| | Silicon Valley speaks out against the federal crackdown in Minnesota, US consumer confidence plummet͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Tech divide over Minnesota

- US consumer confidence falls

- Yen intervention speculation

- Debt threatens world growth

- China-US business ties warm

- Europe EV sales boom

- Trump as activist investor

- Saudi shelves mega-cube

- Girls hit puberty earlier

- Dubious microplastic studies

A critique of US hegemony, on display at a Tokyo gallery. |

|

Silicon Valley divide on response to ICE |

Yves Herman/Denis Balibouse/Reuters Yves Herman/Denis Balibouse/ReutersHundreds of US tech workers are speaking out about the US’ deadly immigration crackdown in Minneapolis, but most of Silicon Valley’s top CEOs remain silent. OpenAI’s Sam Altman told employees that ICE operations are “going too far,” while Anthropic’s CEO characterized the situation in Minnesota as “horror” in a post. They couched their condemnation with praise for President Donald Trump, however, reflecting the tightrope tech chiefs are walking in responding to the unrest without drawing the White House’s ire. More than 800 employees, including those from Google, Microsoft, and Meta, called on their bosses to condemn ICE, but many in AI would prefer staying quiet to “getting dragged into the mind-killing field that is politics,” Transformer wrote. |

|

US consumer confidence falls |

Sarah Silbiger/Reuters Sarah Silbiger/ReutersUS consumer confidence plummeted this month to its lowest level since 2014, a leading index showed, as Americans grew more anxious about high prices and a cooling job market. Even as the US economy keeps growing and inflation eases, the country has been stuck in a “low hire, low fire” labor environment, and the latest reading is a “warning sign to policymakers” to focus on affordability and reviving hiring, one economist said. Geopolitical shocks fueled by President Donald Trump’s volatile foreign policy also weighed on consumers, the survey showed. Trump on Tuesday hopes to refocus voters’ attention on his efforts to bring costs down in a speech in Iowa, a state whose farming industry was hurt in the president’s trade war. |

|

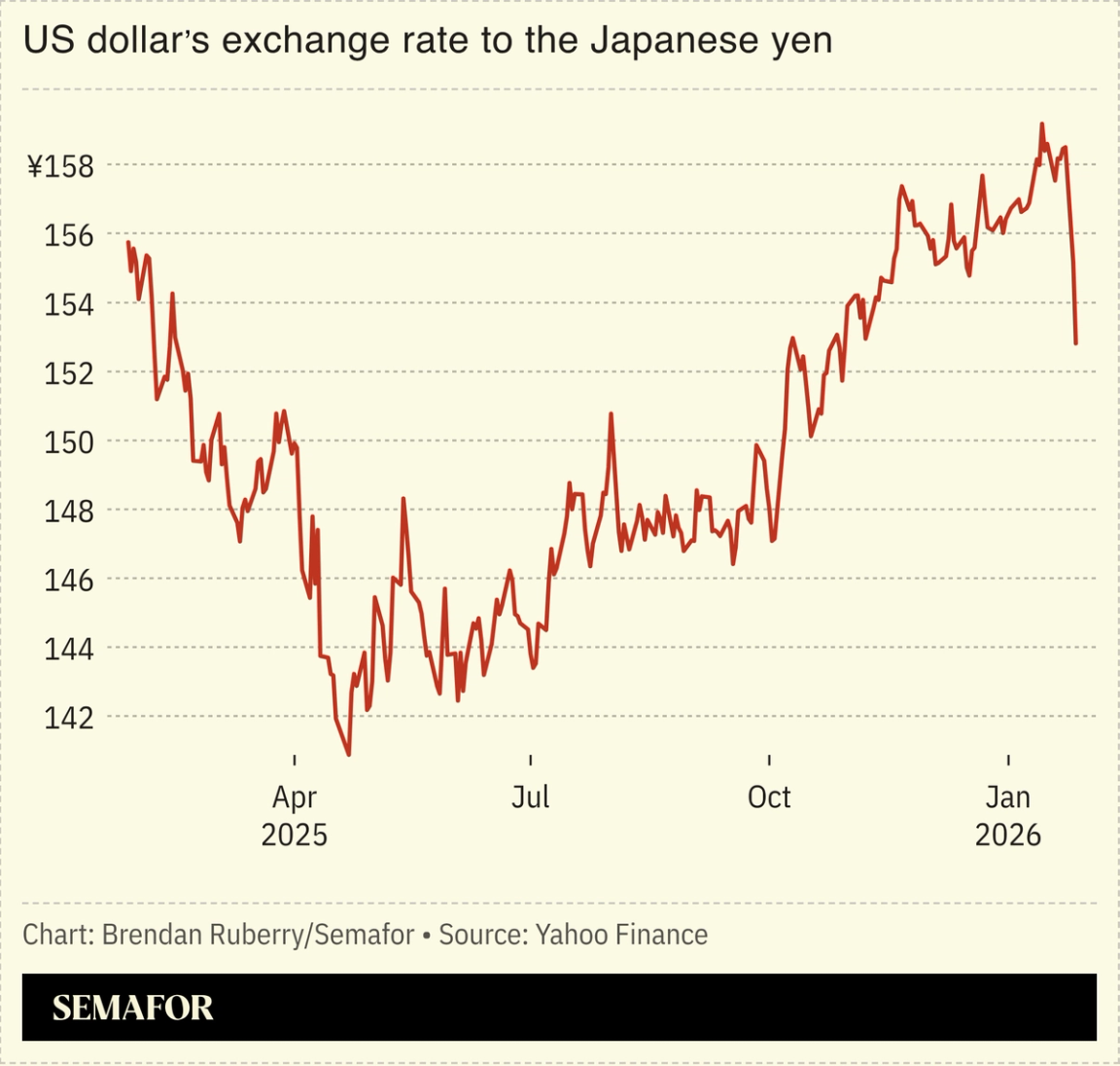

Yen strengthens on intervention chatter |

Japan’s currency strengthened Tuesday as speculation simmered that Japanese and US authorities could intervene after a sharp slide in the yen. Such a coordinated step — which could involve the US buying Japanese assets — is rare and remains unlikely, analysts said. Unilateral moves by Tokyo are more likely: Last week’s sharp yen selloff was fueled by concerns over Prime Minister Sanae Takaichi’s spending and tax cut proposals, and she is eager to get through a Feb. 8 snap election “without markets blowing up,” Bloomberg wrote. A Brookings economist, though, argued that the yen’s best hope is for the Japanese government to sell assets to pay down its debt, which is the highest among the world’s major economies: “The only way to get there… is for things to get worse before they can get better.” |

|

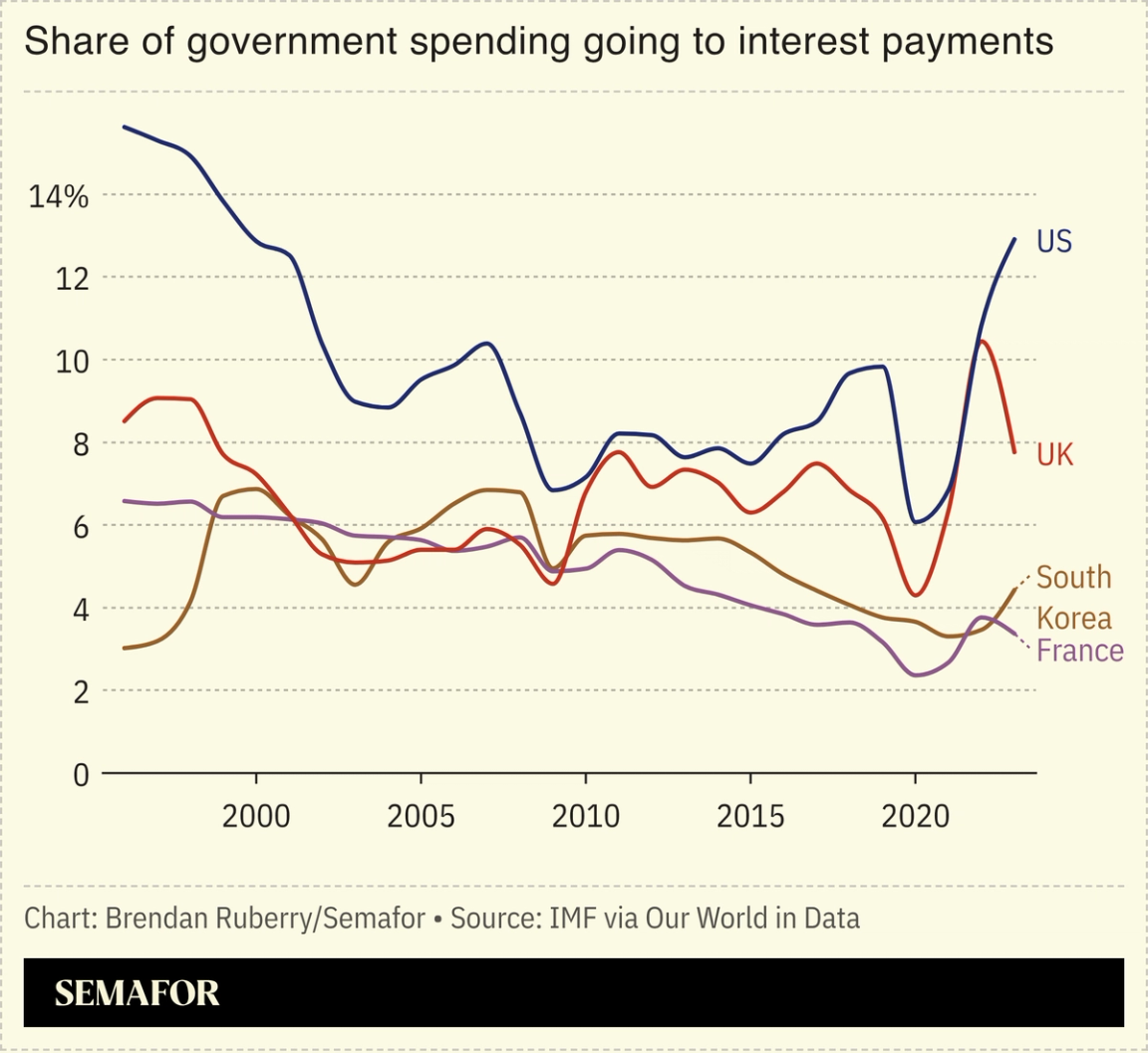

Spending boosts growth but poses risks |

Aggressive government spending in wealthy countries is propping up global economic growth, but poses a threat to long-term financial stability. From the US to Europe to Asia, countries are rolling out large stimulus packages financed by budget deficits, a trend that is expected to boost growth and jobs, The Wall Street Journal reported. But the record debt raises questions about the ability to weather future crises, and risks causing market turbulence: Japan’s bond market was roiled last week by concerns over government spending measures. “The menace of unsupportable borrowing” now looms over the global economy, The New York Times wrote. “The more you consume now, the less you can consume later,” an economist said. |

|

Positive signals on US-China biz ties |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersWashington’s top envoy in Beijing signaled business ties between the world’s two biggest economies are on more solid ground after their trade war truce last October. Ambassador David Perdue reportedly told a closed-door meeting of business leaders in Hong Kong that the US and China had made progress on several agreements, including a massive Boeing sale, ahead of President Donald Trump’s expected trip to China in April. Perdue earlier told Bloomberg that the broader US-China relationship was “improving multi-dimensionally.” Other Western nations are also pursuing closer ties with Beijing as Trump’s trade policies and unpredictable diplomacy reshape global partnerships: Finland’s premier visited China and pledged to boost economic cooperation on Tuesday, and the UK’s Keir Starmer lands in Beijing on Wednesday. |

|

Europe EV sales overtake gas cars |

Fabian Bimmer/Reuters Fabian Bimmer/ReutersSales of all-electric vehicles overtook gasoline-only ones in Europe for the first time in December, boosted by an influx of low-cost Chinese models. The shift comes despite a 38% drop in Tesla sales in 2025 as the Elon Musk-owned carmaker lost ground in the continent to China’s BYD. The EU is also planning to allow more China-made EVs into Europe. EV sales also boomed in the US last year, but American automakers are reining in electrification plans amid the Trump administration’s rollback of EV incentives. For Washington, the growth of EV trade elsewhere “should be taken as a serious signal of future global trends,” a CSIS analyst argued. |

|

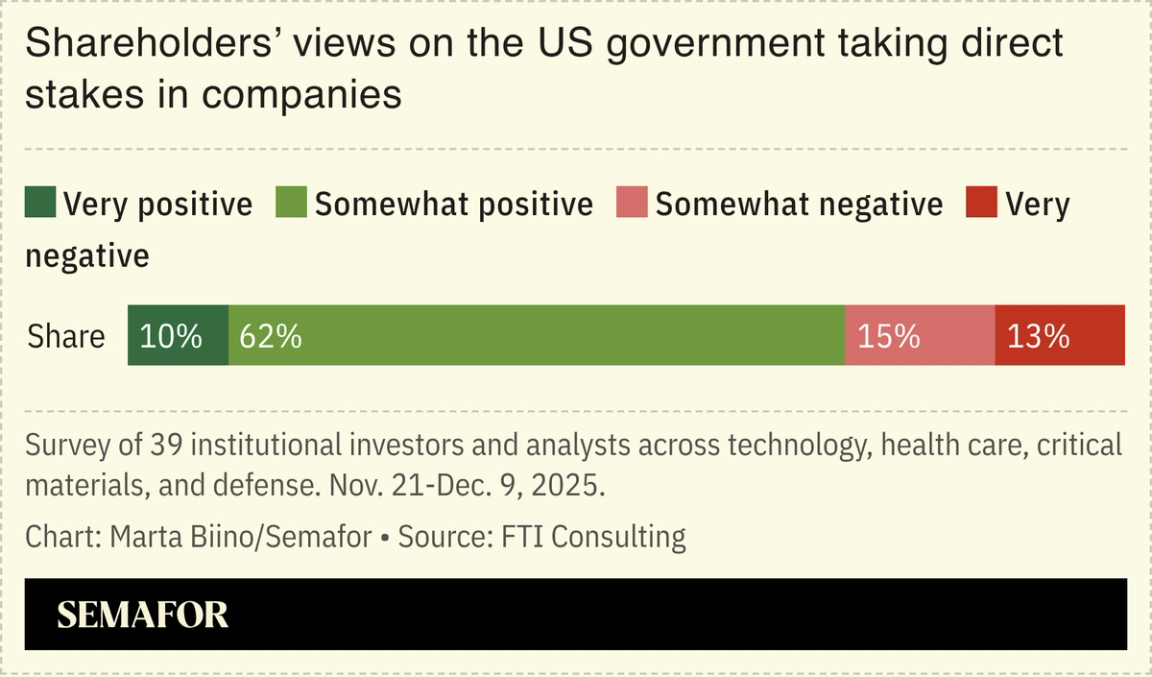

Firms factor Trump into takeover defense |

US companies are stepping up efforts to contain the country’s “ultimate activist investor” — President Donald Trump, Semafor reported. The Trump administration’s $1.6 billion investment in a rare earths miner this week was the latest example of such intervention to put CEO whisperers and takeover defense experts on notice. “There’s really only one answer when the president comes knocking,” so boardrooms must be prepared, one adviser said. Whether trying to fend off federal involvement or court it, the strategy is to have an aggressive DC ground game, corporate experts said. Firms have learned that avoiding the White House is no longer an option. |

|

Nandan Nilekani, Co-Founder & Chairman of the Board, Infosys, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

Saudi shelves its massive cube project |

Hamad l Mohammed/Reuters Hamad l Mohammed/ReutersSaudi Arabia halted construction of a massive cube-shaped skyscraper planned for downtown Riyadh, the latest blow to the kingdom’s glitzy development ambitions, Reuters reported. The Mukaab, a 400-meter by 400-meter metal cube, was billed the world’s largest structure, big enough to fit 20 Empire State Buildings. The reassessment of the project’s financing and feasibility comes as Saudi also plans to scale back its flagship $1 trillion NEOM development and create a new tier of management to improve oversight of the megaproject, Semafor reported. Falling oil revenues have forced Riyadh to slash spending on flashy builds and shift focus to sectors with better near-term returns, like logistics, mining, and AI. |

|

Girls are hitting puberty earlier |

Girls around the world are reaching puberty earlier. Girls got their first period, on average, around 16 in 1840. Today, it’s about 12. The average age of onset of breast development in the US fell from 11 in the 1960s to below 10 in the 1990s. The cause is unknown, although rising obesity is “almost certainly playing a part,” Nature reported. Some scientists suspect hormone-disrupting chemicals in the environment, although evidence is mixed. The health impacts are unclear; some studies link precocious puberty to increased risk of conditions like breast cancer and heart disease, but causality is hard to establish. The change has driven the Endocrine Society to release new guidelines for girls on the border between typical and early puberty. |

|

|