| | In this edition: Growth projections, South Africa’s AGOA uncertainty, and an award-winning Zimbabwea͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- S. Africa’s AGOA uncertainty

- Nigeria hires US lobbyist

- Nigeria-UAE trade pact

- DRC to send US copper

- Uganda restricts internet

- Ghana clears energy debt

A Zimbabwean short film based on a real-life story. |

|

The World Bank’s global economic forecast for the year ahead was, on the face of it, full of good news for African countries. Growth in sub-Saharan Africa is expected to accelerate this year and next, fiscal revenues have improved across much of the region, and many countries are set to benefit from high commodity prices. That’s the good news. But dig a little deeper, and more troubling details emerge: Economic expansion isn’t keeping pace with population growth, and the gap in living standards with the rest of the world looks set to grow. The region is already home to more than 70% of the world’s people living in extreme poverty, and the projected growth of real per capita incomes is lower than in other emerging markets. This is all very familiar. It reminds me of the optimism around the Africa Rising narrative — a loose theory, coined in the early 2010s, which I, like many others, wrote about at the time. It predicted that the combination of higher government revenues and rapid population growth could translate into a broader distribution of wealth that would expand the middle class in many countries. Instead, the commodity supercycle ended, the richest people in the continent’s biggest economies became more wealthy, while many young people found themselves struggling to find work. South Africa, one of the world’s most unequal societies, is a classic example of this problem. This lack of job creation has very real consequences beyond economics. Political unrest in a number of countries last year — including Kenya and Madagascar — was driven by a lack of opportunities for young people. Policymakers across the continent will need to pay attention to the sobering employment picture underlying the growth forecasts, and make sure they don’t repeat previous mistakes. |

|

South Africa’s AGOA uncertainty |

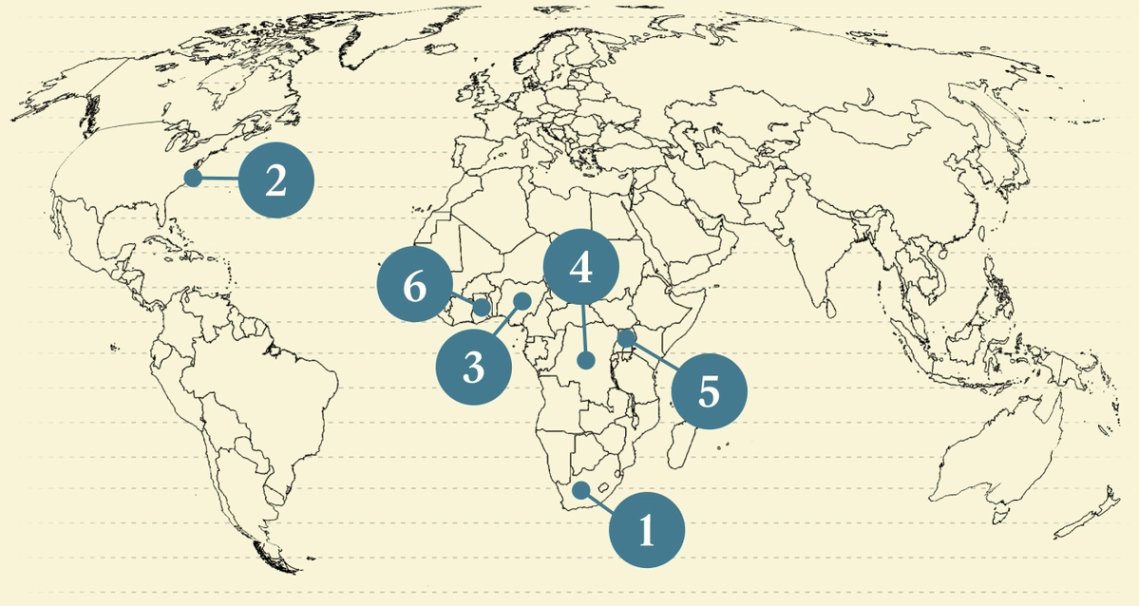

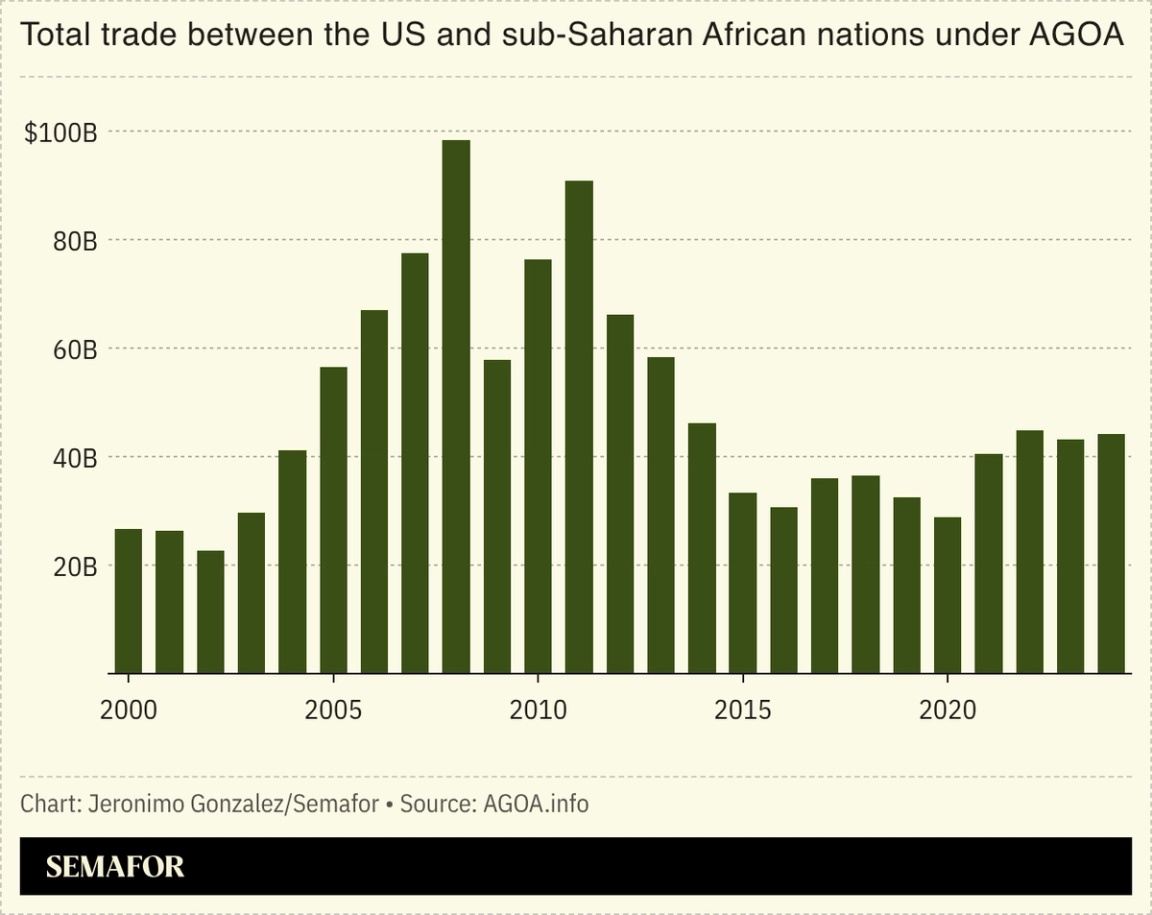

The US House of Representatives voted to extend the African Growth and Opportunity Act (AGOA), but analysts are uncertain if South Africa will remain eligible after the bill makes its way through the Senate. South Africa, Africa’s biggest economy and one of AGOA’s largest beneficiaries, has been in conflict with Washington on a variety of geopolitical and diplomatic issues, but tensions have notably escalated under the Trump administration, which has claimed without evidence that South Africa has enabled a “genocide” of its minority white population. “South Africa has been on the chopping board a few times recently so the chances of it remaining eligible are unclear,” said Kholofelo Kugler, a nonresident scholar at Washington’s Carnegie Endowment for International Peace. US Senator John Kennedy in November filed an AGOA extension bill that explicitly called for the removal of South Africa from the pact. That bill, which landed during a US government shutdown, did not get very far, but could set the tone for negotiations in the Senate. AGOA has allowed dozens of sub-Saharan African countries tariff-free access to the US market for certain products. The deal’s expiry in September plunged thousands of jobs into uncertainty. |

|

Nigeria hires US lobbyist |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersNigeria hired a Washington-based lobbying firm with close ties to the Republican Party to represent its interests in the US. The $9 million deal with DCI Group appears to be a record for African lobbying in Washington, wrote The Africa Report. DCI will help Abuja “in communicating its actions to protect Nigerian’s Christian communities and maintaining US support in countering West African jihadist groups and other destabilizing elements,” according to a contract signed last month. Nigeria had been scrambling to bolster its narrative in Washington in the face of US President Donald Trump accusing its government of mistreating Christians. Abuja had denied the allegations, with analysts noting that jihadist groups in the country’s north have targeted both Muslims and Christians. But on Christmas Day, the US struck IS-linked militants in Nigeria’s northwest: Trump called the air strike a “Christmas present,” while Abuja described the move as a “joint operation” that had “nothing to do with a particular religion.” |

|

Nigeria, UAE sign trade pact |

President of Nigeria Bola Tinubu. Ton Molina/Getty Images. President of Nigeria Bola Tinubu. Ton Molina/Getty Images.Nigeria and the UAE agreed a deal aimed at deepening bilateral trade ties and unlocking investment opportunities across sectors including energy, aviation, and agriculture. The UAE will remove tariffs on more than 7,000 products, Nigeria’s trade minister said, while Abuja will eliminate tariffs on 6,000 products over a five-year period. Nigerian President Bola Tinubu has pushed to attract investment into Nigeria from Western powers but also from partners in Asia and the Middle East. Growing UAE interest in Africa saw Emirati companies back projects worth about $110 billion on the continent between 2019 and 2023, and the UAE pledged $1 billion to invest in AI infrastructure in Africa last year. Emirates Airlines, one of the UAE’s two flag carriers, resumed flights to Lagos in late 2024 after years of tensions tied to Nigeria’s foreign exchange shortage that impeded the company’s ability to repatriate profits. |

|

DR Congo sends US copper shipment |

| |  | Ruben Nyanguila |

| |

Eliseo Fernandez/Reuters Eliseo Fernandez/ReutersDR Congo is set to send the US its first shipment of copper through a new venture backed by commodity giant Mercuria, as Kinshasa tries to broaden its pool of mining partners beyond Beijing. Under a new contract announced on Monday, DR Congo’s state miner Gécamines will ship 100,000 tons of copper from its Chinese-run Tenke Fungurume mine to the US market. The move follows the signing of a strategic partnership between Washington and Kinshasa last month. Gécamines said efforts to prioritize the US as a market was part of a push to “regain its sovereignty” over DR Congo’s mineral output, after decades in which marketing was mainly handled by foreign third parties such as commodities traders Glencore and Trafigura, alongside Chinese buyers and smelters. |

|

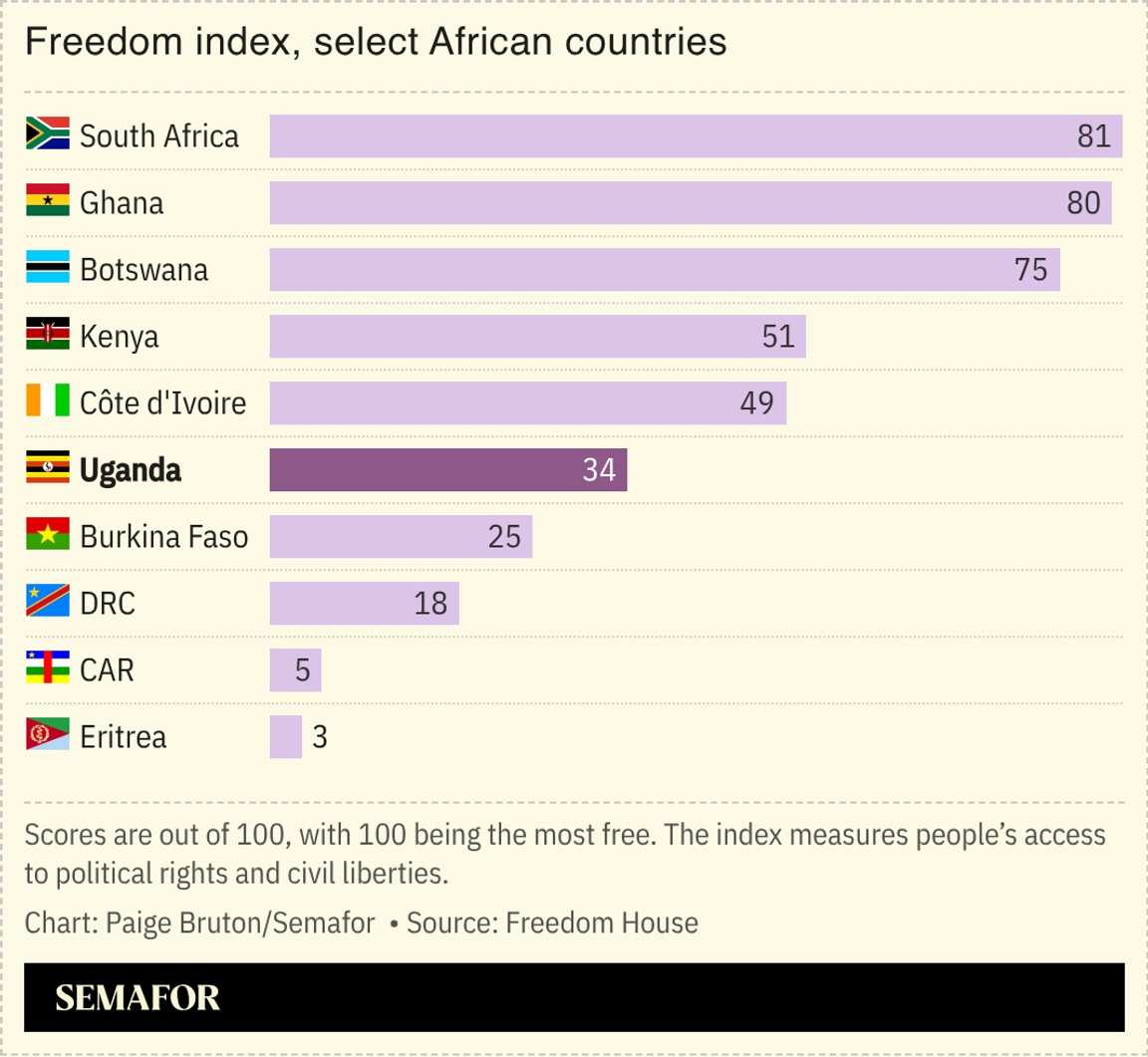

Uganda shuts internet down for elections |

Uganda cut access to the internet nationwide ahead of Thursday’s elections, in which President Yoweri Museveni is widely expected to extend his four-decade rule. Internet shutdowns are used by many African governments to limit the flow of information and suppress protests, with more than 190 shutdowns occurring across 41 African countries between 2016 and last year. Ugandan authorities implemented an internet blackout ahead of the 2021 election, which was marred by pre-election violence and rights abuses, according to observers. Violence also spiked following a crackdown on opposition parties in the lead up to this year’s vote. Bobi Wine, Museveni’s main challenger, denounced the latest move as the acts of a “criminal regime” and called on voters to use Bitchat, an encrypted messaging app developed by X founder Jack Dorsey, to bypass the restrictions. |

|

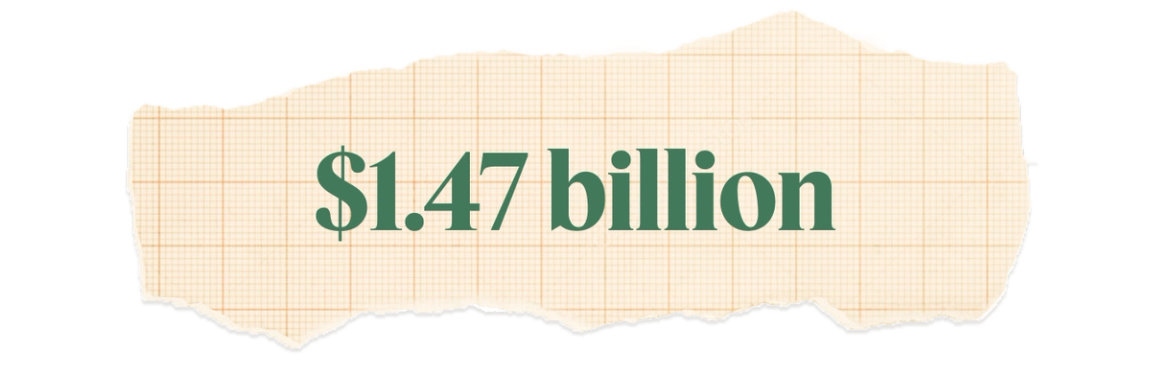

The amount of energy sector debt Ghana said it had cleared. The West African nation was last year among 23 sub-Saharan African countries at risk of debt distress, according to the World Bank, and rising debt service costs have long stymied government spending in vital areas such as education, health, and infrastructure. The country’s accumulating energy debt had also left Ghanaians grappling with increased power outages and disrupted a critical World Bank guarantee to maintain payments for private sector gas supplies in the event of a government shortfall. This “represented a serious governance failure that undermined Ghana’s international credibility,” said the country’s finance ministry, explaining that the new administration which took office this month had resolved the matter through “prudent financial management.” The clearing of the arrears has helped restore operational confidence among independent power producers, Reuters reported. |

|

Semafor has expanded the Semafor World Economy Global Advisory Board, a group of visionary business leaders representing nearly every sector across the US and G20 — who will help guide the largest gathering of global CEOs in the United States of America. Our co-chairs — Ken C. Griffin, founder and CEO of Citadel; Henry R. Kravis, co-founder and co-executive chairman of KKR; Penny S. Pritzker, former US Secretary of Commerce; and David M. Rubenstein, co-founder and co-chairman of the Carlyle Group, continue to lead this effort joined by a broadened roster shaping this year’s program. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open. |

|

Business & Macro |

|

|