| | China and the US have competing visions for the future of energy, and Beijing is looking like the sa͏ ͏ ͏ ͏ ͏ ͏ |

| |   Belém Belém |   Beijing Beijing |   Washington DC Washington DC |

| Energy |  |

| |

|

- Little progress at COP

- Nuclear resurgence

- EV boost

- Ukraine’s emissions payback

- Competing energy visions

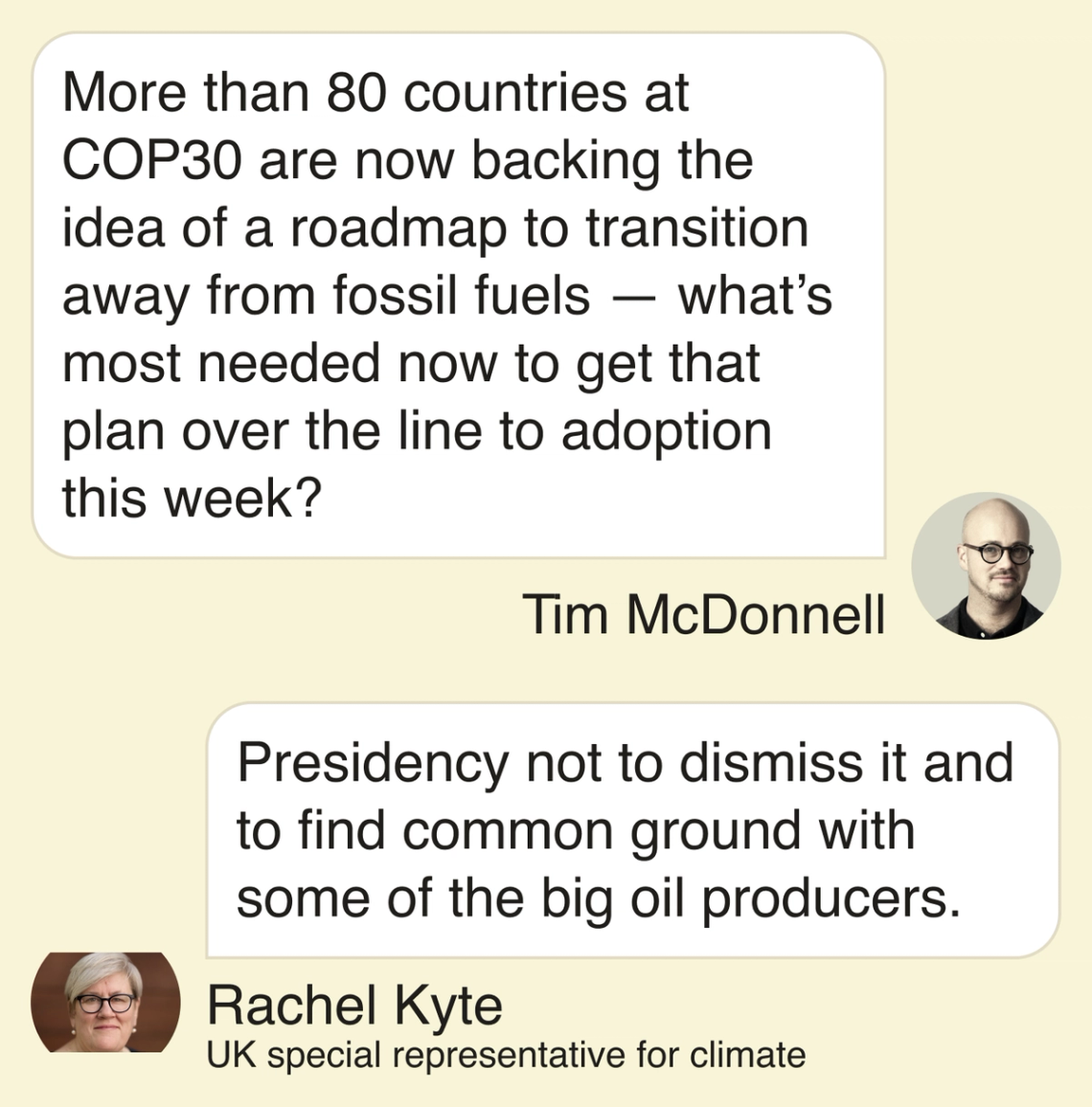

What it will take to adopt a fossil fuel transition plan at COP30. |

|

Adriano Machado/Reuters Adriano Machado/ReutersBrazil’s President Luiz Inácio Lula da Silva arrived in Belém to rally COP30 delegates toward consensus, as the summit approaches its final days with no resolution on key issues. A call for countries to strengthen their national climate plans has met resistance from some developing countries, who, in a classic catch-22 of climate politics, say they can’t do more without more financial aid from wealthy countries, which are reluctant to commit more aid without stronger plans from recipients. Meanwhile, more than 80 countries have now come out in support of creating a detailed plan to transition the global economy away from fossil fuels. But the plan still faces opposition from China and Gulf oil producers, among others. Delegates are also caught up in debate over gender identity, with the Vatican, Iran, and others pushing for a narrower definition in a draft Gender Action Plan, which aims to articulate ways in which countries can address the disproportionate impacts of climate change on women and girls. So far the only thing delegates have been able to agree on is where to host upcoming COPs: In Turkey next year, with Australia serving as the chief mediator, and then likely Ethiopia in 2027. |

|

The amount invested in clean energy and transportation in the US in the third quarter of this year, driven largely by a surge in EV purchases, a new report by Rhodium Group found. EV sales jumped 32% from the previous quarter to hit a new record as drivers raced to grab federal incentives before they expired at the end of September. But such investment levels are unlikely to continue. Other clean tech sectors appear to have already peaked: Investments in EV manufacturing, for example, dropped 30% compared to the same period last year. And while companies announced $6 billion in new projects this past quarter, mostly for EVs and batteries, they also cancelled $2 billion worth of existing projects, primarily in battery manufacturing, Rhodium found. |

|

Ukraine’s emissions payback |

Gleb Garanich/Reuters Gleb Garanich/ReutersUkraine is seeking $44 billion in compensation from Russia for war-related carbon emissions. Kyiv said the claim would cover emissions from the fossil fuels and emissions-heavy commodities like cement and steel used in fighting the war, as well as emissions from forest fires and from the deviation of commercial flights around closed Ukrainian airspace. In total, according to one independent analysis, those emissions add up to at least 237 million metric tons, more than the annual emissions of Austria, the Czech Republic, Hungary, and Slovakia combined. It’s not clear whether Ukraine’s US and European allies will support the idea of taking this money out of frozen Russian assets, or whether another avenue exists by which Moscow could be compelled to pay. In the meantime, Oxford University researchers argue in a new paper that carbon markets could help Ukraine finance its post-war reconstruction, but only if the country’s emissions regulations are improved. |

|

View: Rival energy futures |

| | Kingsmill Bond and Sam Butler-Sloss |

| |

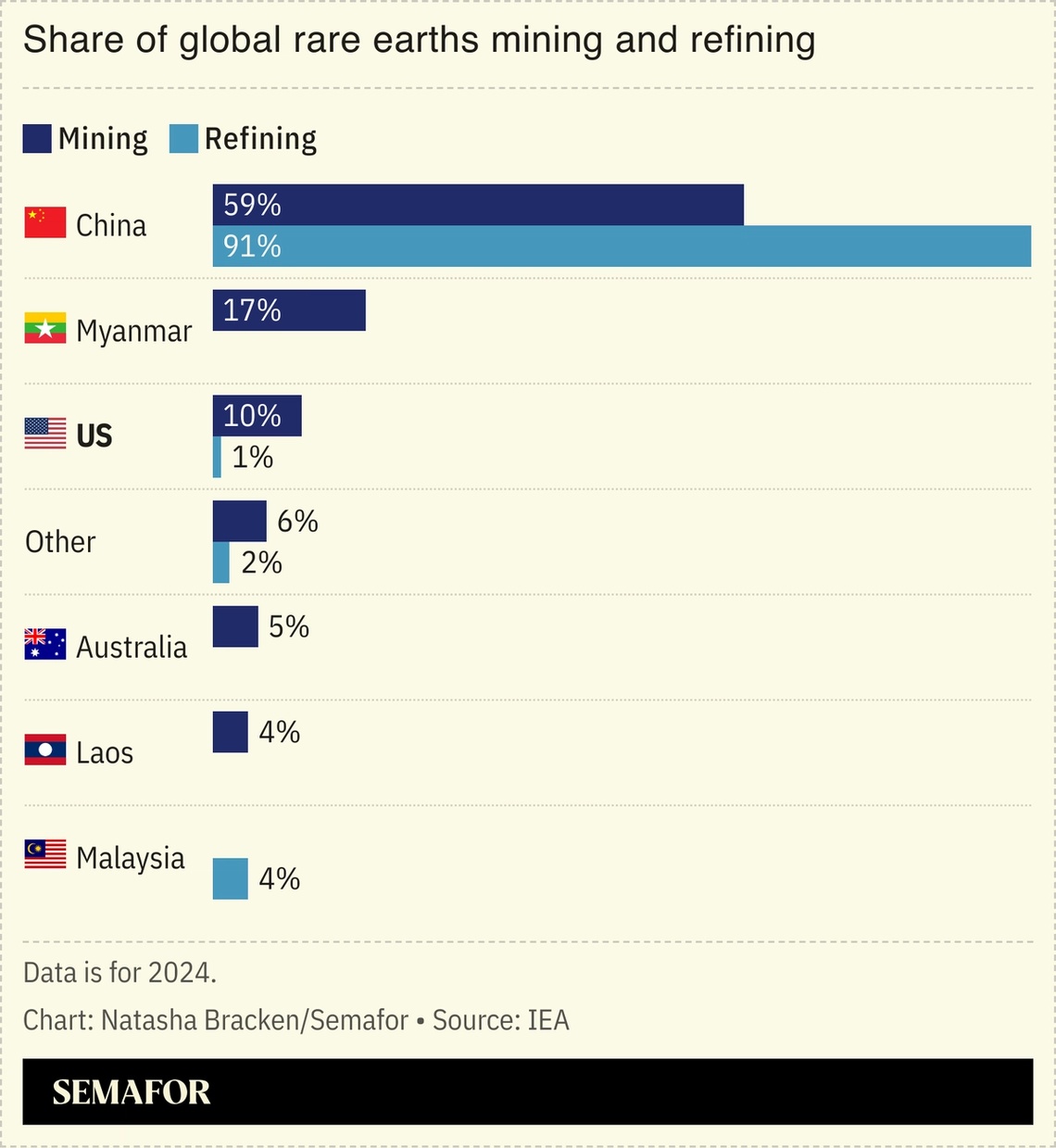

China Daily via Reuters China Daily via ReutersThe world is heading into an era of energy oversupply, with US-backed LNG and China-backed solar competing for the hearts — and wallets — of emerging markets. Beijing and Washington are betting on opposite energy futures. The International Energy Agency’s latest World Energy Outlook shows each country building massive energy export capacity: China in solar panels and batteries, the US in LNG terminals. Even as global demand grows, the world doesn’t need them both. The LNG industry is ramping up supply; export capacity is set to rise 50% to 2030. The US is leading the charge, accounting for more than half the buildout. The country will add as much capacity in the next five years as it built in the previous decade. Even the IEA asks pointedly: Where will it all go? |

|

Fossil Fuels- Green groups sued the Trump administration over its first auction of oil and gas leases in the Gulf of Mexico.

- Decades-long coal-fired power purchase contracts are impeding Asia’s transition to greener energy sources, even though wind and solar are available in abundance.

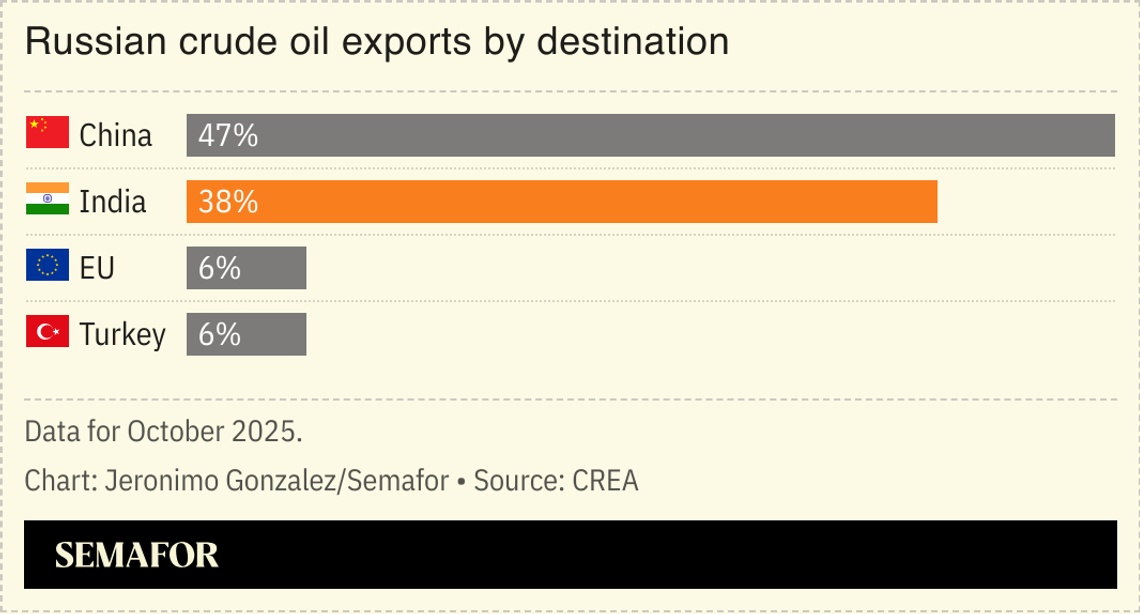

- India is racing to stockpile Russian oil before US sanctions on Moscow’s biggest oil firms take effect tomorrow.

FinancePolitics & Policy- China’s climate envoy told Politico that the EU’s new emission-cutting targets are insufficient, and described the US’ absence from COP30 as a “bad example.”

Minerals & Mining EVs- Sales of pure internal combustion engine cars peaked worldwide in 2017 and have since fallen by 30%, while EV sales increased 14-fold over the same period, according to the International Energy Agency’s latest report.

HealthFood & Agriculture |

|

Rachel Kyte, UK special representative for climate.  |

|

|