| | In today’s edition: Competition over the Gulf of Aden, fracking in Saudi, and how sales tax changed ͏ ͏ ͏ ͏ ͏ ͏ |

| |   Manama Manama |   Kuala Lumpur Kuala Lumpur |   Hargeisa Hargeisa |

| Gulf |  |

| |

|

- Gulf of Aden competition

- Masdar in Malaysia

- Aramco’s Saudi shale play

- DHL expands in Riyadh

- Bahrain’s cyber framework

This week in Gulf history: when the region stopped being tax-free. |

|

Louiza Vradi/Reuters Louiza Vradi/ReutersDevelopments on both sides of the Gulf of Aden — in Somalia and Yemen — are exposing diverging geopolitical interests between Saudi Arabia and the UAE. On one bank, Israel became the first country to recognize the breakaway republic of Somaliland over the weekend, a move swiftly rejected by Somalia, African regional bodies, and more than 20 mainly Arab and African countries: Notably, Saudi Arabia was among them, but the UAE was not. (Abu Dhabi led an Arab League meeting on Monday that “condemned Israel’s recognition.“) The recognition of Somaliland — which has lobbied for independence for more than three decades, and is home to a major Dubai-owned port — adds complexity to the balance of power along a key trade corridor where shipping has been under attack for years, from both the Iran-backed Houthis in Yemen and pirates operating out of Somalia. And on the other bank, in Yemen, UAE-backed separatists in the south are now facing pressure from the Saudi-led coalition to withdraw from two provinces bordering the kingdom — oil-rich Hadramout and neighboring Mahra — with Riyadh warning of military action if they refuse. Alongside events in nearby Sudan, where the UAE is accused of backing a paramilitary force in that country’s civil war (which it denies), the tensions are heightening the sense of geopolitical competition between Abu Dhabi and Riyadh. — Mohammed Sergie |

|

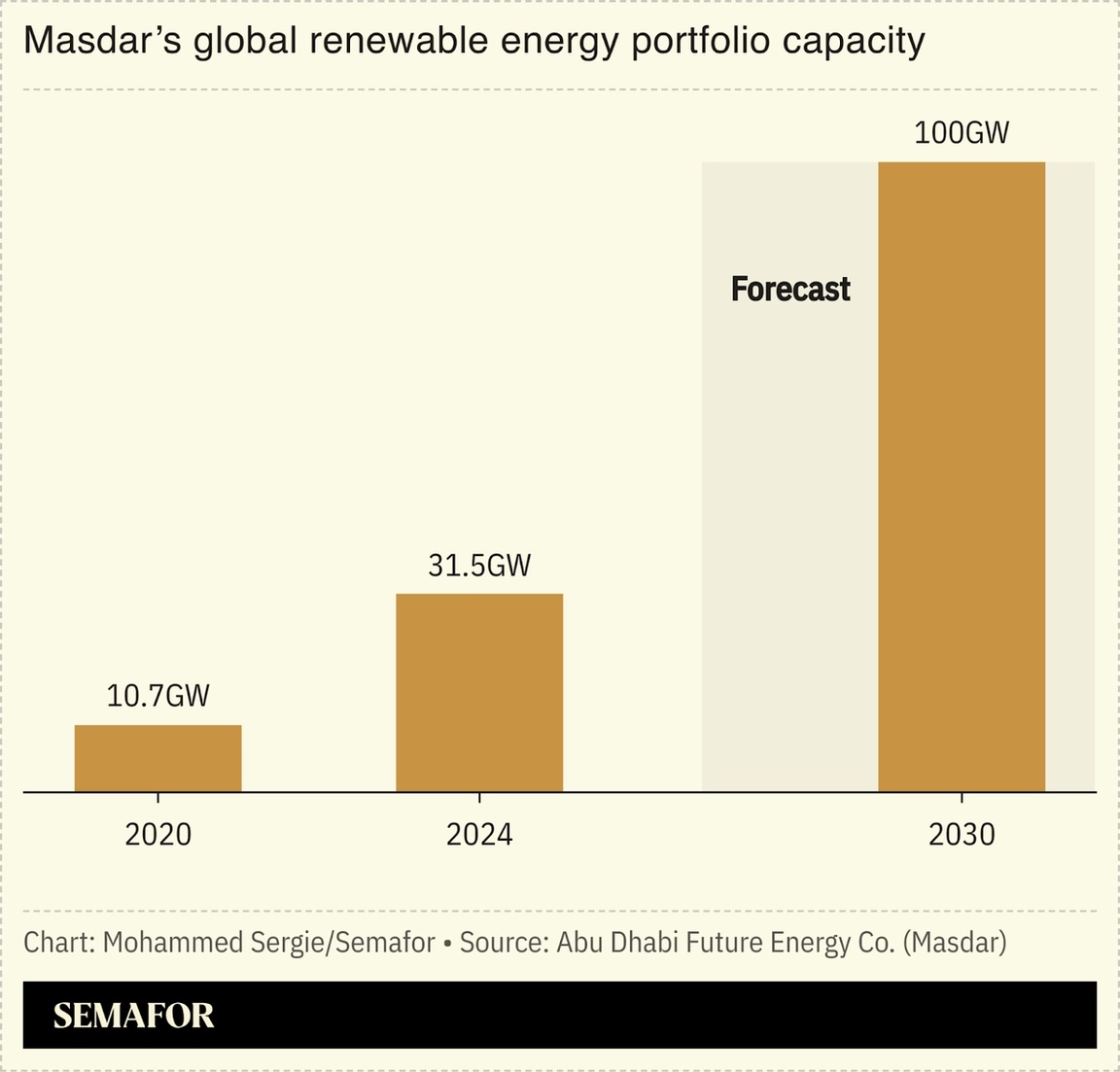

Masdar expands into Malaysia |

Abu Dhabi renewable energy giant Masdar will develop a 200-megawatt floating solar power plant at the Chereh dam in Malaysia — the first fruit of a 10-gigawatt roadmap agreed with the Malaysian Investment Development Authority in 2023. Once complete, it will be the largest floating solar plant in Southeast Asia, able to power more than 100,000 homes. Masdar’s entry into Malaysia adds to a global portfolio which now stretches across more than 40 countries — part of a wave of international projects by Gulf developers, with other key actors including Dubai-based Amea Power and Saudi Arabia’s ACWA Power. Many more deals need to follow if Masdar is to reach its target of delivering 100 gigawatts of clean energy by 2030. At the start of the year, a senior executive told Semafor it needed to add 200 megawatts every week until the of the decade — equivalent to another Chereh dam plant every seven days. |

|

Saudi hires SLB for shale project |

Courtesy of Aramco Courtesy of AramcoSaudi Aramco awarded a five-year contract to SLB as it accelerates development of the Jafurah field, the kingdom’s biggest unconventional oil and gas project. SLB — a Houston-based oil field services and technology company — will provide technology crucial to unlocking gas and liquids from shale reservoirs. Jafurah is one of the biggest shale gas projects outside the US: Aramco estimates the field will produce 420 million cubic feet a day of ethane and 630,000 barrels a day of liquids by 2030, and may require as much as $110 billion in investments. The company aims to lift gas output by more than 60% by the end of the decade, which will help free up more of the kingdom’s crude for export. |

|

Annegret Hilse/Reuters Annegret Hilse/ReutersThe Gulf’s logistics sector is hitting an inflection point, as governments increasingly demand in-region storage and delivery rather than moving goods through ports and running operations from elsewhere, DHL Supply Chain CEO Hendrik Venter told Semafor. The trend is prompting some large capital outlays. The logistics arm of the shipping giant is investing $153 million in a new facility in Riyadh’s Special Integrated Logistics Zone. In Dubai, DHL is adding $140 million in cold storage and bonded warehousing, while in Bahrain it is building a new hangar for express cargo. The push aligns with broader government strategy. Saudi Arabia has spent $74.6 billion since 2016 to become a global logistics hub, with the sector contributing about 6.2% of GDP. Another $192 billion is planned by 2030. — Manal Albarakati |

|

The most powerful people in the world are gathering at the World Economic Forum in Davos, Switzerland later this month to plan for the future, make deals, and defend their hard-won status. Semafor’s Liz Hoffman, Andrew Edgecliffe-Johnson, and Ben Smith will be there to cover what’s happening on the big stage, and to lift the curtain on what’s happening behind it. |

|

Bahrain taps SandboxAQ again |

Stephanie Lecocq/Reuters Stephanie Lecocq/ReutersBahrain has tapped SandboxAQ in a nationwide effort to modernize its cybersecurity. The Palo Alto-based AI firm is partnering with Bahrain’s National Cyber Security Center to deploy its software across some 60 government bodies as the country prepares for an era — expected by the end of the decade — in which quantum computing is prevalent and encrypted code will be vulnerable to hackers as well as more sophisticated AI agents. Manama is already leaning on SandboxAQ to help with its economic diversification drive. In October, Bahrain’s sovereign wealth fund Mumtalakat struck a deal with the firm to help it stand up a biotech industry, targeting more than $1 billion in assets over three years. Bahrain is licensing SandboxAQ’s AI software to accelerate target discovery and develop drugs and therapies. Speaking to Semafor, SandboxAQ CEO Jack Hidary called the deal a fast track to homegrown intellectual property for Bahrain. |

|

| This week in Gulf history |

Jumana El Heloueh/Reuters Jumana El Heloueh/ReutersJanuary 1, 2018, marked the end of the Gulf’s tax-free living era. The UAE and Saudi Arabia simultaneously introduced a 5% value-added tax, or VAT, on most goods and services, breaking with decades of zero-tax living as governments scrambled to plug holes left by an oil price collapse that began in 2014. The tax was intended to boost the governments’ non-oil revenue as budgets became bloated with subsidies and public sector wages. Saudi Arabia had frozen major construction projects and slashed fuel and utility subsidies following a near-$100 billion deficit in 2016 while the UAE was bracing for slower growth. What began as a relatively minor levy is reshaping public finances. Saudi Arabia has since tripled VAT to 15%, generating $49 billion in 2024, almost half of the kingdom’s total tax receipts. Meanwhile, the UAE, which has held VAT at 5% but introduced other taxes, collected two-thirds of overall government revenue from taxes in 2024. |

|

| |