| | Competition for electricity will define the global energy market in 2026.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

The year ahead in energy promises to be dominated by the scramble for electrons, pitting “drill, baby, drill” politics across much of the world against the hard realities of cost and supply chains. The most significant change in rich-country energy markets over the past year or two has been the overturning of longstanding supply-demand dynamics. Electricity, which was abundant enough to be taken for granted, now looks like the bottleneck constraining everything from data centers to manufacturing. Meanwhile oil — which pushed close to record high prices after the pandemic — is oversupplied. In a market with scarce power and a glut of fossil fuels, policymakers and investors will have to make some tough choices about whether they can afford to keep up an anti-green posture. Smart money will look for the speediest electrons to fire up: The AI revolution doesn’t want to wait. But given that global demand for coal, oil, and gas all hit record highs in 2025, and aren’t going away anytime soon, there are still lots of strong bets to make in anticipation of an eventual upswing in the fossil fuel price cycle. It’s never easy to boil the energy story down to a handful of sub-plots. But here are a few predictions that I’m fairly confident will define my coverage in 2026: - Power affordability will be the year’s inescapable talking point. Everyone has their preferred bogeyman: The problem is data centers! It’s wind farms! It’s old coal plants! It’s transmission permitting! It’s carbon regulation! It’s rate design! Politicians will deploy the pursuit of cheaper power as an argument for — and against — all of these and more, with voters deciding which arguments are most convincing.

Meanwhile, expect more partnerships and deals between energy companies and Big Tech, and watch the disappearance of clean energy tax credits in the US to see which businesses and projects are really strong enough to survive on their own. It will likely be a banner year for energy storage, which is the skeleton key to combining renewables’ low cost with the round-the-clock reliability of gas. - LNG competition will heat up, and burn some players out. Oil majors’ biggest gamble at the moment is the full-court press to expand their liquefied natural gas trading capabilities. Especially after the full-scale invasion of Ukraine, LNG looked like a surefire bet: Europe was desperate for it, China needed even more, and plenty of countries across the Global South saw it as the route away from coal. In 2026, a number of new export facilities on the US Gulf Coast will come online or ramp up, competing with new terminals in Australia, Qatar, and elsewhere for market share that — in China and Europe at least — has already started to flatten. The price of gas turbines is going up as the cost of renewables comes down. So the US gas industry needs a strategy to get more competitive.

- China will continue to set the terms of the energy transition. China is the biggest energy story in the world by just about every metric. The country’s power-sector emissions could peak this year, but analysts expect solar deployment next year to moderate from its feverish pace. The choices China makes in 2026 about investments in domestic and overseas cleantech manufacturing, trade controls on critical minerals, and domestic consumption of fossil fuels have enormous ramifications for the economic and security prospects of other countries, not to mention their emissions trajectories. It will be a long time before the US or any other country is even close to catching up.

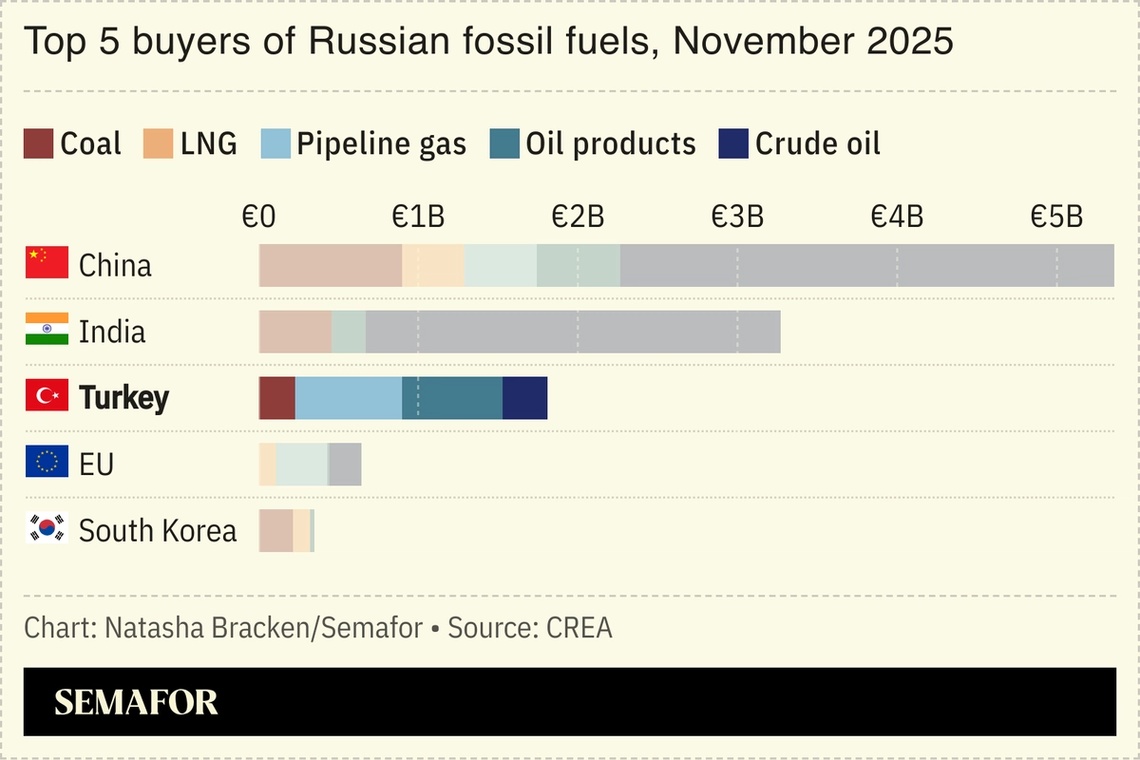

- Energy will play a decisive role in emerging geopolitical conflicts. One interesting takeaway from 2025 was that oil markets mostly shrugged off sanctions and infrastructure attacks, proof that in a glut, policymakers have more flexibility to use energy markets to hurt their adversaries without causing pain for their constituents. That will continue this year in the contexts of Russia and Venezuela.The contest between China and the US on critical minerals and nuclear power innovation will play an even more central role in their broader relationship. Meanwhile, escalating tensions between China and Taiwan will also likely come to hinge on energy; the island nation’s LNG imports are among its chief vulnerabilities. The new era of energy wars is just beginning.

I look forward to connecting with all of you in 2026 about these stories and everything else you’re working on and interested in. We’re off for the rest of the week — have an excellent New Year! |

|

Masdar’s floating solar push |

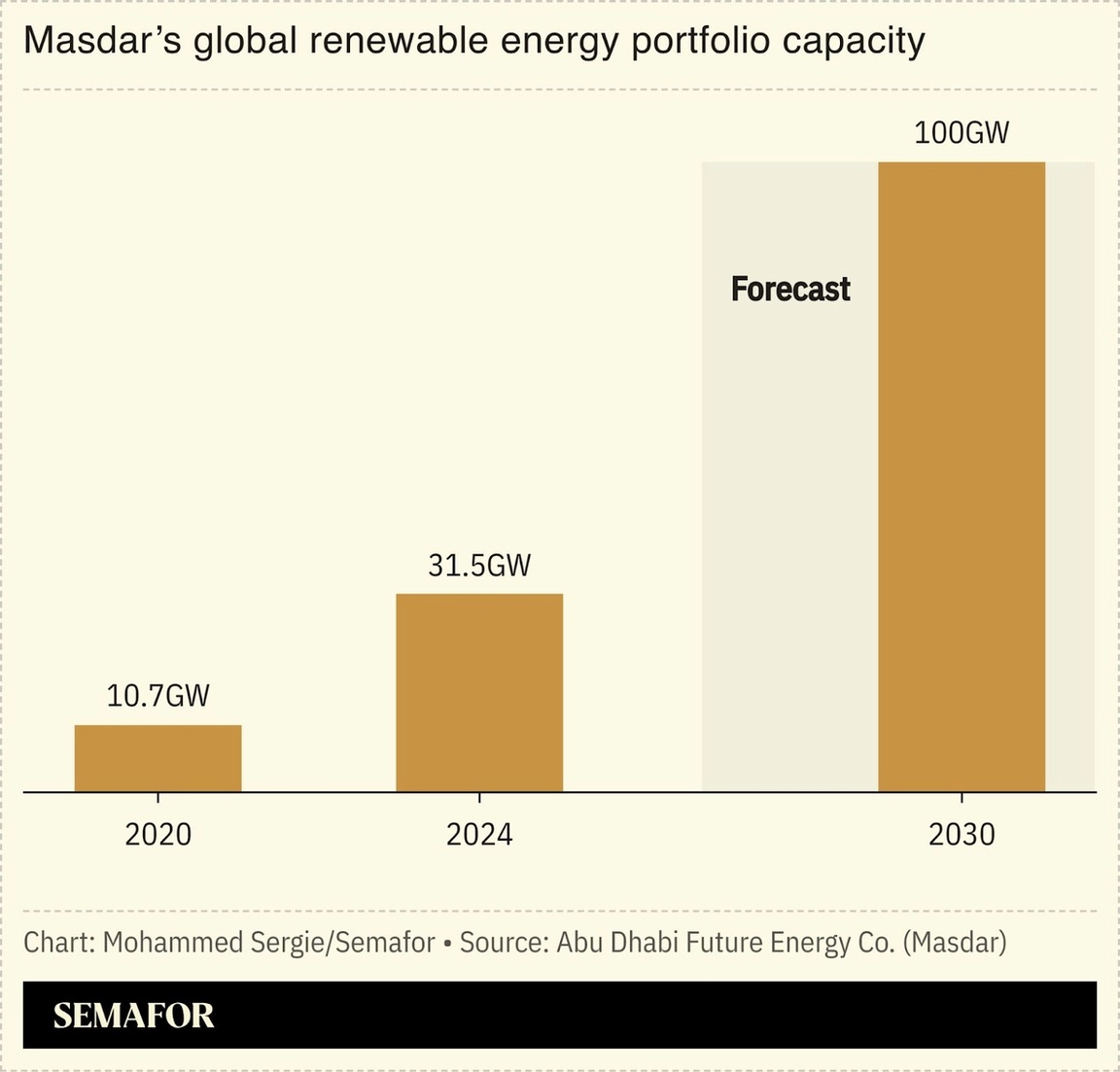

Abu Dhabi renewable energy giant Masdar will develop a 200-megawatt floating solar power plant at the Chereh dam in Malaysia — the first fruit of a 10-gigawatt roadmap agreed with the Malaysian Investment Development Authority in 2023. Once complete, it will be the largest floating solar plant in Southeast Asia, able to power more than 100,000 homes. Masdar’s entry into Malaysia adds to a global portfolio which now stretches across more than 40 countries — part of a wave of international projects by Gulf developers, with other key actors including Dubai-based Amea Power and Saudi Arabia’s ACWA Power. Many more deals need to follow if Masdar is to reach its target of delivering 100 gigawatts of clean energy by 2030. At the start of the year, a senior executive told Semafor it needed to add 200 megawatts every week until the of the decade — equivalent to another Chereh dam plant every seven days. |

|

Ukraine’s nuclear troubles |

Number of years that will likely be required to restart the Zaporizhzhia nuclear power plant after the war in Ukraine ends. US President Donald Trump, in his press conference Sunday with Ukrainian President Volodymyr Zelenskyy, said the plant, which is currently under occupation by Russia, could “open very quickly” and that Moscow and Kyiv are already working together to restart it. The reality for Europe’s biggest nuclear plant is much more complicated, experts say: Zelenskyy has repeatedly rejected the idea of jointly operating the plant with Russia, and although it hasn’t been directly targeted by shelling, the facility would require substantial investment, repair work, new auxiliary infrastructure, and security guarantees, to be operational again. |

|

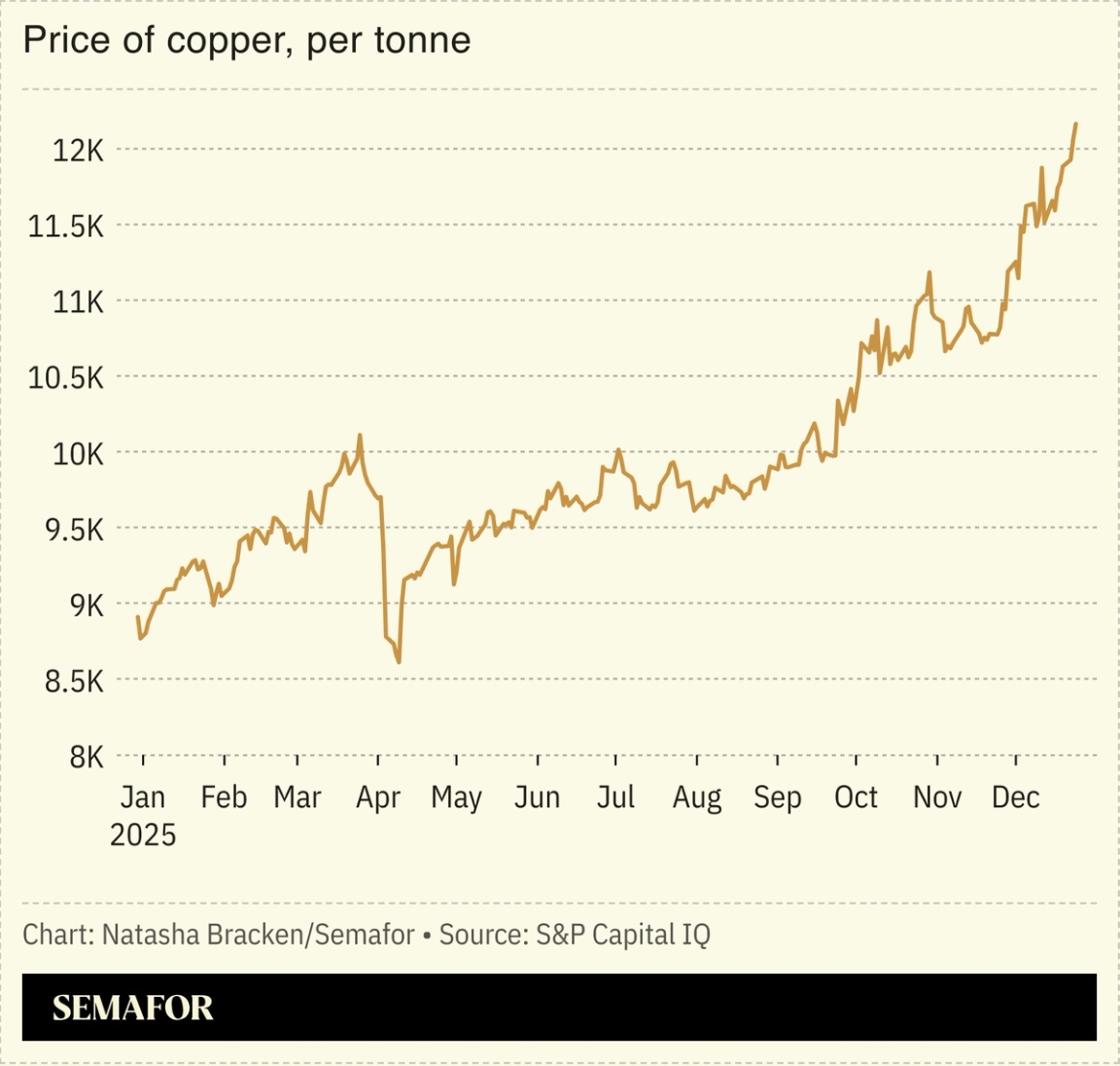

Copper is on track to hit its biggest annual climb in more than a decade as fears of a global shortage grow. Copper’s value comes from its critical role in the energy transition: Powering EVs, the AI boom, and the shift from fossil fuels to renewables. In December, copper hit $12,000 per tonne, its highest rate since the 2009 financial crisis recovery. A major catalyst for the metal’s price hike were US President Donald Trump’s tariffs, which triggered a rush of pre-emptive shipments and prompted energy groups to warn of an extreme shortage of the metal in the rest of the world in 2026. Supply disruptions are another worry, with major copper producers hit by mining accidents this year from Indonesia to the Democratic Republic of the Congo. |

|

AI is set to reshape the modern enterprise. What separates leaders is how they translate promise into performance. Join us in Davos on Tuesday, January 20 as Semafor editors sit down with senior executives to examine how companies are using AI to drive growth, gain advantage, and stay competitive in the next era of global business. Jan. 20 | Davos | Request Invitation |

|

Fossil Fuels- Oil prices rose on Monday over Russian accusations that Ukraine attacked Vladimir Putin’s residence and growing tensions in the Middle East concerning Yemen.

- The EU is considering sanctions on Turkish ports suspected of supplying Russian fuel to Europe.

- India is demanding more than $30 billion from Reliance Industries and BP through arbitration, claiming the companies failed to produce gas from offshore fields, Reuters reported.

FinanceTech- The UK’s renewable-energy startup Octopus plans to separate its utility management platform, Kraken Technologies, into an independent entity valued at $8.65 billion.

Politics & Policy- Trump administration officials are facing backlash from state utility regulators over a White House plan to control part of the country’s power grid in service of AI.

EVs |

|

| |