| | In this edition, how the political climates have shifted in Davos, and Trump’s meddling with interes͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- US’ first Venezuela oil deal

- The case for Big Google

- Netflix, Paramount go to Brussels

- Credit card ripples

- Minerals rush

|

|

Hi from rainy London, where all anyone wants to talk about is Washington. I was talking to a banker this morning about the potential megamerger of Glencore and Rio Tinto, and he invoked the “Trump commodities supercycle.” Another, musing about the skyrocketing price of silver, went straight to the president’s flogging of defense contractors to boost production of missiles, which contain a healthy dose of the metal. Even the violent crackdown on Iran protestors is now essentially a question of what President Donald Trump will and won’t do. (One betting-markets whale lost their wager on a US invasion. Insider trading doesn’t always pay!) Approaching the end of the first year of his second term, Trump is in a very different place than this time last year, when the excitement among CEOs at the World Economic Forum in Davos was unbridled. “Corporate America is unshackled, and the microphones are everywhere,” I wrote then, as executives tripped over each other to find those mics and herald a new US golden age. This year, he’s showing up at Davos at a time of declining political fortunes: Congressional Republicans have suddenly found a backbone, he’s been outflanked by Fed Chair Jerome Powell, ICE’s actions are polling terribly, and Trump’s spaghetti-against-the-wall affordability agenda is rankling the very businesspeople who had hailed him as an economic second coming. Still, Trump has become both the wind and the weathervane of the global economy, blowing himself and it in confusing directions. He’s managed to totally eclipse historical market dynamics and co-opt others into his reality TV show. And his power as programmer-in-chief remains untouched. A quick plug: We’ve got a packed lineup of live journalism at the Semafor Haus in Davos. We’re also bringing back our daily pop-up newsletter, capturing global power as it really unfolds — the deals, the gossip, the ambition, and the absurdity. You can sign up for Semafor Davos here. |

|

US marks first $500M Venezuelan oil deal |

Nathan Howard/Reuters Nathan Howard/ReutersThe Trump administration’s first sale of Venezuelan oil is valued at $500 million, Semafor’s Shelby Talcott and Eleanor Mueller scooped. It represents an initial milestone for the US after the ouster of Venezuela’s former leader Nicolás Maduro. Revenue from the oil sales is currently being held in bank accounts controlled by the US government, with some of the money in Qatar, a senior administration official said. Qatar was described by the official as a neutral location where money can flow freely with US approval and without risk of seizure, though it’s likely to cause consternation among Democrats who have expressed concerns about the prospect of offshore accounts being used. Still, US majors, with the exception of Chevron, remain deeply skeptical of stepping back into Venezuela, having been burned many times before. And continued sales, while an administration priority, will also drive down the price of oil at a time when it is already hovering at four-year lows. |

|

Steve Marcus/File Photo/Reuters Steve Marcus/File Photo/ReutersApple’s picking Google tech to power Siri this week is the latest win for Alphabet, which has all the momentum in the AI race right now and is starting to look a little, dare we say, invincible. It’s easy to forget that federal judges in the past year found Alphabet was running illegal monopolies, in online search and advertising. AI is still intensely competitive, but over time the money will shift to the winners, and Google looks to be in pole position, writes Semafor’s Reed Albergotti, who’s fine with that outcome. He proposes a simple test for worrying bigness: “Is the company spending serious capital on real innovation that could impact the economy or national security?” Google clearly is. A bunch of small companies simply couldn’t have made as big of an impact on such a massive scale. (Once upon a time, the federal government could have, but those days are behind us.) “I’m not sure if search advertising is really driving up consumer prices, but if I have to pay an extra few pennies for my coffee, it’s probably worth the tradeoff,” Reed writes. |

|

Netflix, Paramount make their antitrust cases |

Eric Gaillard/Reuters Eric Gaillard/ReutersNetflix and Paramount Skydance met with the European Commission Tuesday, setting out their early cases for antitrust approvals in their bids for Warner Bros. Discovery. Regulators are worried about Netflix’s potential scale in the EU post-merger, but were generally receptive to both parties’ arguments, people familiar with the matter tell Semafor’s Rohan Goswami. (Netflix and Paramount executives ran into each other in the lobby of the European Commission as they were coming through their back-to-back meeting.) Paramount received a “second request” from US regulators in recent days, the people said; Netflix has not, according to another person familiar with the matter. |

|

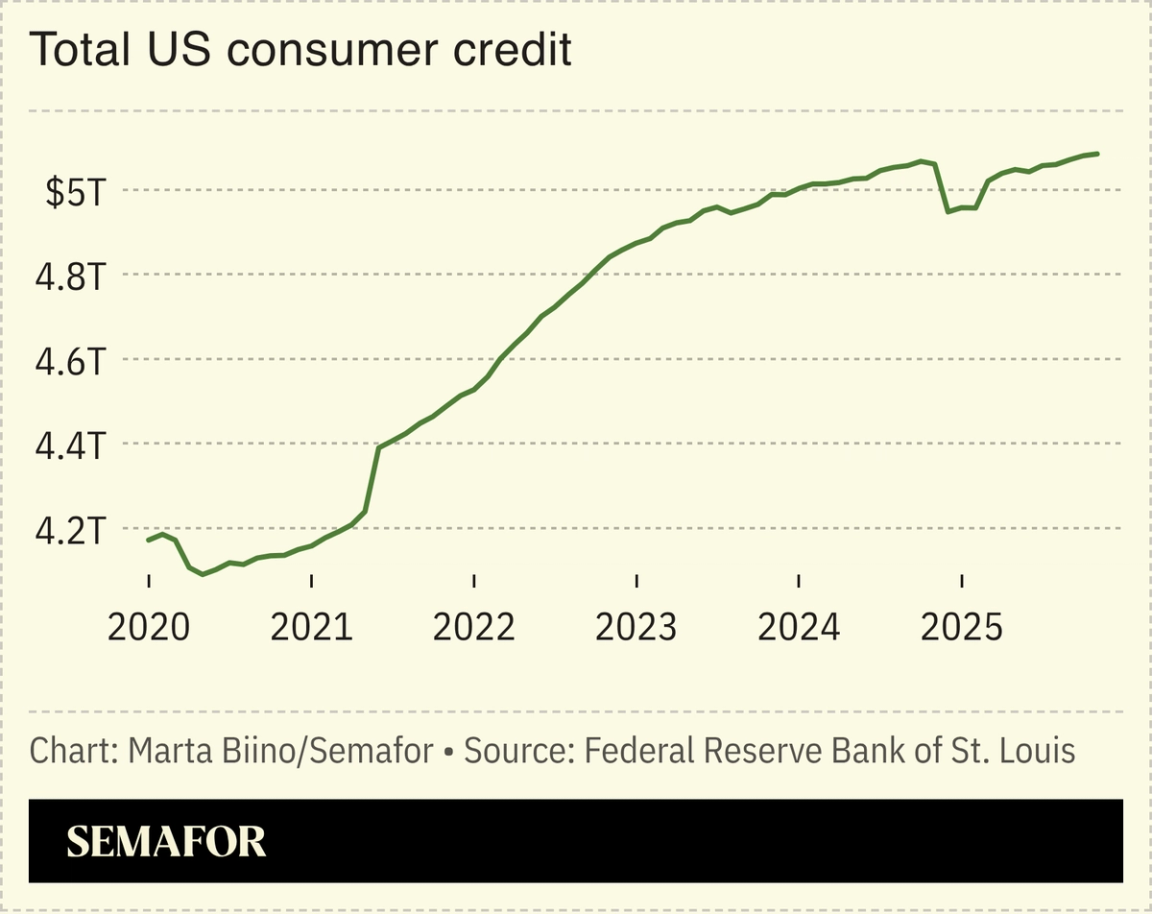

Card issuers warn interest cap would dent economy |

Trump’s 10% credit card interest cap, aimed at relieving pressure on Americans and indicating the economy is doing pretty well, in reality may have the opposite effect. Banks are certainly talking their book, but they came out in full force with warnings that if they can’t charge higher interest then they just won’t extend credit to riskier borrowers. If that happens, not only do companies that rely on offering credit cards take a hit, but so do the people who rely on these cards to make purchases. If consumers spend less, the economy slows. “Affordability is clearly an important issue and one that we look forward to collaborating with the administration on,” Citi’s CFO told reporters. But it would have a “dramatic” impact on subprime borrowers, JPMorgan CEO Jamie Dimon warned. Macy’s CEO Tony Spring put a finer point on it: “You will end up offering less credit to consumers,” he told Semafor’s Andrew Edgecliffe-Johnson. “You will see reward programs become less favorable.” |

|

Saudi mining giant Maaden plans $110B investments |

Francis Kokoroko/File Photo/Reuters Francis Kokoroko/File Photo/ReutersSaudi Arabia’s state-controlled mining company will invest $110 billion in production over the course of the next decade, its CEO told Semafor’s Matthew Martin, as Big Tech’s massive data center buildout spurs fresh demand for copper and other precious metals globally. Maaden plans to triple its phosphate and gold business and double its aluminium business with the investment, Bob Wilt told Semafor. “We are deploying capital at an unprecedented pace,” he said. Maaden has “eight megaprojects on the books right now,” with two underway and six others in various stages of planning. The push comes as Amazon struck a deal with Rio Tinto to tap copper from an Arizona mine — the first restarted in more than a decade — to power its AI data center buildout, The Wall Street Journal reports. Though Rio’s supply won’t be enough to power one data center facility, it fuels the rush for minerals (and their prices) as Big Tech seeks more power to sustain the AI race. Maaden will also shift its exploration focus to looking for copper in the kingdom, after announcing it had discovered 7.8 million ounces of the precious metal. That should be enough for its gold expansion plans for the next five to seven years, Wilt said. |

|

Mary Barra, Chair & CEO, General Motors, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

➚ BUY: Outside. Executives at The North Face parent company VF Corp. are sounding confident on the brand’s turnaround story ahead of Q3 earnings next week. ➘ SELL: Inside. Rep. Lisa McClain, R-Mich., pressed on whether her husband’s investment in xAI, just days before reports of the Musk venture’s expanding role in the Pentagon, was based on insider information: “If it was ... we would’ve bought a heck of a lot more.” |

|

Companies & Deals- Animal spirits: Morgan Stanley and Goldman Sachs closed out the strongest year for investment banking since 2021, though Goldman snatched the equities trading crown from Morgan. BlackRock also reported the biggest quarterly inflows in its history.

- Dipping into the well: Saks’ bankruptcy is taking a dramatic turn. Amazon filed an objection to the proposed DIP financing, arguing that, as a preferred equity investor, the financing violates its consent rights.

Watchdogs- Breaking the line: Trump-appointed Fed Gov. Stephen Miran criticized his colleagues for standing behind Chair Jerome Powell after the DOJ’s criminal probe, signaling his unbridled loyalty to the president.

- Fearmongering: Companies see greater risks to their reputation from the misuse of AI than from being targeted by the Trump administration, according to a new report by public affairs agency Global Situation Room shared exclusively with Semafor — a shift from the third quarter of 2025, when they said the president posed a greater risk.

|

|

|