|

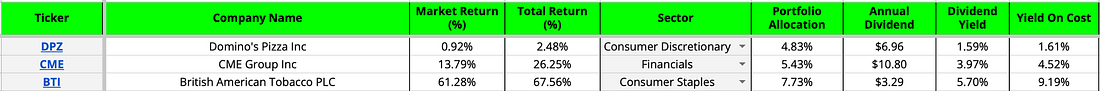

British American Tobacco continues to be our best performing stock.

The total return of British American Tobacco is more than 60% so far.

It’s just had a trading update, let’s see how the company is doing.

Our Investment

We bought British American Tobacco in January as the third stock for the Compounding Dividends Portfolio.

You can read the original investment case here.

Here’s a quick summary of why we bought it:

High Dividend Yield & Low Price: The stock was priced attractively with a very high dividend yield of 8.6% compared to the average of 7.7%.

Strong Cash Flow: BAT showed negative accounting earnings due to non-cash charges, but it generated very strong cash flow.

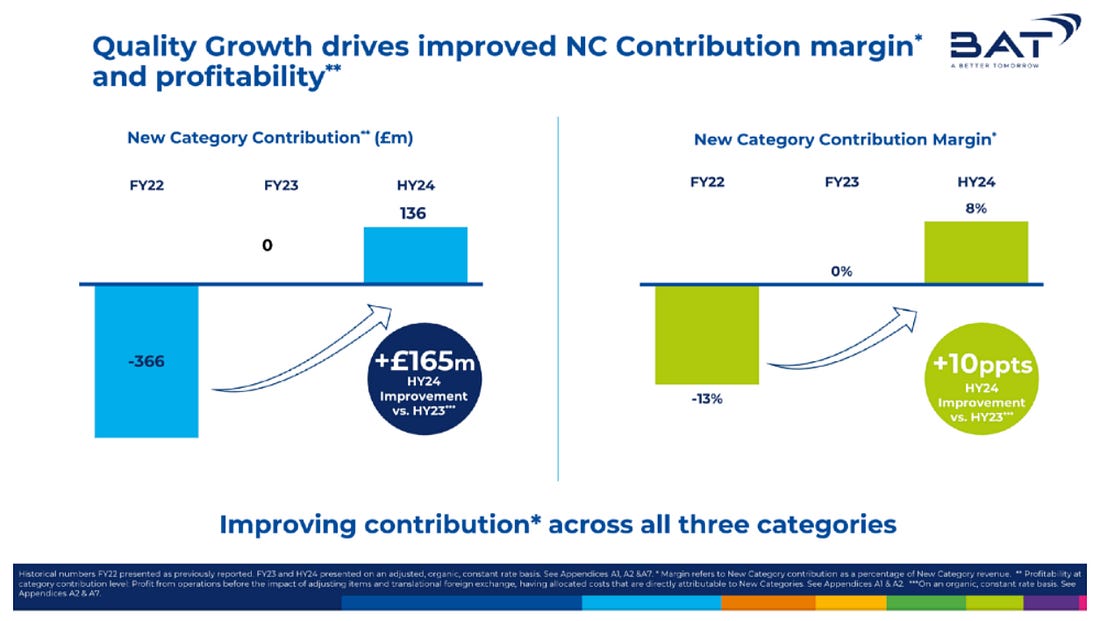

Growth Drivers: New, non-traditional products were growing quickly and had just become profitable, which meant another source of cash flow to grow the dividend.

Buybacks: Management had decided to start share buybacks, signaling that the shares were undervalued.

Performance

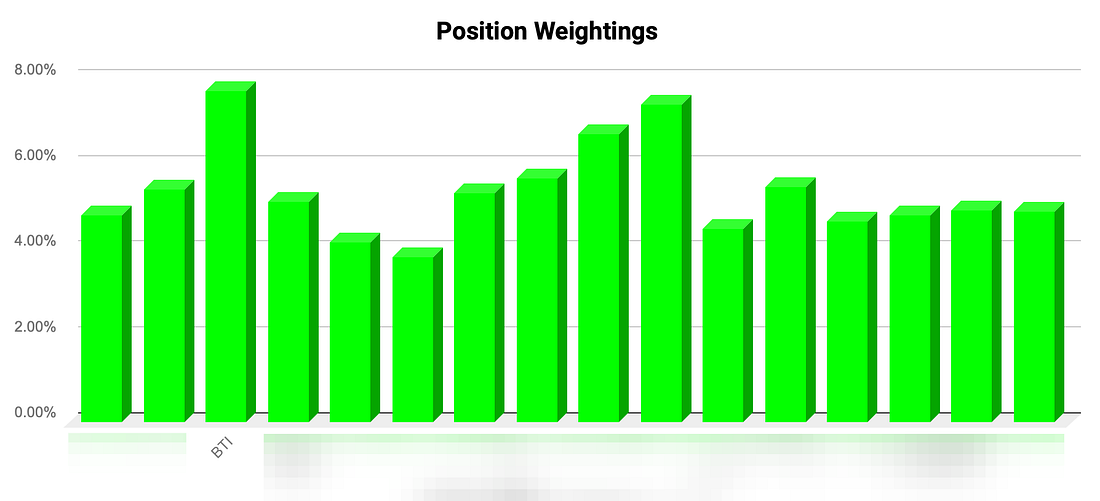

British American Tobacco has grown to be the largest position in Our Portfolio.

It’s also got the highest yield on cost in the portfolio and provides about 15% of our dividend income every year.

Now let’s get to the company’s most recent update.

Financial Highlights

Group Revenue Growth: Expecting 2% growth at constant rates for FY25.

Adjusted Profit from Operations: Expecting 2% growth at constant rates for FY25.

New Category Revenue: Growth is speeding up to double-digit growth in H2, they’re expecting mid-single digit growth for the full year.

Cash Flow: Operating cash flow conversion expected to exceed 95%

Share Buy-backs: Announced an increase in the buy-back program to £1.3 billion for 2026.

Deleveraging: On track to reduce leverage to within the 2.0-2.5x adjusted net debt/adjusted EBITDA target range by the end of 2026.

2026 Guidance: Reaffirmed mid-term growth: +3-5% revenue, +4-6% adjusted profit from operations, and +5-8% adjusted diluted EPS (expected at the lower end of the range).

The takeaway?

British American Tobacco should be able to continue to grow the dividend at rates that will keep up with inflation.