| | In today’s edition: Record year for Gulf bond issuances and AI is coming for everything, or not.͏ ͏ ͏ ͏ ͏ ͏ |

| |   Abu Dhabi Abu Dhabi |   New York New York |   Montreal Montreal |

| | | Global Capital Edition |

| |

|

- Record for Gulf bonds

- AI agents for Gulf boards

- The AI bubble is here

- UAE reveals its AI spend

Latest envy at the hangar: world’s fastest private jet. |

|

In the first nine months of 2025, Middle East sovereign investors deployed more than $56 billion, according to industry tracker Global SWF. The final tally for the year will once again rank them among the world’s biggest dealmakers, and next year will likely be no different as the Gulf vies to control the levers of the future world economy. Artificial intelligence is the driver: Gulf governments see AI as a once-in-a-lifetime opportunity to diversify away from hydrocarbons and improve productivity. Qatar’s launch of Qai, which plans to invest $20 billion into AI infrastructure, is just the latest example of this trend. In tying up with Brookfield, it also illustrates how important Gulf cash is to the US race to control AI. The Saudis have a partnership with Blackstone and Abu Dhabi with BlackRock. Navigating the politics of getting much more access to US-made chips will be essential, as will building out the cheap energy facilities that Gulf states have promised, though the true test will be turning AI hype into profitable businesses. All the most active Gulf funds have a dancing partner. Next year will be all about showing what they can do, and how fast. |

|

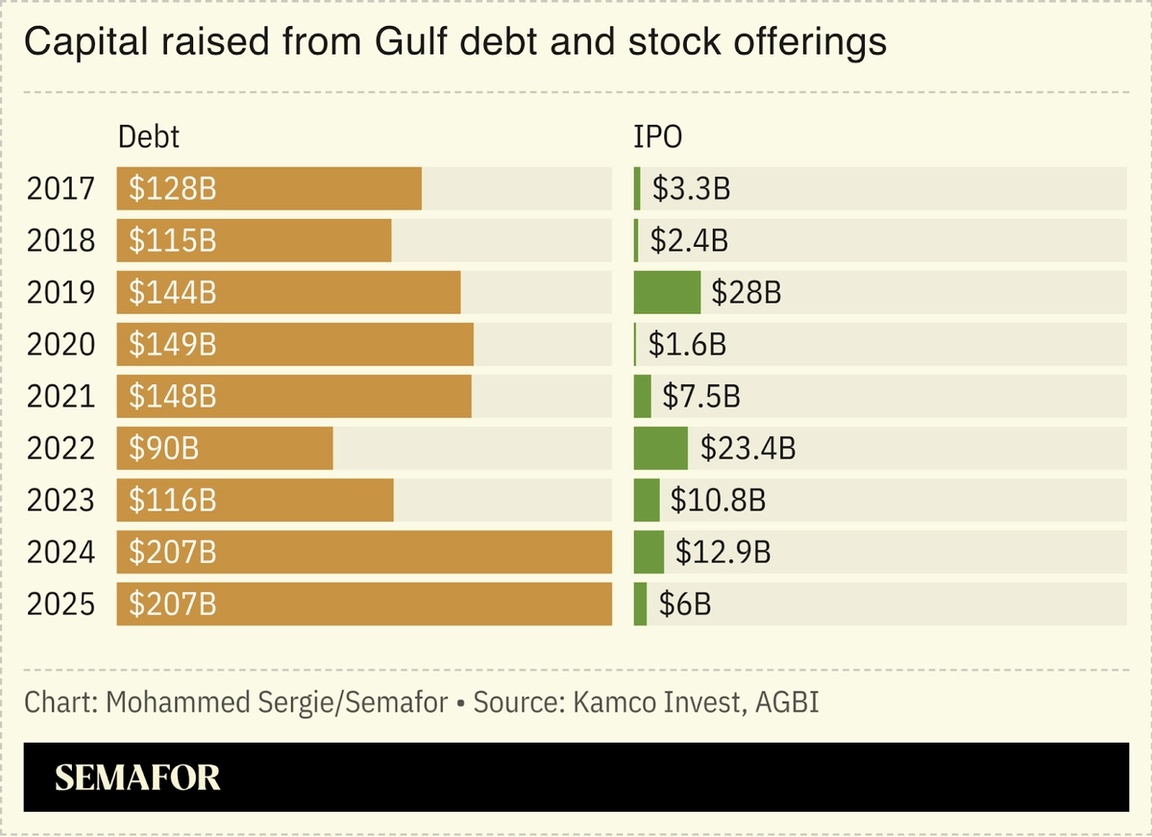

Investors snap up Gulf bonds |

Gulf countries are notable global investors — and, increasingly, major borrowers. Overall around $207 billion worth of bonds and sukuk have been issued this year, according to Kamco Invest, a Kuwait-based asset manager. That’s about the same as in 2024 — excluding the last 10 days of 2025 — but there have been some shifts within the overall figure. Gulf government issuance fell 21%, while corporate debt sales have grown 19%. Spreads have been tight: In one week in October, Abu Dhabi borrowed $3 billion at just 10 basis points spread over three-year Treasurys while Kuwait raised $11.5 billion in bonds priced at a 40-50 basis point premium. Sovereign wealth funds have been active. Abu Dhabi’s ADQ raised $5 billion in financing from the Chinese lenders last week — having pushed the total up from a planned $4 billion due to strong investor demand. PIF raised a $2 billion bond in September and €1.65 billion ($1.9 billion) in October. The health of the debt market is in sharp contrast to that of regional stock exchanges, where indices are lagging the US and emerging markets and the flow of IPOs is drying up. — Dominic Dudley |

|

Boardrooms open to AI in UAE |

Nvidia handout/Reuters Nvidia handout/ReutersCorporate governance is the pointy end of the AI spear in Abu Dhabi: Two of the UAE capital’s most prominent firms are moving faster than the majority of the Fortune 100 in implementing AI into decision-making at the highest levels. Abu Dhabi sovereign wealth fund Mubadala increasingly relies on AI to screen deals, make investment decisions, monitor assets, and, ultimately, sell its own tech products. The $330 billion firm has already sold a white-labeled AI corporate governance monitor to three other companies, Mubadala’s Head of AI Enablement Aidan Millar told Semafor’s Mohammed Sergie onstage at Abu Dhabi Finance Week this month. Meanwhile, Abu Dhabi’s largest listed firm, IHC, has similarly developed a board-monitoring tool with G42 to analyze discussions in real time. Pippa Begg, CEO of London software and advisory firm Board Intelligence, puts the embrace of AI down to overall nimbleness and relative youth, compared to the US and Europe, where data regulations particularly hamper boards. “Here, you’ve got appetite, and then you get execution straight away,” she told Semafor. Board enthusiasm is not the norm: A global survey by McKinsey found that while 88% of organizations now use AI in at least one function, 39% of Fortune 100 companies haven’t introduced board-level AI oversight. — Kelsey Warner |

|

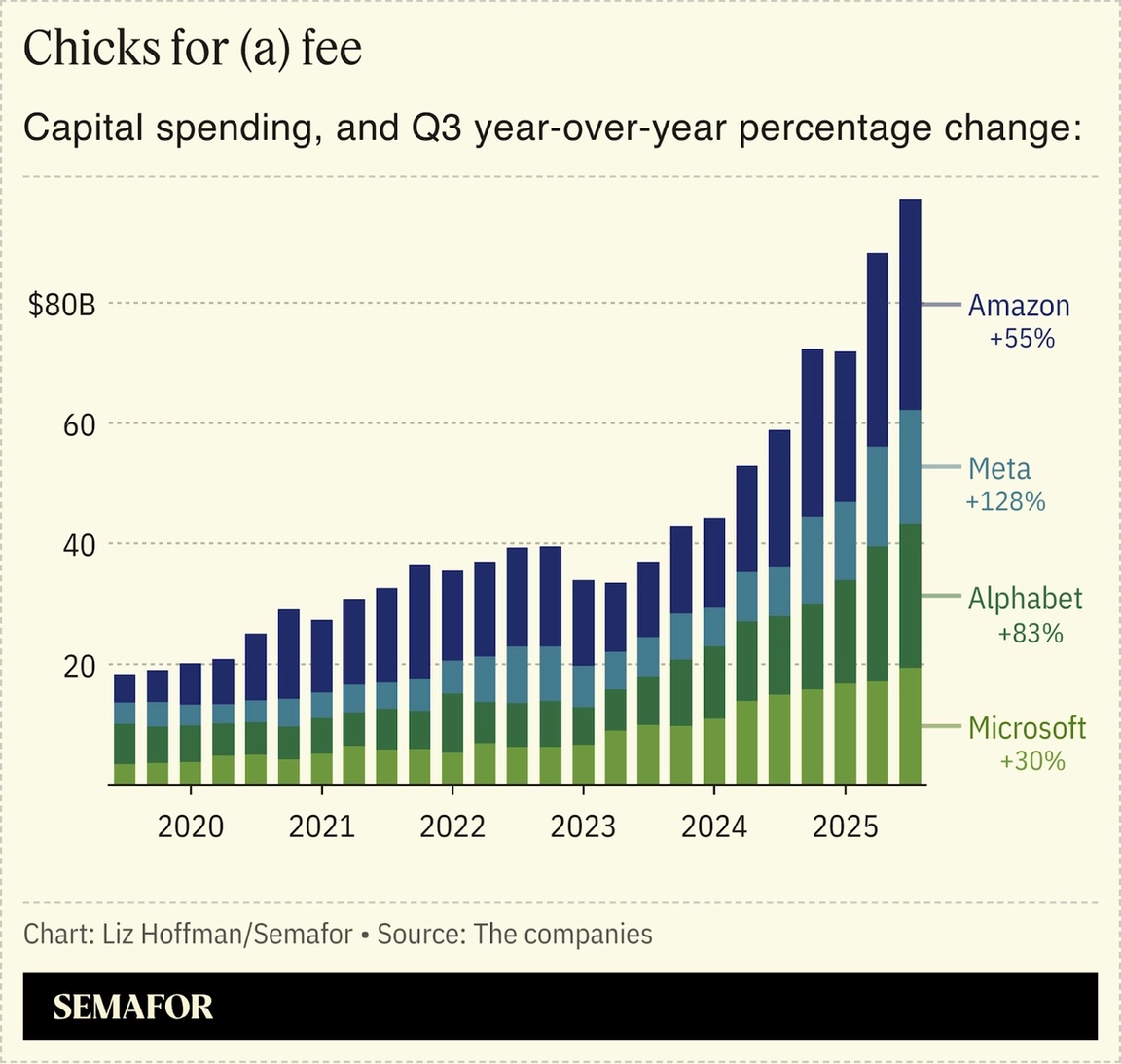

A rising chorus that we are in an AI bubble was one of the biggest stories of the year, Semafor’s Business Editor Liz Hoffman wrote. Big tech companies spent more than $400 billion on AI, a number Bloomberg analysts expect to hit $630 billion next year. Investors are already souring on the industry’s perceived weak links, Oracle and CoreWeave, and debt is creeping in at every level. Lamentable public performances by the industry’s frontmen aren’t inspiring confidence. The big question is where the value AI creates will accrue. For now, it is with the developers of large language models. But past booms show the long-term winners will be upstream (the “picks and shovels” purveyors) and downstream (makers of applications to translate LLMs into profitable enterprises). Shares of electric utility Constellation, which has gone all-in on powering data centers, handily beat Nvidia’s this year. For more stories from Wall Street, subscribe to Semafor’s twice-weekly Business briefing. → |

|

|

UAE bets big on AI future |

The amount of money the UAE has poured into artificial intelligence at home and abroad since the beginning of 2024. The figure — revealed in a recent speech by Omar Sultan Al Olama, minister of State for AI — includes 100 billion dirhams ($27.2 billion) for the Stargate data center project and 180 billion dirhams in overseas investments. The UAE, along with Qatar and Saudi Arabia, is investing heavily in AI infrastructure and applications, with the emirates taking a notable lead in data center capacity and in attracting foreign investment. Microsoft said it’s committing more than $15 billion in the UAE from 2023 through 2030, exceeding its combined investments in Germany and France. — Mohammed Sergie |

|

Courtesy of Bomardier Courtesy of BomardierSkipping airport lines and flying private is a flex, but being the fastest in the sky takes it to another level. That’s the selling point of the Bombardier Global 8000, a $78 million long-haul machine that nearly breaks the speed of sound. It has the range to fly from Dubai to Los Angeles or Sydney, and can land on shorter runways than previous models, opening up 2,000 more airports. The new jet comes as private aviation in the region surges. The UAE is contributing nearly 60% of the industry’s growth in the Gulf. Bombardier is building a new service hub in Abu Dhabi to keep up with the expansion. |

|

| |