|

The Medium identifies essential signals on how technology is shaping creativity, and how creatives are evolving in response.

Reader Feedback: Why Disney Can't Simply License Cloud Services for AI Instead of Owning Them

Cloud contracts cover storage, not AI training. Legal indemnification is unclear. And Paramount/Oracle pay zero margins while Disney must feed the profit margins of AWS and model providers.

[Author’s Note: The nice folks at Substack suggested I start writing a single free post per week. This provides an opportunity to share and respond to invaluable reader feedback.

Wishing you all a Happy Thanksgiving!]

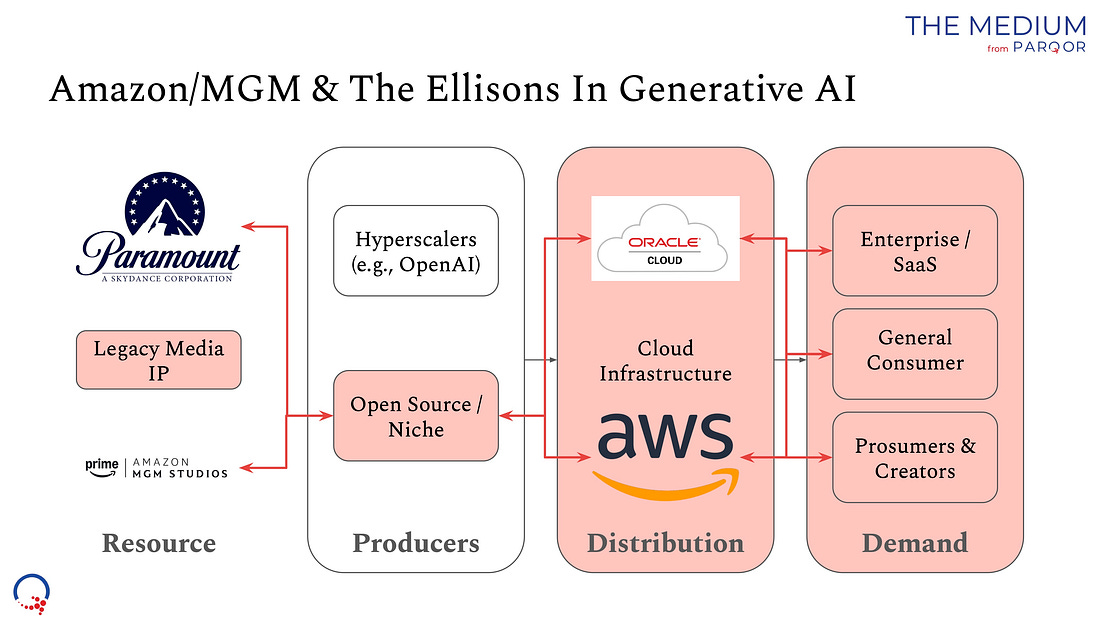

While in LA, I heard two counterarguments to my hypothesis that Disney and other legacy media companies need cloud infrastructure leverage to protect their intellectual property (IP) in the AI era. Only Amazon MGM Studios (via Amazon Web Services) and Paramount Skydance (via Oracle Cloud Infrastructure, also owned by the Ellison family) currently possess this advantage.

In this set up, an end-to-end solution for protecting and licensing IP in the generative AI era is necessary for controlling and monetizing all possible use cases with owned IP. That enables Paramount Skydance or Amazon MGM Studios to enable generative AI use cases around their IP on owned-and-operated platforms and also third-party platforms like Fable Simulations’ Showrunner or Runway.

A former streaming executive argued that a licensing agreement with any third-party cloud service provider could deliver the same advantages as an owned-and-operated end-to-end solution. And, at the Artist & The Machine summit, an entrepreneur in the creator likenesses marketplace questioned the premise that IP and likenesses could be regulated in the cloud. Both arguments expressed skepticism that ownership of a cloud solution was a necessary condition for protecting IP as more generative AI platforms emerge and scale.

So, I took these counterarguments back to Google Gemini. It responded by distinguishing between the cloud as a storage and distribution solution versus the cloud as a solution for creation and training in AI.

Cloud Contracts

First, Gemini pointed out that standard cloud contracts are designed for hosting data, and they are not designed for learning from data. So, right now, Disney hosts its Marvel library on Amazon’s AWS to distribute on Disney+. That services contract does not permit Amazon to remix IP from that library.

Disney is already risk averse about letting third-parties train their models on its uniquely valuable library of IP. That is the crux of its current lawsuit against Midjourney. Amazon is positioned as both a necessary provider of cloud services and a competitor with MGM Studios. This means Disney’s IP would be training both its own generative AI models and any third-party models also using AWS’s cloud solutions for creation and training with AI.

Disney would inevitably demand to isolate its IP from other models, if not from the rest of the internet. This is called “air-gapping”—Disney would want AWS to be a private cloud solution that blocks off all access to the internet. The AI solution only gets smarter for Disney on a smaller set of data.

It is also worth noting here that Amazon stores petabytes of MGM’s raw files in the cloud. The GPU clusters are in the same data center. The same is true for Paramount and its $100 million partnership with OCI (though that is more recent and likely a work in progress). A studio relying on a third-party cloud solution would need to have all IP stored in the cloud, too. The “speed of innovation” loop is physically faster for Amazon and Paramount Skydance.

The Indemnification Problem

Gemini also highlighted legal ramifications, particularly indemnification for potential violations of “fair use”. Lawyers will hold up any agreement that leaves this indemnification unclear. This problem is harder to solve given ongoing legal disputes around “fair use” in generative AI.

Whereas with OCI, Paramount Skydance owns the whole loop. It can train the AI on its entire library. There is still a risk of its IP “leaking” to third-party models, but it is one both Paramount Skydance and Oracle control. They do not need a contract to align incentives—they are the same entity.

The Economic Advantage

Beyond legal advantages, there is an economic one: it is cheaper to own the IP, the AI and the cloud infrastructure. In a standard deal everyone needs to make a profit: The cloud provider (e.g., AWS) must charge a margin on compute (assume 30%); the model provider must charge a margin on its API (20%); and, the studio needs to make a profit on its IP.

Here, the Ellisons own all three and none of the parties need to pay each other a margin. Because they also own the IP, they can sell the exact same features as a third-party model using AWS and charge substantially less for the offering.

In a market defined by speed and model quality, the player with no walls (Amazon/Ellison) beats the player constrained by self-imposed walls (Disney/AWS).

“Cheating”

I had coffee with a subscriber who suggested another advantage—he called it “cheating” but it may be more diplomatically described as “competitive intelligence”. Basically, if you own the cloud you can monitor which IP is growing in popularity on both first-party and third-party tools. That offers insights into marketing and other operational decisions on both the generative AI and streaming platforms.

The closest analogy is Netflix, which monitors the performance of content in certain regions to determine whether to promote the content more globally. That approach has been key to the enormous success stories behind “Squid Game” and “K-Pop Demon Hunters”. The key difference is it monitors its own IP, whereas here Amazon or Oracle would be monitoring third parties.