| | The Trump administration’s first sale of Venezuelan oil is valued at $500 million, an administration͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- First oil sales

- Bull case for renewables

- UK’s offshore wind gains

- Carbon market grows

- Clean air and costly energy

Kyiv faces its coldest winter, and BP takes a $5 billion renewables hit. |

|

US President Donald Trump’s energy dominance agenda is already tilting the balance of power in the market, as geopolitical tensions, oil oversupply, and the green transition come together in Venezuela and Iran. In the past, major civil unrest and regime changes in oil-producing countries would often lead to dramatic, long-lasting oil price spikes, Natasha Kaneva, head of global commodities strategy at JPMorgan, noted this week. That’s no longer the case. The oil market is oversupplied, and the risk of US strikes on Iranian oil infrastructure appears to be low. Even if things do heat up there, the impact on the market is likely to be muted. The US intervention in Venezuela is, if anything, pushing prices in the opposite direction (even as TotalEnergies’s CEO joined the ranks of skeptics about the country’s near-term prospects). When the world’s business and political leaders meet at the World Economic Forum in Davos next week, many conversations will focus on competing visions for this new era of energy security. One critical question is how Trump will use the power he is accruing: Between the anticipated increase in drilling in Venezuela (see our scoop on that below), and what ExxonMobil has already recently achieved in Guyana, the US has effectively added about 20% to its own oil production, Henning Gloystein, managing director for energy, climate, and resources at Eurasia Group, told me. That could give Trump a lot of new leverage in dealing with Iran, Russia, or other adversaries — but it’s far from clear if and how this leverage can be effectively utilized to achieve peace. “There are huge risks in everything going on here,” Gloystein said. “But Trump clearly feels he can control the world in ways he didn’t realize even a month ago, and he’s willing to take big risks.” Key to Trump’s strategy, Gloystein said, is an implicit offer to the US oil industry that lower prices are necessary to keep fossil fuel use elevated for a longer period. That petrostate strategy puts the US at odds with emerging electrostates like China and Europe, which are still banking on a plan to step away from, rather than compete to control, fossil fuels. Marco Arcelli, CEO of Saudi Arabia’s ACWA Power, told me the focus of conversations at recent iterations of Davos has recently shifted so that “the centerpiece is affordability and security more than climate.” That’s not necessarily a bad thing for non-fossil energy, he said: “If you want the cheapest and most secure power, that’s renewables. It’s not a dogmatic discussion about decarbonizing, but simply where the technology has gone.” These questions will be the focus of my reporting in Switzerland next week. Our Semafor Haus, returning to the Grandhotel Belvedere, is set to draw six G7 leaders and 65 heads of state. If you’ll be in town and have an insight or scoop to share about this remarkable moment in energy history, please drop me a line. And as always, we’re bringing back our pop‑up Davos briefing, where my colleagues and I will cover the convening in all its gossipy, productive, and pretentious glory. You can sign up for Semafor Davos here. |

|

| | Shelby Talcott and Eleanor Mueller |

| |

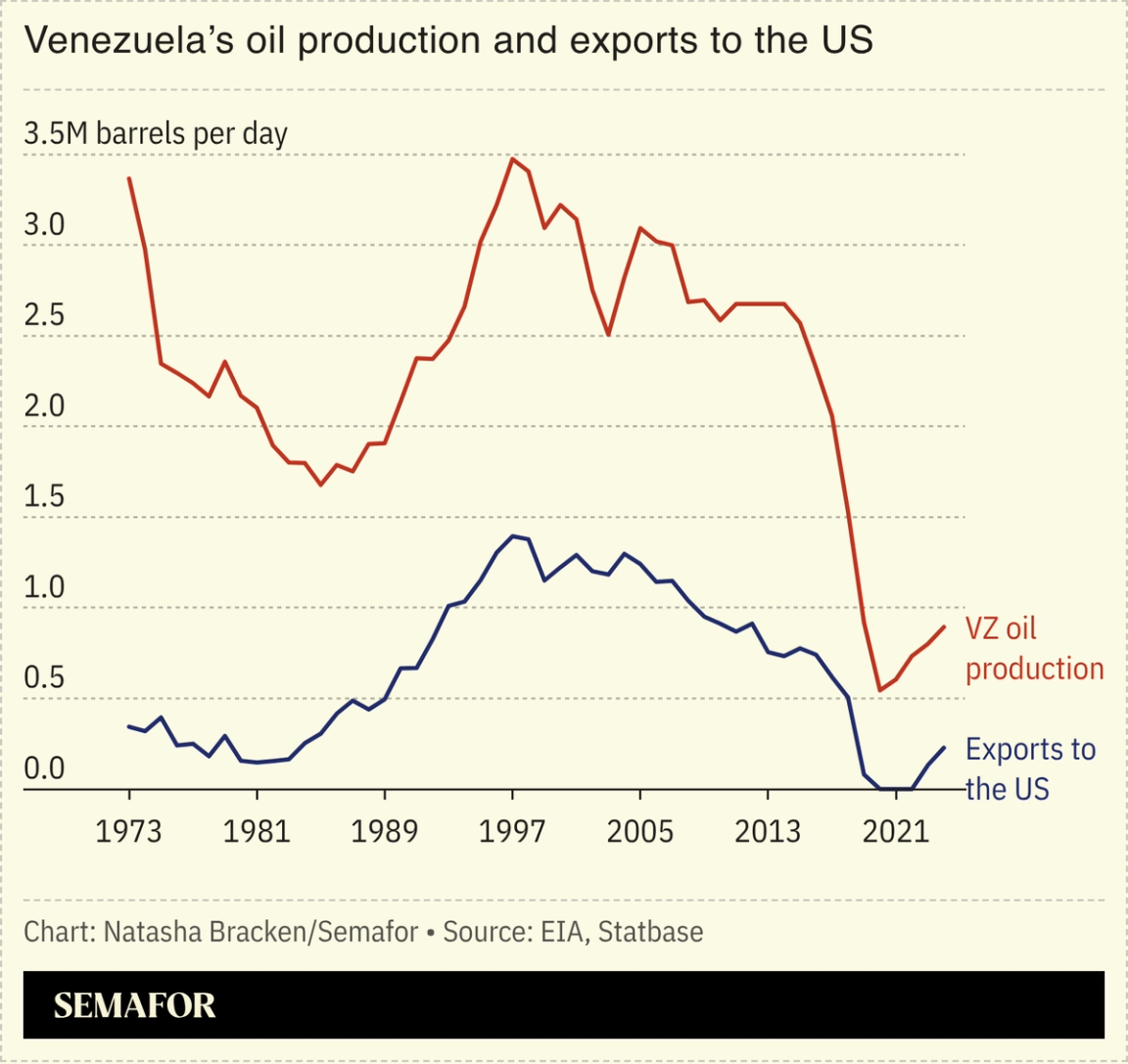

The Trump administration’s first sale of Venezuelan oil is valued at $500 million, an administration official told Semafor. The sale marks an initial milestone in the administration’s stewardship of Venezuela after the US ouster of its former leader, Nicolás Maduro, 11 days ago. President Donald Trump has indicated that the US would effectively run Venezuela for an indeterminable amount of time and take control of up to 50 million barrels of its oil — marketing and selling it while distributing the proceeds back to Venezuela in an arrangement with little precedent. Trump signed an executive order on Friday that provided some details on how the US plans to block courts or creditors from tapping any revenue from those oil sales. Venezuela owes international bondholders, oil companies and others as much as $170 billion — one reason why US firms have been reluctant to help rebuild the country’s infrastructure. |

|

| | Tim McDonnell and Kelsey Warner |

| |

Brian Snyder/Reuters Brian Snyder/ReutersSome of the biggest clean energy investors in the US see a bull market ahead, despite the Trump administration’s pushback on the industry and the wind-down of tax credits. CleanCapital, the country’s number-two operator of commercial-scale solar farms, said this week it had secured a $300 million financing package that will help it increase its capacity 50% in the next 12 months. There’s a rush underway to get solar projects started before they get disqualified for tax credits, CEO Thomas Byrne told Semafor, but even after that window closes the demand for new power is so strong that rising prices will offset the loss of federal subsidies. That view is shared by the private equity giant Brookfield. In a new paper shared first with Semafor, Gayle Miller, a senior adviser to the firm, argued that “renewables are now the cheapest, fastest and most scalable form of bulk electricity generation in nearly every major market.” The firm raised $30 billion in the last year to invest in renewables, Miller told Semafor, and while it is focused on projects that already have power sales contracts in place, there are plenty of those to go around as renewables plus batteries remain the first choice for tech companies’ AI ambitions. “The offtake agreements are at higher prices than we ever expected,” she said. Meanwhile, the CEO of Abu Dhabi-based renewables giant Masdar told Semafor that while renewables rollbacks in the US are “not good for business,” the company still has billions to invest, and is looking to pick up struggling US wind and solar assets. |

|

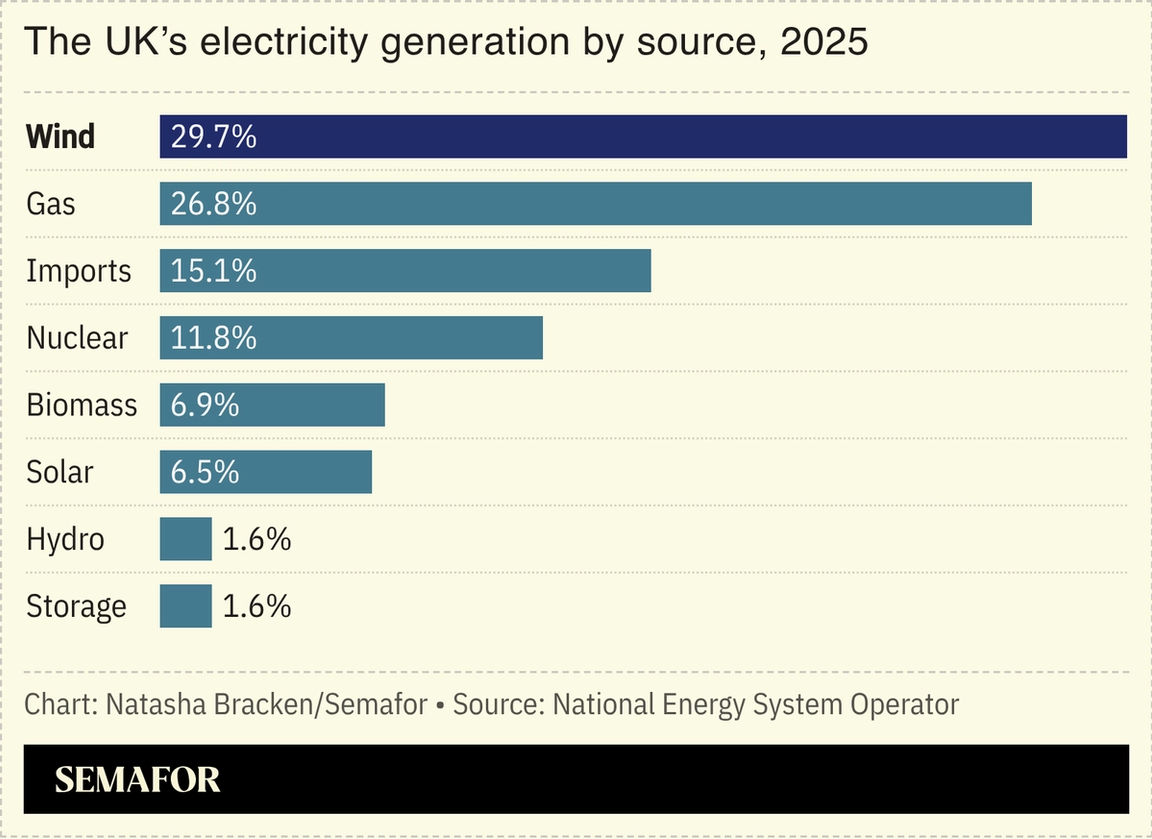

The UK took a major leap toward its 2030 clean energy targets, awarding subsidy contracts for a record-breaking volume of offshore wind capacity. British authorities granted contracts expected to produce 8.4 GW of energy, enough to power roughly 12 million homes, albeit at higher strike prices — the amount guaranteed to producers per MWh — compared to last year’s auction. This could increase household electricity bills, handing fresh ammunition to opponents who argue that renewables are too expensive. While the high upfront construction costs of wind energy hit consumers in the short term, the government argues it remains cheaper than building new gas plants. —Natasha Bracken |

|

Total value of carbon credits bought globally in 2025, up 6% from the previous year. The total volume of credits trading hands has dipped, according to a new report from carbon market intelligence firm Sylvera, as investors learn to steer clear of projects with dubious green credentials. But the value of high-quality projects is rising, as is their share of total credit trades, with highly rated credits accounting for 31% of trades compared to 25% the previous year. The most important driver of growth in this market are government-mandated purchases, rather than voluntary offsets, the report said; the compulsory side of the market is on track to supersede the voluntary side by 2027. |

|

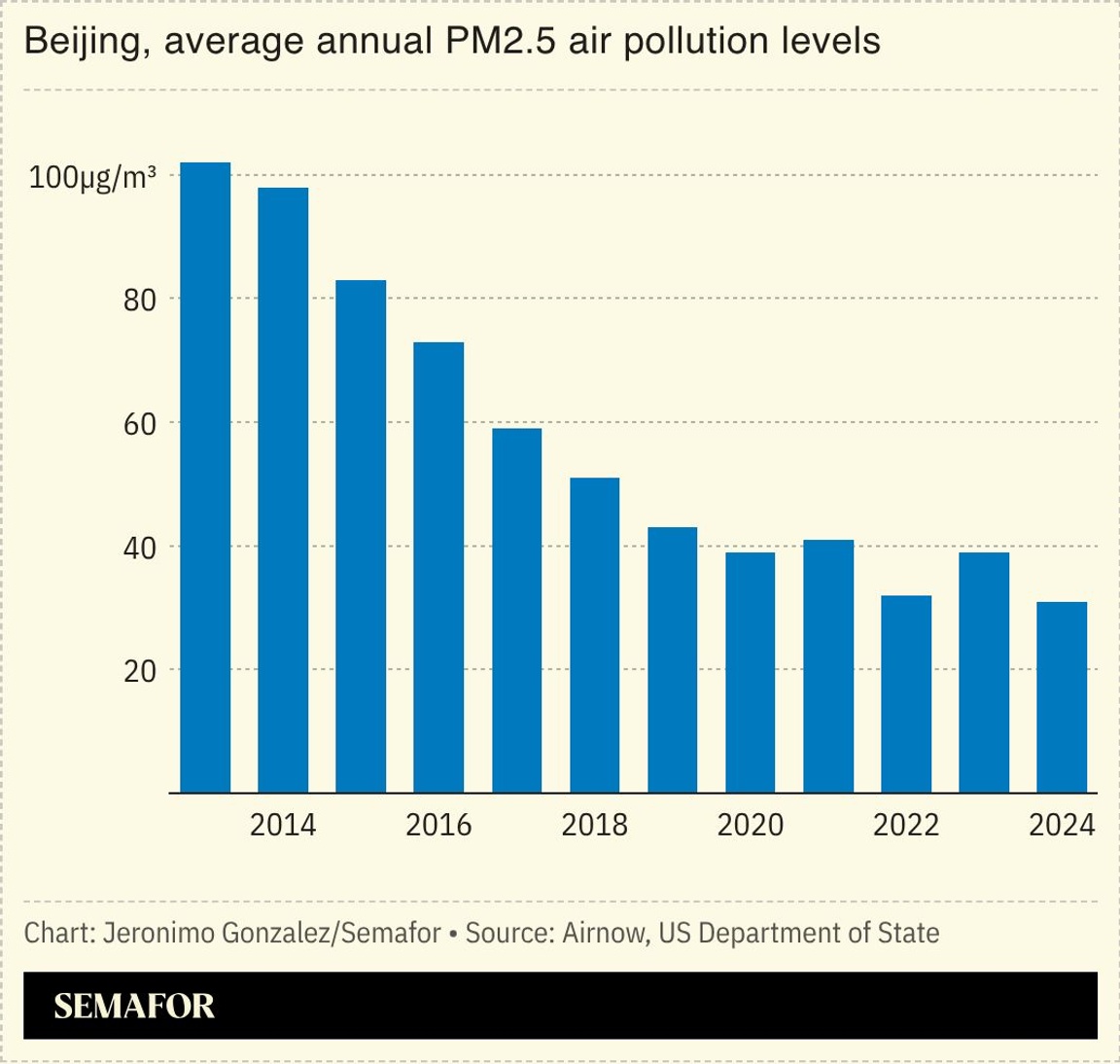

Clean air and costly energy |

China’s efforts to clean up its cities’ air have worked, but driven energy costs up, leaving some rural areas unable to afford heating as temperatures plummet. Replacing coal with renewables or gas has paid off: Beijing’s air quality was “good to moderate” on 95% of days last year, up from 55% in 2013, authorities say. But energy subsidies to incentivize the move have ended. The cost of heating a home over winter is now more than some elderly couples’ pensions, Pekingnology reported, and villagers are huddling under blankets, or secretly burning firewood. There is an ironic echo of a global story: Improving air quality has actually accelerated global warming, as particulate pollution reflected some of the sun’s heat back into space. |

|

New Energy- BP is returning to what it does best — drilling for oil and gas — as the firm announced it will record an impairment charge of as much as $5 billion on its gas and low-carbon energy unit after an attempt at renewables backfired.

- A US judge will rule Thursday on Norwegian firm Equinor’s bid to resume its New York offshore wind project after the Trump administration halted it and several others.

Fossil Fuels- Norway handed 57 licenses to 19 different companies for exploration acreage in the seas off its coast.

- OPEC expects global oil demand to grow at a similar pace in 2027 as this year, and projected a near balance between supply and demand in 2026 despite warnings of a glut.

- Two oil tankers were hit by drone strikes in the Black Sea on Tuesday while heading to a Russian coastal terminal, including one chartered by Chevron.

Finance- Nigeria’s president announced new plans for a $2 billion climate fund as the country bets on green finance to push its energy transition.

TechPolitics & Policy Lisi Niesner/Reuters Lisi Niesner/ReutersEVs- China’s vehicle sales and exports will likely slow in 2026 due to weak demand and ongoing external uncertainties.

|

|

Oleksandr Kharchenko, managing director of the Energy Industry Research Center. Hundreds of thousands of households in Kyiv have been without electricity and heat for days because of Russian attacks on energy infrastructure.  |

|

|