| | As Trump escalates his threats against Greenland, a new study argues in favor of more conventional m͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Venezuela’s new reality

- Copper growing pains

- Growing gas trade

- Climate tech turnaround

- Next steps for TAE

The US withdraws from the UN climate treaty, and Europe buys a lot of Russian LNG. |

|

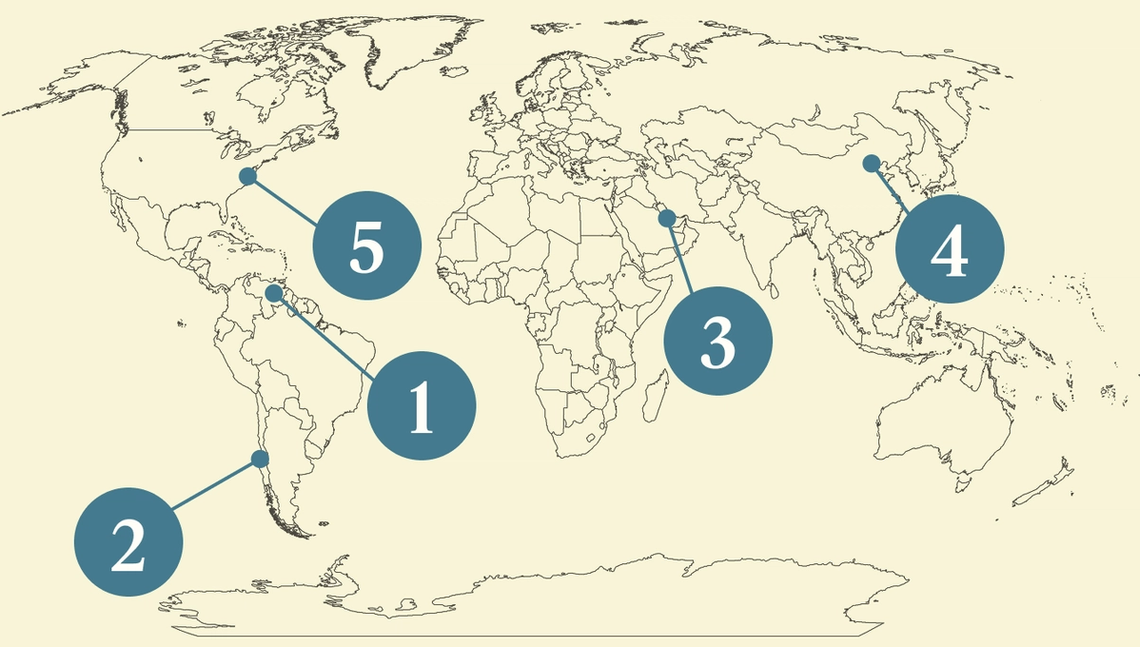

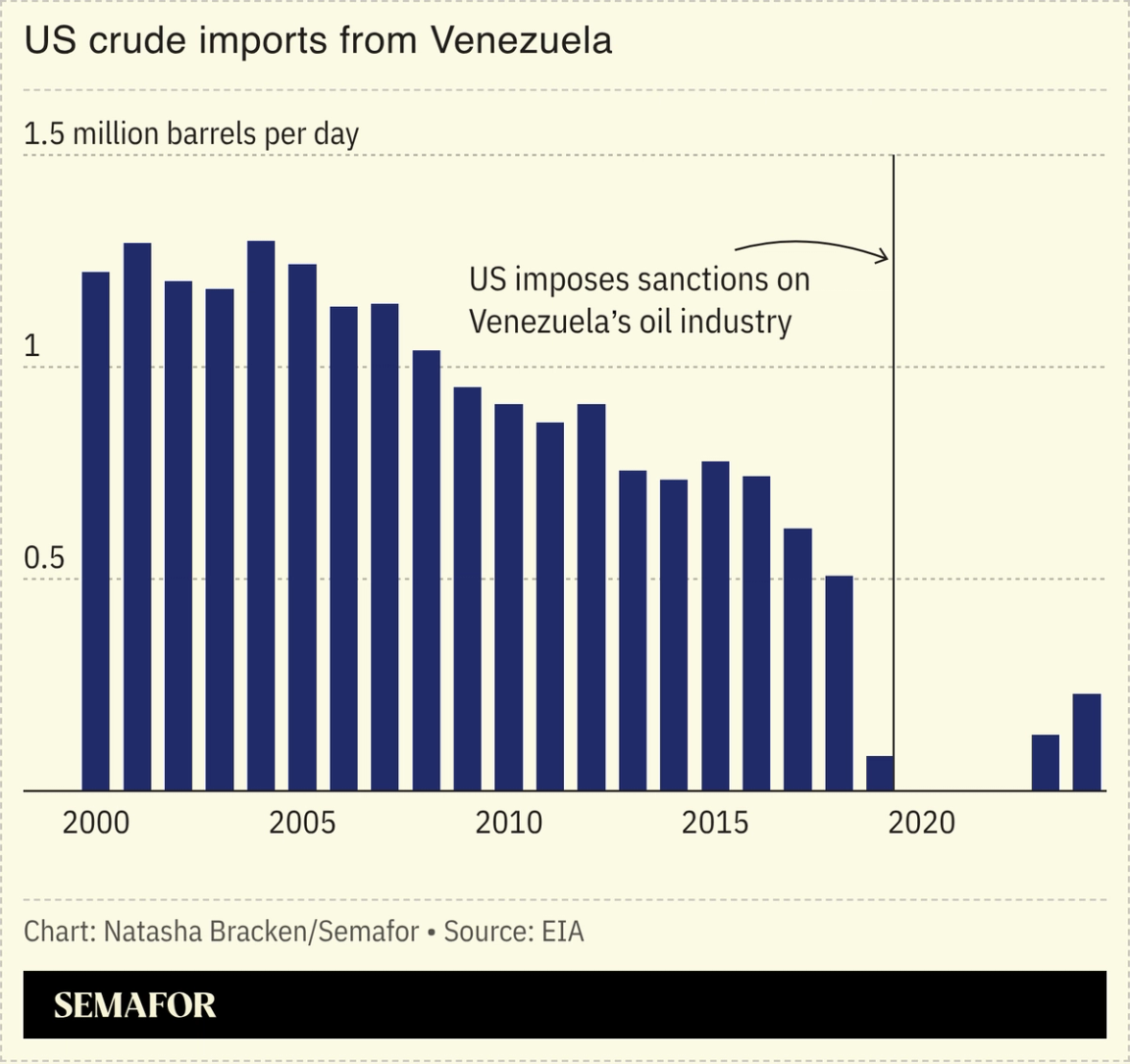

The post-Maduro reality for Venezuela’s oil industry is beginning to take shape. US Energy Secretary Chris Wright said on Wednesday that the US will sell Venezuelan oil “indefinitely,” after President Donald Trump announced Venezuela had agreed to hand over 50 million barrels of oil, worth about $2.8 billion. It’s a small shift in oil flows, equal to about two days of US consumption, but enough to elicit an angry rebuttal from officials in China, the top importer of Venezuelan crude. Bigger changes may be coming soon: US officials are discussing a plan to partially take over Venezuela’s state-owned oil company, The Wall Street Journal reported. US oil executives are due to meet with Trump at the White House on Friday, and are hinting they will want “serious guarantees” before investing in Venezuela. But Chevron is already reportedly in talks to expand its existing license there, and other energy CEOs are expressing interest in Venezuela-related projects. Meanwhile, the US naval blockade of Venezuelan oil continues, with two tankers interdicted on Wednesday, one flying a Russian flag. |

|

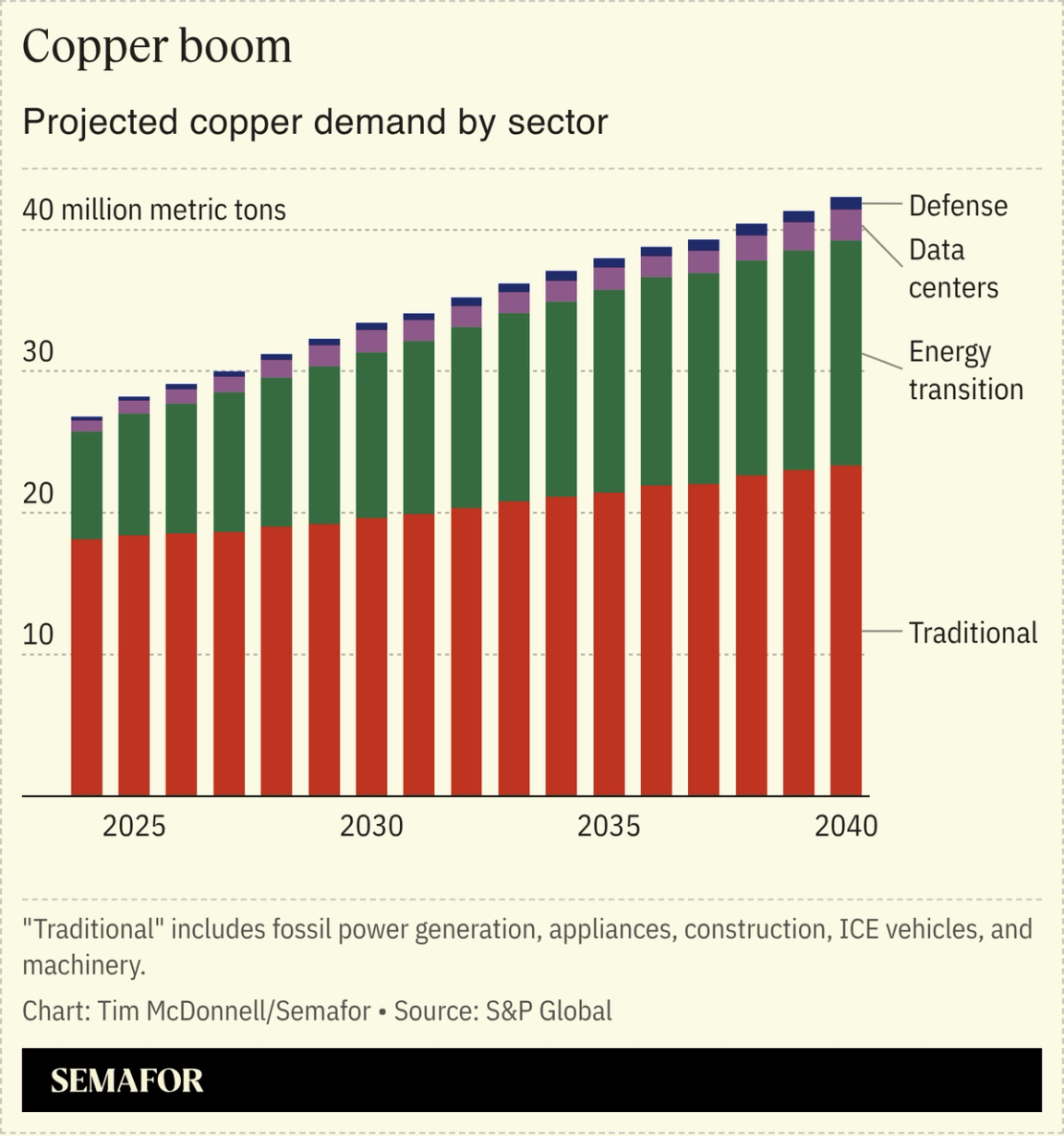

The meteoric rise in the price of copper will likely continue thanks to a growing supply deficit that could reach 10 million metric tons — 25% of projected demand — by 2040, according to a new forecast from S&P Global. Copper is critical for everything from phones and refrigerators to EV batteries, AI data centers, and battlefield drones. Yet new mines are still incredibly slow and expensive to open, and existing ones are becoming more costly to operate as the quality of ore declines. The market is already undersupplied, and in 2025 several of the world’s largest mines were temporarily closed because of disasters including mudslides, earthquakes, and collapsed tunnels. Copper prices reached a fresh record Tuesday of $6.06 per pound. Without policy changes to accelerate the development of new mines, increase recycling, and, most importantly, to forge new trade deals between suppliers, processors, and users, copper shortages will become a major constraint on the AI revolution and the energy transition, S&P Global Vice-Chair Daniel Yergin told Semafor. “The world is electrifying, and copper can be either the enabler or the obstacle.” |

|

cnsphoto via Reuters cnsphoto via ReutersNatural gas is increasingly flowing across borders in the Middle East — even between countries that until recently had frosty relations. This week, Qatar agreed to boost liquefied natural gas supplies and expand energy cooperation with Egypt. The move followed a $35 billion deal announced last month under which Israel will export gas to Egypt until 2040. Egypt also agreed this week to supply gas to Syria via the Arab Gas Pipeline. Together, the deals would have been unthinkable just a few years ago, when Cairo was part of the embargo of Qatar and the former Syrian regime was a pariah. Once the new supplies begin, Israeli gas may indirectly fuel power plants in Syria, a sign of how energy needs are reshaping trade flows across the region. — Mohammed Sergie |

|

Annual growth in global climate tech investment in 2025 compared to the previous year, a turnaround from declines in 2023 and 2024. Total investment hit $40.5 billion, according to a new analysis from Sightline Climate, even though the total number of deals fell 18%, indicating a concentration of investor capital in larger, growth-stage companies. While the biggest single deal was in China — $1.6 billion for a state-backed nuclear fusion startup — the top hub for investment remains the US. And the second-highest number of startups reached an exit, most often an acquisition rather than an IPO. Topping the ranking of companies that are acquiring climate startups: European oil majors, including Shell and BP. |

|

Semafor this week announced it secured major financing, funding it plans to use for an expansion of its global newsroom and live journalism business. The Wall Street Journal described our audience as “C-suite executives, government leaders and public policymakers,” and reported that we’re building “a brand on par with business publications such as The Economist or the Financial Times.” Crucially, Reuters noted, whereas major publishers are “facing declines in traffic,” Semafor generated a profit in 2025, our third full year of operations. Media and business executives taking part in the fundraising included founding backers such as Henry Kravis of KKR and Carlyle’s David Rubenstein, with new backers including European media investors and former US Commerce Secretary Penny Pritzker. |

|

The Nasdaq Market site on the day that shares of Trump Media & Technology Group started trading. Shannon Stapleton/Reuters The Nasdaq Market site on the day that shares of Trump Media & Technology Group started trading. Shannon Stapleton/ReutersUS President Donald Trump’s social media company said that construction of the country’s first fusion power plant will begin in 2026, less than a month after his firm announced a controversial merger with fusion energy company TEA Technologies. The two companies announced on Tuesday that they are currently in the process of selecting a site ahead of construction, with a clear goal in mind: “Guarantee America’s predominant position in the AI revolution,” they wrote. Although Trump has thrown wrenches into green energy initiatives, he’s been bullish on nuclear power, even creating a new Office of Fusion to fast-track the technology amid growing demand for energy to power the AI boom. A nuclear fusion power plant, which would force atoms together rather than split them, and produce more energy than the process consumes, would be a first. The merger, however, immediately sparked controversy over conflicts of interest: The person in charge of regulating these companies now holds a financial stake in their success. —Natasha Bracken |

|

From geopolitical shocks to climate volatility and disruptive technologies, today’s business environment is increasingly resistant to prediction. As public trust frays, CEOs are being pushed to lead with clarity under pressure. Semafor CEO Signal Editor Andrew Edgecliffe-Johnson will sit down with global leaders, including GE Vernova CEO Scott Strazik, on Wednesday, January 21, in Davos to examine how executives are resetting priorities, reassessing risk, and redefining resilience. Jan. 21 | Davos | Request Invitation |

|

New Energy- Freezing temperatures in Europe have led to a surge in power demand as low wind and solar generation cuts electricity supply.

- Danish wind energy giant Orsted said it had filed a lawsuit against the Trump administration’s halting of a second turbine project.

Tom Little/Reuters Tom Little/ReutersFossil FuelsPolitics & Policy- US Democrats demanded information from 8 major oil companies about what they potentially knew of Trump’s plan to seize control of Venezuela.

- US President Donald Trump announced that the US will withdraw from the UN Framework Convention on Climate Change and 65 other organizations, referring to them as “contrary to the interests of the United States.”

- Some climate battles to look out for in 2026 include the DOJ’s lawsuit against Democratic-led states accused of ‘burdening’ fossil fuel production and California’s disclosure law requiring big companies to report climate risks.

|

|

|