| | In today’s edition: PwC makes a comeback in the kingdom, Gulf gamers emerge as big spenders, and mor͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- NEOM shakeup

- PIF ends PwC ban

- Saudi property opens up

- Ukraine-Russia talks

- Gulf rail renaissance

- Obsessed with gaming

When the Gulf united against an invader. |

|

Saudi Arabia has confirmed what has long been speculated: It won’t be ready to host the Asian Winter Games in 2029. Four years ago, the kingdom won the rights to hold the event at Trojena, a planned ski resort in the mountains of NEOM. Back then, the idea of holding winter sports in a country known more for blisteringly hot deserts than snowy peaks seemed absurd. Still, people working on the project said there was a case for a short ski season in the Sarawat Mountains. Ultimately, their problem was less the weather than the ambition. The indefinite postponement is in many ways a reflection of the broader problems at NEOM and the kingdom’s largest gigaprojects. Ambitions often vastly outmatched what was technically feasible or economically sustainable. Moving the Asian Winter Games signals a new willingness to face reality. The government and PIF do not have unlimited resources — no one does — and capital is better deployed on projects more likely to yield a long-term return. Ministers have become increasingly frank: They say there’s no shame in abandoning projects when the numbers don’t add up. The Asian Winter Games is the first casualty of this new mentality. It won’t be the last. |

|

NEOM shuffles management team |

Bandar Algaloud/Courtesy of Saudi Royal Court/Handout via Reuters Bandar Algaloud/Courtesy of Saudi Royal Court/Handout via ReutersSaudi Arabia’s NEOM has brought in a new tier of management to improve oversight of the more than $1 trillion project as a wave of layoffs are carried out following construction delays and cost overruns. The kingdom is scaling down the massive project — at the heart of which is a 170-kilometer linear city designed to house almost 9 million people — with critics saying it has more important development priorities. NEOM, which is controlled by the Saudi sovereign wealth fund and chaired by Crown Prince Mohammed bin Salman, has created a new chief of staff division with five senior executives to oversee governance and engagement with the state, according to people familiar with the matter. The unit is headed by Mazen Alfuraih, who was previously in Public Investment Fund’s real estate division. The move is seen as part of efforts by recently appointed NEOM Chief Executive Aiman Al-Mudaifer to get the project back under control after runaway spending and a series of setbacks, including a tourism island that was shut down shortly after opening. — Matthew Martin |

|

Courtesy of PIF Courtesy of PIFSaudi Arabia’s sovereign wealth fund has ended a year-long ban on new advisory services from PwC, opening the door for the consultancy firm to rebuild its business in the kingdom after a bruising fallout with one of its biggest clients in the region. Public Investment Fund has told PwC that the restriction imposed in February 2025 — sparked when the consultancy tried to hire the chief internal audit officer from NEOM — has been lifted and it can start pitching for new work, according to people familiar with the matter. PIF declined to comment, and PwC didn’t respond to a request for comment. The ban, which limited new advisory contracts from PIF and its subsidiary companies, had been a major blow to PwC, which cut about 60 partners and 1,500 staff across its Middle East operations as a result. — Matthew Martin |

|

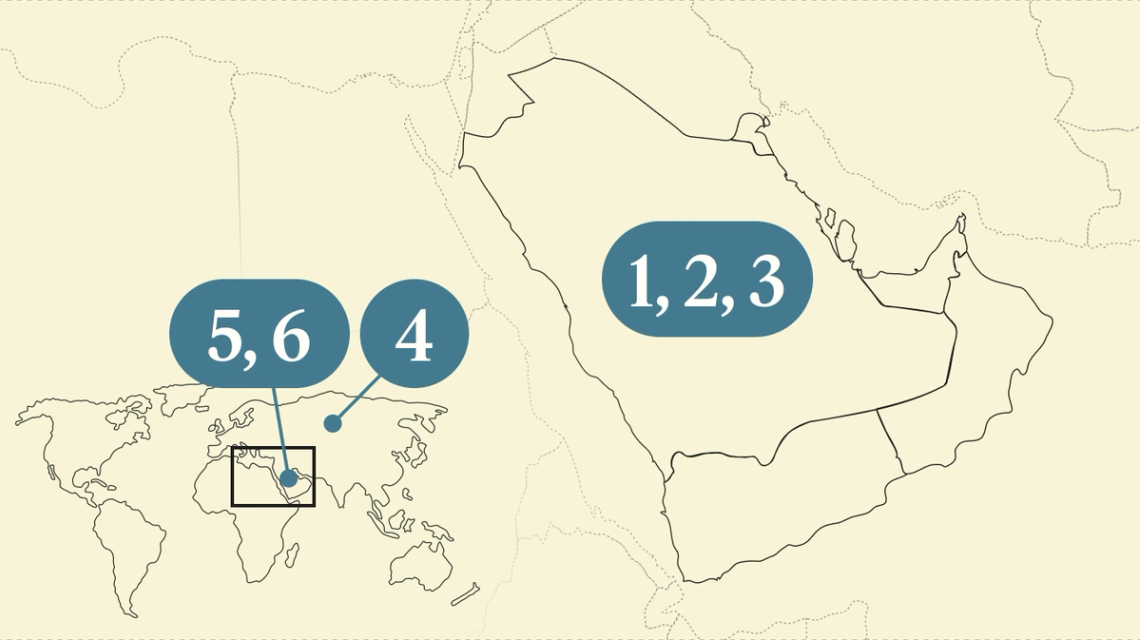

Saudi real estate opens to foreigners |

Courtesy of Diriyah Company Courtesy of Diriyah CompanySaudi Arabia’s real estate market has finally opened up to foreigners, with individuals and companies able to apply through the government’s Saudi Properties portal as of last week. The aim, according to authorities, is to attract international developers, lift the quality of projects, and stimulate the sector’s contribution to non-oil GDP. But there are still some restrictions: In Mecca and Medina, ownership remains limited to Muslims. Property prices in the kingdom fell for the first time in five years in the last quarter of 2025, even as rents rose 8% last year, AGBI reported. Steadily rising prices had prompted a five-year rent freeze in Riyadh and tougher measures like a “white land tax” on undeveloped sites. Just who might buy remains to be seen, but the market is attracting an unusual cast: Bill and Hillary Clinton, John Kerry, Tucker Carlson, Piers Morgan, and Boris Johnson are all due to speak at Riyadh’s Real Estate Future Forum this week. |

|

UAE to host more Ukraine-Russia talks |

Courtesy of Emirates News Agency Courtesy of Emirates News AgencyThe talks between Russia, Ukraine, and the US over the weekend in Abu Dhabi — the first involving all three since Moscow’s full-scale invasion in 2022 — were positive enough to warrant another round in the UAE capital next week, according to a person familiar with the matter. The discussions centered on measures aimed at making progress toward a peace agreement under a US-proposed framework. The event highlighted Abu Dhabi’s role as a diplomatic venue. The UAE — along with Saudi Arabia and Qatar — has built credibility as a mediator and has been involved in facilitating the release of prisoners in the Russia-Ukraine war; Abu Dhabi has participated in 17 such exchanges. Peace talks take things to a different level. — Mohammed Sergie |

|

CRCC/Handout via Xinhua CRCC/Handout via XinhuaSaudi authorities have revived plans for a Jeddah metro and started the bidding process for the Q-Express high-speed rail line in Riyadh linking the capital’s airport to the Qiddiya entertainment park — all part of a wider push across the region to get people and freight off the roads and onto the rails. More passenger trains are being ordered to triple capacity on the mainline network linking Riyadh to cities in the north like Hail and Jouf, and cross-border lines are planned from Saudi Arabia to Kuwait and Qatar. Dubai — the pioneer of urban rail in the region — continues to expand its metro network, and the first Etihad Rail passenger services linking the city with Abu Dhabi and Fujairah should start later this year. Work is also continuing on the Hafeet Rail freight line from the UAE to Oman’s Sohar Port. Slowly but surely, the long-mooted Gulf-wide rail network is taking shape. — Dominic Dudley |

|

Gaming craze touches every level |

The UAE’s average revenue per gamer in 2025, one of the highest in the world and ahead of Saudi Arabia’s $60. To put those figures into perspective, Japan’s was nearly $11 and South Korea’s was just over $30. Across the Gulf, high incomes, young populations, government support for the sector, and widespread internet access are fueling the rise in gaming, AGBI reported. Saudi Arabia, the UAE, and Egypt had a gaming market worth a combined $2 billion in 2024, and that is expected to rise to $2.8 billion in 2029. In Saudi Arabia in particular — a nation led by self-proclaimed “gamer” Crown Prince Mohammed Bin Salman — government-backed investments are driving growth in the sector. Public Investment Fund’s Savvy Games Group is currently pursuing a majority stake in EA games, the studio behind FIFA and Grand Theft Auto; it already owns Scopely, the company behind Pokémon Go. |

|

Dilhan Pillay Sandrasegara, Executive Director & CEO, Temasek Holdings, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

Energy Transition- United Solar, an Oman-based solar materials producer, has secured more than $900 million in financing to build a polysilicon plant that produces the core material used in solar panels. Backed by the Sultanate’s sovereign fund, the facility is expected to support 40 gigawatts of solar output and start production this year.

- Abu Dhabi’s Global South Utilities handed over two solar power plants to the authorities in Yemen. It follows the withdrawal of UAE forces from the country at the start of the year amid a fallout with Saudi Arabia. — Reuters

Power- Omani utility Nama awarded contracts to develop and operate two power plants — the 1.7-gigawatt Misfah plant and the 877-megawatt Duqm plant — to consortiums led by Qatar’s Nebras Energy and South Korea’s Kowepo respectively.

|

|

|