| | In today’s edition: Riyadh asserts its influence in Yemen’s south, and contract awards on Saudi proj͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Saudis consolidate in Yemen

- Riyadh-Abu Dhabi rift

- Gulf project awards dip

- PIF unit wades into VC

- Influencers flock to Dubai

The retreat of global jihadism, and other weekend reads. |

|

Saudi tightens grip on Yemen |

Louiza Vradi/Reuters Louiza Vradi/ReutersSaudi Arabia has asserted its dominance in Yemen’s south and, in the process, exposed sharp differences with the UAE. The swift changes over the past month — during which UAE-backed separatists gained control of large swaths of the country before quickly losing that territory — appear to have been settled, for now. The UAE-backed Southern Transitional Council reportedly dissolved itself after talks in Riyadh this week, during which some members may have been held incommunicado. Its leader fled by boat and then plane, apparently to Abu Dhabi, according to Saudi officials. The developments in Yemen, which remains divided between a Saudi-led coalition and the Iran-backed Houthis, carry regional and global implications. The country sits alongside a major shipping chokepoint between Asia and Europe, and its island of Socotra — beyond its appeal as a tourist destination — hosts military assets and is a node for communications cables. Directly across the Gulf of Aden lies Somaliland, another secessionist region where the UAE has built up its influence. Countries that can maintain military bases on either side have strategic influence over security and trade. The competition over Yemen and the Horn of Africa is intensifying a previously quiet rift between Abu Dhabi and Riyadh that could complicate US-led efforts on Gaza and Iran, and alter how global businesses operate in both countries. |

|

Saudi-UAE spat spills online |

UAE President Sheikh Mohamed bin Zayed meets Saudi Crown Prince Mohammed bin Salman. Courtesy of Emirates News Agency. UAE President Sheikh Mohamed bin Zayed meets Saudi Crown Prince Mohammed bin Salman. Courtesy of Emirates News Agency.The Saudi-UAE rift over Yemen is increasingly visible online, in a worsening war of words. Neither country has a free press, and both enforce strict laws governing social media posts that are deemed to threaten national security or defame their rulers. But just like the Qatar embargo almost a decade ago, those rules seem to slacken when officials make direct accusations against fellow Gulf Cooperation Council members. Most of the vitriol has been aimed at the UAE, with Emiratis largely exercising restraint — and, unlike the Qatar episode, both are avoiding personal attacks on rulers (or their mothers). One Middle East expert warned the divisions could portend a “regional transformation.” But an investor with close ties to Abu Dhabi noted that escalatory steps haven’t yet been taken, such as withdrawal of ambassadors, and urged all sides to “relax.” — Mohammed Sergie |

|

Gulf project spend plummets |

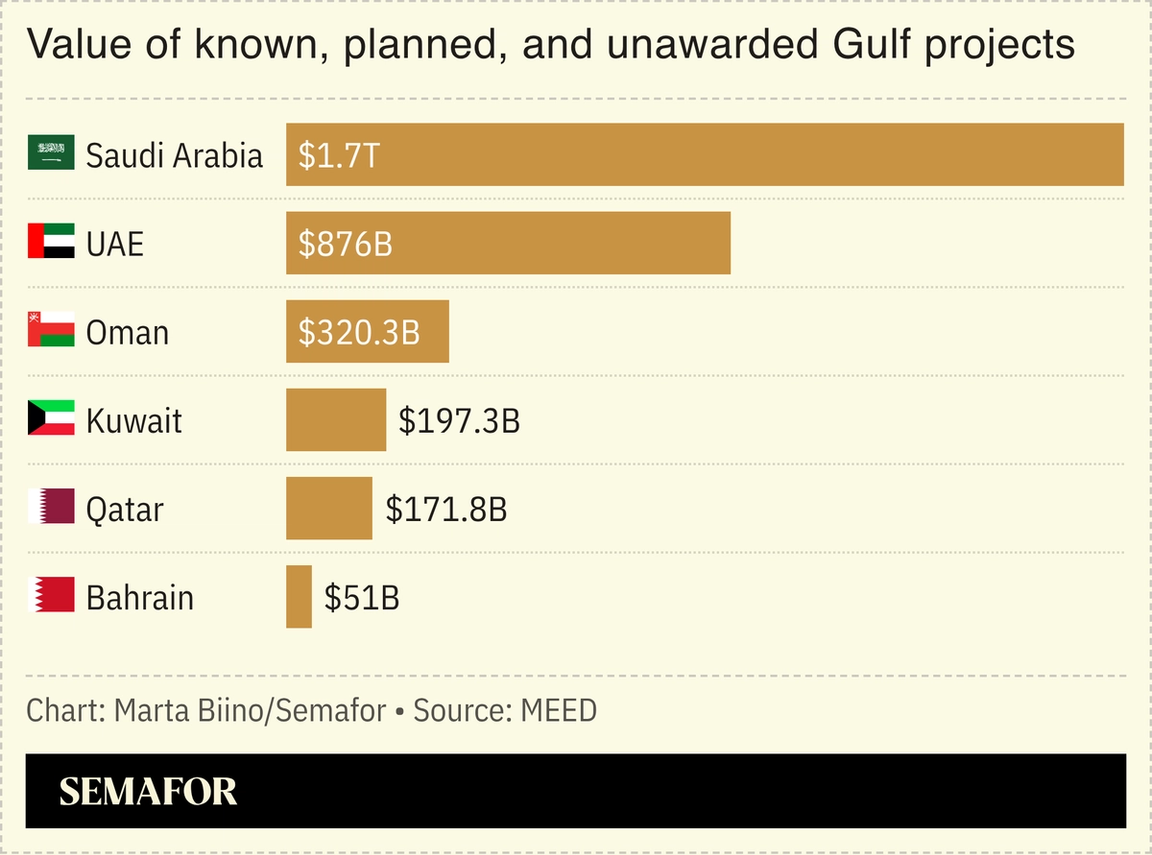

Delayed megaprojects and a drop in energy sector spending led to a collapse in contract awards in Saudi Arabia last year, contributing to a sharp region-wide fall, according to preliminary data from MEED. The total value of contracts in the Gulf fell almost a third compared to 2024, to $213 billion. Deals in Saudi Arabia halved from a record $164 billion in 2024 to $84.5 billion, and the UAE recorded a 15% drop to $87.7 billion. Even so, the Gulf is in the middle of a building boom: Massive real estate and infrastructure developments from Dubai to Mecca, and energy projects in Kuwait and Qatar contributed to overall project spending that was the third-highest annual total on record. Looking ahead, some $400 billion in contracts are in the pipeline in the coming months, according to MEED. |

|

Hotel developer launches VC fund |

A residence developed by Red Sea Global. Courtesy of Red Sea Global. A residence developed by Red Sea Global. Courtesy of Red Sea Global.Red Sea Global, the developer of luxury tourism resorts on Saudi Arabia’s west coast, is stepping into venture capital, launching a fund with Abu Dhabi-based Bunat Ventures focused on artificial intelligence startups in Saudi Arabia. The partners aim to invest in about 25 companies over the next three years, and let them pilot their technologies in Red Sea Global’s operations. The developer hasn’t said how big the fund will be. Saudi Arabia has become the most active country in the Gulf for venture investing, driven by government-backed funds hoping to create jobs and fuel economic diversification, and the arrival of international firms like General Atlantic seeking new growth markets. Red Sea Global is owned by the Saudi government’s Public Investment Fund. — Matthew Martin |

|

(More) influencers in Dubai |

Hollie Adams/Reuters Hollie Adams/ReutersEven more influencers than usual are flocking to Dubai this weekend for the 1 Billion Followers Summit that will take over the city’s financial district, the Museum of the Future, and government hub Emirates Towers. Touted as the world’s largest gathering for content creators, the three-day event kicked off Friday with 30,000 attendees expected — including YouTuber MrBeast, Republican figurehead Lara Trump, and Dubai resident and former soccer star Rio Ferdinand. Dubai’s reputation as a paradise for sun-seekers and digital nomads has been burnished on TikTok and Instagram, and in recent years the UAE has sought to formalize content creation as a profession, bringing it into the fold of its economic transformation drive. Since last year, influencers have needed a government permit before posting promotional content. Some view the move as a positive step that could accelerate payments from large companies to individual creators and streamline taxation and other administrative processes. Saudi Arabia similarly mandates a $4,000 fee for a three-year influencer license. — Kelsey Warner |

|

The digital divide is fast becoming an AI divide. Three billion people remain offline, unable to access the infrastructure and skills for AI-driven opportunities. As intelligent applications reshape global economies, AI readiness demands resilient, scalable infrastructure and rapid digital upskilling. Africa illustrates both the urgency and potential of this moment. Semafor will convene leading experts including Kara Hurst, Chief Sustainability Officer of Amazon to explore how digital skills and AI literacy must evolve in parallel with infrastructure expansion to deliver durable, inclusive growth. Jan. 22 | Davos | Request Invitation |

|

Deals- Saudi petrochemicals giant SABIC agreed to sell its European petrochemical and engineering thermoplastics businesses for $950 million. Shares in SABIC, majority owned by Aramco, are trading at a 17-year low and the company is restructuring to boost profitability. — Reuters

Defense- Saudi Arabia is in talks to acquire Pakistan-built JF-17 Thunder fighter jets, which could be partly paid for by converting $2 billion of Saudi loans to Islamabad. It builds on a mutual defence agreement the two countries signed in September. — Reuters

Education- The number of visas given to UAE students to study at UK universities has fallen by more than a quarter over the past year, after the Abu Dhabi authorities removed the institutions from their scholarship program, due to fears that Emiratis could be exposed to radical Islamist groups on campuses. — Financial Times

Mining- New discoveries outside Saudi Arabia’s traditional mineral belts have pushed the kingdom’s estimated mineral wealth up 90% since 2016 to $2.4 trillion, according to officials. The finds include rare earths, copper, zinc, gold, and more. The announcement comes ahead of Riyadh’s Future Minerals Forum next week. — Arab News

|

|

|