| | In this edition, the art of bargains and favors between the US and Saudi Arabia, and two positive si͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Data worth talking about

- Saudi’s CFIUS path

- Blue Owl’s lonely hoot

- Who regulates AI?

- Media M&A-mongering

- Chinese espionage

OpenAI’s mystery auditor … |

|

Hi from Washington, where I spent yesterday at the Kennedy Center watching a strange geopolitical dance. At a hastily organized but packed US-Saudi Arabia Investment summit, the kingdom agreed to increase the fuzzy $600 billion it agreed in May to invest in the US to $1 trillion, but offered few new details. The deals largely ran the other direction: toward Riyadh. Elon Musk’s xAI will build a 500-megawatt data center in Saudi Arabia. Goldman Sachs, Neuberger Berman, and Franklin Templeton were added as investors in the $11 billion development of Saudi Aramco’s Jafurah gas field. A Pentagon-backed rare earth miner will build the Saudis a refinery. One of New York City’s largest real estate players will develop smart cities in the kingdom. And Saudi’s homegrown AI contender, HUMAIN, is taking a stake in an American startup, Luma — on the condition that a large part of Luma’s data infrastructure moves to the kingdom. Meanwhile, the officially circulated list of Saudi-to-US investments touted the acquisitions of Electronic Arts, announced in September, and Scopely Games, completed in 2023. The Saudi delegates were gracious guests but clear about their priorities. “That’s key,” Saudi Minister of Investments Khalid Al-Falih said when I asked him about the kingdom’s pivot from splashing its cash abroad in hopes of influence and financial profits — sometimes getting neither — toward deals that will generate tangible economic benefits at home. “The kingdom is a partner that can match the needs and capabilities of the US,” Al-Falih said. Saudi Arabia “is not an ATM,” Marc Winterhoff, the interim CEO of Lucid Motors, told me recently. Lucid, a US company but majority-owned by Saudi’s sovereign wealth fund, is the cornerstone of what Riyadh hopes will be a domestic auto sector. For now, it’s a Potemkin industry — Lucid manufactures cars in Arizona and ships them in kits to be assembled in the King Abdullah Economy City to be sold or reexported — but it’s on its way, and a symbol of Saudi Arabia’s demand: Want our money? Build our future. |

|

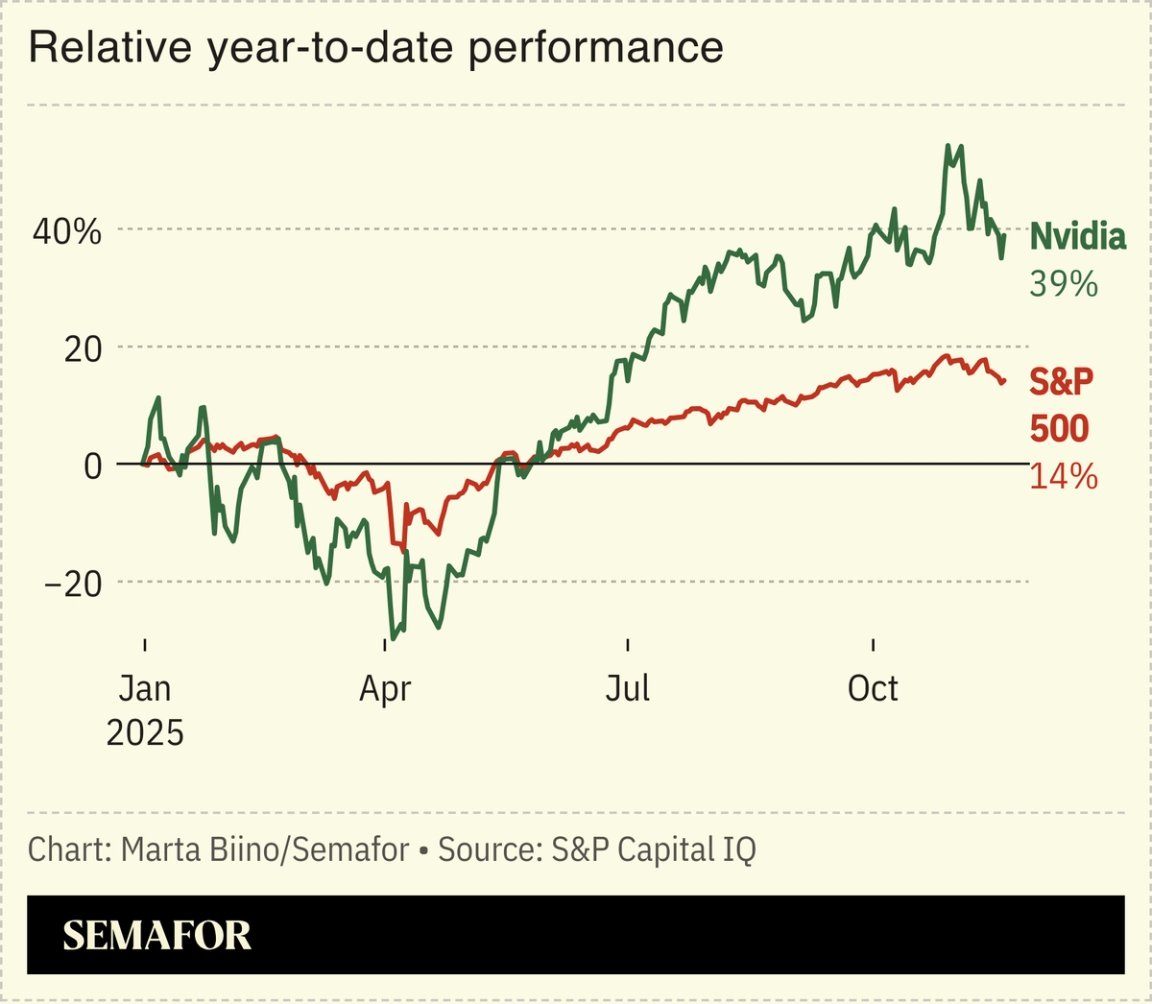

Data obliges a jittery Wall Street |

Trillions of dollars of stock market value hinged on two numbers coming into the week: Nvidia’s quarterly earnings and the latest US jobs report. Both pleasantly surprised. Nvidia forecast $65 billion in sales in the upcoming quarter and CEO Jensen Huang said orders for its advanced AI Blackwell chips are “off the charts” — a message he delivered earlier in the day during a chum appearance with Elon Musk at the US-Saudi summit. Worries of an AI bubble continue to mount, especially as big tech companies begin borrowing to pay for it all. “There’s been a lot of talk about an AI bubble,” Huang said. “We see something very different.” And the 119,000 jobs the US economy added in September were far stronger than expected. It bolstered investor expectations that the Fed won’t cut rates further at its upcoming December FOMC meeting, but doesn’t do much to offer clarity on where the job market is right now: The White House has already said the October jobs data will never be released (and may not have been collected at all). |

|

Scrutiny on Saudi deals may ease |

Saudi Crown Prince Mohammed bin Salman at the US Capitol. Tom Brenner/Reuters. Saudi Crown Prince Mohammed bin Salman at the US Capitol. Tom Brenner/Reuters.Closer ties with the US could ease a longstanding complaint from Saudi Arabia that its investments in the US are unfairly scrutinized under national security laws. The multiagency Committee on Foreign Investment in the US is process-oriented even in Trump’s freewheeling Washington, but tends to wave through investments from allies and look skeptically on others. CFIUS forced a Saudi venture firm to sell its stake in a Silicon Valley chips startup in 2023. And though it never became widely known, Saudi officials complained mightily to the Biden administration after CFIUS prevented its sovereign wealth fund, PIF, from buying control of Washington’s Union Station in 2022. Trump’s designating the kingdom as a “major non-NATO ally,” as well as agreements this week to sell it US fighter jets and share nuclear technology, “will likely further improve Saudi Arabia’s overall ability to make investments in the US today,” Aimen Mir, a partner at Freshfields who ran CFIUS for nearly a decade starting in 2008, told Semafor. |

|

A rare splat for a private-credit king |

Blue Owl called off a plan to merge two of its credit funds, one publicly traded and one private, fearing a shareholder revolt. It’s a rare stumble by the $300 billion firm, whose swift growth has drawn envy and some sniping from rivals on Wall Street. As concerns mount over risky loans — concerns that are real but overblown, in this newsletter writer’s view — the episode points to a slightly different problem inside the world of private investing as it chases after mom-and-pop investors: You can have your marks, or liquidity, but maybe not both. Retail money comes with retail vibes. |

|

Jay Clayton, US Attorney for the Southern District of New York, will join Semafor Business: The Ledger to discuss a recent spate of fraud in the credit markets, and whether Wall Street is doing a good enough job policing itself. As the global financial system enters a new era, long-familiar tools like index funds and ETFs have become commoditized, creating space for newer forms of financial engineering. Semafor’s Liz Hoffman will convene leaders from across the industry to examine the innovations that are likely to reshape the landscape, and which may fade over time. Dec. 2 | New York City | Request Invitation |

|

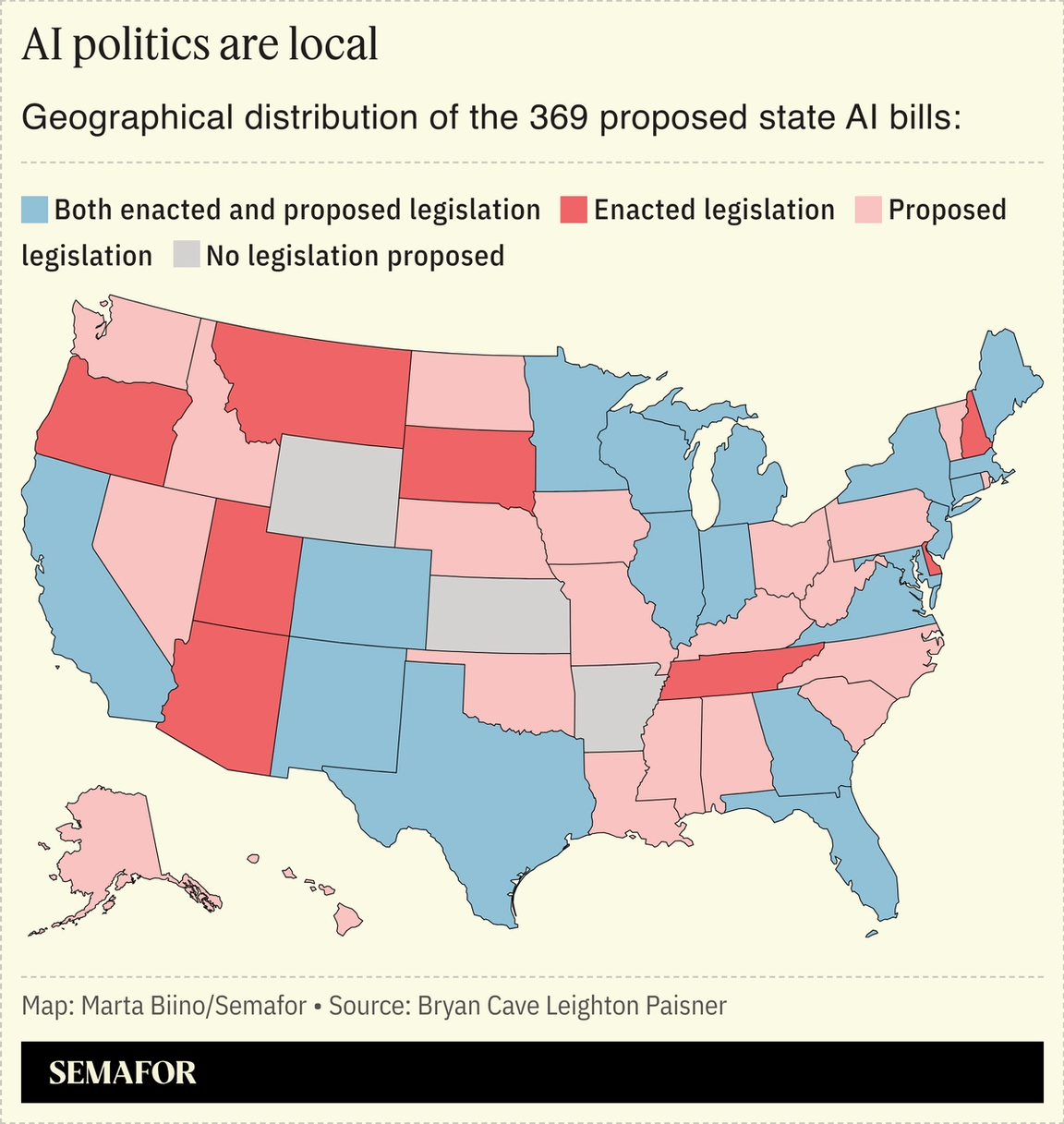

Congressional Democrats are fighting to preserve states’ ability to regulate AI, pitting them against Trump, who wants to keep a “Major Growth ‘Engine’” free from parochial meddling. Sen. Jack Reed told Semafor that he’s working to keep a 10-year moratorium on state AI laws out of the annual defense policy bill, which often attracts unrelated additions due to its must-pass status on Capitol Hill. “We have to allow states to take the lead because we’re not able to, so far in Washington, come up with appropriate legislation,” the Rhode Island Democrat said.  Anthropic CEO Dario Amodei is almost alone among AI executives in criticizing the moratorium, which he called “too blunt an instrument” for tech that is advancing “too head-spinningly fast.” He doubled down on calls for AI oversight in a 60 Minutes interview Sunday. |

|

Without a Carr in the world |

Annabelle Gordon/Reuters Annabelle Gordon/ReutersThe media business has never operated under the normal laws of economics, and investors are betting that a pair of media deals will breeze through regulatory review. First-round bids for Warner Bros. Discovery are due today, with Paramount, Comcast, and Netflix all expected to make some kind of offer, while local TV juggernaut Sinclair is trying to acquire its reluctant smaller rival, E.W. Scripps. Sinclair and Scripps — whose stock has doubled since Sinclair’s approach — have had informal, start-and-stop talks for more than a year, people familiar with the matter said. Both deals run through FCC Chairman Brendan Carr and his boss in the White House. Carr is pro-station consolidation, though he has pushed other media companies to put in place newsroom oversight and shut down DEI plans. In this case, it’s a question of whether the president’s friends — Paramount owner Larry Ellison and the right-leaning Sinclair management — will have immunity, and what will be expected of them in return. — Rohan Goswami |

|

A fresh focus on Chinese corporate spying? |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersThe Trump administration’s all-encompassing focus on trade has taken Washington’s focus off other conflicts with China, from human rights to espionage — but two recent courthouse developments serve as a reminder that American companies remain targets. Federal prosecutors in California indicted two Americans and two Chinese citizens for allegedly trying to smuggle $4 million worth of Nvidia chips and HPE supercomputers into mainland China. The indictment, reported by Court Watch on Wednesday, came out at roughly the same time that Nvidia released earnings. (Buried in those earnings was a tweak that makes it harder to see where its chips are sent.) Meanwhile, jurors heard last week that a staffer forged New York Gov. Kathy Hochul’s signature on invitations sent to Chinese dignitaries, at the same time the aide’s family was allegedly being receiving millions of dollars from Chinese handlers. |

|

The industries, egos, and institutions that shaped modern capitalism — long before the billionaires wore hoodies. From how whisky and hot pants made Southwest Airlines a success to the surprising origin of the VW Beetle, Business History — a new podcast from Planet Money alums Jacob Goldstein and Robert Smith — shares the surprising stories of businesses big and small. Required listening for anyone who wants to understand the business beneath the business. Listen to Business History. |

|

➚ BUY: New York. Zohran Mamdani’s decision to keep a police commissioner beloved by the business community is the first tangible olive branch to a wary Wall Street. (Obama’s favorite banker also got through to the mayor-elect.) ➘ SELL: Miami. The failure of a flashy Brazilian bank leaves Miami’s most expensive office space empty. |

|

|