| | New data shows power demand for data centers is growing rapidly, especially in the regions already o͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- AI ‘hotspots getting hotter’

- Record energy attacks

- Busy week for Total

- China’s EV retreat

- Pipeline backlash

BlackRock’s oil ambitions, and the EU’s green finance headaches. |

|

AI ‘hotspots getting hotter’ |

| |  | Tim McDonnell |

| |

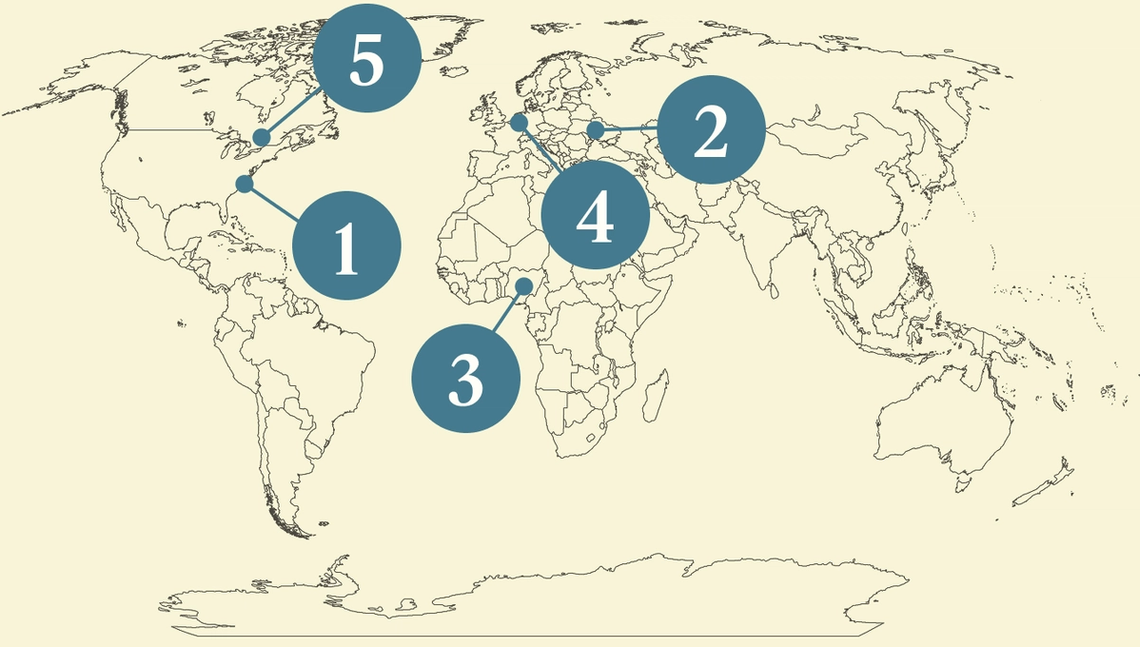

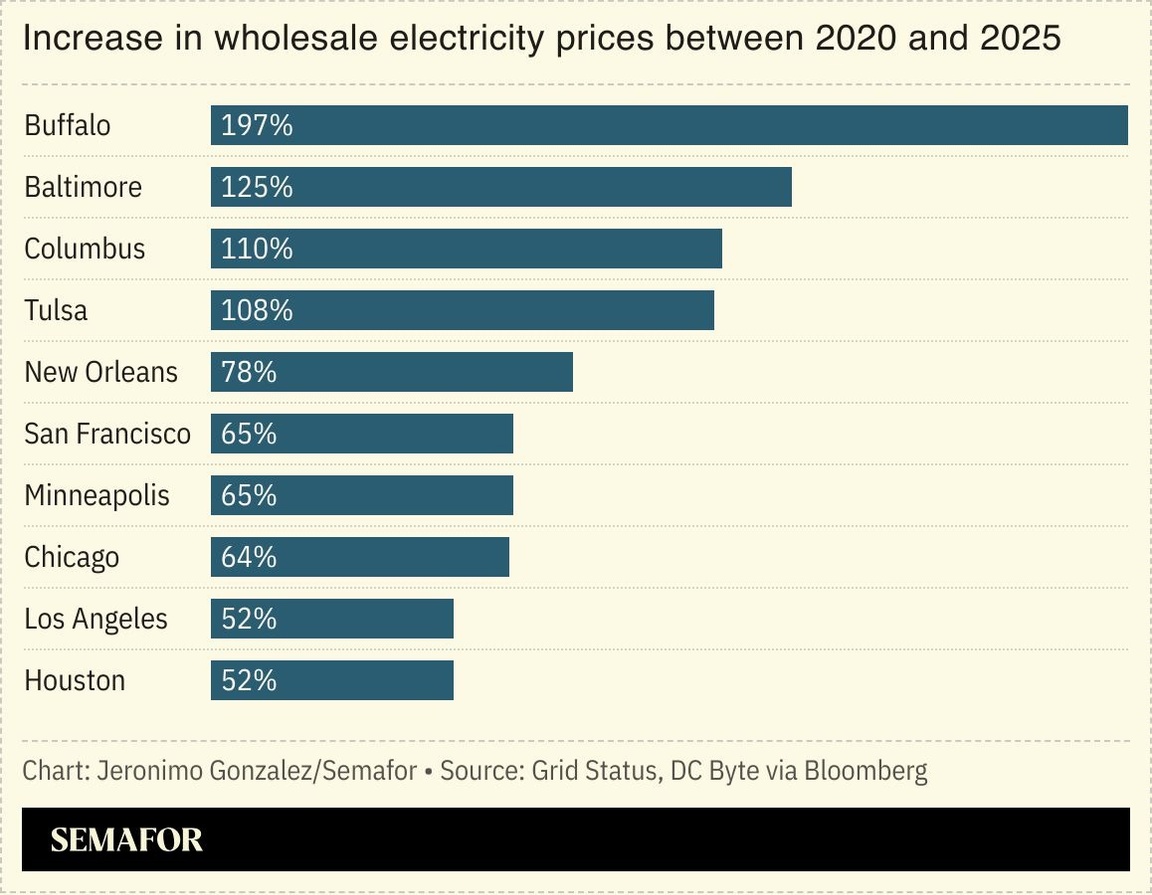

The northeastern US — home to the world’s highest concentration of data centers — faces an even larger wave of incoming power demand than previously anticipated, new figures indicate. That’s driving an escalating dispute among the companies that operate the region’s grids, one in which federal regulators could be forced to intervene. US data centers will require 106 gigawatts of power generating capacity by 2035, BloombergNEF analysts said on Monday. That’s up from about 40 gigawatts today, and 36% more than what BloombergNEF predicted in its last forecast in April, as more — and bigger — data center projects are announced. What’s remarkable about the latest forecast is not just that it’s higher, BloombergNEF senior researcher Nathalie Limandibhratha said, but that data center developers show little sign of branching out from the regions where they are already most highly concentrated. Half of the anticipated new demand will be in the PJM Interconnection — the country’s largest regional power market by capacity and already the epicenter of data center growth — which includes New Jersey, Ohio, Pennsylvania, and Virginia. “The hotspots are getting hotter,” Limandibhratha said. And that’s going to push an already-simmering conflict within PJM — over how to allow more data centers without unduly raising prices and blackout risks for everyone else — to a boil. |

|

Gleb Garanich/Reuters Gleb Garanich/ReutersUkraine carried out a record number of attacks on Russian energy infrastructure in October, intensifying pressure on the Russian economy as US-brokered peace talks inch forward. The offensive included a series of drone attacks on oil vessels in the Black Sea that Kyiv alleges were part of Russia’s sanction-dodging “shadow fleet,” and strikes on an export terminal that is on Russian territory but includes US and Kazakh shareholders. Periodic blackouts also continued in Kyiv and other Ukrainian cities this week following renewed attacks by Moscow on Ukrainian power infrastructure. So far it’s not clear that either side’s energy attacks are leading to significant concessions at the negotiating table. But that could change: Helima Croft, head of global commodity strategy at RBC Capital Markets, said in a note on Sunday that ongoing Black Sea attacks could force a “substantial re-rating” of that corridor for commodity shipments, and that the combination of attacks plus sanctions could force Moscow to shut down some oil production facilities “despite its aversion to closing taps in arctic winter conditions.” Meanwhile, the billionaire part-owner of the Los Angeles Dodgers baseball team has joined the list of contenders to buy the sanctioned company Lukoil’s overseas assets. |

|

Total’s busy week in Africa |

Akintunde Akinleye/Reuters Akintunde Akinleye/ReutersTotalEnergies encountered a mix of breakthroughs and setbacks in its shifting portfolio of Africa-based oil and gas assets. The French major sold a 40% stake in two offshore oil projects in Nigeria to Chevron, and 10% of a different Nigerian offshore field to Shell. The deals, as Semafor’s Alexander Onukwue noted, are the latest in a race by international majors into Nigeria’s offshore industry, “turning away from onshore assets following a wave of theft and vandalism along oil pipelines.” Smaller African companies, including Mauritius-based Chappal Energies and Nigeria’s Heirs Energies, have moved in to buy the onshore assets left for sale by Shell and others. Total’s luck was less favorable in Mozambique: The UK and the Netherlands withdrew a combined $2.2 billion in financing for Total’s new LNG terminal there, citing reports (which the company has denied) of human rights abuses. Total said the project will move forward without that funding. |

|

In Washington, economic power no longer follows party lines. The old frameworks — left vs. right, House vs. Senate, Republican vs. Democrat — no longer fully explain how economic power moves in the Capitol. Today’s influence moves through a wide network, from traditional power brokers to ideological outliers, dealmakers, and policy entrepreneurs. Join us December 10 for one-on-one conversations with leaders including Sen. Josh Hawley (R–Mo.), Rep. Suzan DelBene (D-Wash.), and Sen. Mark Warner (D–Va.), as we map the people moving capital, shaping policy, and redrawing the blueprint of economic power. Dec. 10 | Washington, DC | Request Invitation |

|

The share of EVs sold in Europe and the UK in October that came from a Chinese manufacturer, down a percentage point from the month before. EU and UK sales of Chinese hybrids, relative to non-Chinese brands, also slipped. Despite the setback, thanks to competition with European brands, Chinese automakers — including not just the heavyweight BYD but also newcomers like Chery and Leapmotor — still have a bull market in Europe, and notched their second-best overall EV sales month in October. Meanwhile, exports from China of gasoline-fueled cars are also surging, a new threat to US and EU competitors. |

|

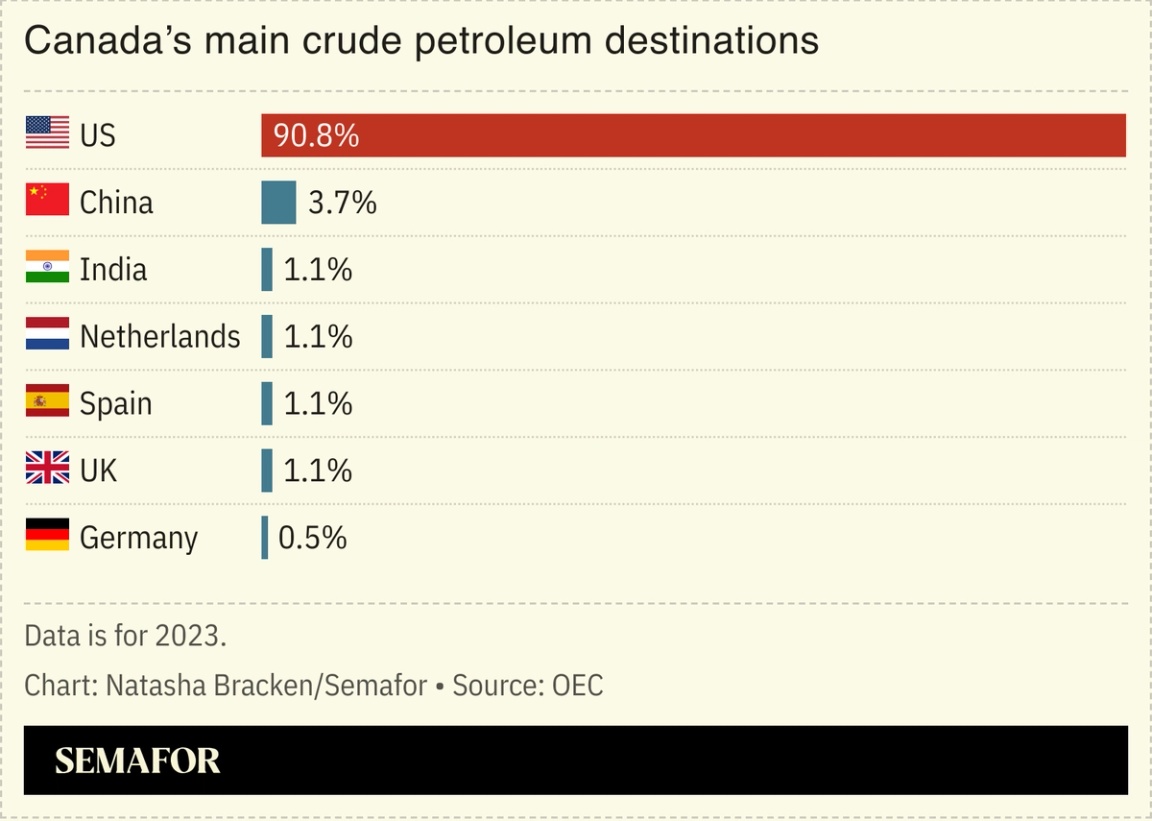

Canadian Prime Minister Mike Carney signed a deal with the energy-producing province of Alberta to help expand the country’s Pacific oil exports, a move Ottawa framed as essential to developing the province’s energy sector while reducing Canadian dependence on the US. At the heart of the deal is a push to advance plans for a pipeline that would carry a million barrels of oil daily from Alberta to a Pacific export terminal, shipping primarily to Asian markets, which currently seem to offer more stability than Ottawa’s southern neighbour. The trade interdependence between the US and Canada, “once a strength, is now a weakness,” Carney said. The agreement exempts Alberta’s proposed pipeline from some federal climate laws in order to spur investment in the province, although Carney also stressed the deal would require Alberta to raise industrial carbon levies on emissions and invest in multibillion-dollar carbon capture projects. The plans drew strong opposition, but improved strained relations between Carney and Alberta’s premier, who had openly blamed the federal government for stifling the province’s economic potential with restrictive emissions policies. -Natasha Bracken |

|

New Energy- Worldwide geothermal spending is projected to surge roughly 20% every year until 2030, according to Rystad Energy.

Jim Urquhart/Reuters Jim Urquhart/ReutersFinance- Zillow, the US’ largest real-estate listings site, has removed a feature that allowed users to view extreme weather-related risks for more than one million homes after agents said it hurt sales.

- Several asset managers are reviewing their exposure to Philippine government debt earmarked for climate and social projects, concerned they may have funded initiatives under investigation for corruption.

- BlackRock, Brookfield, Apollo and other infrastructure investors are targeting top oil and gas firms, seeing potential as the industry struggles with low prices and waning interest from public markets.

Politics & Policy- The EU has disbursed only a small portion of its pledged green technology funding, with companies spending up to 3,000 hours and an average of €85,000 to access funds from a flagship programme.

EVsPersonnel |

|

|