|

Warren Buffett spent nearly 50 years writing letters telling us his exact investing strategy.

In honor of Buffett’s Retirement, Seth Klarman wrote a great piece in The Atlantic breaking down the five traits that made Warren Buffett so successful for so long.

Let’s dive into them and how they can help us keep compounding our dividends.

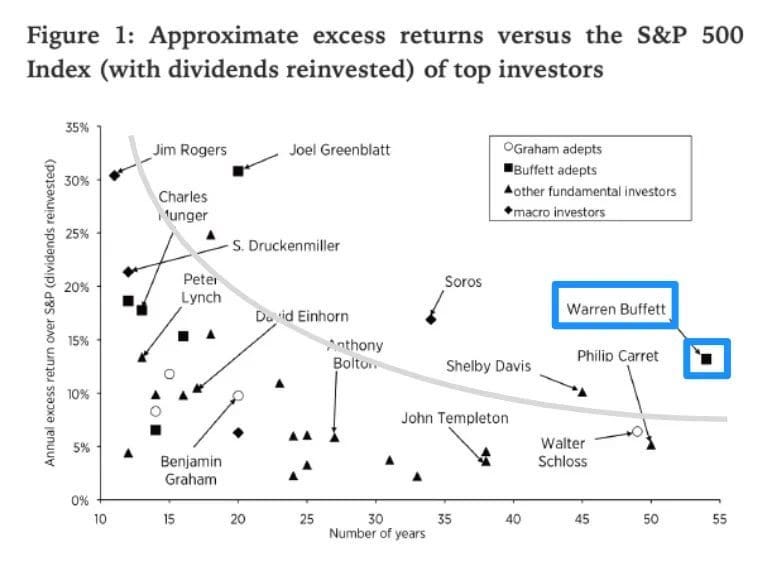

Buffett is widely considered the greatest investor ever.

The most impressive thing isn’t his returns, but how long he’s sustained them.

He’s consistently outperformed the markets for over 50 years.

Here are the 5 things that allowed Warren Buffett to do so well for so long.

1. Decisive Judgment

Warren is known for spending most of his time reading and thinking.

This gives him a broad base of knowledge and mental frameworks to be decisive in his judgement.

In 2008, during the height of the financial crisis, the world was panicking.

While others were frozen by fear, Buffett was decisive.

He quickly analyzed Goldman Sachs and invested $5 billion.

He knew the business was essential to the economy, that the government wouldn’t allow the financial system to collapse, and the terms were heavily in his favor.

The deal included preferred shares that had a 10% dividend.

Goldman bought them back in 2011, making Berkshire $3.7 billion in 3 years.

Lessons for Dividend Investors:

Know your Buy Price: Have a list of high-quality dividend payers and know exactly what price you are willing to pay.

Trust your research: When a fat pitch comes, be ready to swing.

2. Simplicity of Thought

Buffett is able to focus on a few important things without over-complicating or over-thinking an investment.

Buffett often talks about See’s Candies.

He didn’t look at complex spreadsheets, or create complicated models to buy it.

He looked at the brand.

He realized that people in California had an emotional connection to the chocolate.

If they wanted the best, they went to See’s.

It was a simple business with pricing power - they could raise prices every year, and people would still buy.

Lessons for Dividend Investors:

The Six-Year-Old Rule: If you can’t explain how a company makes money to a child, don’t buy it.

Focus on Cash: For dividends, the thing to focus on is Free Cash Flow. If the company makes more cash than it spends, it can pay you.

3. Stick with the Best

Buffet no longer settles for ‘good’ or ‘cheap’.

He wants the best businesses and once he buys them, he has the conviction to hold the winners.