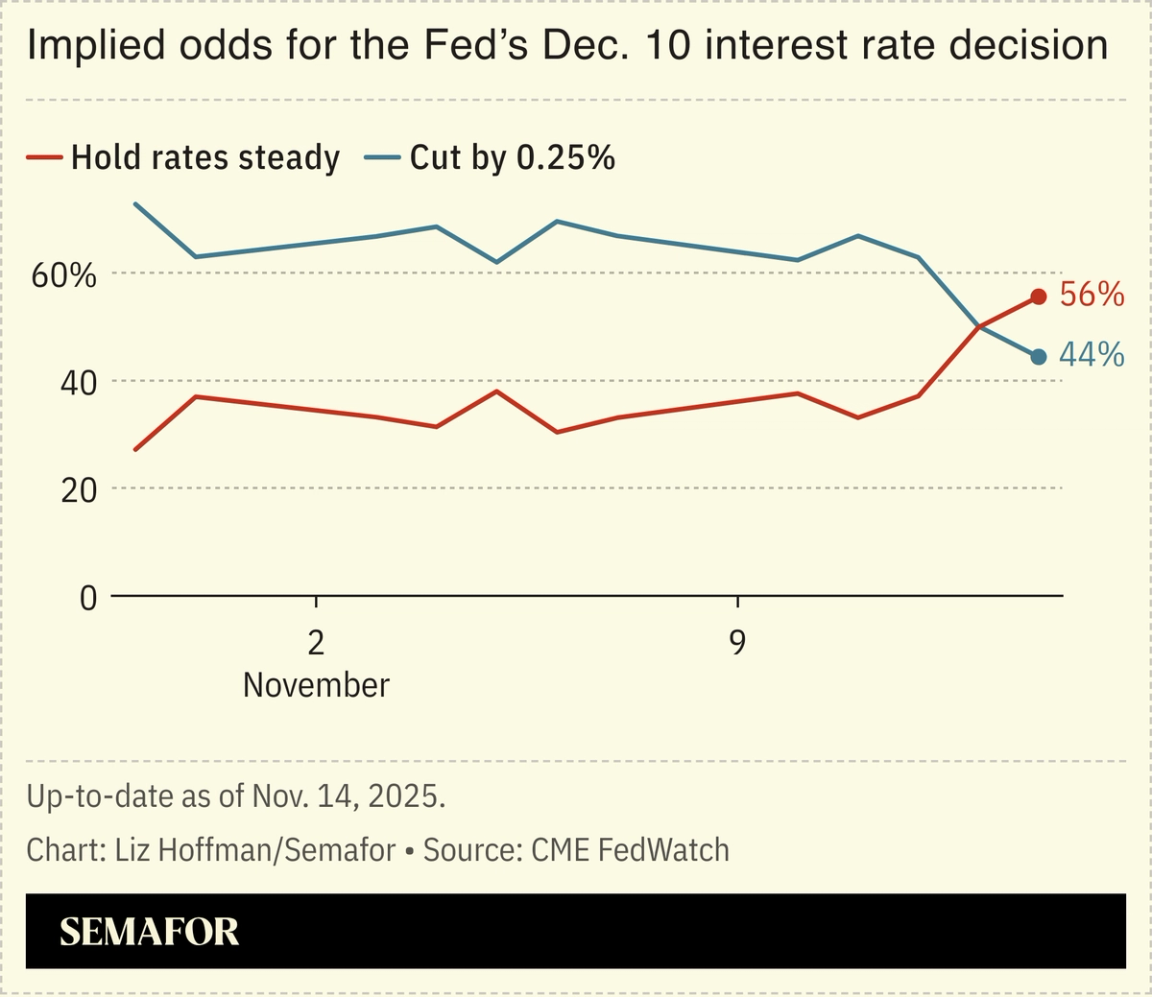

The US government will release September’s jobs report on Thursday, ending a nearly seven-week data void that confounded policymakers already struggling to diagnose the economy’s health. Some figures will likely never be released and others will come with an asterisk. The shutdown changed at least one Fed official’s mind about whether stubborn inflation or a weakening jobs market is a bigger threat to the US economy — a tough call as Trump’s new affordability messaging competes for headline space with mounting corporate layoffs. Traders’ expectations for a December interest rate cut have dropped from 70% two weeks ago to under 50% today. |

|

Your move, corporate America |

Trump’s top securities regulator is baiting companies to ignore their shareholders. SEC Chair Paul Atkins said this week that the agency will “not respond to… and express no views on” companies’ decisions to exclude shareholder proposals from their corporate ballots. Companies have long complained about politically progressive shareholders pushing referendums on workforce diversity, political contributions, and climate policies. Historically, companies needed the SEC’s blessing to swat away requests for ballot access, but can now do so on their own. “The SEC seems to be not-so-subtly inviting Delaware corporations to force the issue,” all but promising to back them up in court, said Joel Fleming, a lawyer who represents shareholders in lawsuits against companies. Atkins isn’t a MAGA culture warrior, but the critics of corporate “wokism” now cheering him on might regret it: Progressive proposals are waning, while anti-ESG proposals are growing, data from 2025 corporate elections shows.  Who will step up? Close observers of the companies-vs.-shareholders fight will note that’s a tempting offer for Exxon, but it, alas, is incorporated in New Jersey. Meanwhile, many of the companies most likely to pick a fight with Delaware have already left the state. |

|

Europe’s banks navel-gaze |

Denis Balibouse/Reuters Denis Balibouse/ReutersPivots from UBS and Deutsche Bank are a make-or-break moment for Europe’s economy, which has long been held back by its blundering banking sector. UBS chair Colm Kelleher has talked to Treasury Secretary Scott Bessent about moving the Swiss bank to New York, the Financial Times reported. UBS hasn’t notified the Swiss regulator, something it would swiftly do if its musings were serious, a person close to the company said. But with a $26 billion capital shortfall hanging over its head, its options are limited: a punishing capital raise, fighting Zurich in court, staging a long-shot referendum, or redomiciling through a merger or otherwise. A negotiated settlement looks likeliest: “As we have said repeatedly, we want to continue to operate successfully as a global bank out of Switzerland,” a spokesman said. Meanwhile, Deutsche Bank rolled out an ambitious plan it hopes will turn the page on years of restructurings and tactical retreats. CEO Christian Sewing said “our long-term vision is to be the European champion” — something the continent’s parochial and nationalistic banking sector badly needs. |

|

A sudsy take on price controls |

Angelina Katsanis/Reuters Angelina Katsanis/ReutersThe economists are fighting: Our scoop last week about Lina Khan’s plans to make New York City cheaper — starting with the price of concessions at sports stadiums — set off a heated X economic debate about every everyman’s favorite topics, externalities and elasticity. Matt Yglesias and Harvard’s Jason Furman argued that lower beer prices will mean higher ticket prices, which Biden antitrust architect Tim Wu thinks is dumb, or at least an empirical question worth answering. Everyman-fluent billionaire Mark Cuban threw in with the popularists: “They call fans the 6th man for a reason.” “You need to listen to economists, but you don’t need to defer to them in all things,” Wu said in an interview from his book tour in the UK. “The government subsidizes the subway to the stadium — is that making baseball tickets more expensive?” Khan’s role in Mayor-elect Zohran Mamdani’s affordability efforts is part of a new romance with price controls. Mikie Sherrill won the New Jersey governor’s race this month after promising to freeze electricity prices. |

|

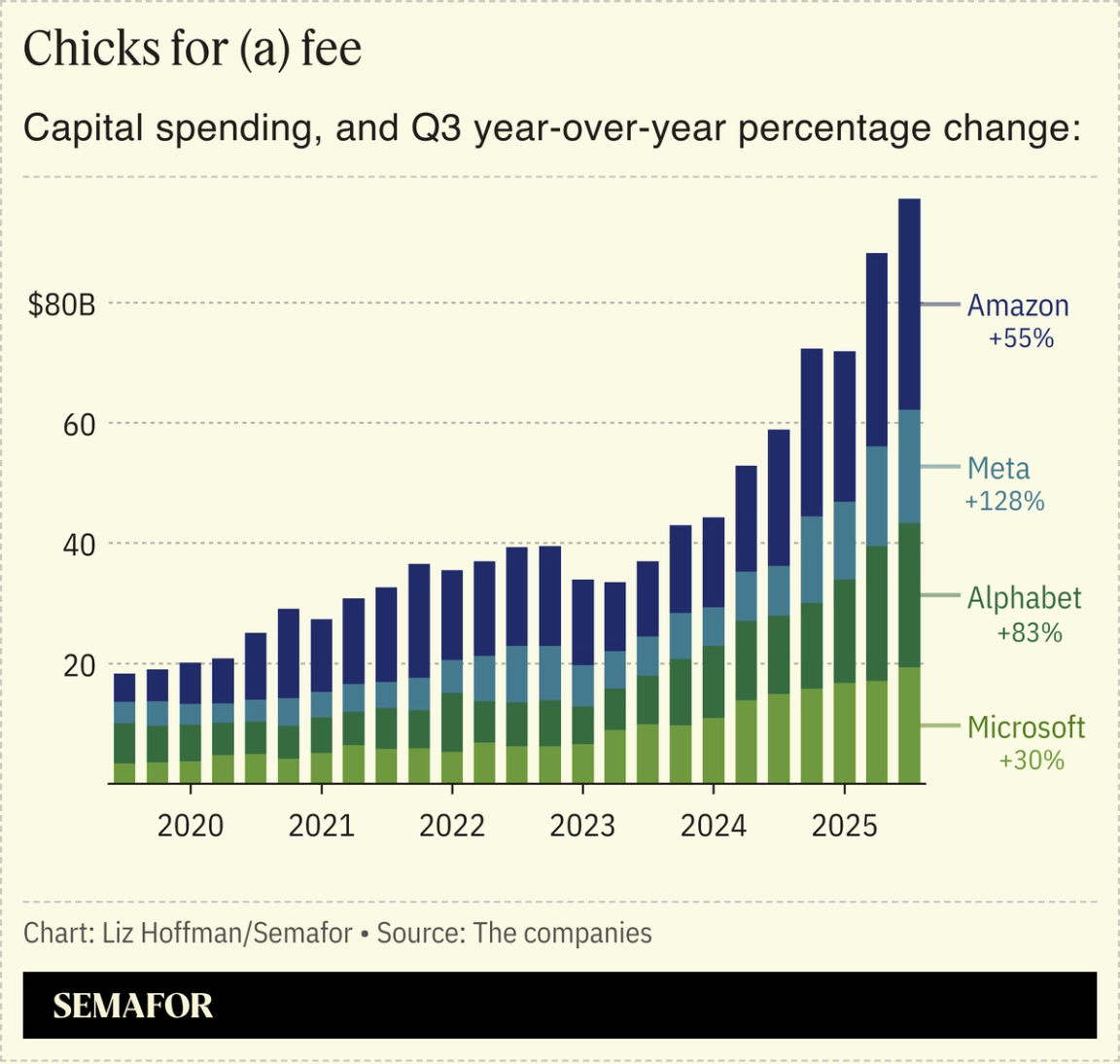

Big Tech is on a borrowing binge |

Big Tech giants have embraced borrowing to fund their AI buildouts. Amazon’s $15 billion bond offering Monday follows Alphabet ($25 billion), Meta ($30 billion), and Oracle ($18 billion) issuances, and has US corporate offerings on track for one of its busiest years ever. Early in the AI boom — the salad days of spring 2025 — calls for calm rested on the idea that big tech companies were cash-flow machines and funding their AI ambitions out of profits from prosaic advertising and software businesses. The speculative borrowing and equity offerings of past bubbles, in fiber and railroads, hadn’t materialized yet. (Liz may have top-ticked that argument.)  It has now: AI-related borrowing is pushing $200 billion this year, according to the Financial Times, and stealth debt is at work in less obvious ways, amplifying investment funds’ bets and hidden in off-balance-sheet leases. Some tech giants are “reaching the limit of what their free cash flow can fund,” 5C’s Michael Koester said at a Semafor event last week, noting that “Oracle is already levered.” Investors have noted that, too: Oracle’s bonds have slipped and its stock price is now below where it was before disclosing its big deal with OpenAI. |

|

The global financial system is entering a new era. The innovations that once reshaped markets, from index funds to ETFs, have become commoditized. In their place, a new wave of financial engineering is emerging. Semafor’s Liz Hoffman will convene leading figures in global finance at Semafor Business’ The Ledger. Onstage, they’ll explore which innovations will shape the future of the financial system — and which are poised to collapse under their own weight. On-the-record conversations with Michael Patterson, senior managing director of BlackRock; Gregg Lemkau, co-CEO of BDT & MSD Partners; Jay Clayton, US Attorney for the Southern District of Manhattan, and more will dive into the new risks and new power brokers behind today’s financial innovations. Dec. 2 | New York City | Request Invitation |

|

➚ BUY: Cantor. The Lutnick family firm is having a record year, something its controlling shareholders insist is unrelated to their father’s job as Commerce Secretary. ➘ SELL: Canter. Under Armour founder Kevin Plank wants the state of Maryland to buy his luxury horse farm, The Baltimore Banner reports, after cutting the price from $22 million to $18.5 million. |

|

Companies & Deals- Wallet share: OpenAI unveiled its first big play for personal finance, a partnership with tax prep and budgeting software maker Intuit. No details on what Intuit is paying, but it’s an overdue example of real companies using AI, a missing ingredient in this hype cycle so far.

- Dis-regulated: Nexstar’s CEO Perry Sook says broadcasters’ true competitors are tech companies, not each other, as he courts regulatory approval to buy rival Tegna for $6.2 billion in a deal that is, technically, illegal.

- Not again: A problem at Cloudflare, which services about a fifth of all websites, brought down much of the internet today. Its collapse

|

|

|