|

|

2025 was an amazing (investing) year.

The S&P 500 increased by +18% this year.

What have we learned this year? Let’s share 10 crucial investment insights.

Serious investors

I am looking for a few interested investors who want to step up their investment game in 2026. You can apply here if you think it’s something for you.1. Time in the market > timing the market

Timing the market is a fools game.

The only role of market timers, is to make fortunetellers look good.

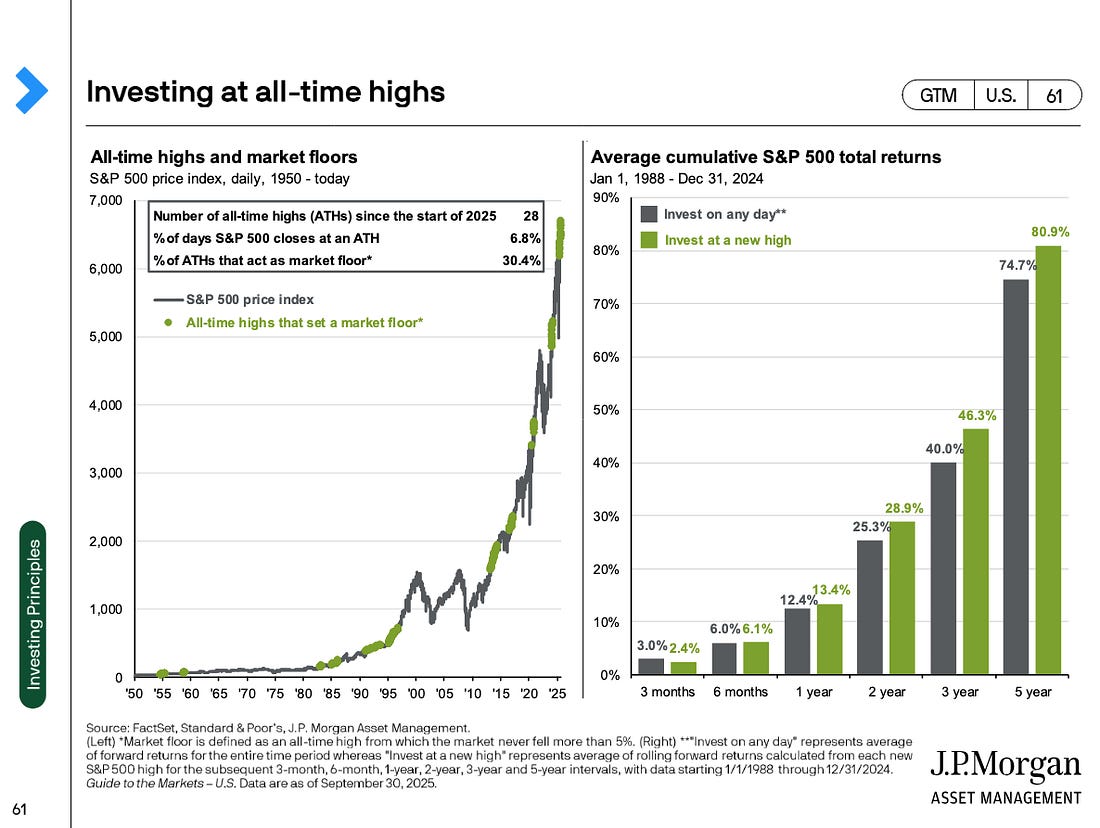

As you can see in the chart below, you actually slightly outperform the market by investing at all-time highs:

2. The market looks expensive

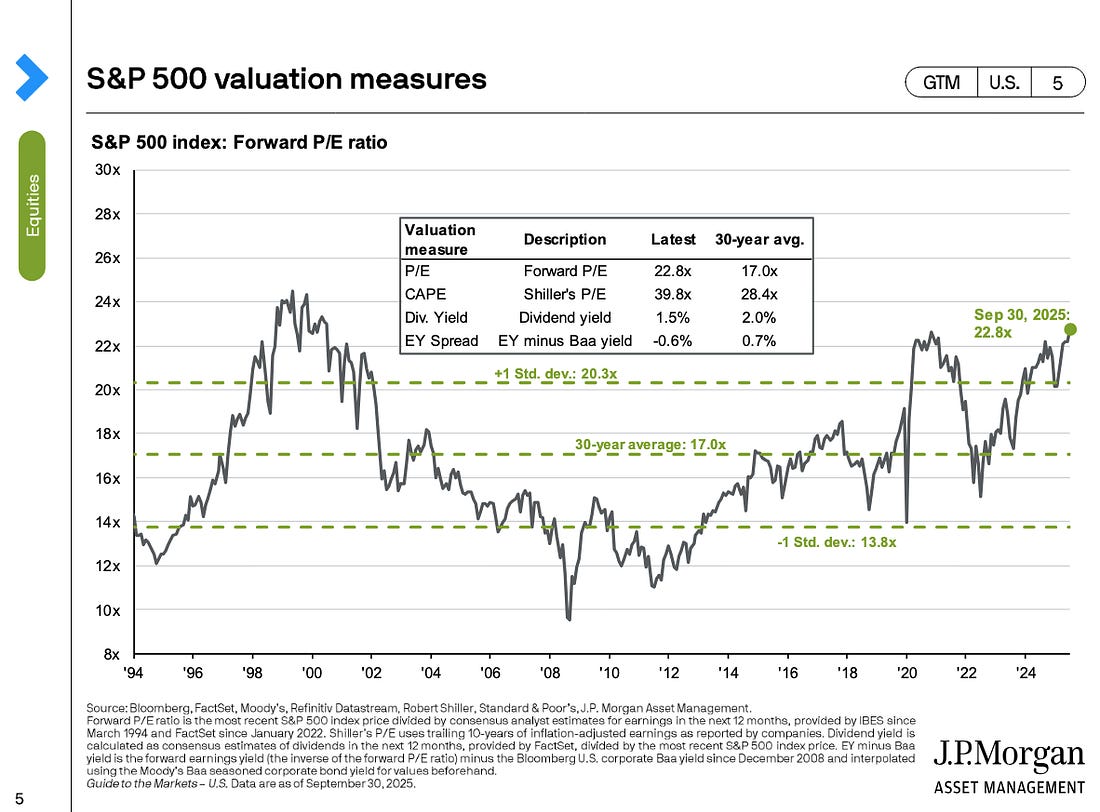

The S&P 500 looks richly valued today:

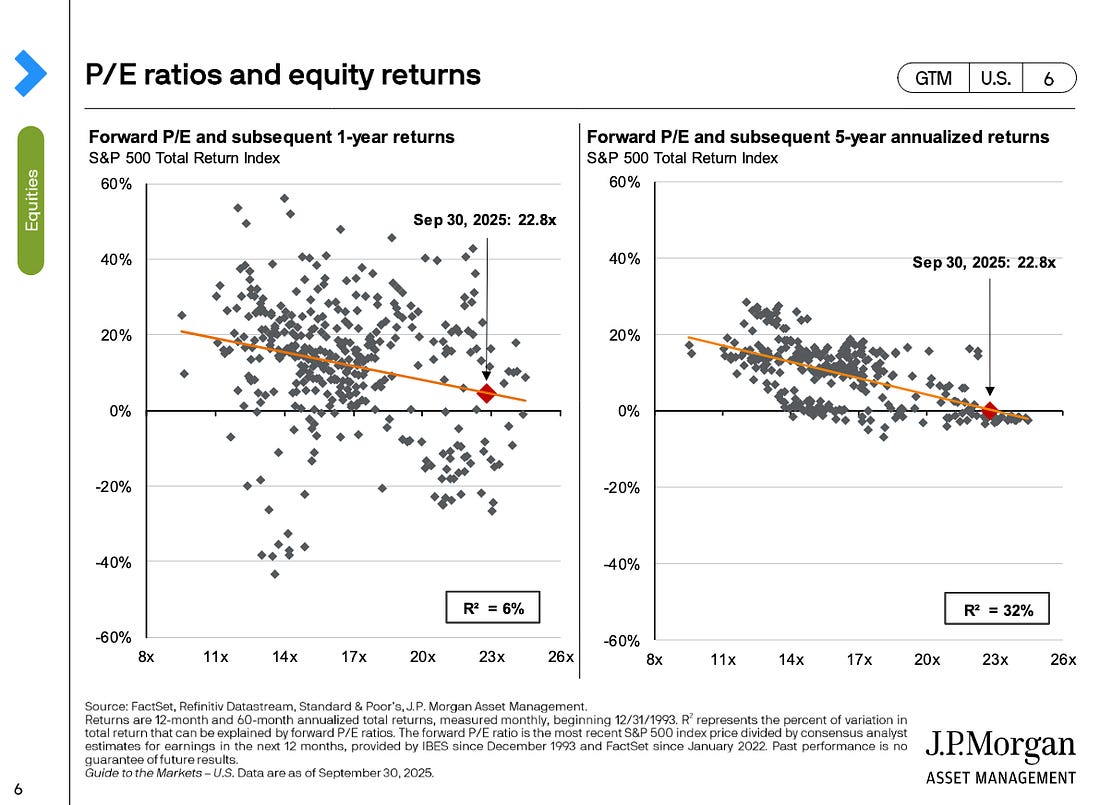

As a result, the expected return for the S&P 500 looks rather low.

JP Morgan even says you could expect a return of 0% (!) over the next 5 years:

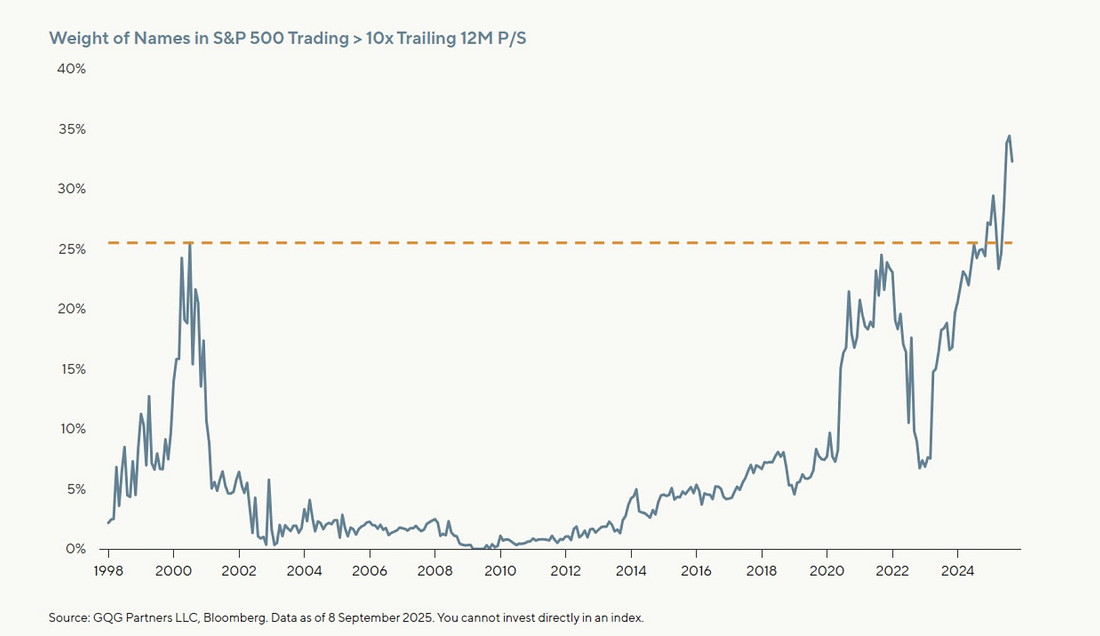

There have never been more companies within the S&P 500 trading at a Price-to-Sales ratio over 10x:

The good news? If you exclude Big Tech stocks, valuation levels already look way more reasonable: