|

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Look Outside the Lists

Most of the popular dividend lists (like Aristocrats) exclude companies that hold their dividend steady for a few years instead of raising it.

A flat dividend during tough times shows commitment and reliability.

It means they’re not cutting your income!

General Mills hasn’t cut its dividend since 1929 (that’s 96 years!), but it often doesn’t make the growth lists because of flat periods.

|

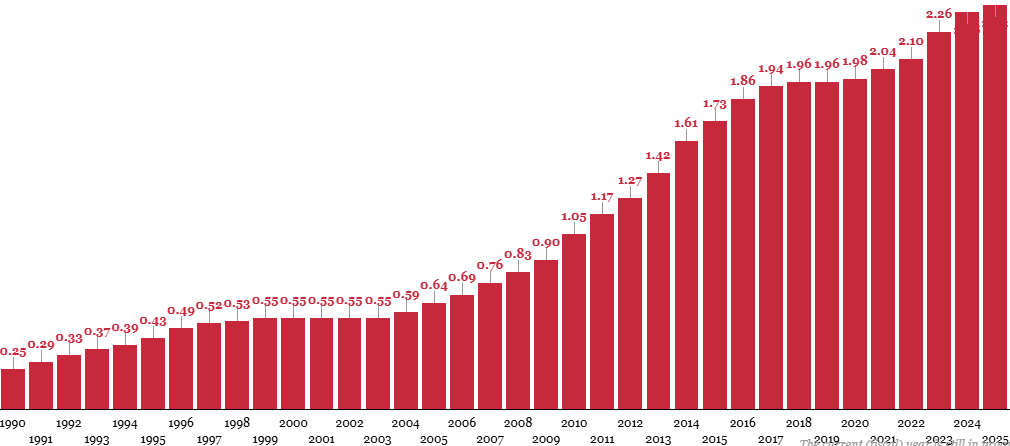

2️⃣ In Investing, Fees Matter

Fees may not seem like much each year, but over time they have a big impact.

The chart shows that over 20 years, a high 2.3% annual fee cost the investor £100,000 compared to a low 0.3% fee.

That’s because they’re charged on your original money and the growth you earned (compounding works against you).

Always choose the lowest-fee funds and brokerage accounts you can find.

|

3️⃣ An Investing Quote

Legendary investor Charlie Munger (Warren Buffett’s business partner) warned us about one of the worst mental roadblocks in life and investing: envy.

Getting jealous over someone else’s portfolio just leads to panic buying, or chasing hot stocks.

Envy is a ‘total net loss’ because it doesn’t help you, and distracts you from focusing on your own long-term plan.

Plus, it’s not even fun!

“There is nothing more counterproductive than envy. Someone in the world will always be better than you. Of all the sins, envy is easily the worst, because you can’t even have any fun with it. It’s a total net loss.”

— Charlie Munger

4️⃣ 10 Stupid Things to Avoid In Investing

Charlie Munger was full of wisdom.

He said that his first goal was to avoid being stupid.

Click the image to see the thread of 10 stupid things to avoid in investing.

5️⃣ Example of a Dividend Stock

We’re going back to point #1 for our Dividend Stock example - General Mills.

They make money by producing and selling packaged consumer foods.