|

|

Hi Partner 👋

Investing is one of the most wonderful things in the world.

The ‘best‘ way to do it? It depends on your financial goals.

At Compounding Quality, we talk about three main paths:

Getting Rich: Small quality companies that are growing very quickly

Staying Rich: Established quality stocks that are still growing attractively

Living Rich: Quality companies paying an attractive dividend

Today, we’re focusing on Living Rich.

The goal of Living Rich is simple: build a portfolio that generates enough dividend income to cover your expenses.

When you can do that, you’ve achieved financial freedom.

26 Dividend Stocks for 2026

TJ Terwilliger recently put together a list of 26 stocks for 2026 for Compounding Dividends.

These companies:

Generate healthy consistent cash flows

Distribute cash to shareholders via dividends

We want to share this research with you.

Let’s dive into the list.

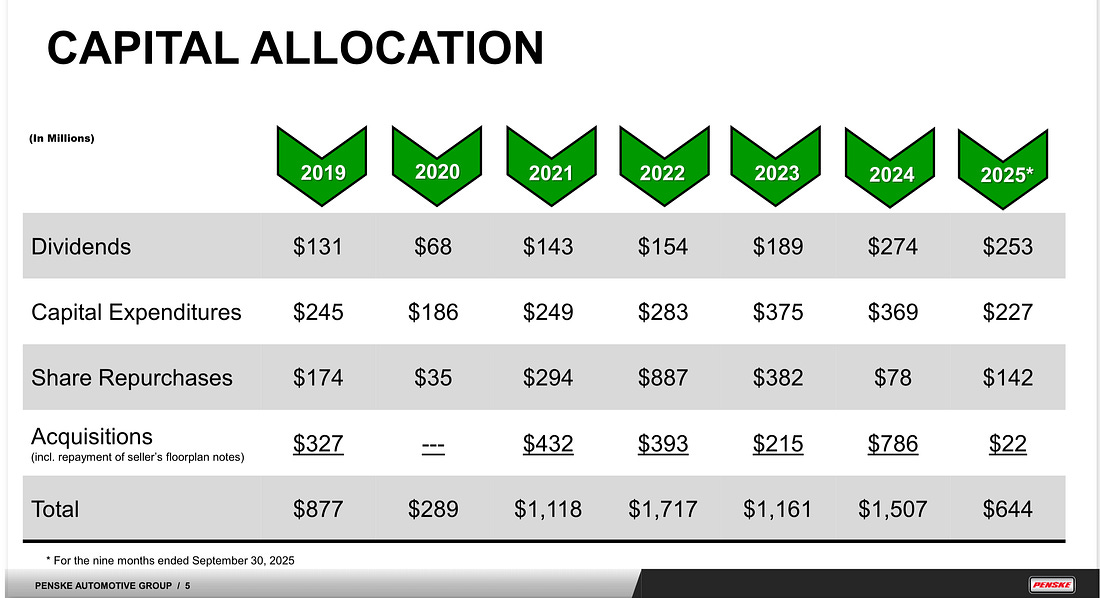

26. Penske Automotive Group ($PAG)

How the company makes money:

Penske is one of the world’s largest automotive retailers and a leading international transportation services company. They operate hundreds of retail dealerships across the US and UK, alongside a significant commercial truck segment and a large stake in Penske Transportation Solutions.Why It’s Interesting

Local Monopolies: Dealerships are protected by state laws that limit competition, creating a regional monopoly.

The Service Department: While car sales can be cyclical, the service and parts departments provide high-margin, recurring revenue.

Rising Complexity: As vehicles become more complex, owners are less likely to DIY, driving more business back to specialized dealer service centers.

Dividend Yield

Current Yield: 3.3%

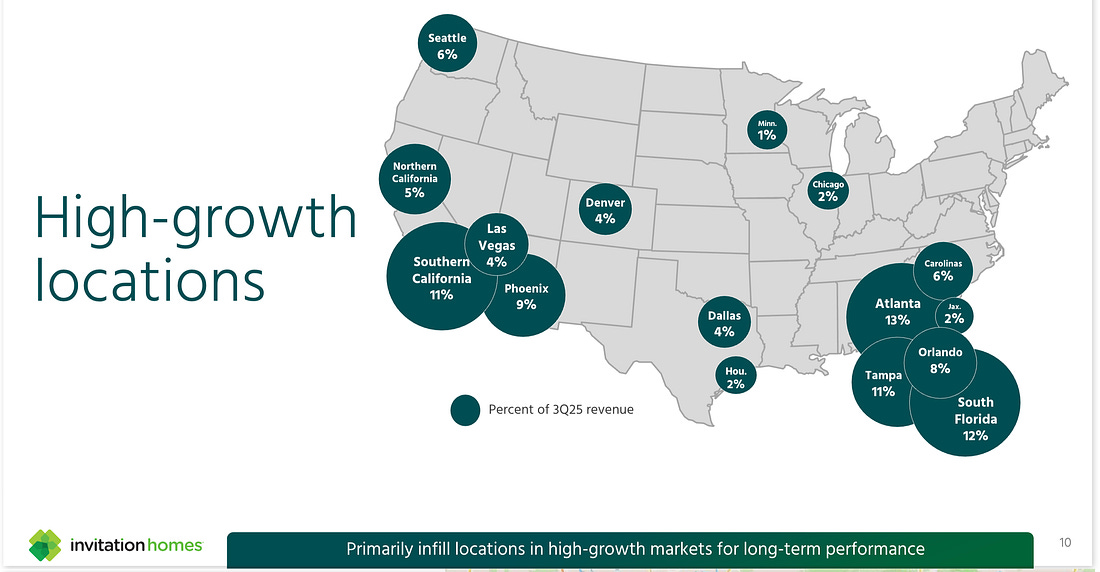

25. Invitation Homes ($INVH)

How the company makes money:

Invitation Homes is the premier single-family home leasing company in the United States. They own and manage a massive portfolio of high-quality homes in areas with strong job growth and great schools.