| | The US and Saudi Arabia agree a rare earths deal, China reportedly readies a real-estate stimulus, a͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - US-Saudi rare earths deal

- Shutdown hits US data

- China property stimulus

- Indian rush for Russian oil

- US-Venezuela tension

- S. Africa free trade call

- Turkey to host COP31

- Uyghurs lose Turkey haven

- AI comes for CEOs

- Universe’s first stars

A meditative film about parenthood from an award-winning Georgian director. |

|

US, Saudi ink rare earths deal |

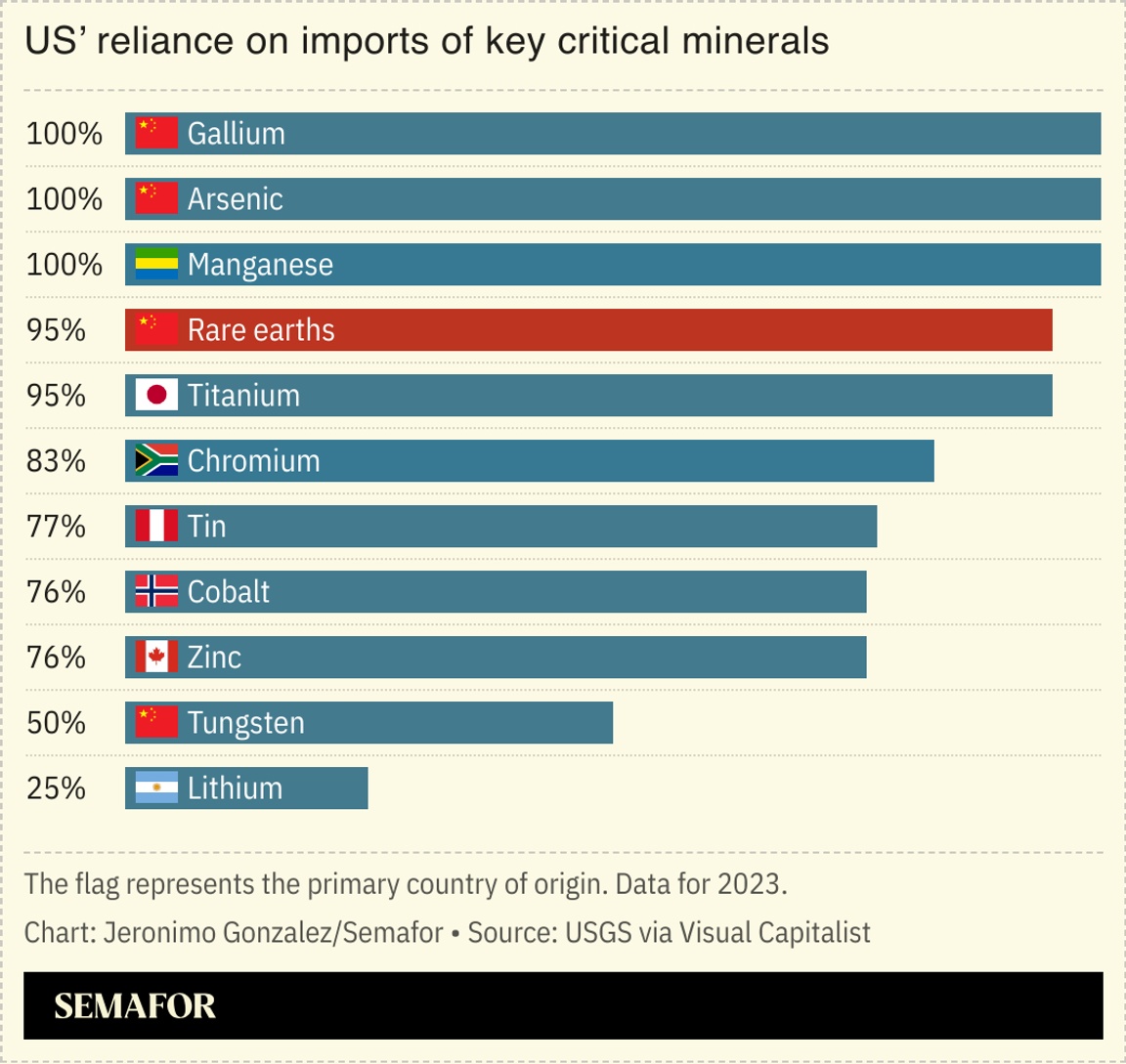

The US and Saudi Arabia agreed to develop a rare earths refinery in the Gulf kingdom, the latest in a slew of investments announced after days of meetings between their leaders. Under the deal, an American minerals firm will partner with Riyadh’s state-owned mining company to supply both countries’ manufacturing and defense industries, which currently rely heavily on rare earths from China, the industry’s dominant player. While Western nations are racing to diversify their supply, experts have warned that production sites could take years to come online, with a senior official in Greenland — which the US has targeted for its vast deposits — saying it could be a decade before production starts. |

|

US data lost for good in shutdown |

Kent Nishimura/File Photo/Reuters Kent Nishimura/File Photo/ReutersSome US economic data was permanently lost during the government shutdown, an information shortfall that will make economic policymaking much harder. The Bureau of Labor Statistics said the October jobs report would not be released independently, because surveys were halted: It is the first time in 77 years that the government will not publish an unemployment rate. Price data may also be lost. The lack of information comes with the Federal Reserve divided over whether to cut rates in December, a crucial decision given rising consumer worries about inflation. Last month, the Fed Chair Jerome Powell preached caution: “What do you do if you’re driving in a fog?” he said. “You slow down.” |

|

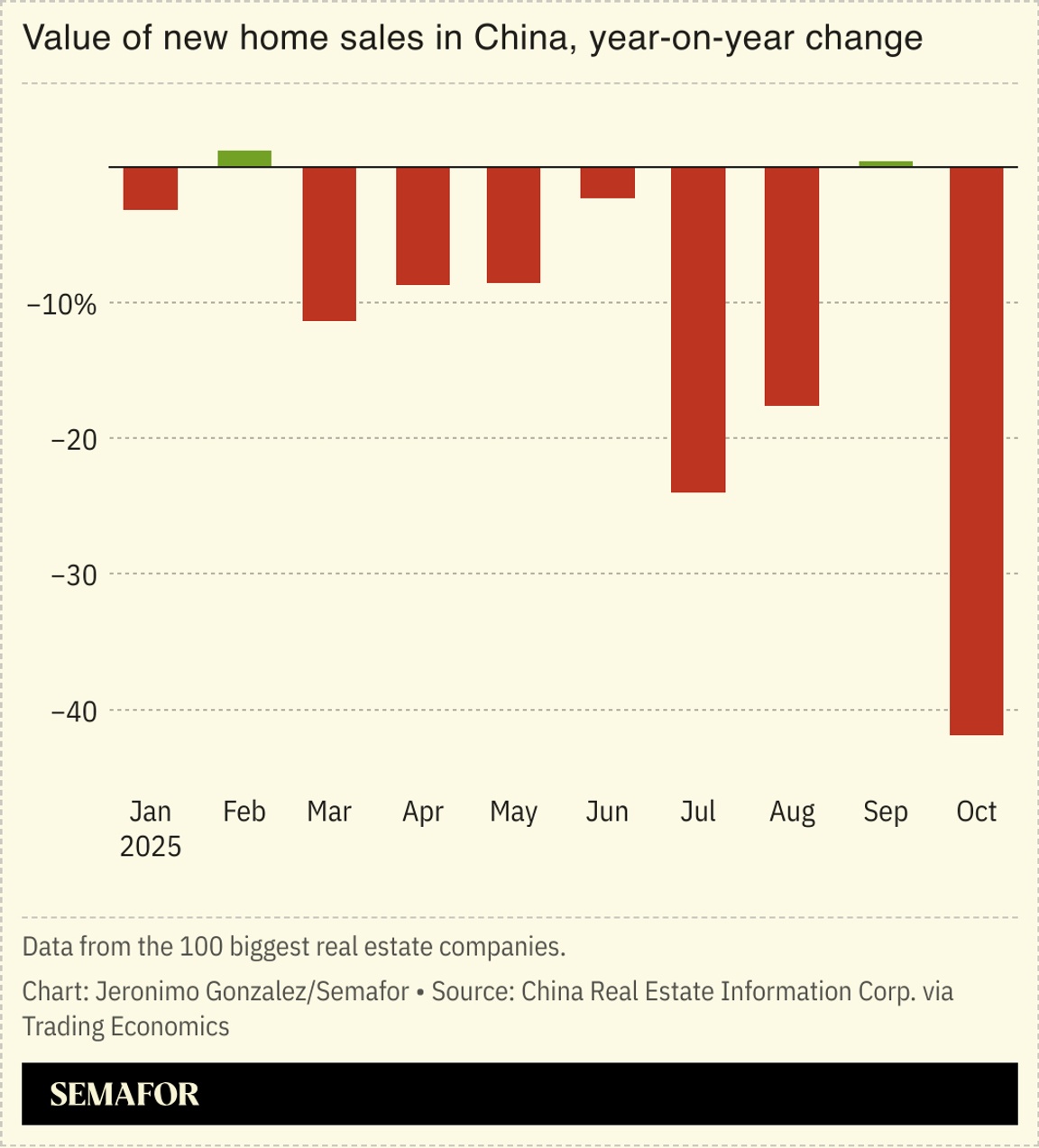

China grapples with real estate woes |

China is reportedly considering a new stimulus package for its struggling real estate sector, a mammoth industry that if weakened further could threaten the country’s financial stability. Officials in Beijing are for the first time considering options such as mortgage subsidies and lowering home transaction costs to reverse the sector’s years-long slump. While Chinese investors have gradually reduced their exposure to real estate, a huge share of the country’s wealth remains tied up in property that is fast losing value. Despite Beijing’s intervention, “the real estate market downturn will continue for some time,” a former Chinese finance minister said, calling on authorities to keep fiscal policy loose to defend the world’s second-biggest economy from a property crash, Caixin reported. |

|

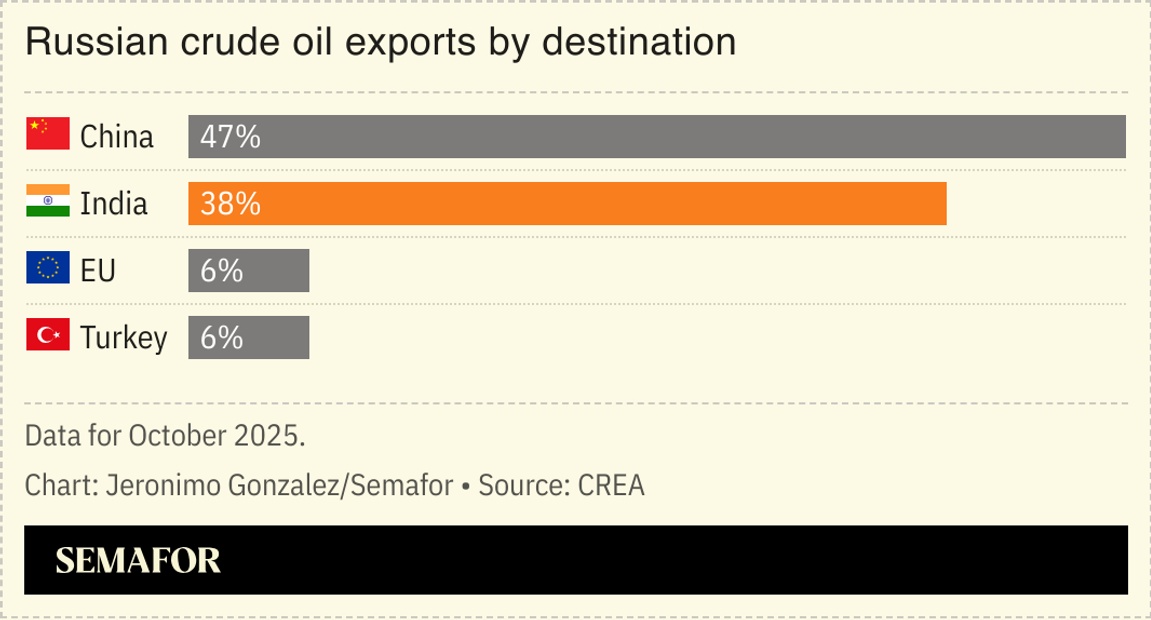

India stockpiles Russian oil |

India is racing to stockpile Russian oil before US sanctions on Moscow’s biggest oil firms take effect tomorrow. New Delhi has been buying Russian crude at steep discounts since the Kremlin’s 2022 invasion of Ukraine, taking advantage of reduced demand thanks to EU restrictions, and Moscow’s desperation for foreign currency. But the intake has caused friction between Delhi and Washington, and in August US President Donald Trump imposed punishing 50% tariffs on India. That did little to reduce India’s purchases, but a more recent approach, penalizing companies that bought from Russian oil majors, was more effective: India’s oil refiners are expected to fall in line, although a Carnegie Politika analysis noted that they could “resume purchases when Trump’s attention wanders.” |

|

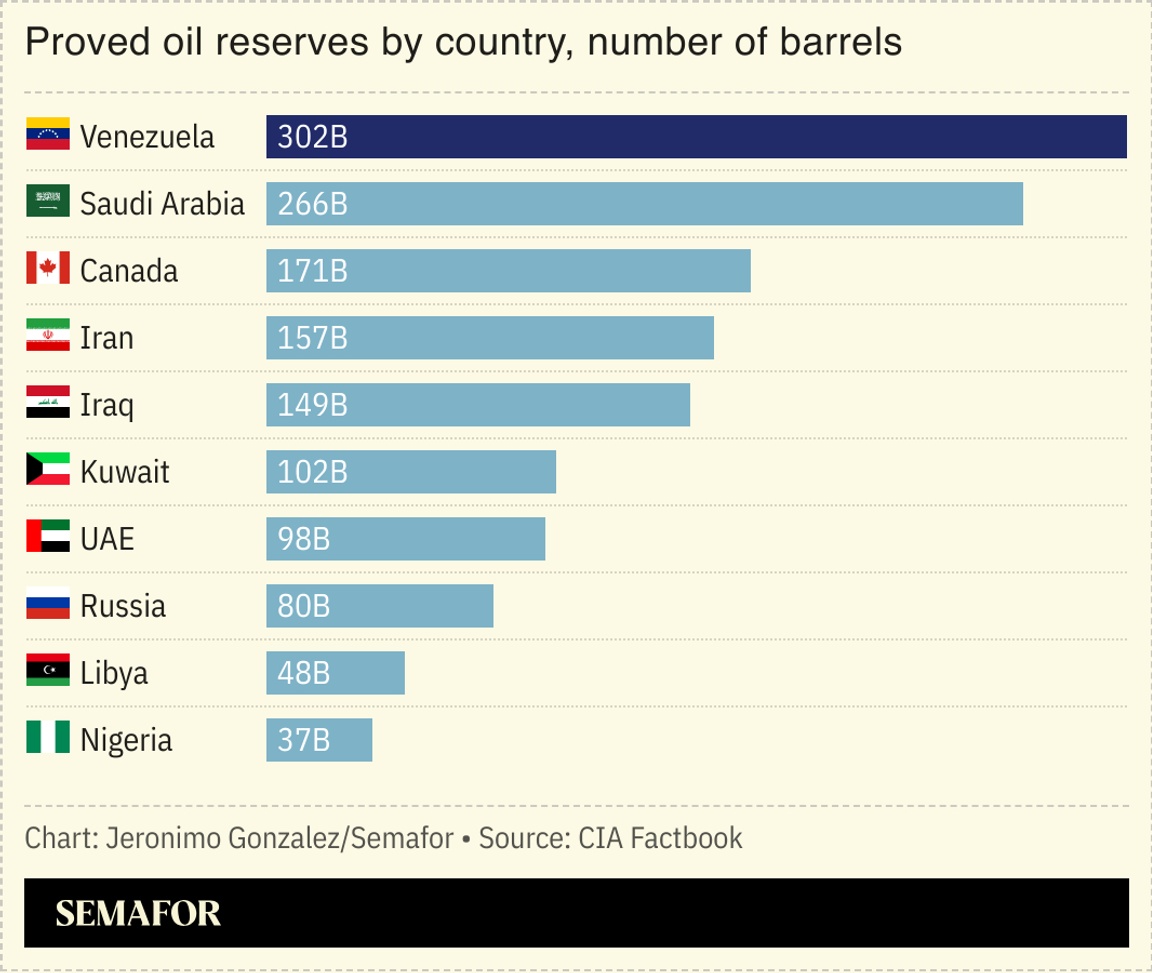

US reportedly OKs Venezuela ops |

US President Donald Trump reportedly approved covert CIA plans inside Venezuela that could pave the way for a broader military campaign in the country. While the White House says its focus is on halting drug trafficking, experts believe its real aim is to oust Venezuelan President Nicolás Maduro, who reportedly agreed to stand down after a delay of two or three years, an offer rejected by the White House. Washington’s campaign, which includes the deployment of the world’s biggest aircraft carrier, has triggered a rally in defaulted Venezuelan bonds, reflecting investors’ enthusiasm for a country with enormous economic promise: According to Venezuelan opposition leader and Nobel peace laureate María Corina Machado, the economic benefits of a transition could be worth $2 trillion. |

|

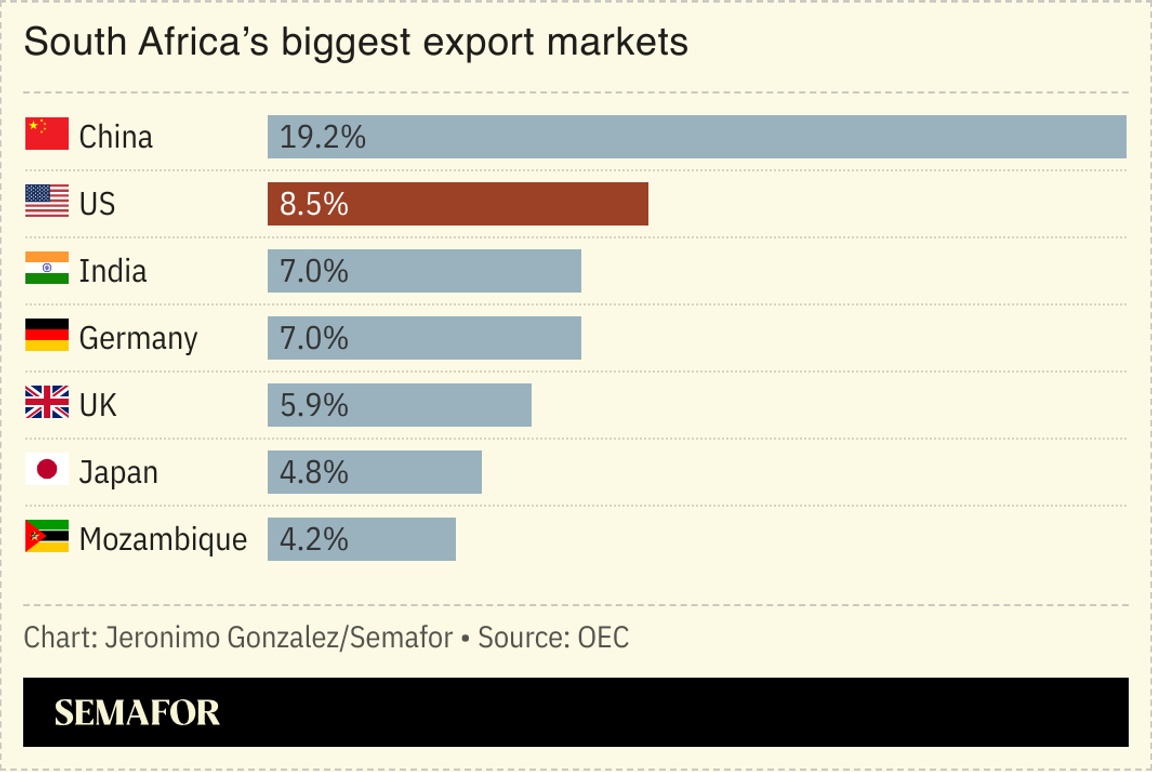

South Africa must shift to a “free trade approach” and pivot away from its current focus on investment treaties, the country’s special envoy told Semafor. Former deputy finance minister Mcebisi Jonas said Africa’s largest economy should diversify its commercial ties to protect itself from the “weaponization of trade.” The US — South Africa’s second-biggest export market — hit Pretoria with some of its steepest tariffs earlier this year over what President Donald Trump said is the mistreatment of white South Africans, a move that could cost Africa’s most industrialized economy 100,000 jobs. Speaking at Semafor’s Next 3 Billion summit in Johannesburg, Jonas said the country must look to strengthen trade with the US and EU, “but also begin to look at markets where we could be stronger.” |

|

Turkey to host COP after Australia tussle |

Anderson Coelho/Reuters Anderson Coelho/ReutersThe COP31 climate summit next year will likely be held in Turkey after a compromise with Australia. The two countries agreed to an unusual divide: Usually, the COP president comes from the host, but an Australian will lead in 2026. The decision is a relief for the UN, because the lack of a host was becoming embarrassing, and because COP is a major diplomatic event. Preparing for thousands of visitors and building consensus around the summit’s goals in just a year will be difficult. The organization has been more forward-looking for COP32, set to be in Ethiopia — the first sub-Saharan African host since 2011. Semafor’s Alexis Akwagyiram reported “cautious optimism” that it would boost focus on climate change’s impact on Africa. |

|

Turkey no longer a Uyghur haven |

Dilara Senkaya/Reuters Dilara Senkaya/ReutersTurkey’s status as a haven for China’s Uyghurs is on the decline. Ankara had an essentially open-door policy for the persecuted Muslim minority, and Turkey is home to around 50,000 Uyghurs. But that door is closing, and the government has even attempted to deport some refugees back to China. The reasons are twofold: A growing hostility to Turkey’s hitherto generous migrant policy, similar to the anti-migration sentiments growing across Europe, and Ankara’s increasing closeness to Beijing, Le Monde reported. Since 2022, an economic crisis has left Turkey in need of foreign currency, and it has turned to China for support; simultaneously, the government has cracked down on individuals whom the Chinese Communist Party has labeled terrorists. |

|

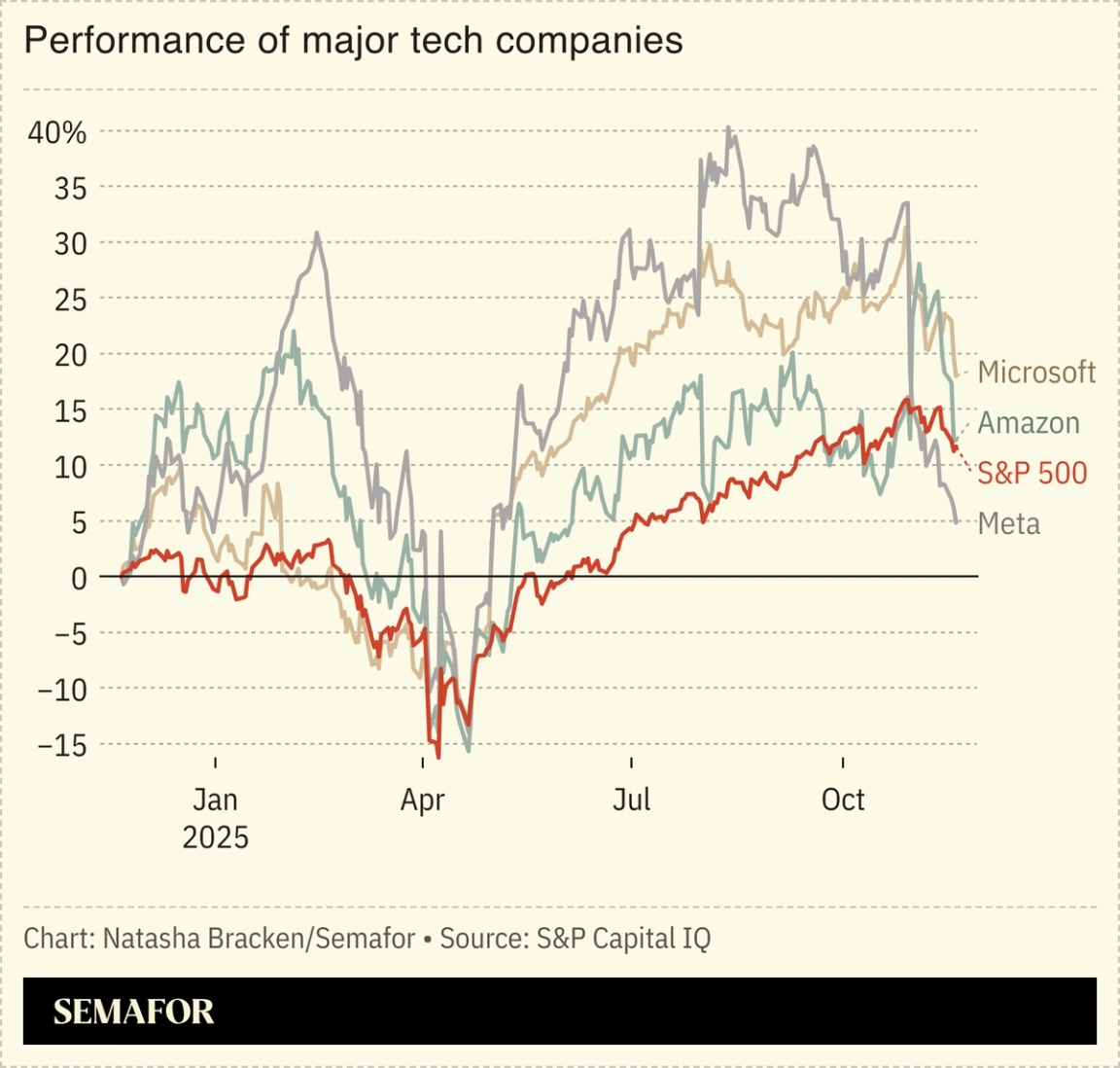

AI moves into TV show recaps |

Amazon Prime will introduce AI-generated recaps for shows, claiming “theatrical-quality” production values for the trailer-like catchups. The move will no doubt be helpful for elderly Flagship writers who struggle to remember what happened in earlier episodes released years before, but highlights again AI’s ability to do previously complex human jobs. Distilling an entire season’s narrative into key points is a real skill. The AI revolution has taken an unexpected route through the professions; artists, lawyers, and software developers might not have anticipated that their work would be more automatable than, say, plumbing. Even Big Tech leaders are not safe. Google CEO Sundar Pichai said being a CEO is “maybe one of the easier things” AI could soon do. |

|

|