| | Jamie Dimon hits out at the criminal investigation into Jerome Powell, Greenlanders reject joining t͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Greenland shuns US

- Dimon criticizes Fed probe

- Record China trade surplus

- Brazil risks US tariffs

- Iranians fight web blackout

- Uganda blocks internet

- Green shoots for Boeing

- Saks files for bankruptcy

- Dutch pensions’ big impact

- Cancer survival rates up

A space for ‘reflection, empathy and connection’ in a Tokyo art exhibition. |

|

Greenland doesn’t want to join US |

The prime ministers of Greenland and Denmark. Liselotte Sabroe/Ritzau Scanpix/via/Reuters The prime ministers of Greenland and Denmark. Liselotte Sabroe/Ritzau Scanpix/via/ReutersGreenland’s prime minister said the self-ruled territory would not join the US, and would instead remain part of Denmark despite Washington’s threats of annexation. In response to Jens-Frederik Nielsen’s comments, US President Donald Trump said “that’s going to be a big problem for him.” Despite polls showing the vast majority of Greenlanders are against becoming part of the US, Trump has repeatedly vowed to take over the territory, which, if he got his way, would make it Washington’s biggest-ever land acquisition. The diplomatic spat came ahead of today’s high-stakes meeting in Washington between the foreign ministers of Greenland and Denmark, the US secretary of state, and the US vice president, Bloomberg reported. |

|

Trump hits back at Dimon over Fed |

Jamie Dimon. Marco Bello/Reuters Jamie Dimon. Marco Bello/ReutersUS President Donald Trump rebuked Jamie Dimon for criticizing the administration’s criminal investigation into Federal Reserve Chair Jerome Powell. The JPMorgan CEO had warned that the probe could “chip away” at the Fed’s independence, echoing warnings from Republican lawmakers, among others. Trump has hitherto been friendly with Wall Street, but his pressure on the central bank has drawn concern. He has sought to dismiss another Fed governor, and repeatedly called for rates to be cut, eroding the bank’s independence. In part, Trump’s demands are driven by voters’ affordability concerns that threaten to undermine his popularity: He has also called for banks to cap credit-card interest rates at 10%, potentially costing banks $100 billion a year. |

|

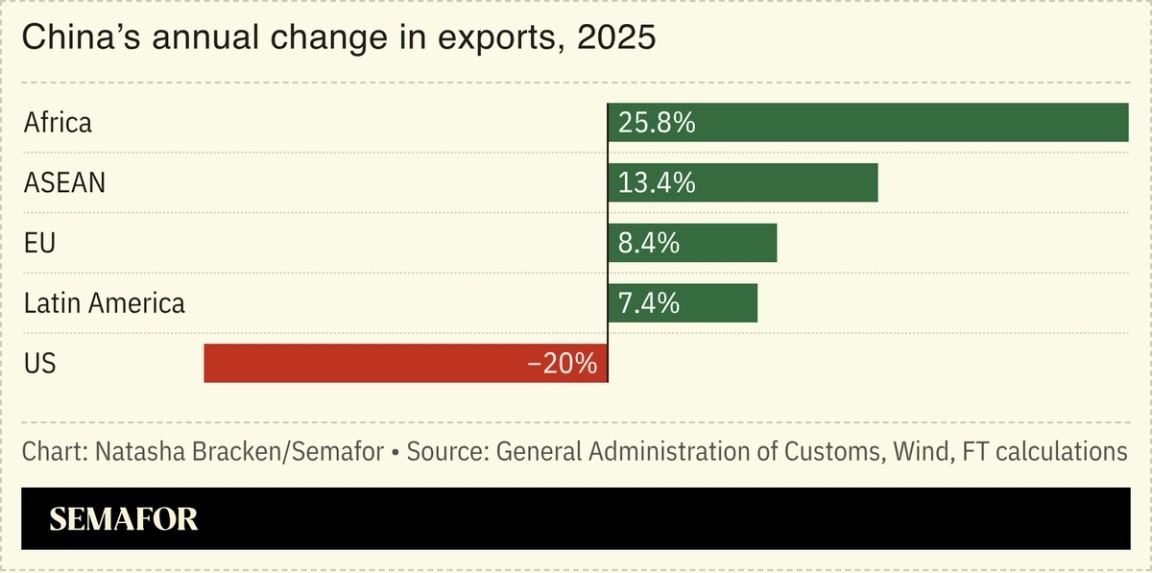

China reports $1.2T trade surplus |

China reported a record $1.2 trillion trade surplus last year, an indication the world’s second-biggest economy is weathering US tariffs. While shipments to the US have plummeted, exports to Africa, Europe, and Southeast Asia surged in 2025, feeding anxiety that local industries may be decimated by cheap Chinese imports. President Donald Trump has vowed to boost Chinese purchases of US products, and when asked if Chinese markets could open to US goods, said he thinks “it’s going to happen,” Reuters reported. Meanwhile, Canada’s prime minister will also look to boost Chinese purchases of Canadian goods — which tumbled by more than 10% last year — during his visit to Beijing this week. |

|

Semafor has expanded the Semafor World Economy Global Advisory Board, a group of visionary business leaders representing nearly every sector across the US and G20 who will help guide the largest gathering of global CEOs in the US. Our co-chairs — Ken C. Griffin, founder and CEO of Citadel; Henry R. Kravis, co-founder and co-executive chairman of KKR; Penny S. Pritzker, former US Secretary of Commerce; and David M. Rubenstein, co-founder and co-chair of the Carlyle Group — continue to lead this effort joined by a broadened roster shaping this year’s program. Joining the Advisory Board will be our inaugural cohort of Semafor World Economy Principals, an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

Brazil risks US tariffs with Iran trade |

Amanda Perobelli/File Photo/Reuters Amanda Perobelli/File Photo/ReutersBrazil’s $3 billion trade surplus with Iran risks making it a target of US tariffs, potentially reversing a recent rapprochement between Brasília and Washington. US President Donald Trump this week threatened 25% levies on any country doing business with Iran, pledging support for widespread anti-government protests that have gripped the country for days. Last year, the US leader threatened 50% tariffs on Brazil in response to what he said was the unfair prosecution of former Brazilian president and Trump ally Jair Bolsonaro. But after meeting his Brazilian counterpart, Trump changed course, easing levies on Latin America’s biggest economy. Now, however, Brazil’s multi-billion dollar agricultural trade with Tehran could land it back in Washington’s crosshairs, Reuters reported. |

|

Iranians sidestep internet blackout |

IRIB via WANA(West Asia News Agency) via Reuters IRIB via WANA(West Asia News Agency) via ReutersIranians are seeking, with some success, to bypass the regime’s internet blackout amid the country’s deadliest protests in years. The country’s walled-off web is supposed to prevent citizens from seeing non-approved content, but is leaky, and during the recent unrest, Tehran tried to cut off access altogether. Iranians, though, have found ways around it, notably SpaceX’s Starlink, whose direct-to-satellite broadband is hard to block; there are thousands of Starlink receivers in Iran. The government is trying to jam it, with some success, Ars Technica reported, while the Elon Musk-owned company is trying to bypass those measures. SpaceX has reportedly made Starlink access free in Iran, and US President Donald Trump has asked Musk to work on boosting Iranians’ internet access. |

|

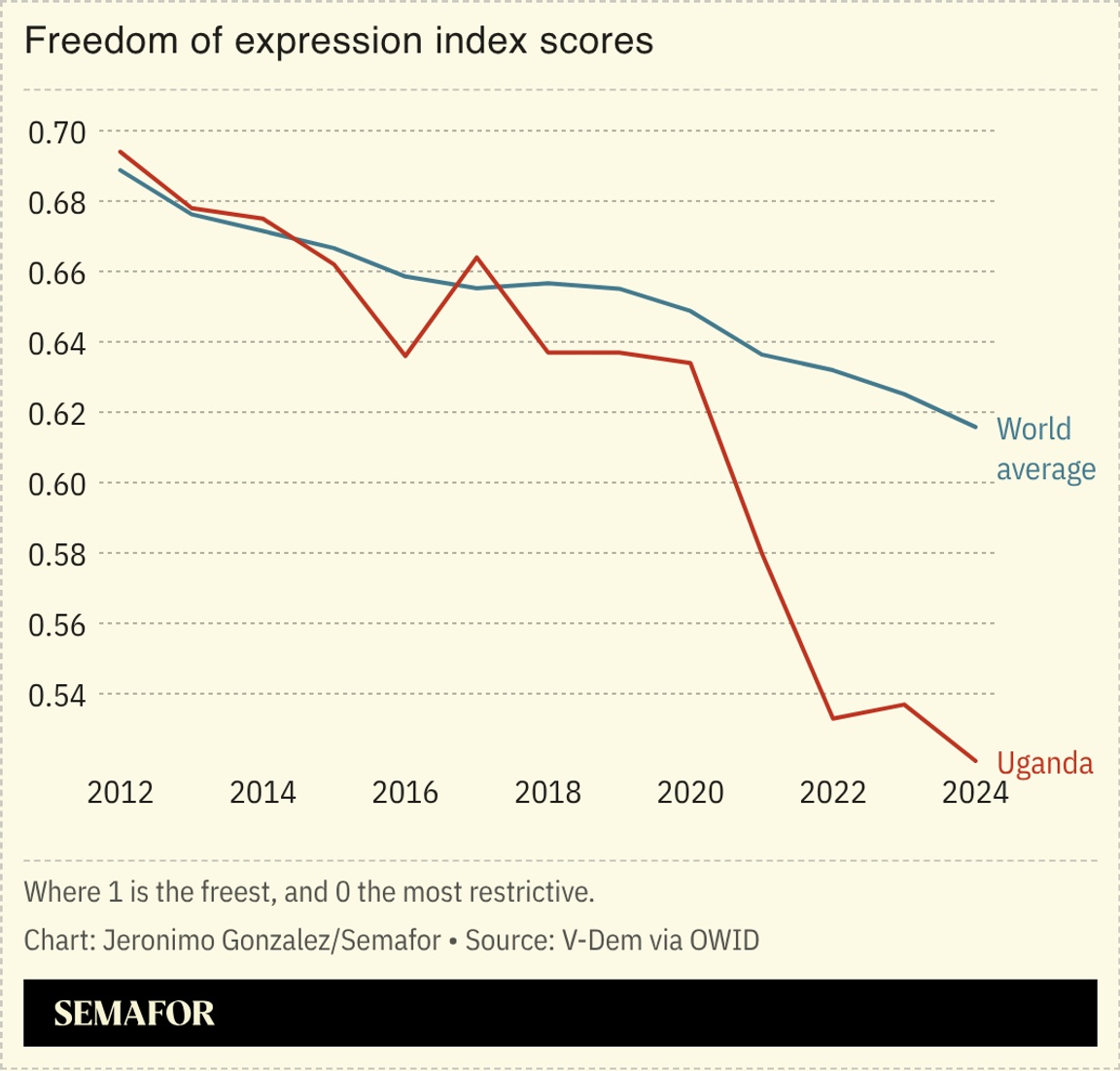

Uganda blocks internet ahead of vote |

Uganda blocked internet access ahead of this week’s presidential election, as octogenarian Yoweri Museveni seeks to extend his four-decade rule. Authorities in Kampala said the blackout would prevent the “weaponization of the internet” ahead of Thursday’s vote, but critics say the move is intended to weaken potential protests if the election results are contested. Though opposition candidate and pop singer Bobi Wine has built a large following among Uganda’s young population, experts say Museveni — who has ruled with an iron fist since 1986 — looks set to win a seventh presidential term. Regardless, Wine has vowed to fight on: “They’ll see me broken but they’ll never see me give up,” he told The New York Times. |

|

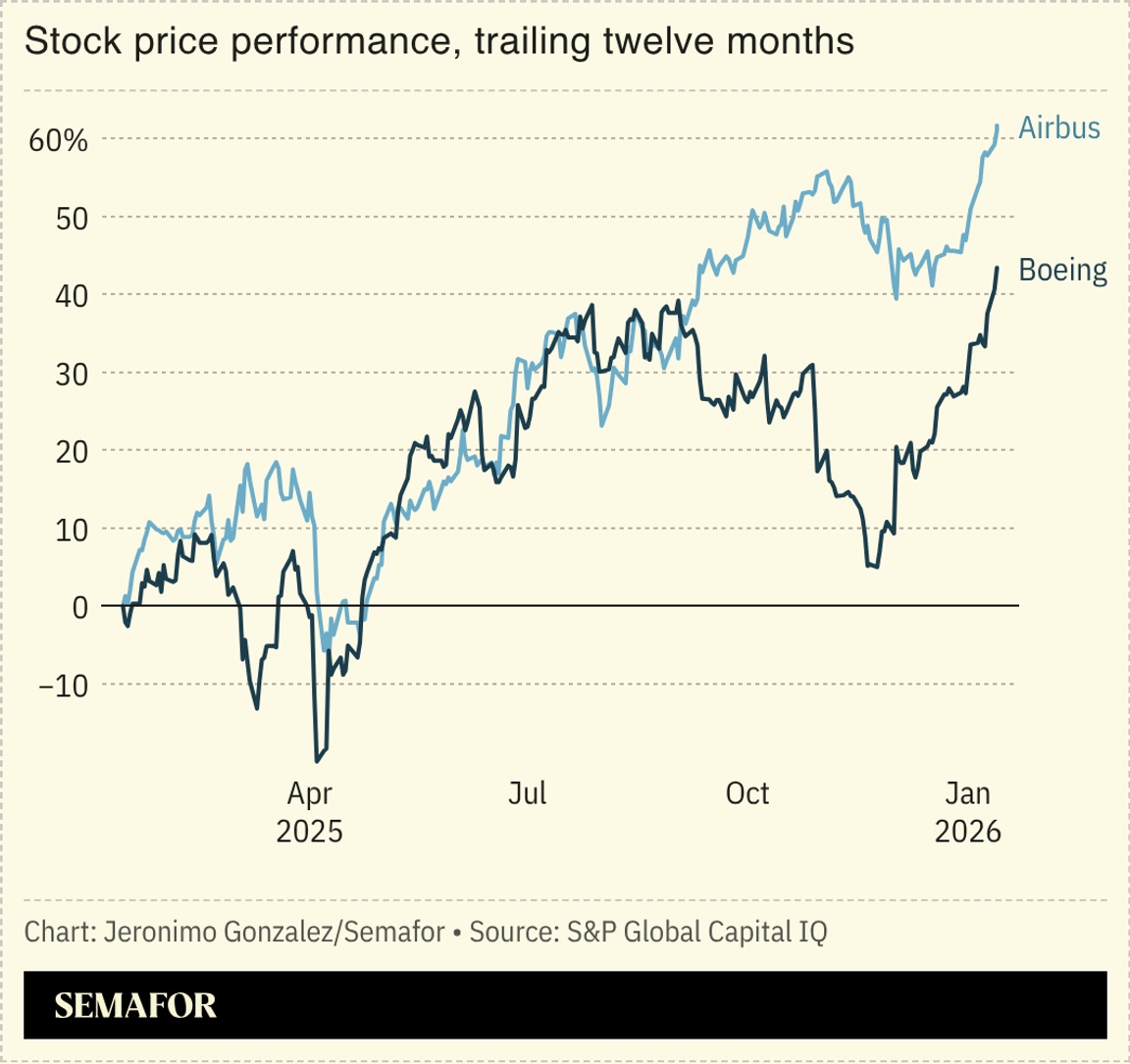

Boeing orders outpace Airbus’ |

New Boeing orders outnumbered Airbus ones for the first time this decade, as airlines worldwide seek to placate Washington by buying American. Boeing has had a nightmare few years, with two deadly crashes and one near-catastrophe on its flagship 737 Max airliner since 2018. But US regulators eased restrictions in a sign of growing confidence, and airlines upped their order numbers — albeit partly “to ingratiate themselves with the Trump administration,” the Financial Times argued. The company booked 1,075 orders last year compared to 1,000 for its chief rival. The air industry in general is booming: Delta Air Lines forecast a 20% profit jump this year, driven by high-end customers. |

|

Saks files for bankruptcy |

Kylie Cooper/File Photo/Reuters Kylie Cooper/File Photo/ReutersSaks Global filed for bankruptcy, the latest sign of the ongoing struggles high-end department stores are facing. The company owns the iconic US luxury outlet Saks Fifth Avenue, and in 2024 pushed through a $2.7 billion merger with fellow retailers Neiman Marcus and Bergdorf Goodman. But the deal left it with $2 billion debt, and profits are down as it struggles to compete with e-commerce rivals. The department store landscape has “changed irrevocably,” The New York Times reported; brands sell directly to consumers, via the web or through their own stores, meaning Saks’ “biggest suppliers are also their biggest competitors.” Demand for luxury goods has also been uneven, with a strong period of growth ending last year, McKinsey said. |

|

|