| | In today’s edition: Looking back at the major business stories in the Gulf in 2025, and what we are ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- The Gulf’s AI playbook

- Splashy SWF deals

- Rent is too high

- New airline takes flight

- Defense spending spree

World’s fastest roller coaster in Riyadh. |

|

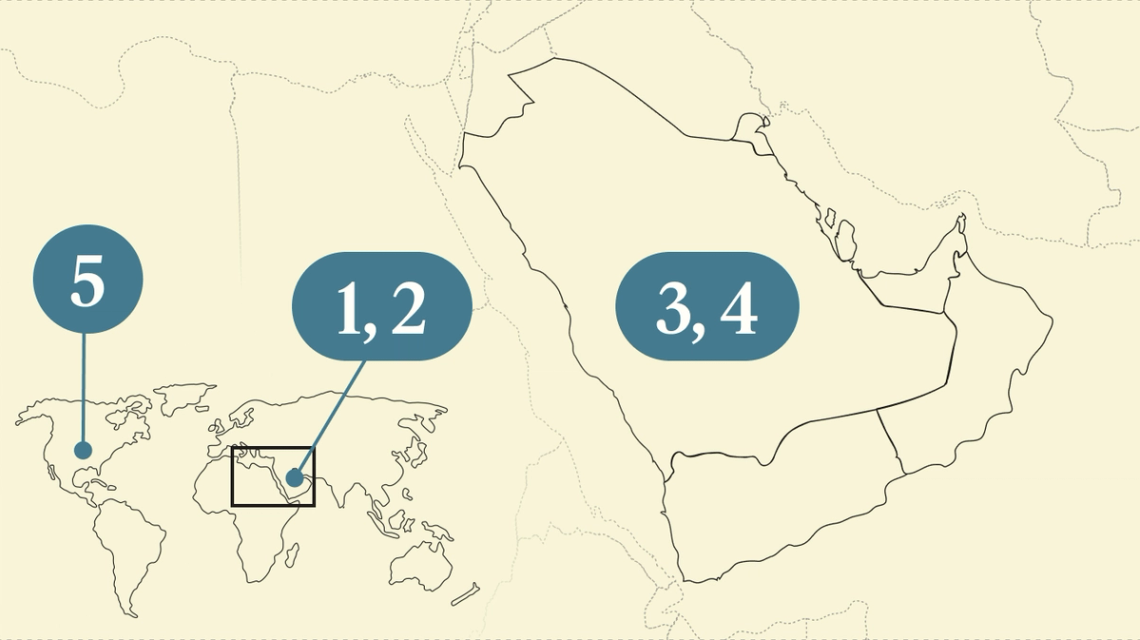

The biggest business and political storylines in the Gulf this year seem disparate — war between Israel and Iran, bets on artificial intelligence, big swings in tech and finance, and massive weapons deals. But they share a common thread: US President Donald Trump. Since returning to the White House and making his first call with Saudi Arabia’s Crown Prince Mohammed bin Salman, Trump has signaled that Washington is engaged. He sees room for cooperation between Gulf states, Israel, Türkiye, and the Levant, establishing a new regional security architecture that takes advantage of Iran’s retreat. This is not a firm alliance, and not just because of Israel’s central role. Tensions between Abu Dhabi and Riyadh this week over the UAE’s backing of separatists in Yemen is one example of the strain among friends. Just as few predicted how the June Israel-Iran war would play out, outcomes in Gaza, Somalia, Yemen, and other hotspots — all with direct implications for the Gulf — are unknowable. The economics are easier to predict. AI is a big theme next year as sovereign wealth funds in Qatar, Saudi Arabia, and the UAE deploy capital at scale from newly-launched platforms like HUMAIN and Qai. Cost-cutting and consolidation in government budgets and companies will also be a focus as the region grapples with a potential oil glut. These are tomorrow’s worries. For now, we wish you a restful end to the year. This is our final briefing of 2025. We’ll be back on Jan. 5. |

|

Rebecca Lewington/Cerebras Systems/Handout via Reuters Rebecca Lewington/Cerebras Systems/Handout via ReutersArtificial intelligence deals in 2025 revealed the contours of ambitious national strategies that could define the Gulf’s economic diversification in the years ahead. The biggest announcements came during US President Donald Trump’s visit in May, when Saudi Arabia stood up HUMAIN, a PIF-owned AI national champion, which struck chip deals with Nvidia and Qualcomm. Meanwhile, Abu Dhabi-backed AI conglomerate G42 is on schedule to open the first phase of its massive Stargate UAE data center campus in 2026. Qatar this month launched Qai with plans to invest $20 billion in AI infrastructure in a joint venture with Brookfield, having already backed OpenAI rival Anthropic. Similarly, HUMAIN has a partnership with Blackstone, and Abu Dhabi’s MGX — an OpenAI backer — tied up with BlackRock for data center investments. The year was not without reality checks, though: G42 and Microsoft have struggled to come up with a business case for a stalled data center project in Kenya, Semafor scooped. Across most of the AI sector, profits have proved elusive but Gulf governments are still pouring money in, seeing the technology as a one-two punch to diversify and improve productivity. This year we followed the chips; next year will be about seeing what they do. — Kelsey Warner |

|

Dado Ruvic/Reuters Dado Ruvic/ReutersThe PIF-led $55 billion buyout of video games giant EA marked the largest-ever private equity acquisition — and a $110 million payday for Goldman Sachs. The September megadeal was the most notable in another active year for Gulf sovereign investors. Others included a rare two-way deal between Mubadala Capital and TWG Global, which saw stakes traded between an Abu Dhabi alternative asset manager and an LA Lakers-owning American financier. Qatar’s sovereign wealth fund — along with investors led by billionaire Nelson Peltz’s Trian and General Catalyst — this week backed the $7.4 billion takeover of asset manager Janus Henderson. In their heft, creativity, and strategy, these transactions may tell us something about the direction of investments in the years ahead. In the first nine months of 2025, Middle East sovereign investors deployed more than $56 billion, according to industry tracker Global SWF. The final reckoning is set to once again rank the region’s sovereign funds among the world’s biggest dealmakers. As Semafor’s Matthew Martin wrote, “Next year will likely be no different as the Gulf vies to control the levers of the future world economy.” — Kelsey Warner |

|

Gulf property boom has limits |

Satish Kumar/Reuters Satish Kumar/ReutersReal estate isn’t the most productive asset, but the industry is on a tear in the Gulf. Rising prices in Abu Dhabi, Dubai, and Riyadh are starting to make the cities unaffordable, however, and governments will likely take more steps to ease the strain on citizens and residents. Riyadh imposed a five-year rent freeze in September and expanded the white land tax — a levy on vacant or underdeveloped urban land meant to push owners to build or sell. Analysts say 2026 activity in Saudi Arabia will hinge on how those rules land, alongside January’s long-awaited potential opening to foreign buyers. The biggest question: when will Dubai’s market turn? Sales of homes valued at more than $10 million are still brisk. But prices are no longer accelerating at the same pace that saw them nearly doubling in the past five years and the emirate may be approaching the top of the cycle, AGBI reported. — Manal Albarakati |

|

Gulf aviation still soaring |

Courtesy of Riyadh Air Courtesy of Riyadh AirRiyadh Air’s first Boeing 787 Dreamliner underwent its initial test flight in December, bringing the Gulf’s newest carrier a step closer to getting its fleet into the air. It is an important element in Saudi Arabia’s tourism push and part of a region-wide love for aviation that shows no sign of abating. Gulf airlines are now awaiting more than 1,500 deliveries from Airbus and Boeing, with Emirates and Qatar Airways the biggest buyers. While newer planes are more fuel efficient and allow for quieter cabins, the backlog is growing. That is driving a wave of investment in existing aircraft, with deals this year to add better wi-fi, plusher seats, and more enticing food and drink. Overseas passengers are a key target market, but Gulf locals are keen travelers too. In its latest market forecast, Airbus said Saudis took an average of 1.5 flights each in 2024 but it expects that figure to double by 2044, overtaking Americans and Europeans. — Dominic Dudley |

|

From geopolitical shocks to climate volatility and disruptive technologies, today’s business environment is increasingly resistant to prediction. As public trust frays, CEOs are being pushed to lead with clarity under pressure. Semafor CEO Signal Editor Andrew Edgecliffe-Johnson will sit down with global leaders, including GE Vernova CEO Scott Strazik, on Wednesday, January 21, in Davos to examine how executives are resetting priorities, reassessing risk, and redefining resilience. Jan. 21 | Davos | Request Invitation |

|

Regional instability underpins arms deals |

Ognen Teofilovski/Reuters Ognen Teofilovski/ReutersMost industries suffer ups and downs, but defense is usually an exception, and certainly has been in the Gulf. By one estimate, the Middle East accounted for more than a quarter of all global arms imports from 2020-24, with Qatar, Saudi Arabia, and the UAE leading the way. This year’s deals suggest that trend will continue, as regional instability shows no sign of easing. In May, the US unveiled $142 billion of arms sales to Saudi Arabia and more than $40 billion to Qatar, during US President Donald Trump’s regional tour. That was followed later in the year by a mutual defense pact with Qatar, a similar agreement with Saudi, and the promise to sell advanced F-35 jets to the kingdom. The US is the Gulf’s most important defense partner, followed by European suppliers. China could become a more serious rival, particularly as it attaches fewer strings to its sales, which is one reason why Washington is trying to draw Gulf powers closer now. Gulf countries are also looking to expand their influence and connections, as seen with the Saudi-Pakistan mutual defense pact announced in September and the UAE’s deepening relationship with Israeli arms suppliers. — Dominic Dudley |

|

Mohammed Benmansour/Reuters Mohammed Benmansour/ReutersAs Saudis ring in the New Year, some are doing it at 250 km/h. The first Six Flags theme park outside North America opens today in Riyadh’s Qiddiya, the long-promised “city of play,” led by Falcon’s Flight — a roller coaster marketed as the world’s tallest, longest, and fastest (outstripping the 240 km/h Formula Rossa at Abu Dhabi’s Ferrari World), whose descent mirrors a falcon diving on prey. With most theme parks in the kingdom either seasonal or decades old, expectations are high, and anticipation has been building for months. Qiddiya, which the kingdom’s sovereign wealth fund expects will attract 48 million visitors annually once complete, is part of a broader push to use leisure and entertainment to help diversify the economy away from oil. Tourism currently accounts for about 5% of Saudi GDP, with the government targeting 10% by 2030. |

|

|