| | In today’s edition: Mubadala Capital raises a debut fund for co-investments and Saudi lures the ultr͏ ͏ ͏ ͏ ͏ ͏ |

| |  | | | Global Capital Edition |

| |

|

- Mubadala’s new fund

- FDI is all AI now

- China lending plummets

- Saudi’s ultrawealthy pitch

- All that glitters…

Rembrandt’s Young Lion Resting is in Riyadh this week. |

|

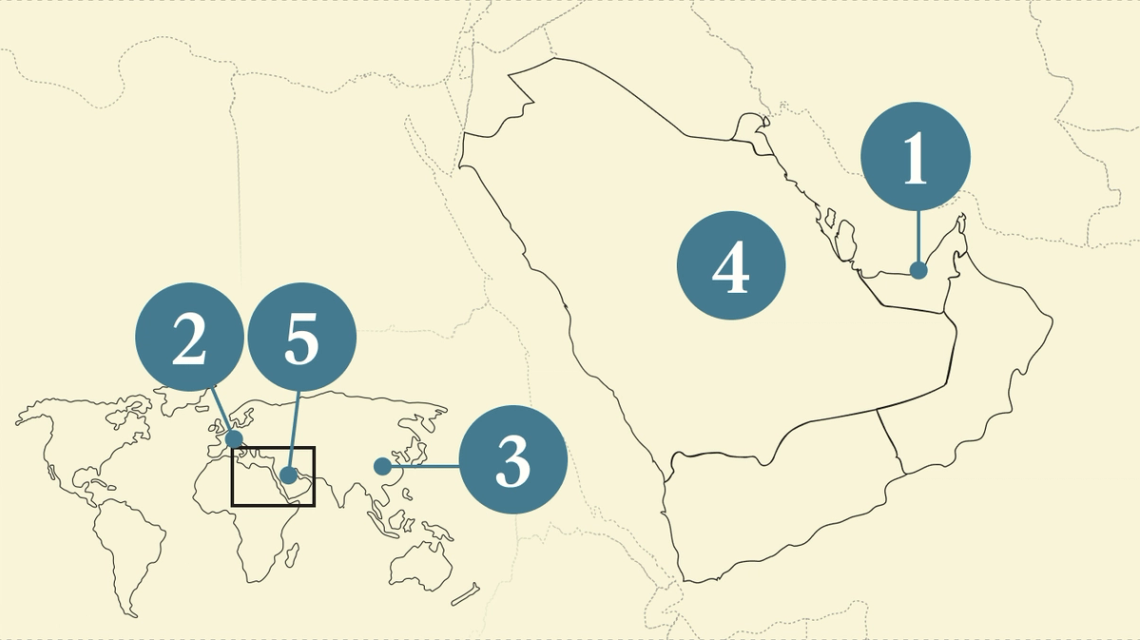

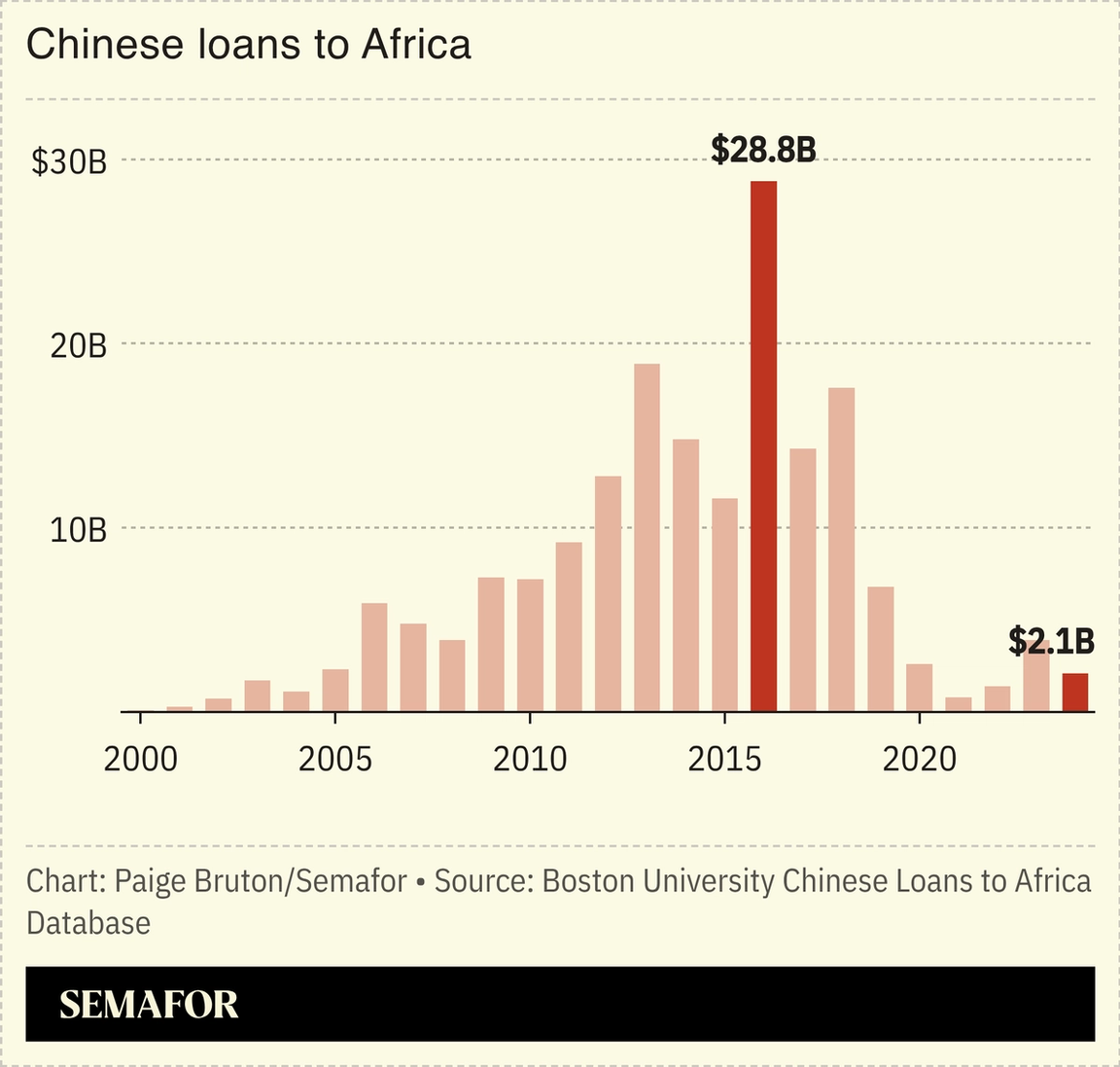

It’s still a golden age in the Gulf, but the region is facing uncomfortable scenarios. Another war with Iran could disrupt oil supplies, with a potential closure of the Strait of Hormuz sending prices above $100 a barrel (though most Gulf producers wouldn’t benefit because their crude would be stranded). Without a war, prices are trending lower amid a supply glut. The priority, even with lower prices, is to keep investing in oil and gas — which continue to fund the region’s growth. S&P Global Ratings expects national oil companies to spend an average of $115 billion to $125 billion a year through 2027, driven by expansion in the UAE and Qatar and maintenance in Saudi Arabia. Companies are also increasingly striking foreign deals: This week, ADNOC’s international investment arm XRG boosted its stake in a US LNG project.  Beyond the oil patch, the calculations diverge. For Kuwait, Qatar, and the UAE, a period of sustained lower oil prices would hit savings rather than domestic consumption, according to Ziad Daoud, Bloomberg’s chief emerging markets economist. Saudi Arabia, on the other hand, would need to make “spending adjustments,” he said. Some are already underway as the kingdom postpones or scraps its most ambitious projects. Oil and war — familiar themes here — are feeding uncertainty that could weigh on regional equities and capital flows, even as Gulf economies continue to outpace global growth. |

|

Mubadala courts outside capital |

Fatima Al Noaimi. Courtesy of Mubadala Capital. Fatima Al Noaimi. Courtesy of Mubadala Capital.Mubadala Capital has raised $554 million for its first co-investment fund, surpassing its initial target in the latest sign of growing investor appetite for exposure to the firm’s deal flow. The fund attracted investors from Asia, Europe, the Middle East, and North America, and aims to do around eight deals a year, investing in companies alongside Abu Dhabi’s $360 billion sovereign wealth fund or other global private equity firms. Mubadala Capital — the external asset management arm of the Abu Dhabi sovereign wealth fund — initially targeted about $400 million for the vehicle. “This fund really came about in response to investor demand,” Fatima Al Noaimi, co-head of Mubadala Capital Solutions, told Semafor. Mubadala Investment Co. launched Mubadala Capital around 15 years ago. It has since become the first sovereign wealth fund to take in third-party capital, and now manages around $30 billion. Mubadala, with around $360 billion in assets, is one of the world’s most active sovereign wealth funds, giving it access to deal flow across the globe. — Matthew Martin |

|

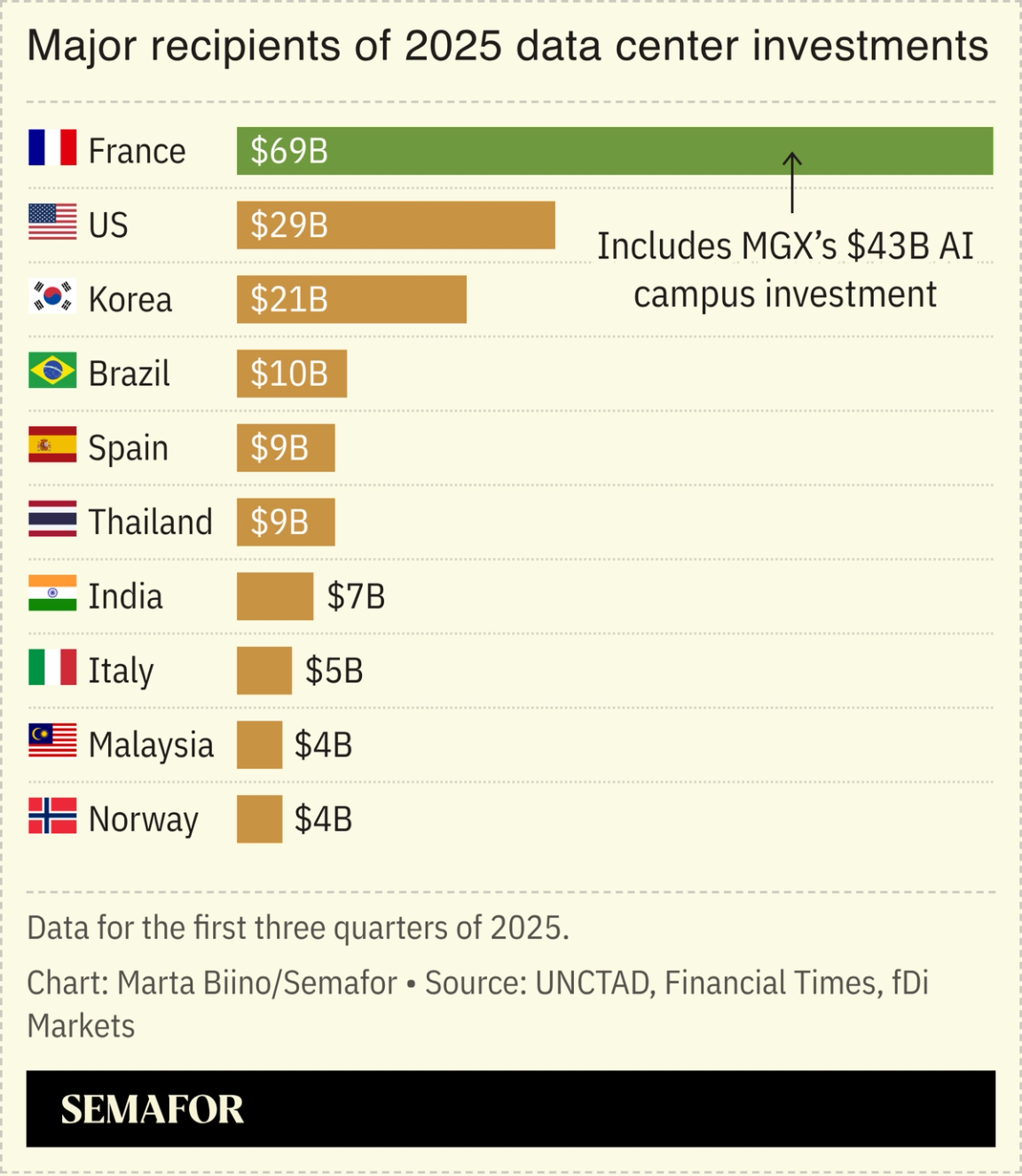

AI changes shape of foreign flows |

Data center spending is driving foreign investment levels, and UAE-based investors are behind some of the biggest deals. Declining appetite for industrial and large-scale infrastructure, and a renewables boom that “appears to have run out of steam” were partly supplanted by the sheer scale of capital poured into data centers and semiconductor manufacturing last year, according to the United Nations Conference on Trade and Development (UNCTAD). The total value of projects globally remained high in 2025: Investments in new data centers surpassed $270 billion, representing more than one-fifth of all investment projects, according to UNCTAD. A pair of $20 billion project finance deals — Dubai-based developer DAMAC Properties’ commitment in the US and a massive data center in Abu Dhabi — are among the biggest of 2025. The changing tide toward technology-intensive sectors is making it more challenging for lower-income countries to attract foreign investors, according to the trade body. FDI rose by 22% in high-income economies and declined by 5% in lower-income countries last year. — Kelsey Warner |

|

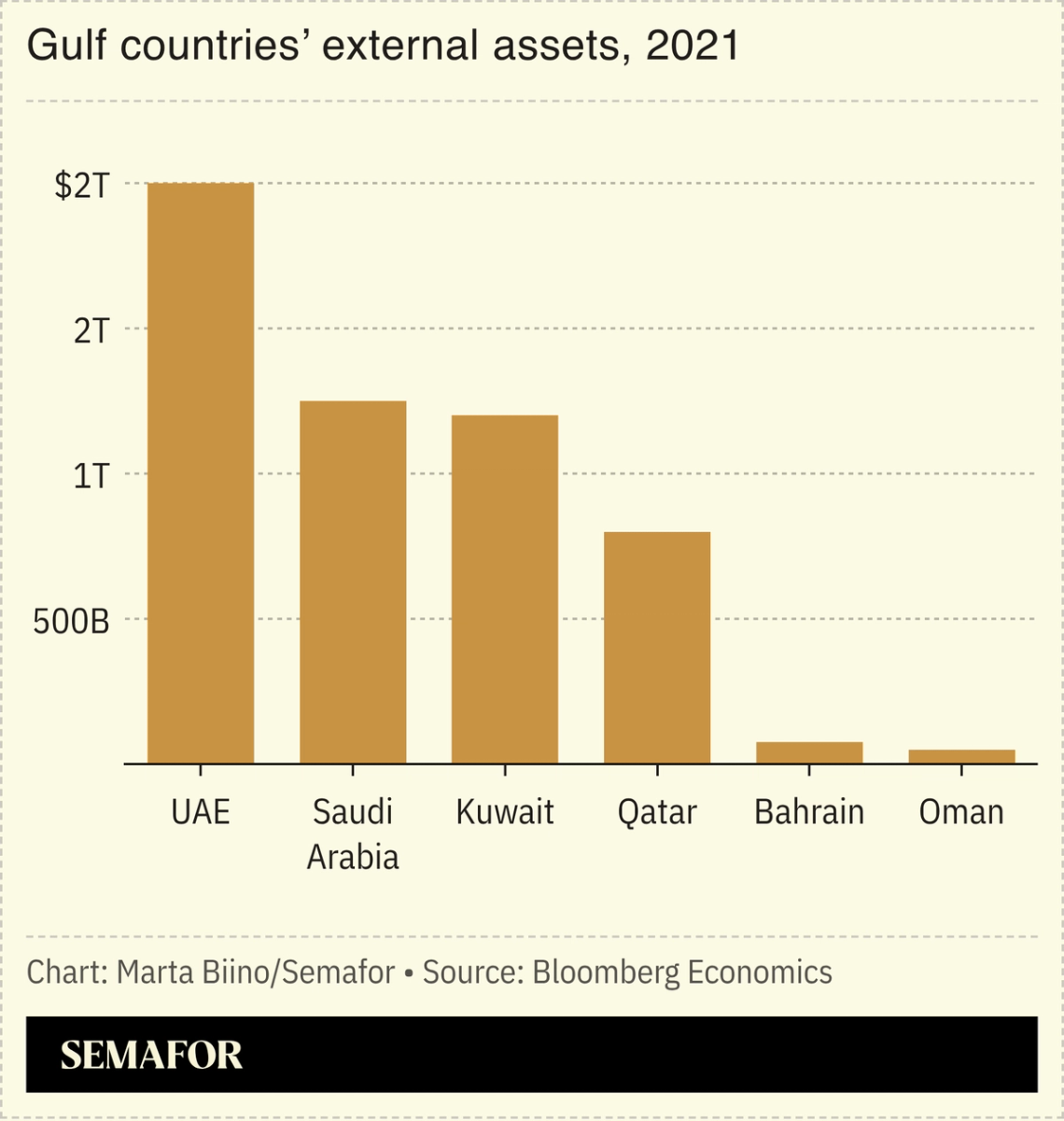

China shifts Africa lending strategy |

Chinese lending to Africa has plummeted as Beijing shifts its focus to strategic investments on the continent. Total lending in 2024 amounted to $2.1 billion, down by more than 90% from its 2016 peak, a Boston University report showed. The pivot partly reflects the poor performance of previous loans, after several African nations defaulted. In response, Beijing has recalibrated its engagement with the continent, pursuing investments in strategic projects — notably in energy, mining, and transportation — amid an intensifying rivalry with Washington. The fall also stems from more restraint by Chinese lenders, and borrowing constraints in Africa tied to continued post-pandemic shocks, debt restructuring efforts, and an increasingly volatile international order, Boston University researcher Mengdi Yue told Semafor. Meanwhile, Gulf countries and firms are boosting their exposure: The UAE is one of the biggest investors in Africa, deploying more than $118 billion between 2020 and 2024. — Alexander Onukwue |

|

Ultrawealthy in Saudi sights |

Courtesy of NEOM Courtesy of NEOMIf you own a superyacht or are worth more than $30 million, Saudi Arabia wants you. The kingdom may open its premium residency program to a wider range of candidates, Bloomberg reported, as the Gulf’s urban centers compete to attract high-net-worth, educated denizens to live, work, and spend. High-achieving students and a wider range of entrepreneurs may also be invited to apply for the status, which comes with perks such as fee exemptions and access to the real estate market. Expanding the premium residency scheme follows similar efforts by Bahrain, Qatar, and the UAE, all of which are trying to keep foreign workers — and their spending — in their countries for longer than previous expat stints in the region. |

|

Gold surge triggers Gulf buying frenzy |

Amr Alfiky/Reuters Amr Alfiky/ReutersGold’s surge past $5,000 an ounce this week has triggered a rush among buyers in the Gulf, where the metal can make up a major portion of people’s savings. Driving the 18% rise this year was a weaker dollar, geopolitical tension, and heavy central-bank buying, in the steepest gains since the financial crisis. Beyond institutional buyers, the frenzy has hit gold souks across the Gulf, with the price per gram becoming a topic of discussion across generations. Grandmothers, to whom collecting gold is considered a teachable life skill (rooted in the era of women not being allowed to own property or have a bank account) are having their “I told you so” moment. Young Saudis are encouraging friends to buy — now referred to as investing in — gold. Gold girls are the new finance bros. — Manal Albarakati |

|

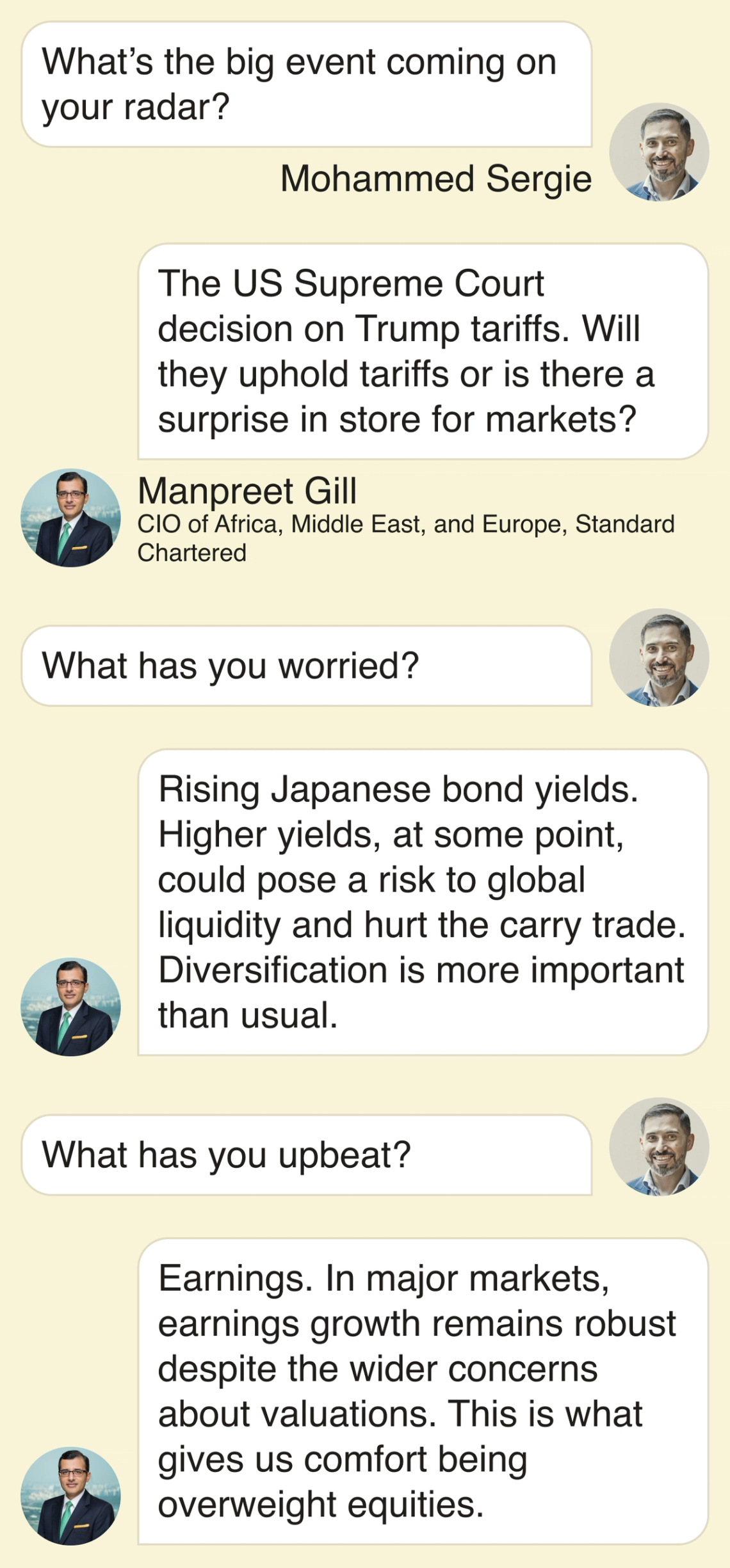

Every week, we ask a different expert what they’re focused on. Today, we’re talking to Manpreet Gill, CIO of Africa, Middle East, and Europe at Standard Chartered.

|

|

Rembrandt’s ‘Young Lion Resting.’ Rembrandt’s ‘Young Lion Resting.’The most important Rembrandt drawing to hit the auction market in 50 years is coming to Saudi Arabia. The Dutch painter’s Young Lion Resting, estimated at $15–20 million, will be on public view in Diriyah’s Bujairi Terrace this week. The pre‑sale exhibition of various works will be open all week, leading up to an open‑air auction Jan. 31 (which, unfortunately, the Rembrandt is not a part of) in the Diriyah amphitheater before the lion heads to Sotheby’s New York on Feb. 4. What is up for auction is still remarkable. The full lineup of “Origins II,” Sotheby’s second Saudi auction, mixes Middle Eastern artists with international icons like Picasso and Warhol across 64 lots. With Art Basel headed to Doha next month, Frieze following in Abu Dhabi, and museum-grade storage on the rise, the region is steadily cementing itself — and its tax-friendly reputation — as a collector’s haven. — Manal Albarakati |

|

Ben’s View: There’s little evidence that the administration has focused on reducing the demand for unauthorized workers, despite a declaration from immigration czar Tom Homan last year. → |

|

|

|