| | Why the world’s largest waste management company made a $3 billion bet on the US. ͏ ͏ ͏ ͏ ͏ ͏ |

| |   Paris Paris |   Johannesburg Johannesburg |   Beijing Beijing |

| Energy |  |

| |

|

- AI waste boom

- SMR consolidation coming

- Mining for collaboration

- Power emissions peak

- ‘Toothless’ sanctions

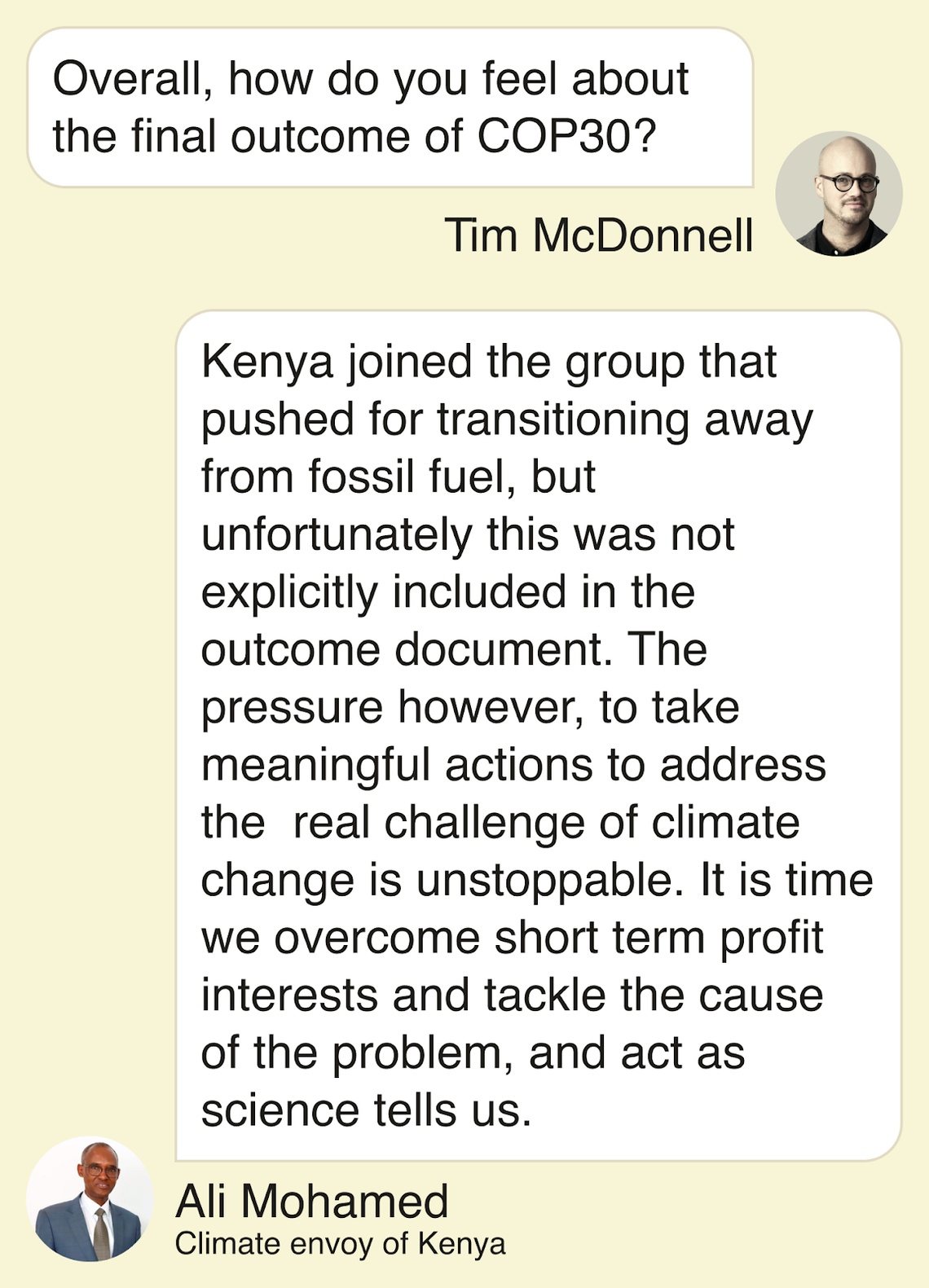

Kenya’s postgame call to action following COP30. |

|

All things considered — including the fire that almost took the venue down — COP30 went about as well as it could have. Did the push by European countries to include an explicit new mandate on the “transition away from fossil fuels” make it into the final decision? No. But that was always almost certain to be too tall an order. Any forum where Saudi Arabia and Tuvalu have to agree on the best course of climate action is going to look like a letdown to many observers. But there are a few takeaways that are slightly more encouraging. For one, the workaround solution that the summit’s Brazilian leadership put together — a new UN “implementation accelerator” and a transition “roadmap” — amount to almost the same thing Europeans demanded, and at the very least will produce some interesting new talking points for oil-producing countries to parry. For another, the conference actually happened, and produced a decision. Another low bar, yes, but these days it shouldn’t be taken for granted that a global conference on climate change can even reach a quorum; governments may not be rising fully to the occasion, but they (not counting the US, of course) are at least demonstrating a persistent willingness to keep talking about the issue. Finally, it’s important to bear in mind that COP exists on a parallel track to the real, global economy. Even a far more (or less) ambitious-sounding outcome in Belém would do very little to alter the near-term course of the energy transition. Those decisions are being made elsewhere: in national legislatures, in boardrooms, around kitchen tables. And while the US and Gulf countries continue to pursue a fossil-centric vision of growth, China is sticking to its strategy of dominating clean energy tech and betting that economics will continue to shift in its favor. That’s the contest that matters most. The outcome will take different amounts of time to play out in different countries. But even if COP delegates can’t quite bring themselves to sign off on a fossil fuel death warrant, there’s little doubt that big changes are already on their way. |

|

| |  | Tim McDonnell |

| |

The world’s biggest waste management company sees the AI boom as a lucrative chance to expand its US footprint, Veolia CEO Estelle Brachlianoff told Semafor. The France-based company on Friday announced its biggest acquisition since 2022, agreeing to pay $3 billion for the US hazardous waste manager Clean Earth. While the Trump administration has moved quickly to roll back climate-related regulations, Brachlianoff said, waste that could harm public health or the environment remains tightly controlled. And every stage of the AI value chain — from manufacturing chips to disposing of old hardware from data centers — is a business opportunity for waste management. At the moment, Veolia’s portfolio is about 60% Europe-based, with the rest in the US, the Middle East, and elsewhere; Brachlianoff said she aims to push that balance closer to 50-50. And offering waste management services in the US also creates a platform to sell Veolia’s other services, including water treatment and energy efficiency, to a wider base of customers. One core business that Veolia is unlikely to expand to the US anytime soon is recycling, she said: Between low public interest, a powerful fossil fuel industry promoting the use of virgin plastics, and inconsistent recycling regulation, American market conditions aren’t favorable. |

|

Andreea Campeanu/Reuters Andreea Campeanu/ReutersThe field of startups working on next-generation small modular nuclear reactors is due for a wave of consolidation, the CEO of one leading enterprise in the sector told Semafor. X-energy, an SMR startup backed by Amazon, closed one of the largest-ever fundraising rounds for that technology on Monday, locking in $700 million from a group of venture and private equity firms that pushed its total capital base to more than $1.5 billion. In an increasingly crowded landscape of competing SMR startups, many of which are raising hundreds of millions of dollars, X-energy stands out for the number of deals it has already closed, set to build about 150 reactors in the US and UK for Amazon and others. Compared to a few years ago, Wall Street is becoming much more open to SMRs, X-energy CEO Clay Sells said: The technologies are more developed, political support is more consistent, the pull of data center demand is more urgent, and more investors are getting educated. But it won’t be easy to successfully construct the first commercial-scale facilities, he warned, and more investment is needed in the upstream companies supplying SMR makers with materials and equipment. So by the time SMRs can actually function as a new backbone of data center power demand, some investors are likely to get burned: “I do think there’s going to be a natural consolidation,” he said. |

|

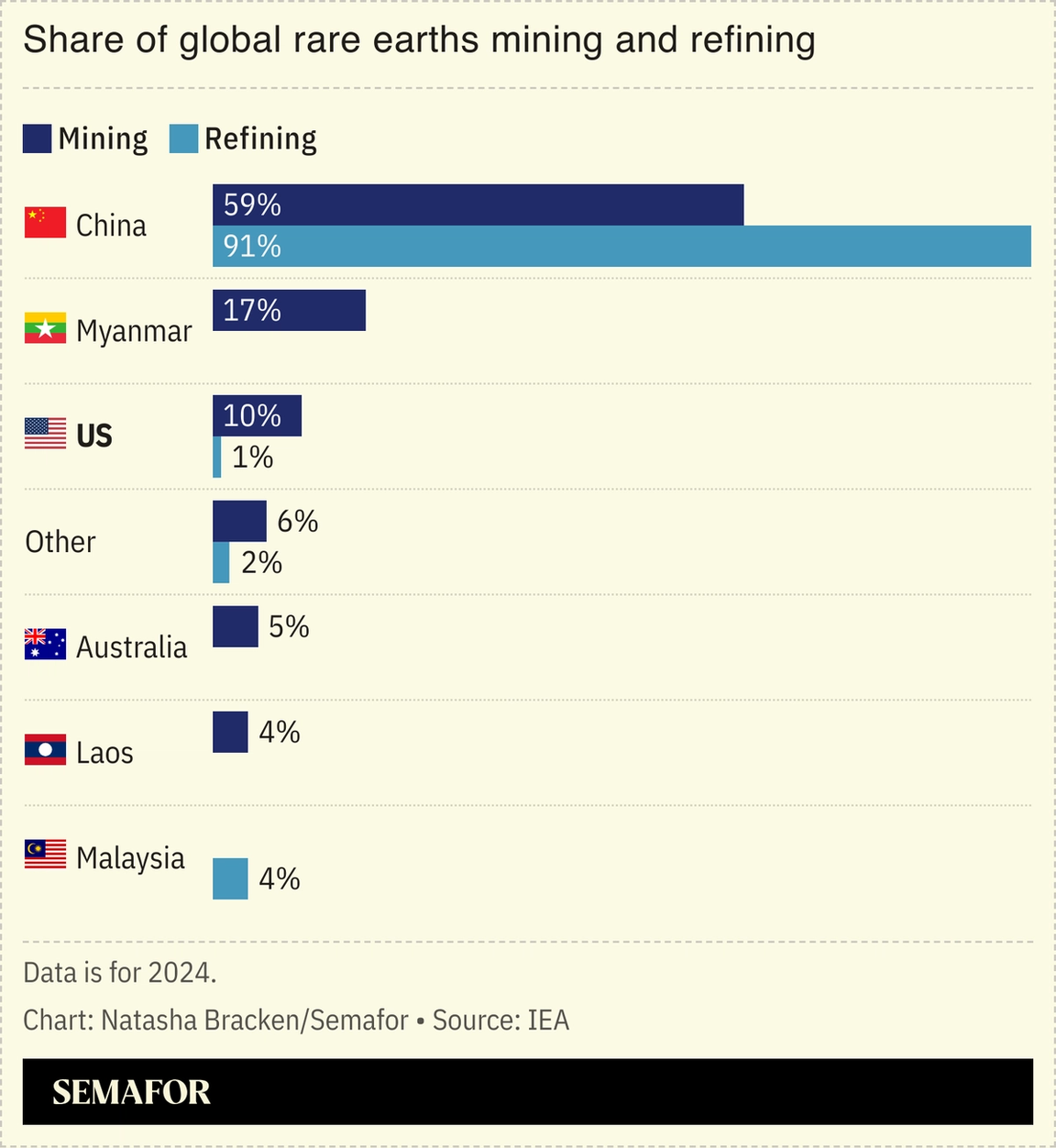

Chinese Premier Li Qiang called for an alliance with other developing nations for rare earths production in a speech at the G20 summit in Johannesburg, as Beijing steps up its competition with Washington over the key minerals. China already dominates the production and refining of rare earths, which are essential for defense and technology manufacturing. Li, the country’s second-highest ranking official, said 19 nations had already committed to join the alliance, while vowing to expand the group. South Africa’s mining minister made a similar call for collaborative action, but he argued African countries should coordinate mining policies to avoid the continent becoming trapped in a cycle of low-value extraction. Addressing a mining event, Gwede Mantashe urged African producers to “unite as a producing continent” and end what he called a “race to the bottom” in tax breaks and licensing concessions. A senior official in South Africa’s mining ministry, speaking on condition of anonymity, told Semafor that officials had discussed approaching a multilateral body, such as the African Union or UN, to explore what a continental mechanism could look like. |

|

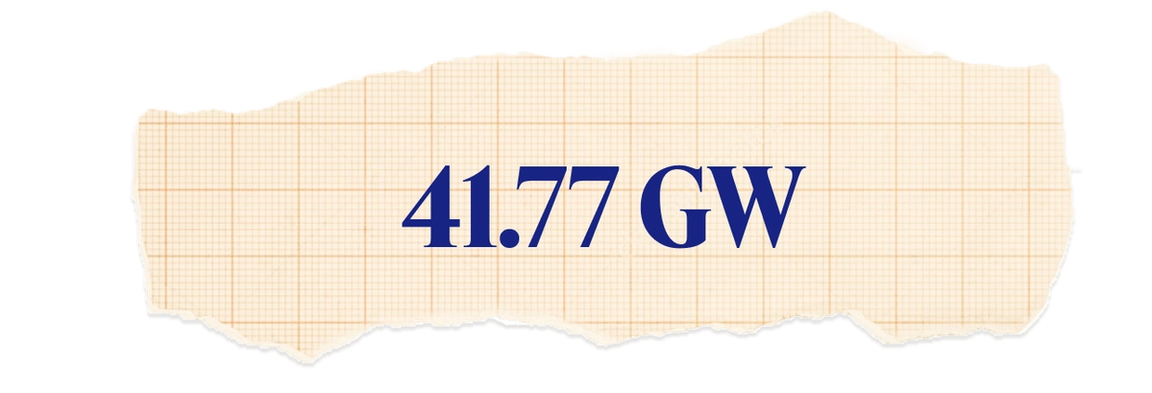

The amount of new coal power capacity approved in China in the first three quarters of 2025, potentially putting Beijing on track to hit its power-sector emissions peak this year, as capacity additions fall for a second consecutive year, a new report found. Talk of reaching an emissions peak in China is largely driven by the country’s mammoth growth in renewables deployment, which accounted for 59% of its total installed power capacity between 2021 and 2025, even surpassing coal for the first time at the start of this year. And while 2025 is shaping up to be the second-lowest year for coal approvals in the 2021-2025 period, maintaining this momentum is far from guaranteed: Solar power installations have dropped sharply, and both solar and wind are entering seasonal downturns, so coal-fired generation will likely need to increase heading into the winter demand peak. |

|

Stringer/File Photo/Reuters Stringer/File Photo/ReutersOil prices tipped downward on Tuesday, a sign traders are still more worried about an oversupplied market than the risk that uncertain Ukraine peace talks mean Russian crude is unlikely to come back into circulation. Cheaper oil, and the effect of US and European sanctions, are expected to push Russia’s oil and gas revenue down 35% in November compared to that month last year, according to Reuters. Russia’s oil sales to India, which have been a lifeline as Western customers turned away, are now coming at their steepest discount in years and may fall off even more in December, traders say, as Indian refineries seek to avoid coming under secondary sanctions. At a meeting in Beijing this week, Russian officials pushed a plan to make up the gap by selling more oil and LNG to China. And that’s where the rub for the Trump administration comes in: As long as the US avoids placing secondary sanctions on China, in the interest of maintaining better relations on minerals trading and other issues, the sanctions on Lukoil and Rosneft will mostly be “toothless,” two prominent scholars warned. |

|

New Energy- Exxon halted plans to build one of the world’s largest hydrogen production facilities over weak customer demand, its CEO told Reuters.

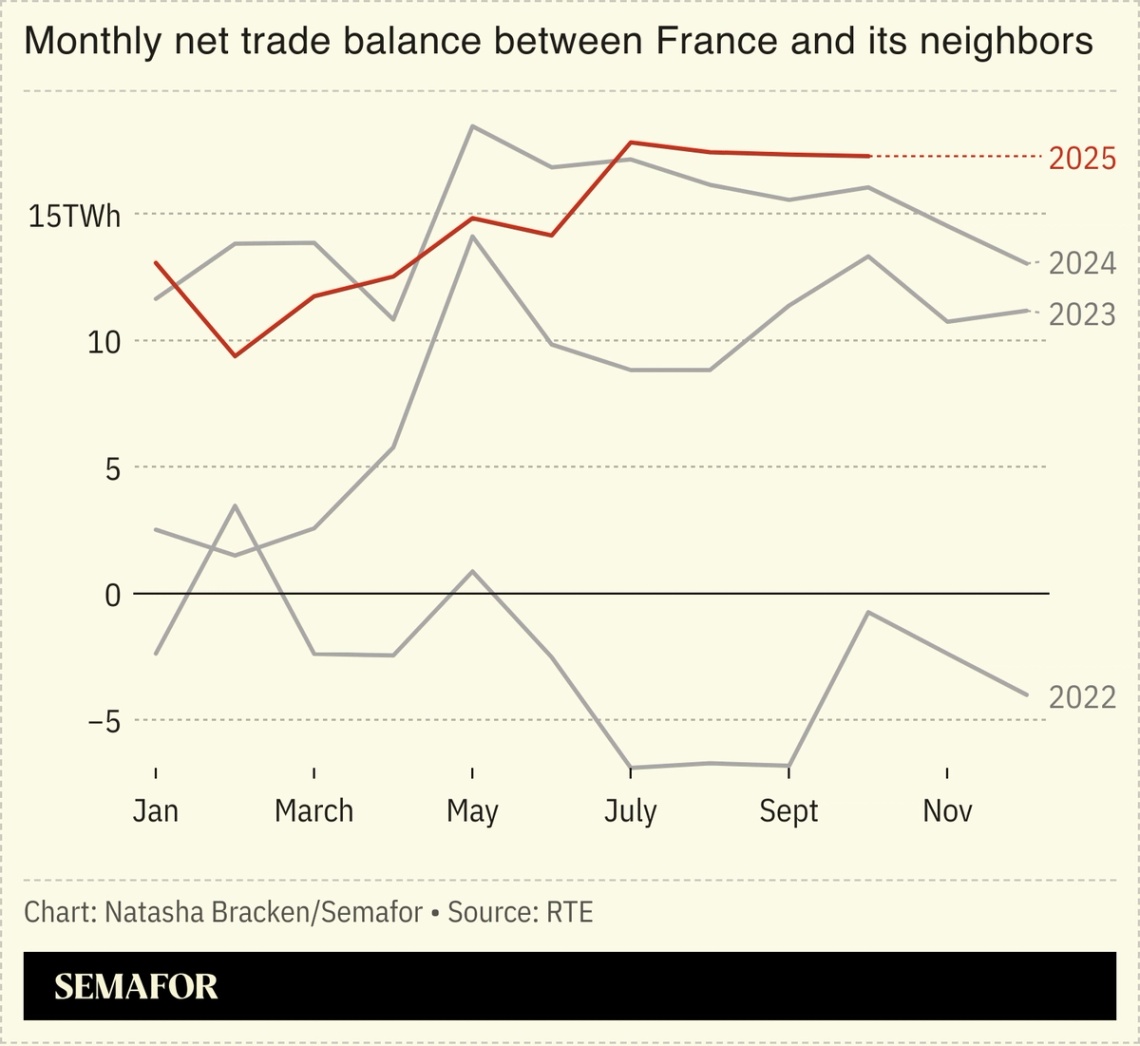

- France exported the most electricity in at least two decades from July to October, driven largely by the country’s improved nuclear fleet, which supplies more than two-thirds of the country’s electricity.

Fossil FuelsFinance- The US Export-Import Bank said it would invest $100 billion to boost efforts to secure US supply chains for critical minerals, nuclear energy and LNG, the Financial Times reported.

Minerals & Mining- China’s rare earths exports in October dropped 5.2% from a month earlier, while shipments to the US hit a nine-month high.

EVs |

|

Ali Mohamed, climate envoy of Kenya.  |

|

|