| | In this edition, why corporate CEOs still haven’t embraced AI, and Orlando Bravo is instead waiting ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Orlando Bravo on AI bubble

- Trump, activist investor

- ‘Mother of all trade deals’

- Saudi’s penny-pinchers

- Data center conquests

Dan Loeb is back … |

|

AI was everywhere at the high temple of capitalism last week — except when you asked CEOs what they were actually using it for. The Promenade at Davos had delivery robots and “multi-agent decisioning platform” demos, but few non-tech CEOs showed up with big announcements. The closest I heard was Bank of America CEO Brian Moynihan telling my colleague Andrew Edgecliffe-Johnson about new AI capabilities to “retrofit” the bank’s chatbot, Erica, that launched in… 2018. Scale AI’s CEO, trying to turn P&L hawks into believers, said companies investing in AI could expect to see returns on that money in two years. Back at sea level this weekend, I was thinking about all this as I read Substacker Jasmine Sun’s latest piece, which gets at a conundrum of this tech moment. While tech bros are vibe coding their way through travel lines and arguments with their spouses, most normal people are, at best, enjoying slightly less ad-clunked recipes (for now!). The New York Times’ Kevin Roose made a similar observation of the “yawning inside/outside gap.” Sun explains why: “Most people’s problems are not software-shaped,” no matter what our cultural and political overlords in Silicon Valley think. This may also explain why corporate adoption of AI has been so slow. CEOs’ problems, for the moment, are also not software-shaped. They are Donald Trump-shaped. Executives trying to plan for an AI future are being bombarded with a neverending stream of real-life crises like the violence in Minneapolis, where corporate America’s fence-sitting response has pleased nobody. Silicon Valley’s futurism is more grating than usual when the world is reliving an ugly past. In today’s newsletter: The CEO problems that were software-shaped were catered to by a generation of tools that are now being challenged by AI and battered in the public markets. So we sat down with Orlando Bravo, the world’s biggest pure-play software investor, in an interview below. |

|

Orlando Bravo warns of AI contagion |

Courtesy of Thoma Bravo Courtesy of Thoma BravoThe venture capital industry and AI are “absolutely in a bubble,” according to one of the biggest tech investors in the world, and it won’t easily be deflated by policymakers. “I think you just have to wait for it to pop,” Orlando Bravo, founder and managing partner of the $180 billion tech private-equity firm Thoma Bravo, told Semafor. “People are taking enormous risks for small probabilities of enormous returns.” Thoma Bravo’s portfolio companies, which sell everything from cybersecurity defense to CFO planning software, are the best window we have into corporate AI spending and whether there is enough appetite to justify Silicon Valley’s huge investments. Bravo also lived through the dot-com bubble, which scarred a generation of tech investors but didn’t spill over into the broader economy. He thinks we won’t be so lucky this time, as blue-chip companies and twitchy, overleveraged retail investors load up on AI bets. “It would just spread,” he said. “That market cap dwindling would have a big effect.” Beyond the AI bubble, we talked about where his own software empire is vulnerable to vibe coding; how CEOs are using AI as an excuse for cost cuts; and if his junior employees are secretly using bots to do their work. |

|

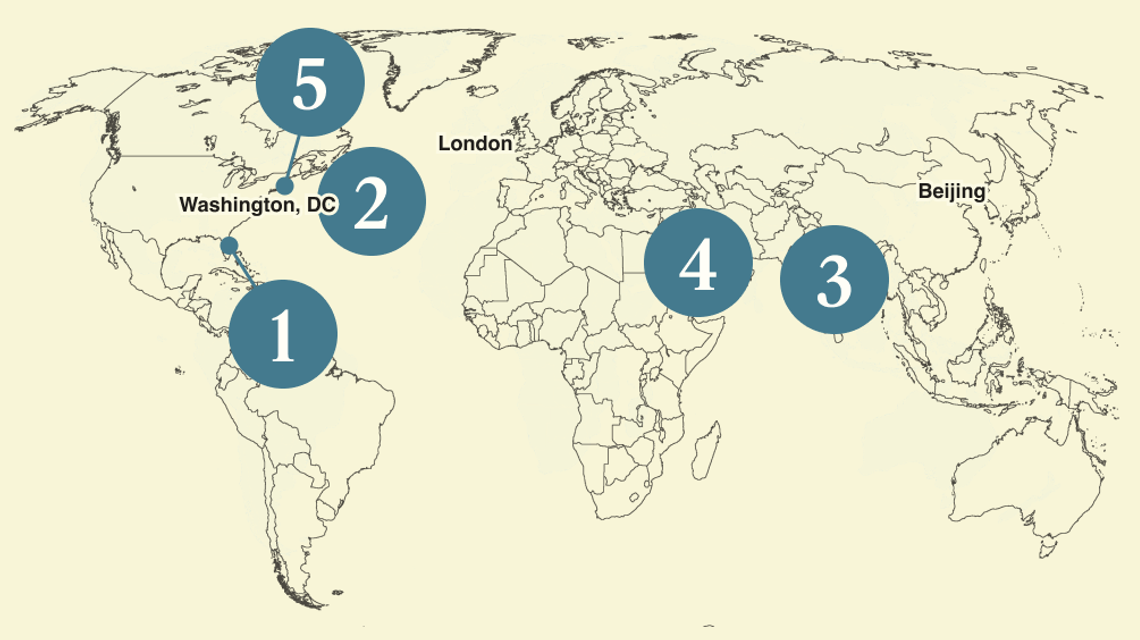

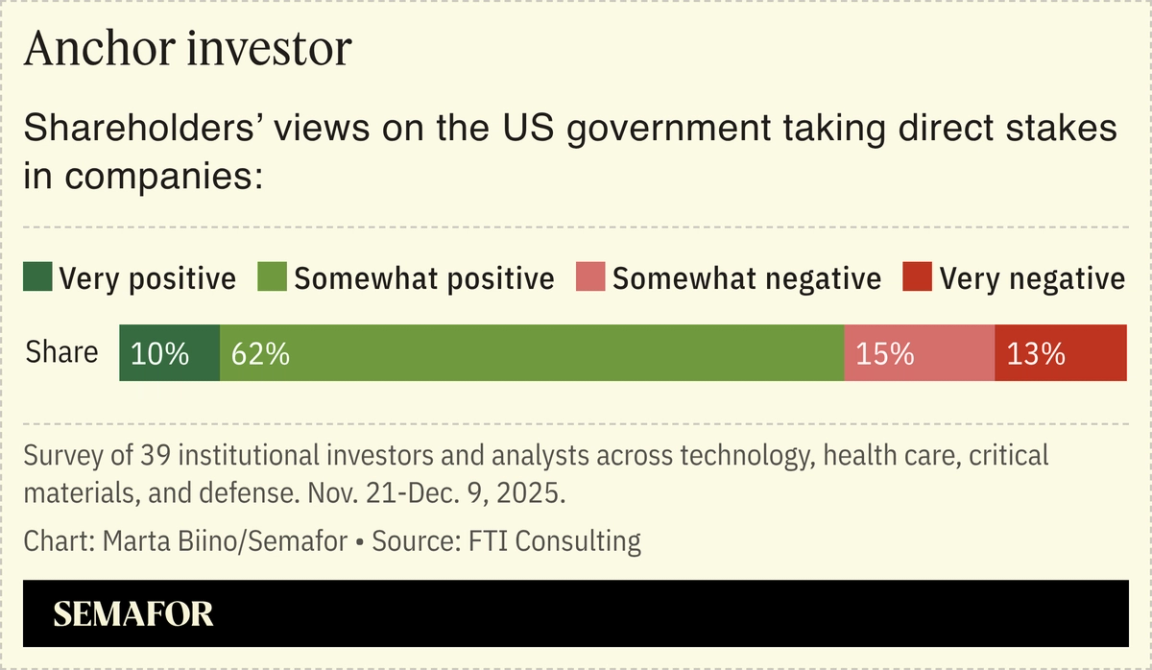

CEOs prep plans for activist-style Trump battles |

Corporate advisers have built a lucrative business fending off hostile takeover attempts and vocal activist investors. Now, their clients want them to apply those same skills to contain America’s most potent investor: President Donald Trump, Semafor’s Rohan Goswami reports. The Trump administration’s $1.6 billion investment in an American rare-earths miner is the latest private investment ruction highlighting the need for CEO whisperers and takeover defense experts who had already begun to include “the president wants to own a bit of us” in their quarterly “what-if” scenario planning, one advisor told Semafor. And whether companies are trying to fend off an investment from the US government — or court one — the strategy is the same: an aggressive DC ground game and close ties to Trump’s inner circle. |

|

US tariffs prompt trade deals everywhere else |

Altaf Hussain/Reuters Altaf Hussain/ReutersCanada Prime Minister Mark Carney’s barnburner Davos speech has already turned into real action: a landmark trade deal between the EU and India shows countries sidestepping Washington rather than knuckling under to it. The EU expects to double exports to India by 2032 as part of the deal, which had been negotiated for two decades; while India, which is facing 50% tariffs on goods sold in the US, anticipates EU-bound exports to soar. Trump’s threats have sparked an urgency in Brussels, which accelerated talks with several trading partners. Carney’s call to arms to the world’s “middle powers” was a rhetorical reset to a global trade picture scrambled by the Trump administration. Canada’s deal with China, which will put affordable Chinese EVs on Americans’ doorstep, is another sign that global leaders are hedging their bets. The White House, meanwhile, appears committed to extracting concessions: On Monday, the president announced 25% duties on South Korea for “not living up” to the two countries’ trade agreement. |

|

Saudi’s NEOM boosts oversight |

Saudi Crown Prince Mohammed bin Salman. Bandar Algaloud/Courtesy of Saudi Royal Court/Handout via Reuters. Saudi Crown Prince Mohammed bin Salman. Bandar Algaloud/Courtesy of Saudi Royal Court/Handout via Reuters.Saudi Arabia’s latest solutions to problems at its massive futuristic desert city NEOM are task-masters and penny-pinchers. The regime brought in a new tier of management to improve oversight at the mammoth project, which has faced cost overruns, pared its most sci-fi-worthy ambitions, and laid off workers as plummeting oil prices force Riyadh to slash spending, Semafor’s Matthew Martin reports. Critics have long questioned the viability of Saudi Crown Prince Mohammed bin Salman’s flagship project, especially at a time when the kingdom has more important — and achievable — priorities. A more bullish indicator from the Gulf: the UAE’s Mubadala has raised $550 million for its first co-investment fund, surpassing its initial target in the latest sign of growing investor appetite for exposure to the firm’s deal flow, Matthew scoops. Launched 15 years ago, Mubadala has gone from a government fund to a bona fide manager of outside money, and will now share its global deals with third-party investors. |

|

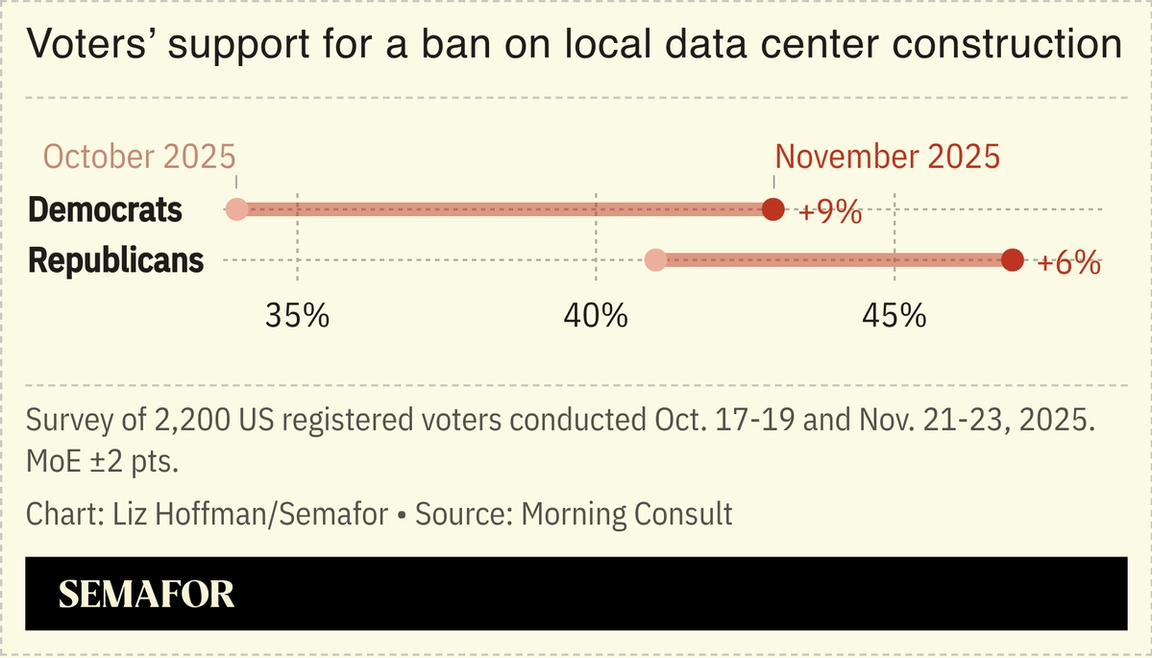

Politics won’t stop data center buildout |

Nvidia is investing $2 billion in CoreWeave to build more data centers, which are emerging as a political hotbed in the US midterm elections. At least 25 projects were canceled last year following local opposition, Heatmap News reported, and nearly as many were held up just this month, according to research firm MacroEdge. Data-center operators are on a lobbying blitz to win over lawmakers and, as Semafor’s Rachyl Jones recently reported, hiring architects to lessen the dystopian vibes. Communities are rightly asking “what is this going to do for employment, which is obviously often not that much. What’s it going to do to the power system?” Brandon Freiman, head of North American infrastructure investing at KKR, told Semafor last week in Davos. Freiman said data centers can help lower power prices by spreading utilities’ fixed costs over a bigger base of customers. “The additional demand is actually, in many cases, helpful,” he said. We also asked CoreWeave Vice President Nick Robbins last month about the populist backlash facing the company as it shifts from renting data centers to building its own. He was more optimistic about the job and tax benefits to communities, but cautioned: “Waiting for the grid to be entirely sustainable puts us behind countries that are less thoughtful on the subject, and I’m not sure that’s a worthwhile sacrifice.” |

|

Why do more than 1.5 million professionals start their day with The Hustle? Because it’s the only business newsletter that makes you smarter without boring you to death. Get growth stories, biz, and tech trends, and insights, all in 5 engaging minutes. Subscribe today. |

|

➚ BUY: Shelter From The Storm. American Airlines posted an upbeat outlook for 2026 despite projecting a revenue hit from Winter Storm Fern’s havoc. ➘ SELL: Tangled Up In Blue. JetBlue wasn’t so lucky, blaming “macroeconomic uncertainty” for wider losses and lower revenue. |

|

Companies & Deals- DC bet: Prediction market giant Kalshi opened a DC office, a sign it’s looking to ramp up its lobbying effort. But they’ve opted for a decidedly non-Trump point man: John Bivona, a longtime Democratic operative, will be its first head of government relations.

- Pay in kind: Private credit firms are selling debt to themselves at record levels to generate cash as private equity deals take longer to close, according to data from Jefferies.

- Do it yourself: Rheinmetall, Germany’s largest arms manufacturer, is in talks with local satellite producer OHB to create a satellite service for the German army that rivals Elon Musk’s Starlink.

Watchdogs- BlackRock’s Dark Horse: Rick Rieder has surged as Polymarket trader’s odds-on favorite for the next Fed chair, even though there’s little evidence he’ll beat out more established favorites. (CNBC’s Steve Liesman, who has covered the Fed for years, surveyed market participants, only 6% of whom believe the pick will be the BlackRock executive.)

- Good enough: The US Transportation Department said it will use Google’s Gemini AI to write regulations. “We don’t need the perfect rule,” the agency said. “We want good enough.”

|

|

|