| | In this edition, global executives try to separate signal from noise at Davos, and China finally giv͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- The end is near

- California dreaming

- Fink’s triumph

- Low-key UBS

- Energy bets

- Kalshi crackdown

|

|

A year ago in Davos, Nasdaq’s President Tal Cohen explained to me the value of proximity to Donald Trump: “The last voice in the room is the most impactful.” Back then, pilgrimages to Mar-a-Lago and cameos at the inauguration were, CEOs thought, a way to influence the president, whose bid-ask approach to governing endeared many in the business community to Trump during his first term. Show up, say the right things, shape policy. A year later, that two-way radio has become a megaphone. There is still value in showing up, but any hope of influence is gone. “Being in the room enables me to get that feedback,” on what clients can expect on issues like tariffs, Tim Walsh, chair and CEO of KPMG US, told my colleague Andrew Edgecliffe-Johnson this week, but “I’m not sure we’re getting new information.” Or as GE Vernova CEO Scott Strazik said on stage at Semafor Haus: “I’m always just trying to listen.” Trying to “find opportunities” to plug into the White House’s agenda means “listening carefully and consistently, and find[ing] that pattern recognition as best you can,” he said. Real influence over Trump costs money, if it’s available at all. The best executives and investors can do is try to separate signal from noise. Markets are getting better at that: pre-pricing in the TACO trade, for example, explains the lack of market swings on swing-worthy headlines. But it casts masters of the universe as passive participants in what many had expected to be a bustling marketplace for influence-peddling. |

|

US, China sign off on TikTok US spinoff |

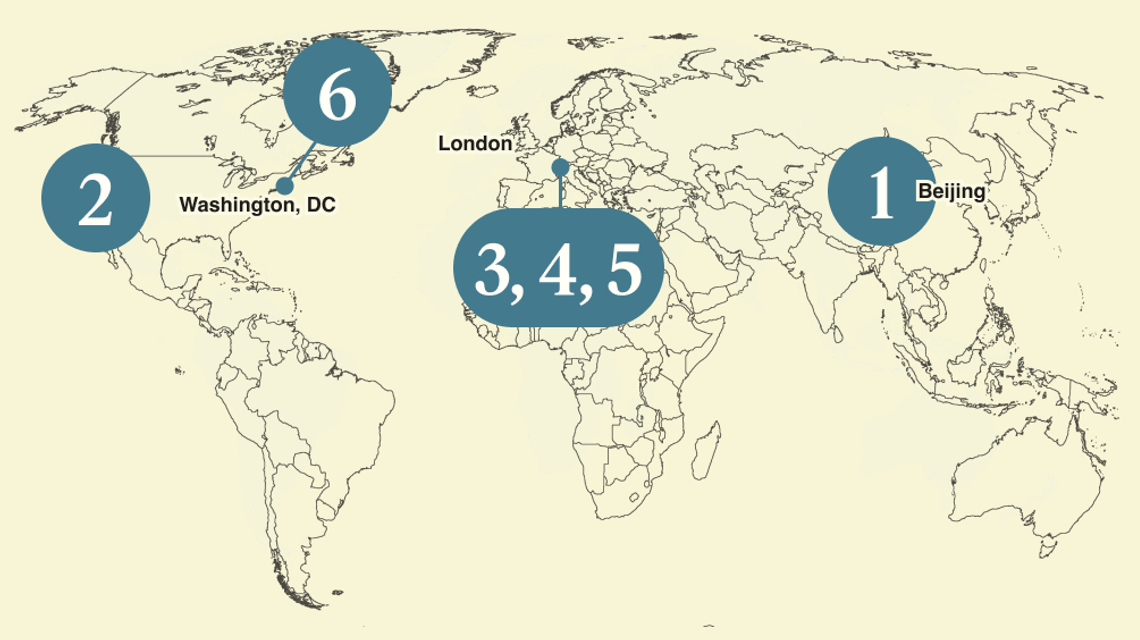

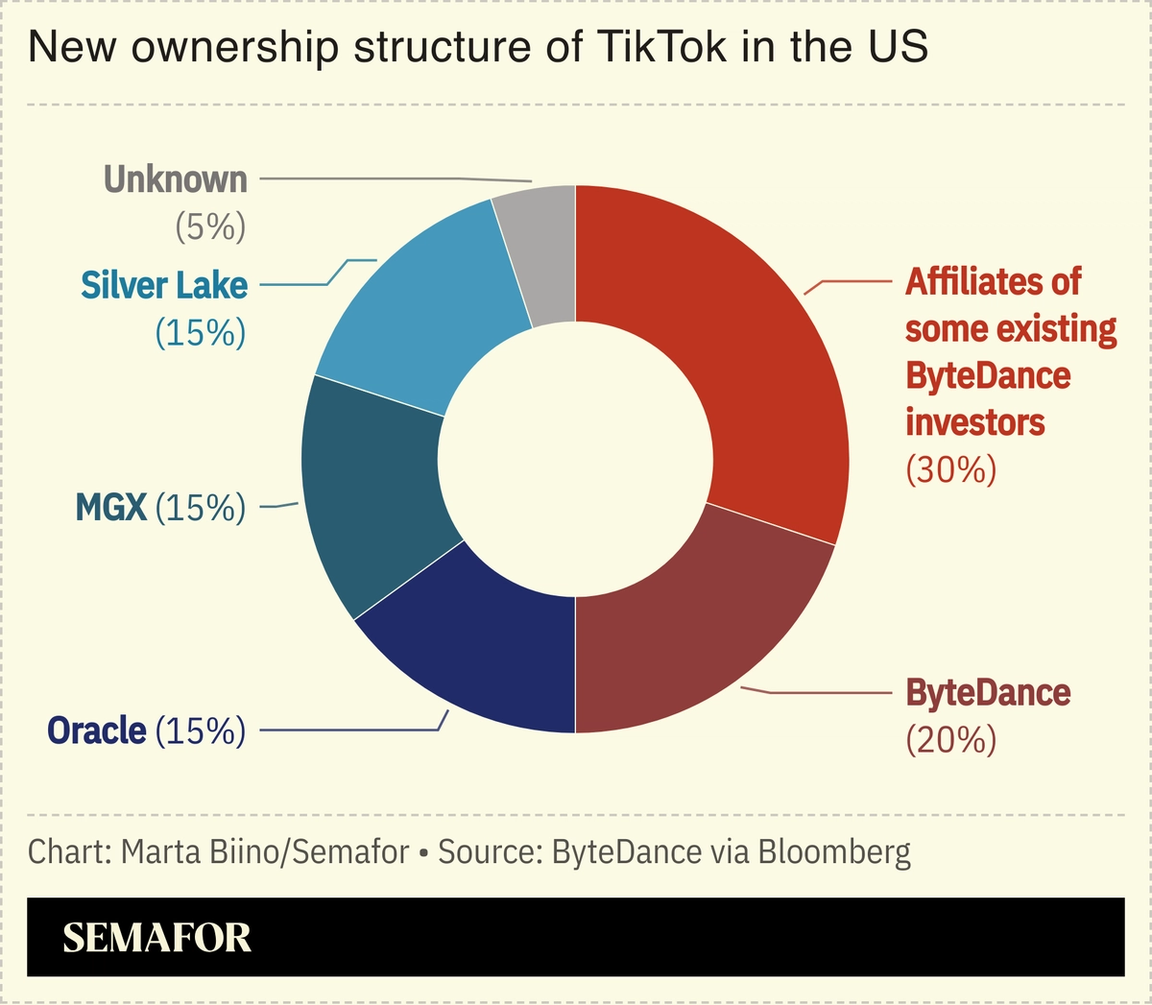

The US and China have signed off on a deal to sell TikTok’s US business to a consortium of mostly US investors led by Oracle and Silver Lake, people familiar with the matter told Semafor’s Liz Hoffman and Reed Albergotti. The deal — outlined by the CEO of TikTok parent ByteDance in an internal memo sent last month — is set to close this week. Bytedance CEO Shou Chew said in December that ByteDance had signed a binding agreement with investors but that regulators hadn’t yet indicated their approval and that “there was more work to be done.” The deal closing suggests an end to an on-again, off-again battle, removing a sticking point in US-China relations at a time when tensions are running high. The new structure leaves ByteDance with just under 20% of the US business, with 15% stakes going to Oracle, Silver Lake, and MGX, a state-owned investment firm in the UAE focused on AI. Other investors include Susquehanna, Dragoneer, and DFO, Michael Dell’s family office. It was unclear how much ByteDance received for the US business — Vice President JD Vance said in September the deal would value the unit at roughly $14 billion. It was also unclear what negotiations occurred over TikTok’s powerful algorithm, which has been the main point of contention between the two governments. The Treasury, White House, Oracle, and Silver Lake didn’t immediately respond to requests for comment. A spokesperson for the Chinese embassy in the US said “China’s position on TikTok has been consistent and clear. I have nothing new to share at the moment.” |

|

Newsom: Wealth inequality will choke businesses |

Denis Balibouse/Reuters Denis Balibouse/Reuters“Businesses can’t thrive in a world that’s failing,” California Gov. Gavin Newsom told Semafor’s Ben Smith at Davos. The Democrat is opposed to a controversial wealth tax. He joins a growing chorus of business leaders warning about stark inequality in the US, but appears to have few solutions. “Plutarch said it to the Athenians 2000 years ago: The imbalance between the rich and the poor is the oldest and most fatal ailment of all republics,” Newsom said. Newsom has defined himself as the left’s friendly neighborhood populist and a foil for Trump. But on this issue, he’s joined sides with the billionaires who oppose a ballot initiative to tax billionaires 5% of their net worth. “I’m opposed to it,” Newsom said. “It’s already had a very negative impact on the state and it’s a badly drafted initiative.” His criticism echoed that of Bridgewater founder Ray Dalio, who told Semafor that while the political resentment around near-trillionaires was a real concern, the relative ease with which “wealth” is created today — “almost out of nothing” — made one-off levies like California’s less sensible. |

|

How Larry Fink (and Trump) saved Davos |

Denis Balibouse/Reuters Denis Balibouse/ReutersA year ago, it seemed plausible that the world’s most important gathering would fizzle. Then the CEO of the world’s largest money manager took it over, twisted some elbows —– and it’s so back. BlackRock CEO Larry Fink stepped in at a precarious moment for the World Economic Forum. Its longtime chair, Klaus Schwab, had departed under a cloud of scrutiny. Populists and nativists had upended its globalist view. CEOs cloistered themselves inside the hotels. Fink cajoled CEOs onto the Congress Center’s main stage and pushed some WEF programming out into the wild. And he personally asked Trump to come, he confirmed in an interview Thursday, an appearance that cemented Davos’ relevance. “I played some role in bringing people here, but it was not a hard lift,” Fink told Semafor. “All the uncertainty that everybody writes about, everybody wanted to come here and talk about it.” 2026 Davos was a bit less fun and free-wheeling than in years past, but so is the world. Reflecting that reality saved Davos — from the populists, and from itself. |

|

UBS runs its own low-key Davos |

UBS President Colm Kelleher. Tyrone Siu/Reuters. UBS President Colm Kelleher. Tyrone Siu/Reuters.As global companies splash marketing budgets at Davos to impress customers and influence government officials, the one with perhaps the most to lose has probably spent the least. UBS, the giant Swiss bank, is running a low-key Davos out of its permanent branch at Promenade 48. The bank’s powerful and combative executive chairman, Colm Kelleher — seen and heard at past Davoses — has been quiet this year. The company is in a high-stakes battle with its Swiss regulator, which is trying to force UBS to raise tens of billions of dollars of capital. CEO Sergio Ermotti just announced he’ll retire in April 2027, opening a 15-month window to resolve the impasse, either through a negotiated settlement or by UBS redomiciling out of Switzerland. The move would leave Switzerland, the birthplace of high finance, without a national champion in a world increasingly dominated by American banks. Ermotti did do some press this week, including offering a counternarrative to huffy European investors looking to dump US assets. “There is no choice to the dollar,” he said. |

|

Smart money still bets on clean energy |

Antranik Tavitian/Reuters Antranik Tavitian/ReutersTrump added renewable energy to his long list of grievances during his address at Davos, calling wind turbines “losers” that only appeal to “stupid people,” and lamenting that “you’re supposed to make money with energy, not lose it.” Counterintuitively, Trump is actually doing energy bankers and private equity firms focused on renewables a favor: When climate action was popular with the Davos elite a few years ago, there was a stampede of investment into renewables that drove frothy valuations for developers and steep reductions in power contract prices. Now the vibe has reversed, suppressing some of that froth. Meanwhile, power prices are rising thanks to skyrocketing demand for data centers and a renewed focus by fossil fuel importers on producing more electricity from domestic renewables. The result is a disconnect between the message coming from the White House and the opportunity that seems obvious on Wall Street. “We’re busier in renewables than we’ve been in the last 10 years,” Brandon Freiman, head of North American infrastructure at KKR, told Semafor’s Tim McDonnell. |

|

States begin crackdown on prediction markets |

A Kalshi prediction poll during the 2024 presidential election. Kayla Wolf for The Washington Post via Getty. A Kalshi prediction poll during the 2024 presidential election. Kayla Wolf for The Washington Post via Getty.Kalshi and Polymarket’s decision to follow Uber’s playbook — grab market share now, worry about regulators later — has worked pretty well, until now. A Massachusetts judge this week ordered Kalshi to cease operations in the state, after regulators filed suit alleging the company was operating an unlicensed sportsbook there. The company is facing similar litigation in Nevada — and while the injunction is only temporary, and focuses on sports betting, the legal action presages the broader efforts by states to protect the lucrative revenue gambling brings in. “I don’t know what else to call it, except for, you know, cosplaying, right?” Massachusetts Gaming Commission Chair Jordan Maynard told Semafor earlier this month, before the injunction was handed down. “If it looks like a duck and quacks like a duck, it’s a duck, right?” Kalshi and Polymarket have both been dogged by allegations of insider trading, with users venting their frustrations over denied payouts and opaque rules. Regulators, for their part, are concerned about underage bettors and potentially criminal interference to tilt or rig real-life events. — Rohan Goswami |

|

Tired of financial newsletters that bury the lede, or worse... don’t have one? That’s why more than 1 million investors start their day with The Daily Upside. Written by former Wall Street insiders, it cuts through the noise with actionable market insights that actually matter. Subscribe for free and stay ahead. |

|

➚ BUY: Lemonade. The insurance startup is offering a first-of-its-kind 50% rate cut for Tesla drivers who utilize the company’s “Full Self-Driving” software. (Reuters reports no money is changing hands between the companies.) ➘ SELL: Lemons. Defective see-through leggings are just the latest headache for Lululemon. The company pulled its new “Get Low” line from its online store following customer complaints, giving more fuel to founder Chip Wilson’s anticipated proxy fight. |

|

|