| | The EU agrees to loan Ukraine $105 billion, China pushes to join a Pacific trade pact, and wind turb͏ ͏ ͏ ͏ ͏ ͏ |

| |   Cambridge Cambridge |   Beijing Beijing |   Canberra Canberra |

| Flagship |  |

| |

|

The World Today |  - EU agrees $105B Kyiv loan

- Europe’s global ambitions

- Japan eyes Central Asia

- US-South Africa ties erode

- Trade deals gain momentum

- Washington backs USMCA

- TSMC boosts work abroad

- US, Aus shooting responses

- Solar firms battle price war

- Wind farms help marine life

Semafor’s editor-in-chief kicks off our year-end recommendations series with ‘the best guide to Washington today.’ |

|

Valentyn Ogirenko/File Photo/Reuters Valentyn Ogirenko/File Photo/ReutersEU leaders agreed a $105 billion loan to Ukraine after efforts to leverage frozen Russian assets in order to help Kyiv stumbled. The bloc has debated using the $246 billion in Russian funds for months, but Belgium, where most of the money is held, was concerned about financial and security repercussions, and demanded guarantees from other EU countries, which they rejected. Still, the loan provides vital cash for Ukraine — President Volodymyr Zelenskyy said that without it, drone production would be severely curtailed. The collapse of the assets program is a blow to EU leaders who backed it, but the new solution is better, the Financial Times’ chief foreign affairs commentator argued: It is durable, repeatable, and legally tested. |

|

Calls for EU to assert global role |

Stephanie Lecocq/Reuters Stephanie Lecocq/ReutersThe EU’s focus on regional crises has cost it the global geopolitical sway the bloc appears to crave, a leading expert argued. Recent upheavals — including Brexit, the COVID-19 pandemic, and, most notably, Russia’s full-scale invasion of Ukraine — have for years dominated the bloc’s attention. European Commission President Ursula von der Leyen must use her second term to focus on reasserting the EU’s role as a global actor, Francesco Siccardi, the deputy director of the Carnegie Endowment’s Europe program, argued. “The EU will have to reinvent itself once again to chase its ambition of a global Europe,” he wrote. |

|

Japan courts Central Asian nations |

Kim Hong-ji/File Photo/Reuters Kim Hong-ji/File Photo/ReutersJapan today opens its first summit with Central Asian nations, joining China and others in the scramble for the region’s abundant natural resources. Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan have rich supplies of fossil fuels and critical minerals, and historic links to Beijing and Moscow. Those factors have led Western capitals — and now Tokyo — to compete for their attention: In particular, the region offers a way of breaking China’s stranglehold on rare earth production. Despite, or because of, the longstanding ties, China’s rising influence is unpopular in Central Asia, particularly as Beijing props up autocratic regimes, and Japan and the West see an opportunity to stop it falling into China’s sphere of influence. |

|

US-South Africa rift escalates |

Kevin Lamarque/File Photo/Reuters Kevin Lamarque/File Photo/ReutersThe Trump administration said South Africa faced “severe consequences” over Pretoria’s opposition to US efforts to aid Afrikaners, widening a bilateral rift. The comments came after Pretoria reportedly expelled several Kenyan nationals sent to South Africa to help members of the country’s white minority relocate. Since the start of his second term, US President Donald Trump has accused South Africa of waging a “genocide” against its white population — an allegation rejected by experts — imposing hefty tariffs as punishment. South African officials have sought to improve ties by making concessions, only to be rebuffed by the US. “How do you take this forward is a real conundrum,” a South African expert told the Financial Times. |

|

Trade deals gain ground despite US |

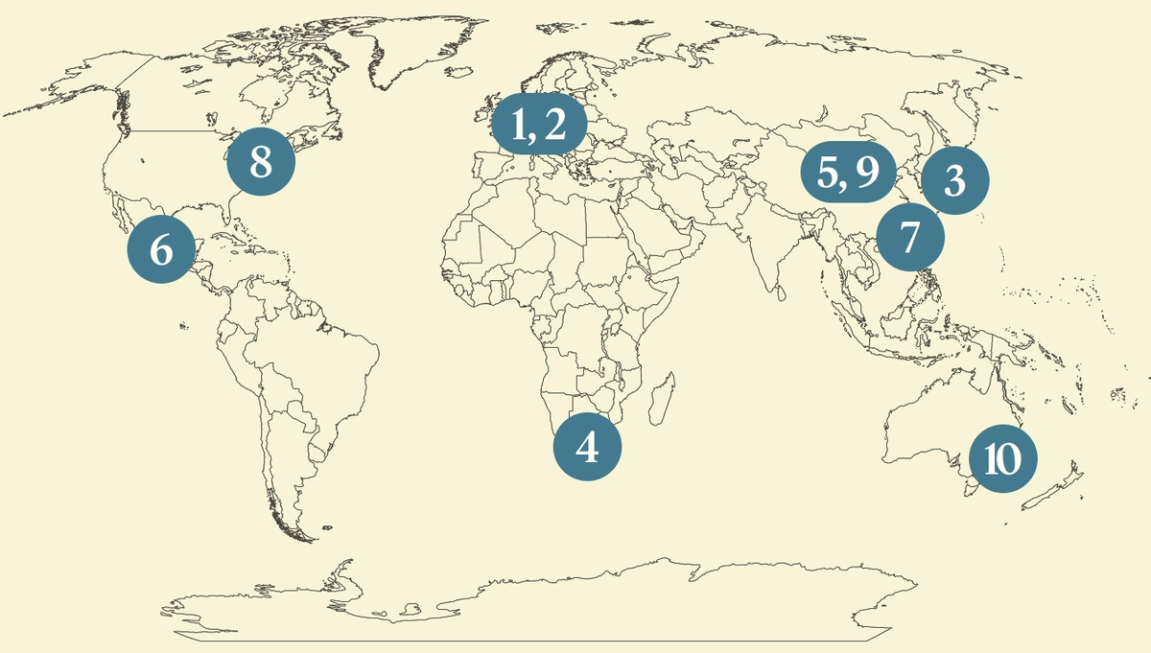

An expo in Hainan. Casey Hall/Reuters An expo in Hainan. Casey Hall/ReutersBeijing designated an island with an economy comparable to a small European nation as a distinct customs zone, part of efforts to drive commerce and seed China’s targeted accession to a trans-Pacific trade pact. Hainan, a tourist destination famed for its resorts, this week became a duty-free region and now allows foreign companies to operate in sectors there that they are barred from in mainland China. Beyond luring foreign investment, Beijing is also aiming to join the CPTPP free-trade deal, underscoring how even as US protectionism has grown, trade has deepened elsewhere. Cambodia recently applied to join, too, while the EU is pushing agreements with India and with a South American bloc, and China has pressed for a Gulf deal. |

|

US issues USMCA trade demands |

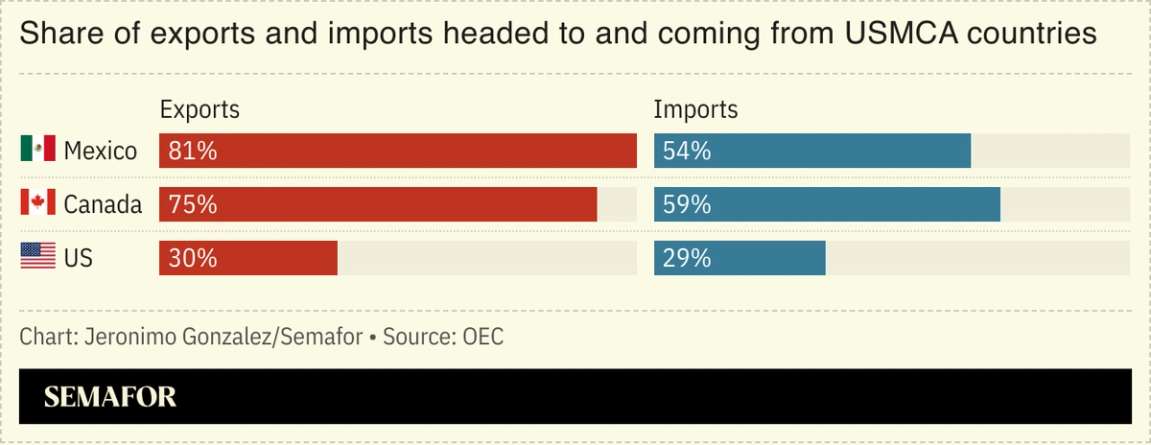

Washington’s top trade official said he supported maintaining a free-trade agreement with Canada and Mexico, while presenting a series of tough demands he wanted integrated into the deal. Jamieson Greer’s comments came after US President Donald Trump suggested letting the US-Mexico-Canada Agreement lapse, despite it being signed during his first term in office. Greer’s remarks will buoy officials in Ottawa and Mexico City, who are gearing up for next year’s high-stakes review of the USMCA, at which point signatories may withdraw. Though Canada and Mexico have recently made moves to diversify their economies, both remain heavily dependent on the US for much of their exports and imports. |

|

TSMC ups plans for overseas chipmaking |

Taiwan Semiconductor Manufacturing Co., the world’s dominant chipmaker, is accelerating plans to move advanced production overseas, a move that would reduce the world’s exposure to a potential Chinese invasion of the island. TSMC’s first foreign manufacturing plant, in the US state of Arizona, is already producing chips, and the company is planning to open another there sooner than expected. The firm will also use a new Japanese plant to make more advanced chips than previously anticipated. TSMC produces over 90% of the world’s most advanced semiconductors, and the AI boom is driving demand ever higher. Beijing views Taiwan as part of China, and should it invade, global industries from carmaking to defense would largely grind to a halt. |

|

What is Instagram in 2025? That was the first question on Ben Smith’s and Max Tani’s minds when they sat down with the head of the platform, Adam Mosseri, for this week’s Mixed Signals. The conversation covers Instagram’s new move onto TV screens, the dominance of Reels and DMs, and whether “everything is becoming television.” Mosseri also explains how the company is competing with TikTok and YouTube, and whether “AI slop” is a legitimate concern for social media feeds. |

|

Australia, US crack down after shootings |

Jeenah Moon/Reuters Jeenah Moon/ReutersAustralia and the US responded in contrasting ways to recent high-profile shootings. Australian Prime Minister Anthony Albanese pledged the largest gun buyback in almost 30 years after father-and-son gunmen killed 15 people at a Hanukkah event on Bondi Beach, Sydney. Meanwhile, US President Donald Trump suspended the immigrant program that the suspect in a shooting at Brown University used to gain US residency. The Portuguese national, also suspected of killing an MIT professor, was found dead Thursday. The countries’ responses are not atypical: Trump also imposed new migration rules after an Afghan national shot two National Guard troopers in November, while a 1996 mass shooting in Australia led to a rapid tightening of gun laws. |

|

China solar firms tackle competition |

Tingshu Wang/Reuters Tingshu Wang/ReutersChinese solar businesses hailed progress in combating cutthroat competition that has sent prices for panels plummeting, but which has also left several companies on the brink of collapse. The firms debuted an industry-wide consolidation fund, which aims to use resources provided by major solar manufacturers to buy up and subsequently close down smaller, less competitive producers. But analysts at Trivium, a research firm, noted that several challenges meant “ |

|

|