| | Freezing US temperatures are having global consequences, Europe accelerates a push for wind power, a͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Global impact of US cold

- Europe’s wind push

- Energy investments surge

- China’s storage boom

- Data center blowback

A rare-earth stock rally, driven by the Trump administration. |

|

Bing Guan/File Photo/Reuters Bing Guan/File Photo/ReutersA brutal cold snap in the US drove natural gas prices higher globally, showcasing the world’s growing dependence on American fossil fuels. The Trump administration has, largely successfully, prioritized the export of liquefied natural gas, with Europe particularly dependent on US supplies after slashing its reliance on Russia: Around two-thirds of exported American LNG heads across the Atlantic. But the winter storm — which has left 10 people dead and a million without power — has led to surging gas prices in the US, up around 120% in the past week, as suppliers have had to shut drilling sites because of the cold and prioritize domestic demand. As one Reuters columnist put it, “When the US freezes, the global LNG market catches a cold.” The worst may be over. Despite the mass power outages, the US grid itself held up remarkably well, while additional wind and solar capacity helped bridge gaps. (It helped that the storm struck over the weekend, when loads are typically lower.) Early signs also indicate that LNG production is recovering, and “prices have likely peaked,” ING commodities analysts forecast. The cold weather is expected to continue for several more days, however, so any progress could be fitful. — Prashant Rao |

|

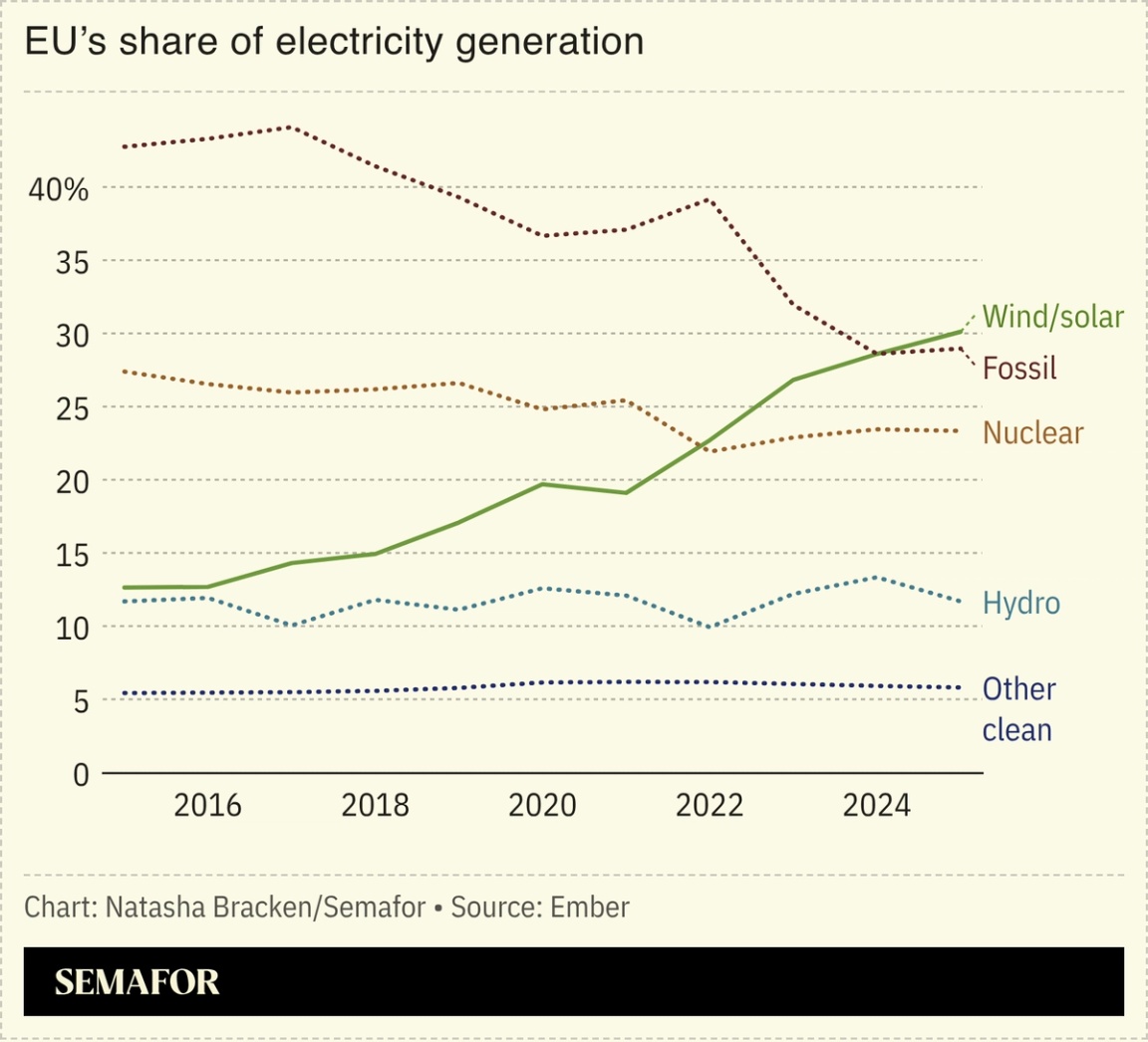

Ten European countries, including the UK, France, and Germany agreed to build an offshore wind power grid in the North Sea, a landmark deal aimed at strengthening the continent’s energy security by reducing its dependence on fossil fuels. The agreement, signed on Monday in Hamburg, involves developing 100 GW of offshore wind power — enough for 143 million homes — and linking the turbines to multiple countries’ electricity infrastructure. Proponents argued that the new deal could generate €1 trillion of economic activity for Europe. The continent has in recent years drastically cut its reliance on Russian pipeline gas following Moscow’s 2022 invasion of Ukraine, but its main source to fill the gap, Washington, has proven unreliable, making homegrown clean power all the more necessary. — Natasha Bracken |

|

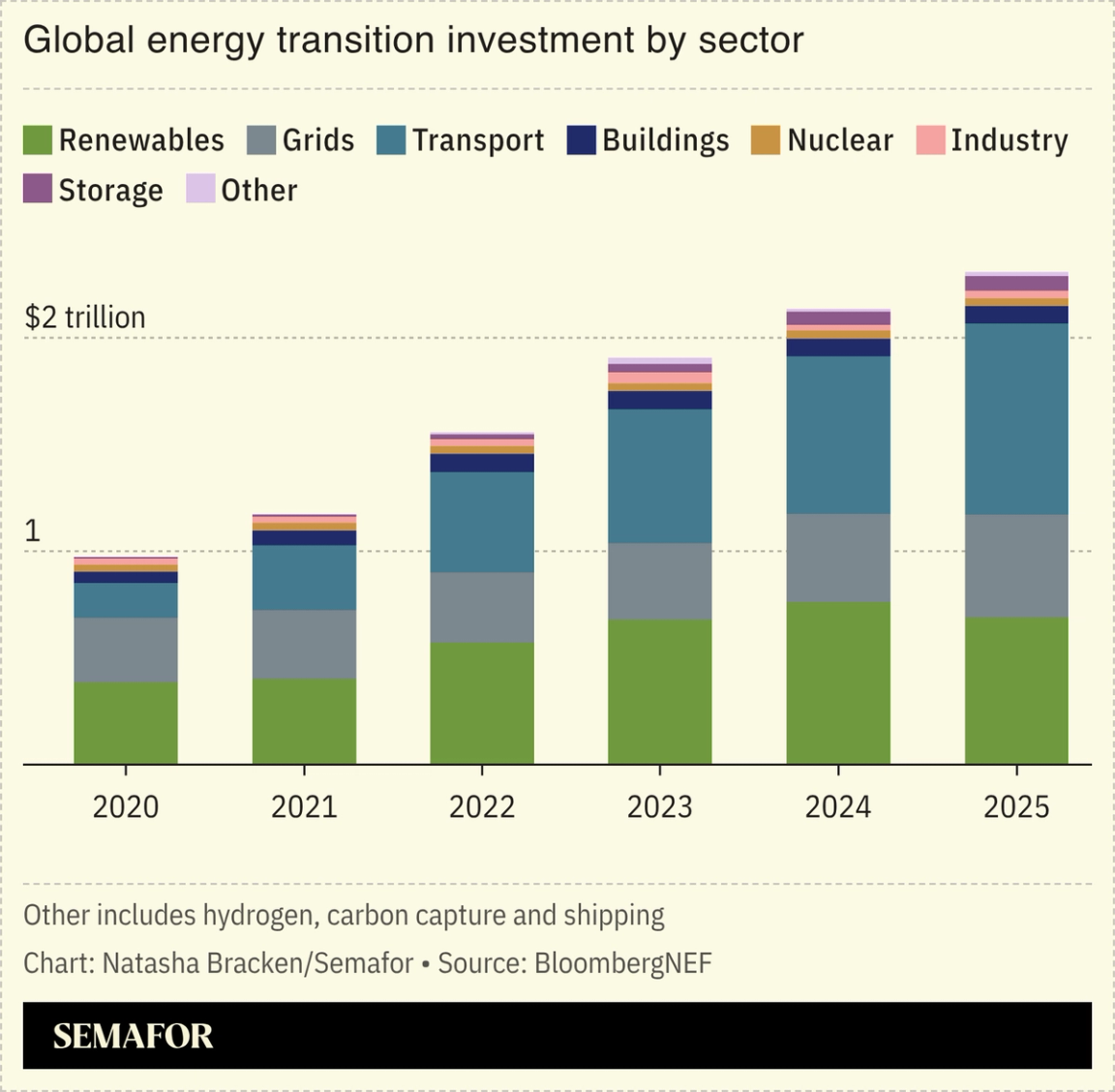

Despite seemingly endless downbeat news about green investments worldwide, global spending on the energy transition reached a record $2.3 trillion last year — and has further yet to go: That’s according to BloombergNEF research published this week. Overall, investments related to electrified transport made up the biggest single chunk, but a wide variety of categories — including the deployment of clean tech and the expansion of the green supply chain, as well as equity investments in climate-tech and borrowing for the energy transition — ticked up. Even investments in the US rose 3.5%, despite policy rollbacks, trade restrictions, and broader tensions. More spending is on the way: BloombergNEF projects annual investment in the energy transition worldwide will grow to $2.9 trillion in five years. |

|

Euisun Chung, Executive Chairman, Hyundai Motor Group, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

Jason Lee/File Photo/Reuters Jason Lee/File Photo/ReutersChinese energy storage firms saw orders in 2025 surge to a record, driven by growing demand in rich-world markets — including ones locked in trade disputes with Beijing. Overall, the Chinese Energy Storage Alliance reported orders totalling 366 gigawatt-hours last year, a 144% annual increase, with more than half of the purchases coming in the latter six months of 2025. Among the biggest buyers, the Chinese business-focused outlet Caixin said, were US and Australian customers: Though Washington’s tensions with Beijing have made headlines, US President Donald Trump’s One Big Beautiful Bill Act has been key to growing demand for energy storage, by offering a 30% tax credit. That increased demand is likely to force Chinese suppliers to begin diversifying their manufacturing sites, Wood Mackenzie said in a report forecasting the trends that will define the sector this year: Chinese firms are keen not to be shut out of lucrative markets by tariffs, or escalating local-content requirements, the research firm noted. |

|

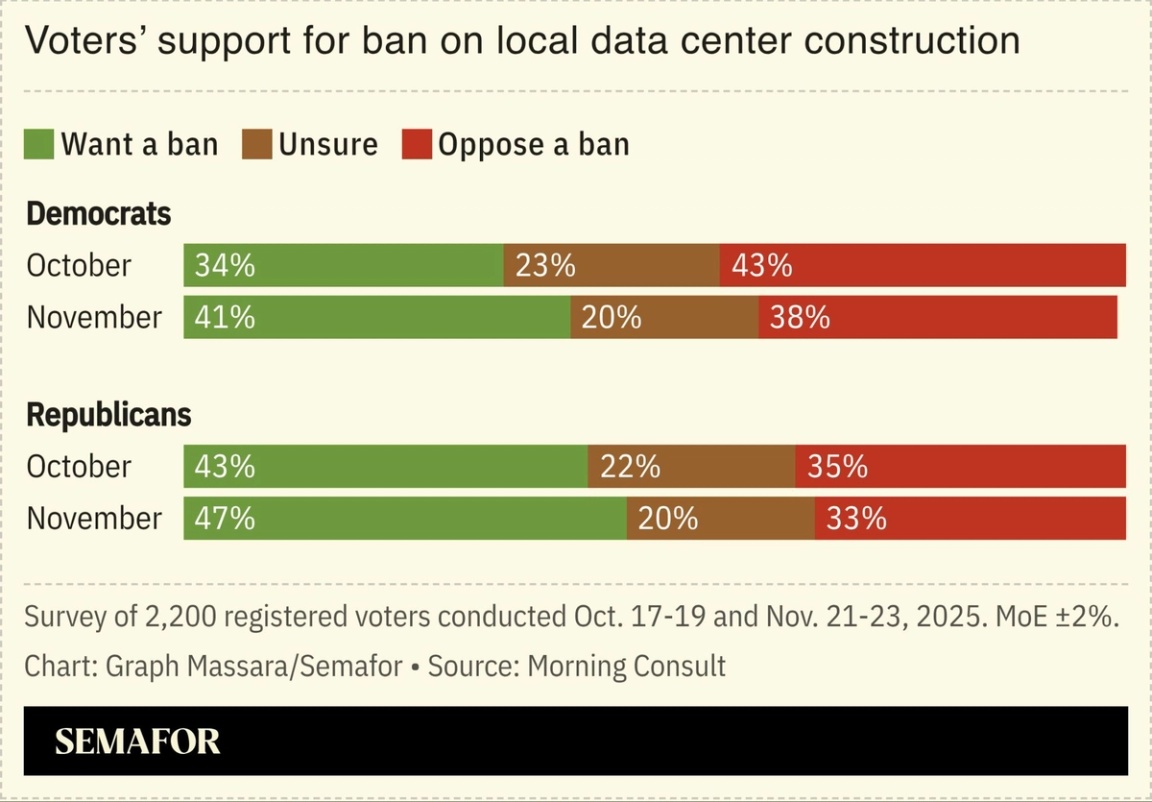

Nvidia is investing $2 billion in cloud computing provider CoreWeave to boost the buildout of data centers, which are set to become a central political focus in the US this year. Some of the country’s largest data center operators plan to boost spending in an attempt to lobby lawmakers and affected communities to back the projects, which have faced resistance over accusations that they drive up energy prices and use too much water. At least 25 projects were canceled last year following local opposition, Heatmap News reported, and another two dozen were blocked or delayed just this month, according to research firm MacroEdge. A populist backlash to data centers could play out in this year’s midterm elections across partisan lines, analysts say. |

|

New Energy- New York’s utility regulator approved extending subsidies to keep the state’s aging nuclear plants open until at least 2049.

Fossil FuelsFinance- Most major US public pensions lack clear targets, credible definitions, or transparent disclosures for climate-solutions investing, failing to protect workers’ retirement savings from growing climate-related financial risks, a new report found.

Politics & Policy- The Trump administration announced it’s cancelling nearly $30 billion of financing from the Energy Department’s green bank, approved under former President Joe Biden.

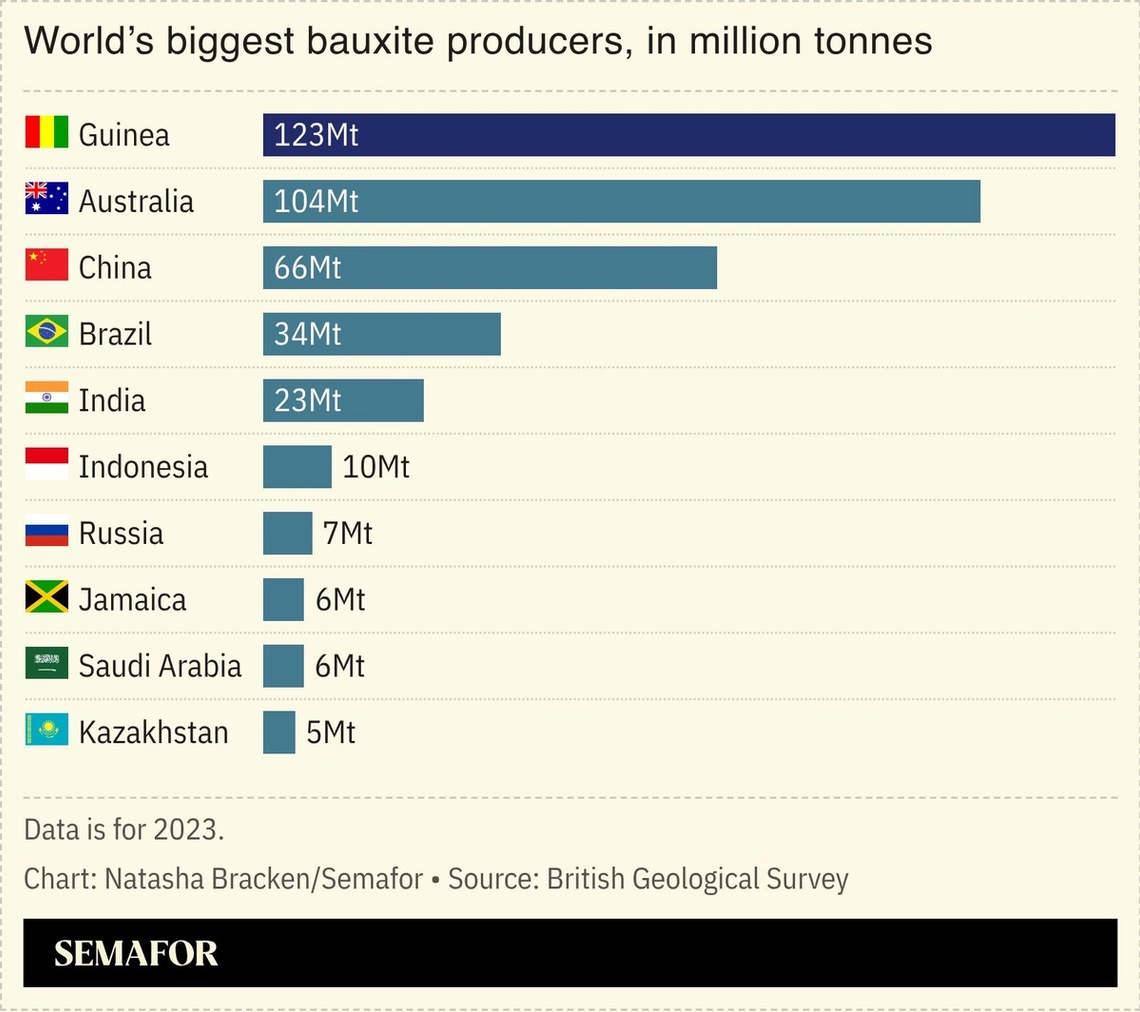

Minerals & Mining- Guinea said exports of bauxite jumped by 25% last year to meet soaring demand from China, which has recently tightened its grip on the African nation’s resources.

|

|

Ben’s View: There’s little evidence that the administration has focused on reducing the demand for unauthorized workers, despite a declaration from immigration czar Tom Homan last year. → |

|

|

| |